Wise Mission Update Q4 2018

To the Wise community,

With 4 million people on Wise moving 3 billion pounds a month we’re closer again to achieving the mission of money without borders - instant, convenient, transparent, and eventually free. As more people and businesses switch to Wise, it lets us make transfers cheaper for everyone and fuel our mission.

How much progress did we actually make on our mission in Q4 of 2018?

Price: breakthrough - EU mandates to stop hidden fees

In 2014 we demonstrated semi-naked in front of the Bank of England, showing that unlike the banks we have nothing to hide. We have been campaigning for transparency ever since. In Q4 the EU and Australia have taken critical steps to establish order in the wild west of FX markups.

The European Parliament passed a law that requires disclosure of FX markups on cross-currency transfers within the EU. The rules should come into place by Q1 2020 and help people and businesses see the full cost of what they’re really being charged.

In Australia, the Competition Commission (ACCC) has begun an inquiry into the costs of foreign exchange and how banks and other providers hide fees in exchange rate markups. Banks and other providers are being asked to demonstrate how they price international money transfers. Australia is one of the countries where the average hidden markup has steadily increased over the years as banks understood that no-one is keeping them honest.

For our customers, we continue to focus on reducing the fees we charge. When more people and businesses switch to Wise, it costs us less to make these transfers happen. In the first half of 2018 we were able to carry out many significant price cuts. In Q4 we increased our volumes, which has not (yet!) resulted in many price drops.

But we did make some progress - a new local integration in South Africa allowed us to reduce the fees on every transfer by 45 ZAR (£2.5).

We also introduced higher fees for people paying with POLi in Australia (AU$1) and with debit cards in the US. It allows us to keep this payment methods open for people, who value the convenience. It also keeps the fees down for the majority of people, who fund with cheaper options.

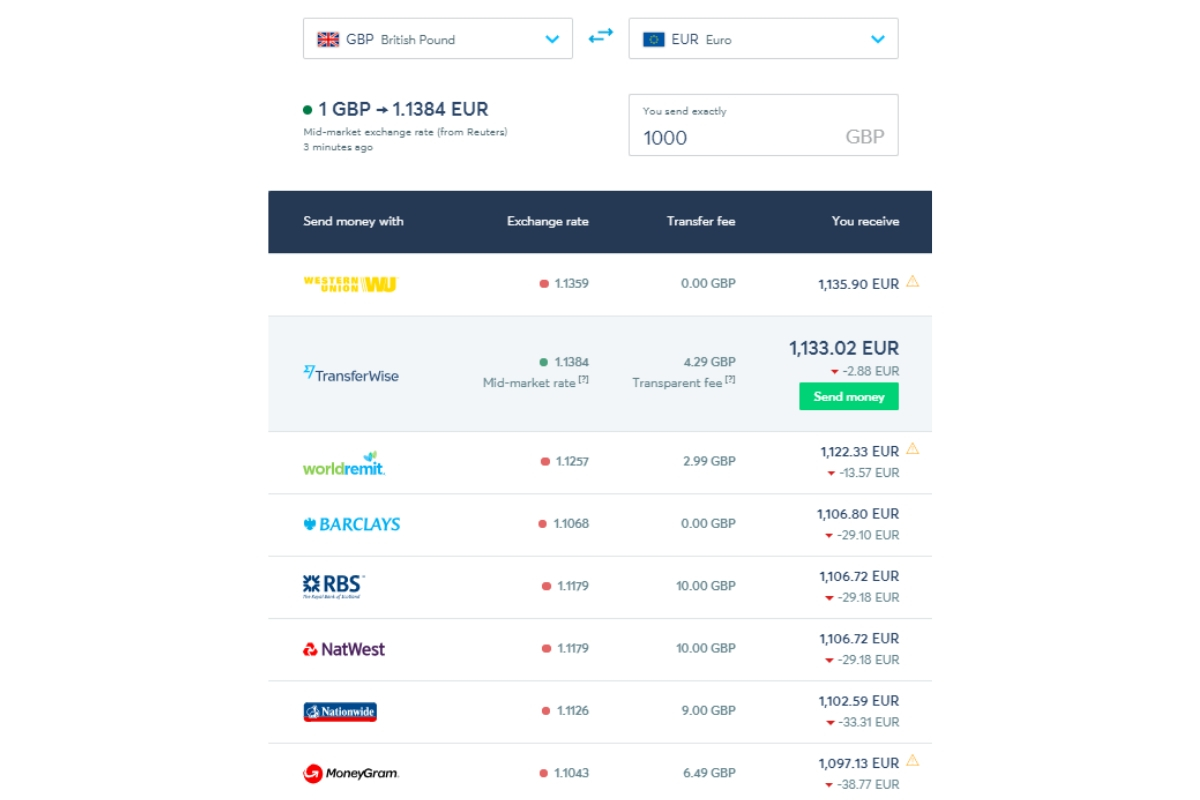

Our price comparison tool now includes Barclays, Rabobank, ING and Xoom so you can see where and how much they hide their fees in exchange rate markups. We now cover 80% of banks and currency brokers in the UK and over 30% around the world.

Speed: 14.1% of transfers delivered under 20 seconds

We reached 14.1% instant up from only 12.4% in Q3. We achieved this by connecting into the still nascent instant payment system SEPA Instant in the Eurozone. Now every 6th transfer going to a Euro bank account from Wise arrives there in under 20 seconds. The share of instant transfers will get bigger over time as more European banks connect to this new instant system.

Our new local integrations brought instant transfers to Singapore and Hong Kong. About 16% of our transfers going to our 17 Asian currencies now arrive instantly, with India receiving a big share of instant payments there.

We connected GBP balances on borderless accounts to all other UK banks over the instant system - now you can move pounds between any other UK bank and your Wise account in under 20 seconds.

An instant, sub-20 seconds international transfer feels like magic when we compare to the 3-5 business days with a bank. But it isn’t yet possible everywhere in the world, in some places the current mission is getting from “days” to “hours” and then from “hours” to “minutes”.

For example, our Brazilian users used to wait on average twice as long for their transfer to arrive, in Q4 already 10% were delivered in under 1 hour. The average in Hong Kong went from one day in Q3 to one hour in Q4.

In some places we took a step back. In Ghana we switched away from an instant payment system, just because it was down once every week. The less magical once-daily delivery works like clockwork for now.

The accuracy of estimated delivery time improved only marginally to 76% arriving within 2 hours of offered ETA, up from 75% in Q3.

Convenience: businesses get new features, but onboarding suffers

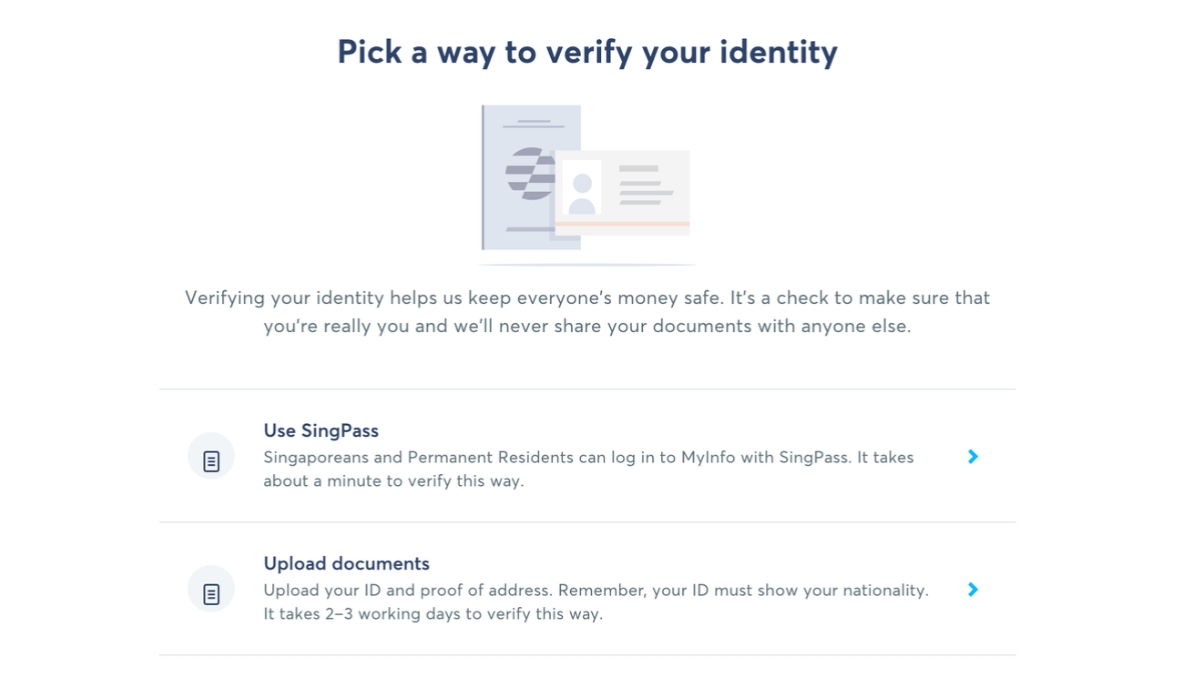

In 2016 we opened a small office in downtown Singapore, because everyone wanting to use Wise had to visit us for face to face document verification. Since then we’ve convinced the Singapore government that we can achieve the same or better result online. Better yet, in Q4 we brought instant onboarding to Singaporeans, in collaboration with the government data service MyInfo. Across the 56 countries we operate, Singapore has in a few years become the slickest onboarding experience.

In contrast, the experience for business owners hoping to start to use Wise has worsened, even while our operational onboarding and due diligence teams are pulling long hours to deal with the demand. The queues of businesses that have to wait longer than 3 days has grown by 33% since Q3.

Our iPhone users in Eurozone, US and Singapore can now fund their transfers conveniently and instantly from Apple Pay.

Dutch users banking with the challenger bank bunq can now use Wise directly from their banking app, same as Monzo users in the UK and the N26 users in the Eurozone. Suddenly bunq became super competitive in the Netherlands, where the large banks ING, Rabobank charge their customers for their international business 2.3x more than bunq.

Thousands of businesses using Xero for accounting have connected their borderless account feed to Xero since we enabled the integration in November, making their international bookkeeping a breeze.

Over 250 software engineers are working on our mission today, but this is not enough. We opened our API to developers to build automations, features and integrations with Wise. You can sign up and take a look. You will eventually benefit from convenience, when your bank will bring Wise to you in your banking app, your accountants can make Wise payments directly from their systems and so on. Using this API, bunq (see above) was able to integrate Wise in under 7 weeks.

We issued more than 15,000 of the first business debit cards in Q4. Our users asked for these to pay for international subscriptions, hosting and travel for their businesses.

Coverage: New Zealand gets borderless

We have brought Wise to people and businesses in 56 countries, linking into local payment systems, often translating the website and apps into the local language, adhering to the rules and licensing regimes set by the local governments. Our mission will be complete, when we bring its benefits to everyone on our planet.

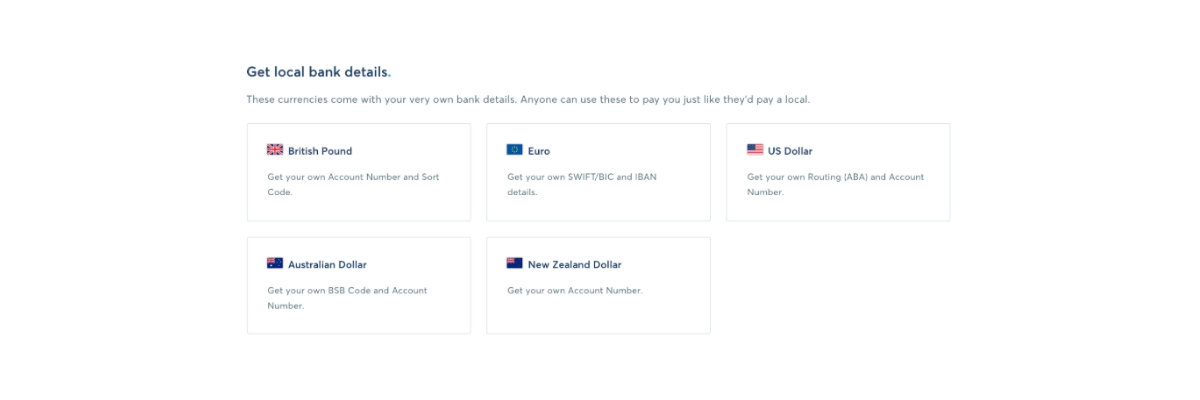

New Zealand became the 5th country after the US, UK, Germany and Australia, which gives you local account numbers on borderless. Businesses anywhere in the world can now invoice their customers with local NZ account numbers.

In Q4 we started onboarding Japanese businesses to Wise after being live in Japan for personal customers for 2 years.

Due to quirks with Mastercard, it took us a few months longer to bring the debit cards to Ireland. The first batch of 1,000 cards have been shipped to our users on the waiting list.

Help us with the mission

We have plenty of work left to do. Want to make payments easier and finance more fair for consumers and businesses all around the world?

Read about working on our mission on Glassdoor, then apply on our jobs site and join the team of 1300+ people from 71+ nationalities, working in 11 offices around the world.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.