Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it) by looking at how many of you call in support.

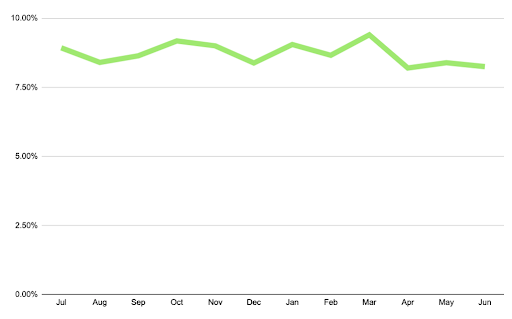

The good news is that in Q2 2023, even less of you had to contact us. In fact, only 8% compared to the 10% we had in Q1. That’s the lowest we’ve ever been in the last 3 years.

You talked and we improved, focussing on 3 key problem areas:

Over the last year, we’ve had to put in more checks to protect your money. But that’s not always been convenient, especially when we’ve had to ask you for more information. In the last 3 months, we’ve worked hard to make this experience a little more straightforward. For example, it’s now much clearer in the app if we need more information to reactivate your account. And it’s worked, reducing the number of you needing support by 7%.

When it comes to ordering a Wise card, we realised there were often a lot of questions. And we’ve answered some of those by making it clear what you need to do to get a Wise card and where it is once you’ve ordered it. This has reduced the number of you needing help by 11%.

We’ve worked hard to improve the multiple payment methods we offer. And we’ve paid special attention to adding in PIX as a payment method, making Brazilian Real transfers even easier.

Making it easier to join Wise through our referral programme – Signing up is now smoother for those customers who are invited through the Wise referral program. We ask less questions, so you get set up faster.

Improving our registration experience – We prevent the creation and use of multiple accounts by the same individual. However this has meant that people with the same name were unable to open a Wise account. Meanwhile, those who had trouble logging in, were mistakenly creating a duplicate account and getting stuck. Behind the scenes, we’ve gotten better at figuring out whether it’s a new or duplicate account to ensure we’re not blocking new users from registering.

Better at explaining your options for holding money – We’ve made it easier to understand the different ways you can hold your money in the UK, EU and Singapore, namely by better explaining our assets and interest features.

Removed the scheduled transfer limit – Previously, you could only schedule transfers up to 3 months away - but we didn’t communicate this very well. Don’t worry, we removed this limitation and now you can schedule your transfer as far in advance as you’d like.

Improving transaction privacy – For additional privacy, you can now swipe left to hide a transaction from view in the Wise app.

Automating transfer retries in the UK – Sometimes when you make a GBP transfer, the payment is rejected because the recipient's bank is undergoing maintenance or experiencing an outage. But now, we’ll automatically attempt the transfer again as soon as the bank on the other side is ready, and we’ll keep you updated on any progress.

Keeping you informed about transfer delays – When you send money, your recipient’s bank needs to accept the transfer. Previously, we’d tell you the transfer was complete once we had sent the money from your Wise account. Now, we’ll let you know if there’s a delay on the recipient's end, so you’re always clear where your money is.

Connecting your bank account to Wise in the UK got easier – Previously we asked you to make a transfer before you were able to connect your bank account. Now you can connect anytime you like.

Helping you find recipients faster on Android and on the web – We’ll show your 5 most recent contacts upfront, allow you to give your contacts a nickname, and put your contacts and recipients into a single list. iOS coming soon.

Improving experience for Country of Residence input – You told us this screen was confusing, so we listened. And now, it’s simple.

Making it easier to submit your Proof of Address – We’re clearer about what we need, so more of your documents are now getting accepted on the first go.

Making sending money to mobile wallets even easier in Ghana and Kenya – We now accept more phone number formats, and have made it clearer which fields are optional and which are mandatory.

Fixing card order error bug – Previously, when a card order failed, a bug would show you messages intended for our own developers. But we’ve fixed it so now you only see messages meant for you.

Sharing transfer status when using WeChat in China – Now you can update your recipient on the status of your transfer. Simply click on the URL shown in WeChat to get redirected to Weixin.

Making it simpler to tell the difference between your local and international receive details – We redesigned the account details screen so it’s clearer for you to find and share the right set of account details to get paid – whether it’s a local or international payment.

Blocking SMS fraud – We built tools to prevent cyber criminals abusing our registration form by requesting mobile verification codes.

Automatically updating batch payment status – Have a Business account? You’ll notice that your batch payment status will automatically be updated to match the status of all the transfers within that batch.

Updating the team page for Business accounts – Newly invited team members will now show up under “Pending members” on the team page as soon as an invite is sent.

Making it instant and free to settle business payment requests – When you receive a payment request, it's now default for you to pay straight from your Wise balance since these payments are free and instant.

Create and find business payment requests seamlessly – We made the Request Payment form more straightforward to complete and introduced filters. You can now search for your payment requests using filters like; expiry date, paid, unpaid, expired, or cancelled.

Making it easier to find transactions that need your attention – If you’re an Approver, you can now click “See all” to view all of the transactions that require action from you - whether it’s approving direct debits, scheduling transfers, or something else.

Making spending limits for business more flexible – We’ve removed the default limit previously set by us, and now enable you to customise your own limits.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Our average price changed from 0.65% to 0.66% in Q2. Overall, this quarter we 😞Increased fees on sending money from EUR, CHF, HUF, MYR, SEK, RON, BGN, HKD,...