Self-employed tax calculator

How to use the self-employed tax calculator:

Use the self-employment Income Tax calculator to work out your take-home pay after business expenses, National Insurance contributions and Income Tax:

Enter your gross annual income into the calculator. If your income varies, use an average over a few months for the best results.

Add up and enter all your allowable business costs, which can be deducted from your income before tax.

The calculator will then work out your profit after tax, and what you need to pay in Income Tax and National Insurance, taking into account the normal tax free allowance levels.

The tax and NI figures in the calculator are intended as a guide, and are based only on the information entered. Tax can be complex, and professional advice may be required. If you're not sure how, or how much to pay then you should get expert help, from an organisation such as Tax Aid.

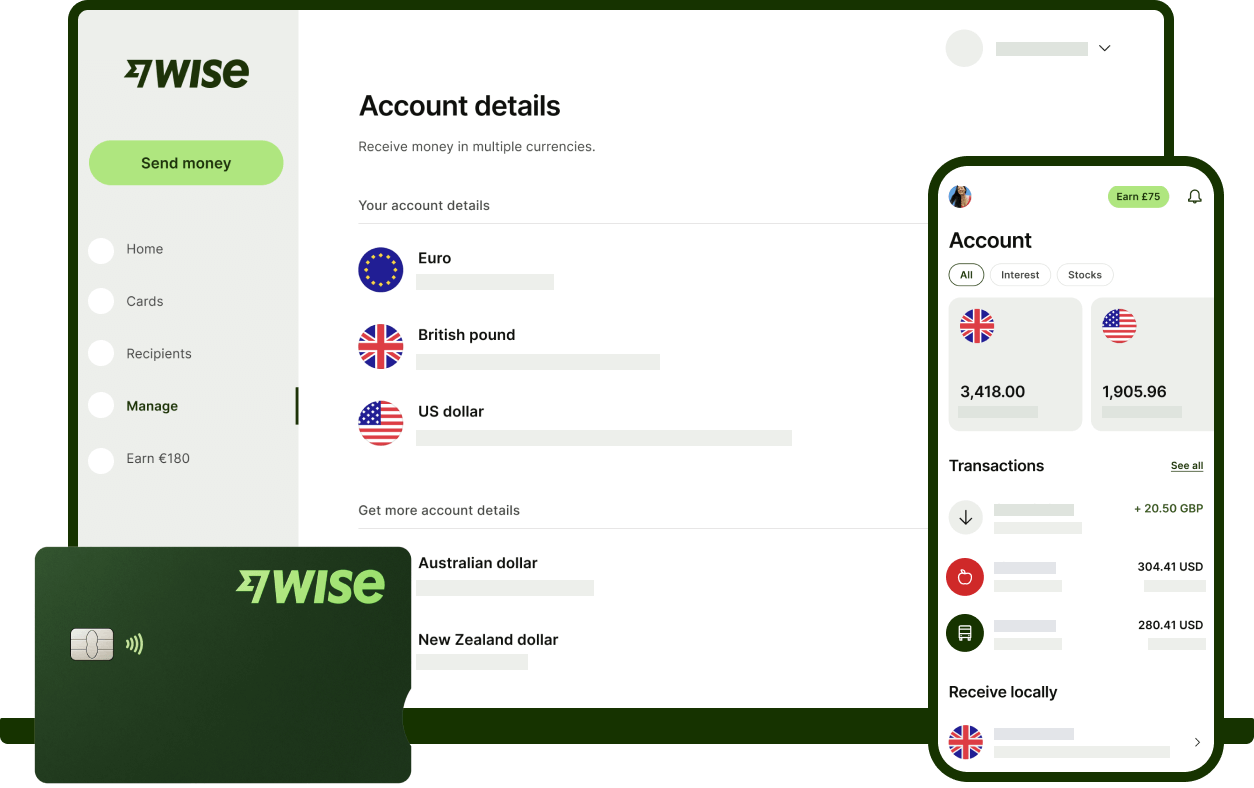

Open a Wise Business account online and in just a few minutes.

If you work with customers or suppliers overseas, you could save with a Wise Business account.

Pay invoices, and receive payments from abroad easily, and hold multiple currencies in the same account for convenience. You’ll also get a business debit card, and your own bank details for the UK, US, euro area, Australia, New Zealand and Poland, to receive payments in these regions.

Wise Business offers integration with Xero accounting - making it easier to keep a record of all your income and expenses. That way, you’ll have everything to hand when it’s time to fill in your Self Assessment tax return.

Doing business in multiple currencies? Get your Wise account now. Try Wise Business

Self-employed expenses: how to calculate your business costs?

HMRC allows self-employed people to deduct certain business costs from their income before calculating tax. These include:

- Some costs for a work vehicle or other transportation

- Accountant and legal fees

- Business insurance

- Office costs such as postage and printing

- Business premises costs, or a share of your utility bills if you work from home

- Marketing costs

Strict rules apply to which business costs are deemed allowable expenses. Take professional advice if you’re not sure what to include.

Self-employed tax: how much tax will I pay on my income?

While employees have their tax deducted at source through the PAYE system, self-employed workers will need to calculate, submit, and pay their taxes themselves.

As a self-employed worker, you’ll first need to notify HMRC of your self-employed status, and then complete an annual Self Assessment tax return. You’re responsible for paying your taxes and any other necessary contributions yourself.

Tax is complicated, and depending on the type of business you run, you may have to make several different payments:

- Income Tax – you’ll calculate and then pay your Income Tax and National Insurance through your annual Self Assessment Tax return

- VAT – once you register for VAT you’ll need to complete a VAT return every quarter, using HMRC’s Making Tax Digital scheme

- Dividend tax – if you’re the director of a limited company you may need to pay tax on dividends

- Corporation Tax – limited companies pay corporation tax through a company tax return

Self Assessment tax return - things to keep in mind:

-

Before completing your tax return, gather all the information you have about your earnings for the tax year, and any allowable business expenses

-

Keep a record throughout the year of all your income and expenses, including receipts and bank statements. This makes it much easier to complete your tax return accurately

-

Make sure you know your UTR (unique taxpayer reference) number, which you’re given when you register for Self Assessment. Find it on correspondence from HMRC regarding your tax return

More salary calculators

Take-Home Pay Calculator

The take-home pay calculator will tell you your monthly salary or annual earnings after normal UK tax and National Insurance contributions. Get this easy to use salary calculator here.

Hourly Wage Calculator

Calculate your salary or take-home pay from your hourly rate, using this simple and free excel based hourly wage calculator

Pro-Rata Salary Calculator

Work out your wage from your pro-rata salary if you work part-time. Or check how much you will take-home if you change your working hours, with this handy pro-rata salary calculator.

Freelance efficiently with Wise Business

Get the tools you need to manage your finances as a freelancer.