Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

At Wise, we are committed to providing our consumers with the best possible experience

when it comes to transferring money across borders. Over the last quarter, we've been hard at work to improve both the speed and accuracy of our services. Here's a look at the exciting developments we've achieved in Q3 and what's in store for Q4.

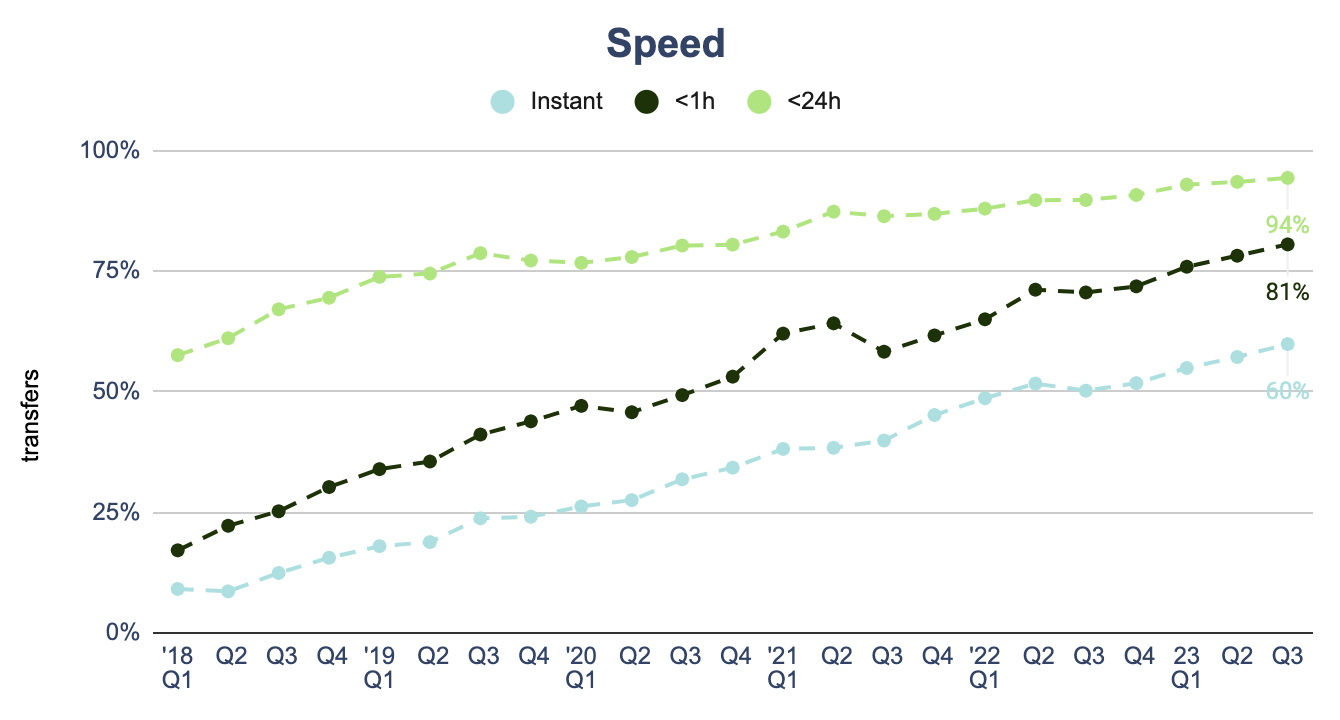

In August, we achieved a significant milestone by reaching a 60% instant transfer rate. This means that a substantial portion of your transfers now complete in under 20 seconds, providing you with quicker access to your money when you need it most.

One growing trend which has contributed to this is the rise in people sending money to and from each other on Wise. Sending money between Wise balances is instant, so it's the fastest way to get money to your loved ones. 67.2% of transfers initiated on Wise are now either from or to a balance, which is contributing to the overall increase of instant transfers on Wise.

We've witnessed continuous speed improvement in various regions, such as New Zealand (NZD), Asia, and Europe (EUR):

Working with partners, we’ve increased the speed of our transfers across Asia.

Last quarter, Thai Baht (THB) instant transfers grew from 66.9% to 72.1% as we increased the number of transfers we paid out with our instant payout partner.

In Hong Kong we have a new local banking partner, DBS, so when you send money with Wise we now receive your funds instantly, meaning that 99% of transfers funded by Hong Kong Dollar are even faster.

Additionally, this quarter 6% more transfers sent to Indian Rupee (INR) are now instant. A few things contributed to these improvements:

In Europe, we've also made significant strides:

77.3% of transfers to EUR were instant last quarter, growing 3.4 percentage points month-over-month. This improvement was largely driven by holding more money in Europe so we could payout transfers more reliably, and fixing an outdated payment process which was previously causing downtime on the route.

Sending money to Hungarian Forint (HUF) also got faster - 88.1% of transfers were instant, increasing by 3.1 percentage points. This was driven by the Hungarian national bank pushing banks to allow larger transfers to be processed instantly.

In New Zealand, the banking system also changed to allow transfers under 10,000 NZD to be paid out every day, instead of only working days. This means transfers made to NZD over the weekend won't have to wait until Monday to be paid out.

Finally, we've been working hard to make 70% of USD payouts instant. Our partnership with JP Morgan has enabled us to make payouts to Chase accounts instant, resulting in 13% of all USD payouts taking less than a minute. We're also collaborating with another partner to support instant payouts for customers whose banks participate in the Real-Time Payment network. This could potentially make 44% more payouts instant, providing maximum ease at full speed.

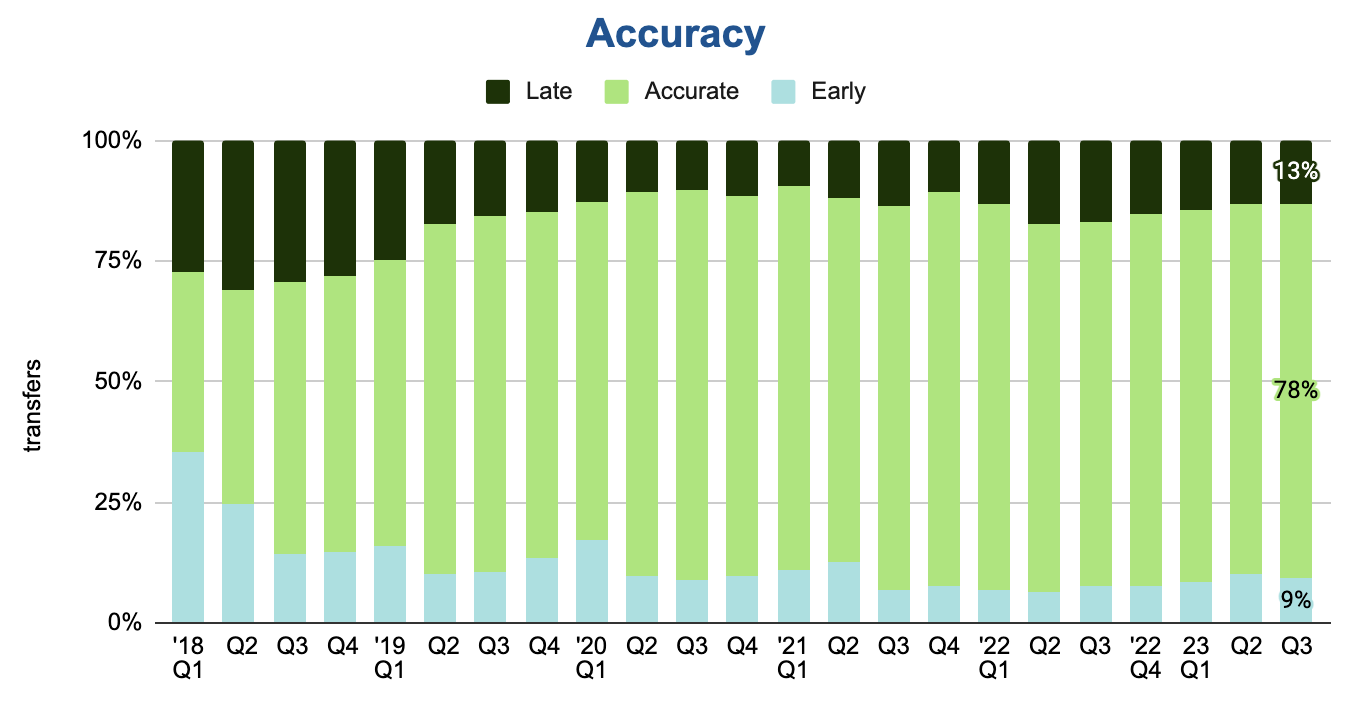

While speed is crucial, we understand that it’s also important that your money arrives when we say it will. We're glad to say 1% more transfers were on time in Q3, compared to Q2. Here's how we've improved accuracy and what's on the horizon for Q4:

One significant improvement came from reducing instant transfer delays by 17.7%, with the number of instant transfers being delayed dropping from 1.64 million in July to 1.35 million in August. This achievement was largely due to improving the performance of our screening processes, especially in the areas of fraud and anti-money laundering (AML).

In Q3, we did face some challenges, particularly sending money to AUD, where we saw instant transfer rates drop from 34.7% to 29.3%. The root cause of this was technical issues on our banking partner side. We're working with them to fix this.

As we move into Q4, we are addressing delays in certain currencies like Pakistani Rupee (PKR) and Indian Rupee (INR), which were affected by payout issues earlier this year.

We’re all about maximum ease at full speed, and our Q3 progress has laid the groundwork for an even faster Q4 and beyond - making sure that your money reaches its destination quickly and reliably.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it)...

Our average price changed from 0.65% to 0.66% in Q2. Overall, this quarter we 😞Increased fees on sending money from EUR, CHF, HUF, MYR, SEK, RON, BGN, HKD,...