Free balance sheet template

What is a balance sheet?

A balance sheet captures the net worth of a business at any given time. It shows the balance between the company’s assets against the sum of its liabilities and shareholders’ equity — what it owns versus what it owes.

The balance sheet gives useful insights into a company’s finances. Because balance sheets typically include the same categories of information, they also allow comparison between different businesses of the same type.

A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position.

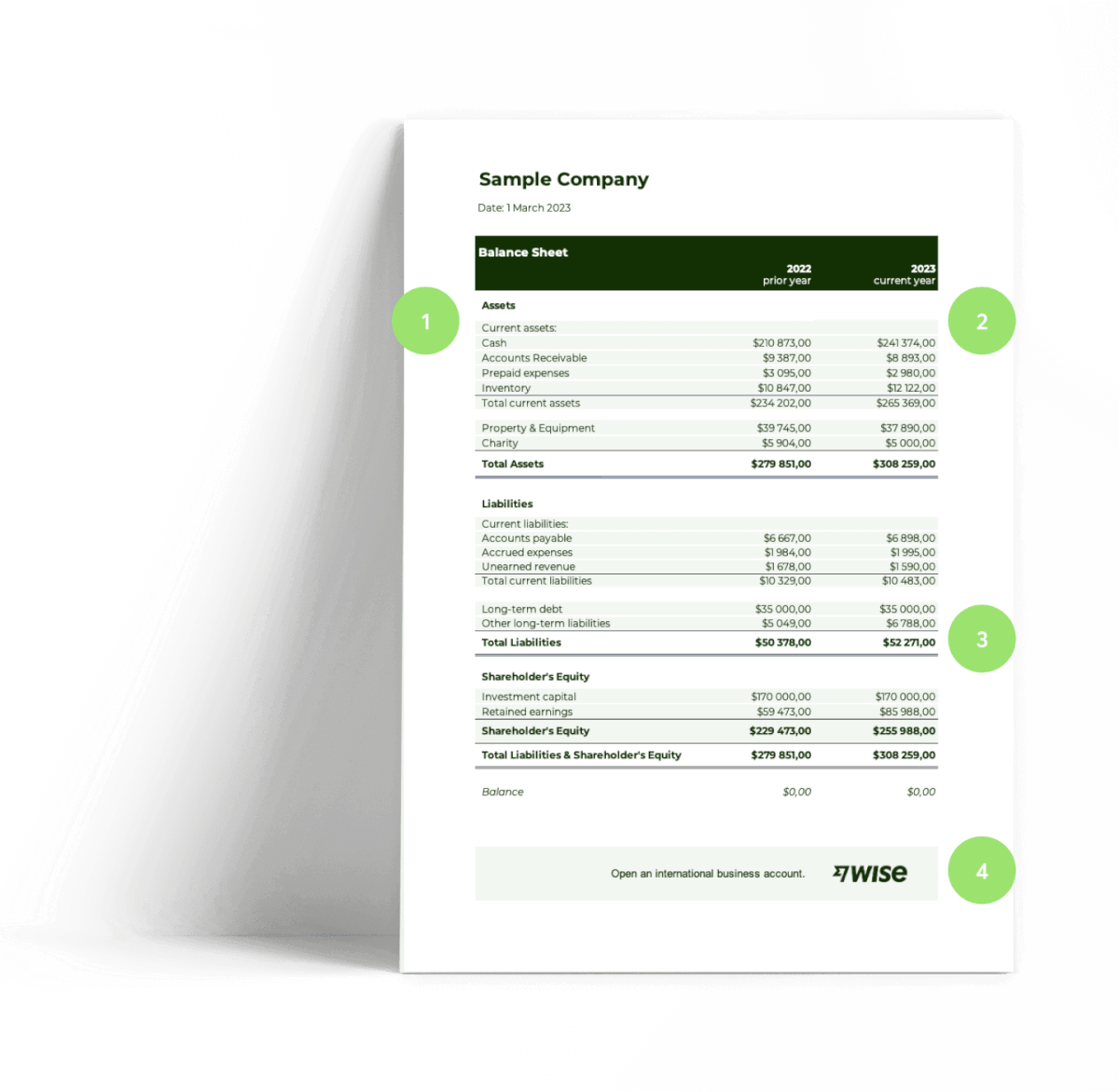

Download your basic balance sheet template.

To receive the download link on your email, please enter your email address. When you enter your email, you’ll also be signed up to receive the Wise Business newsletter, our free monthly email packed with handy guides and tips on how to grow your business internationally. You can unsubscribe at any time.

The hassle-free international business account.

Maintaining a simple balance sheet is a smart way to track your company as it expands. Ready to take it to the next level and start working with international clients and investors? Get a Wise multi-currency business account to accelerate your business growth.

You’ll get bank details for the US, UK, euro area, Poland, Australia and New Zealand, to receive fee-free payments from these regions. Hold 40+ different currencies, and switch between them using the mid-market exchange rate.

Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow.

Balance sheet format.

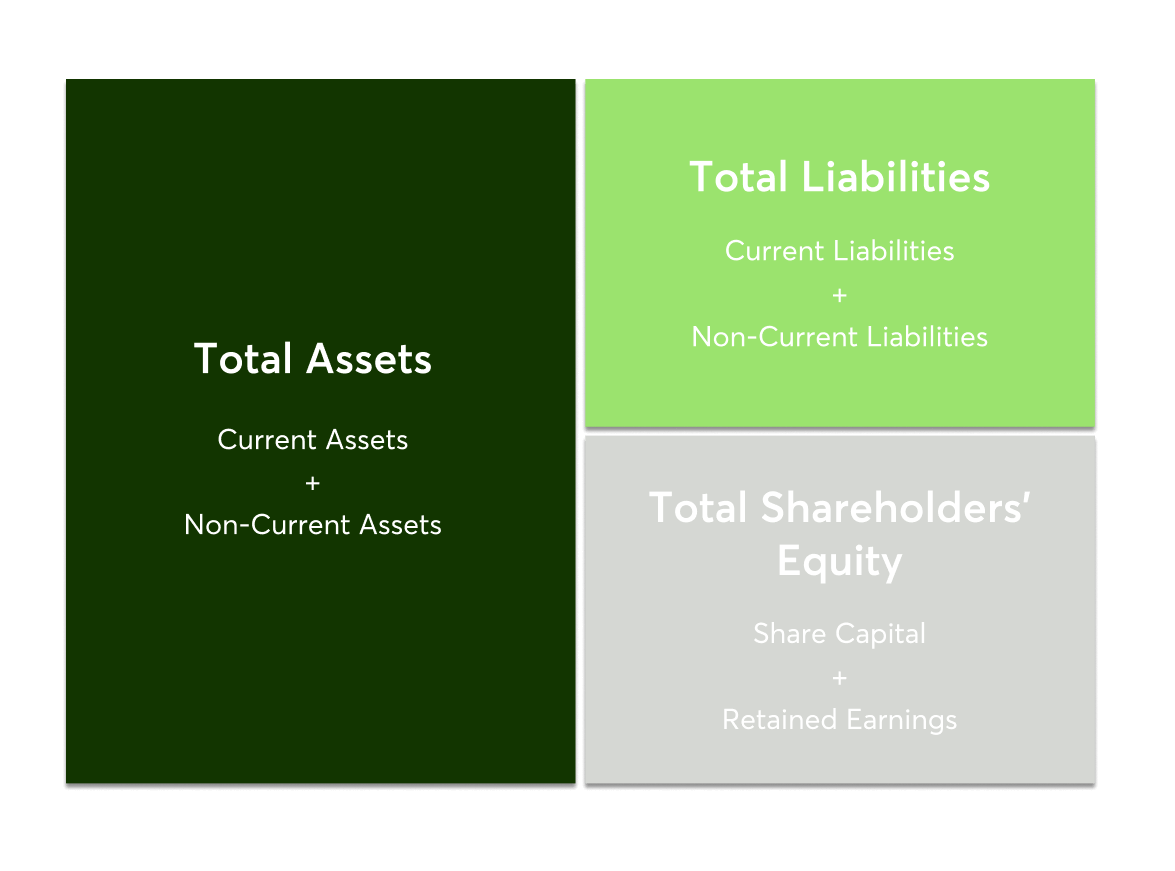

Balance sheet equation.

The basic balance sheet formula is:

Assets = Liabilities + Equity

As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other.

Think of it this way. Whatever a business owns — its assets — have been financed by either taking on debt (liabilities), or through investments from the owner or shareholders (equity).

Different industries, and therefore different companies, may have slight variations in reporting standards. However, balance sheets all typically use the same line items. Looking under the surface of these figures lets analysts and investors see how the business is doing financially, and compare one company to another.

What are assets on a balance sheet?

On a balance sheet, assets are usually described starting from the most liquid, through to those long-term assets which may be more difficult to realise. Let’s take a look at the type of assets which feature on a balance sheet.

Current assets

Current assets are also referred to as short-term assets. These are typically liquid, or likely to be realised within 12 months. Here are some examples.

- Cash and equivalents, including your business checking account balance

- Accounts receivable and any short-term invoices you’re owed

- Inventory including goods for sale, raw materials and items being made

- Expenses you have paid in advance, such as rent or business insurance

Non-current assets

Non-current, or long-term, assets, include investments and other less tangible assets which nonetheless can bring value to your business. Take a look at these examples to give you an idea of what to include.

- PP&E — this stands for property, plant and equipment, and is usually shown net of depreciation

- Intangible assets such as trademarks, patents, copyright and goodwill

What are liabilities on a balance sheet?

To complete your balance sheet template you’ll need to add in details about the debts and liabilities your company owes. Here’s a run through of the information you need to capture.

Current liabilities

Current liabilities are the items a company owes in the next year, and can include things like unpaid supplier invoices, or upcoming repayments for debts you’ve committed to like business loans. You can expect to include items like these:

- Accounts payable — also known as AP, the debts you owe to suppliers or to cover anything else bought on credit

- Current debt/notes payable, which covers all non-AP bills you’ll need to pay in the coming 12 months

- Current portion of long-term debt, so the amount you need to pay back in the next year, from any long term liabilities like a mortgage or business loan

Non-current liabilities

Non-current liabilities means any long term liabilities. Here are a couple of examples.

- Company-issued bonds

- Long-term debt such as a mortgage, including the principal amount left to repay and any interest which will be added

What is equity on a balance sheet?

When you start a business, you’ll often need to finance it with your own money. It’s important to capture this in the equity section of the balance sheet — even though it wouldn’t be considered the same as a loan from the bank.

Shareholder’s or owner’s equity balance sheet

This is whatever will remain if you subtract the liabilities of the company from the assets. Exactly how the equity is made up will vary from company to company, depending on the business type and stage. Here’s what you might include.

- Owner’s investments in a business

- Share capital if the company has been investor funded

- Retained earnings, where the business has decided not to issue all profits as dividends, but has held some itself to reinvest

Download a Google Sheets balance sheet template.

To receive the download link on your email, please enter your email address. When you enter your email, you’ll also be signed up to receive the Wise Business newsletter, our free monthly email packed with handy guides and tips on how to grow your business internationally. You can unsubscribe at any time.

Watch your business grow with Wise

Get all the tools you need to build your business. Hold, send and receive multiple currencies, to connect with global suppliers and customers.