What did the GBP team build in 2018?

How to achieve zero fees in GBP (and any other currency)

It’s no big secret that at Wise, we’re obsessed with achieving our mission of instant, convenient, fair, and eventually free payments for everyone on the planet. Reputable institutions are still charging an arm and a leg for currency conversions, and hiding their charges in a fiddled-with exchange rate. With all this going on, we’re proud to offer a significantly lower price to millions of people around the globe. That said, we still have a long journey ahead of us.

For us to truly make our mission a reality, we can’t just drop our fees to zero today. Sure, it would make a great short-term present for a lot of people, but it’d fade away as quickly as a firework. And that’s not good enough. We want low fees, forever. The only way to achieve this is by driving costs down faster than we’re lowering fees.

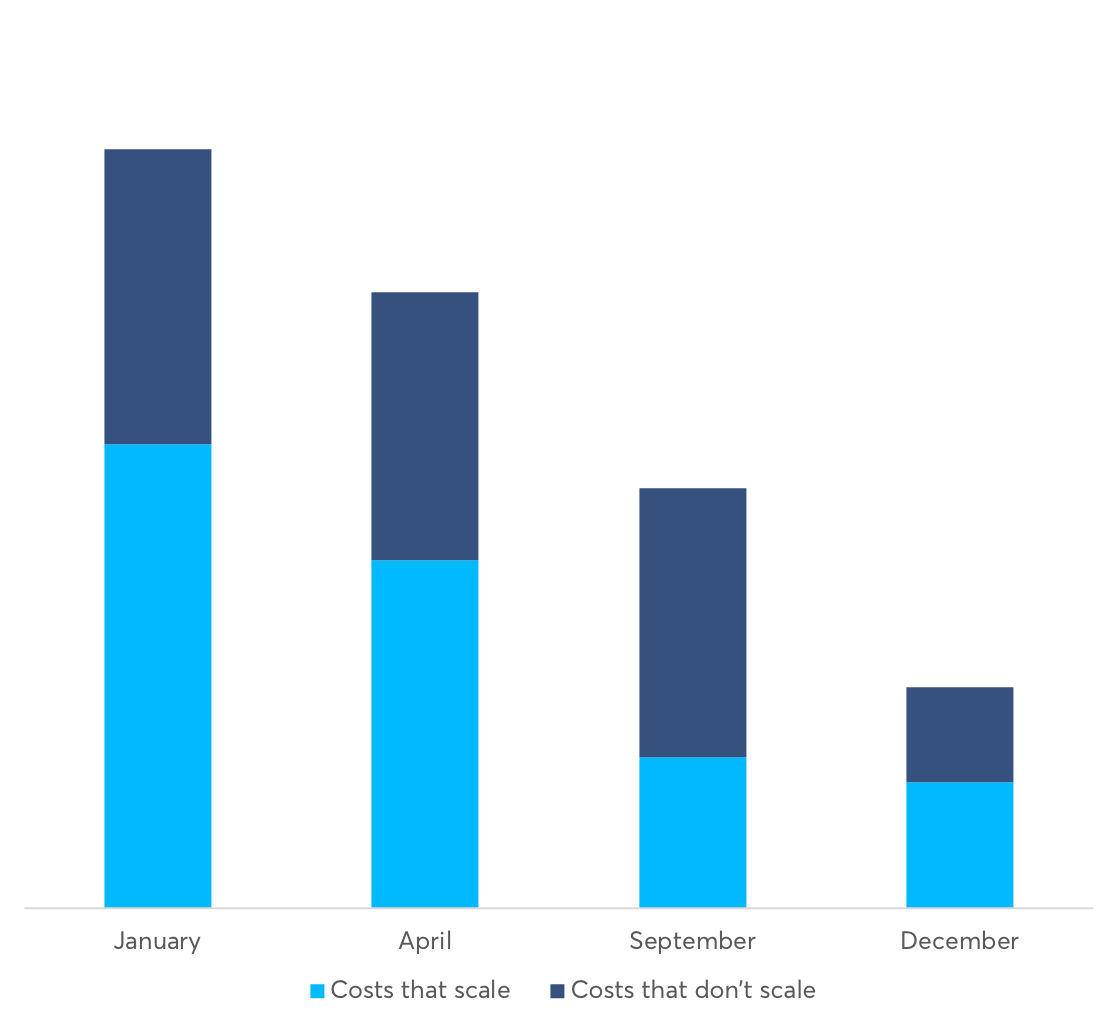

Costs that scale vs don’t scale

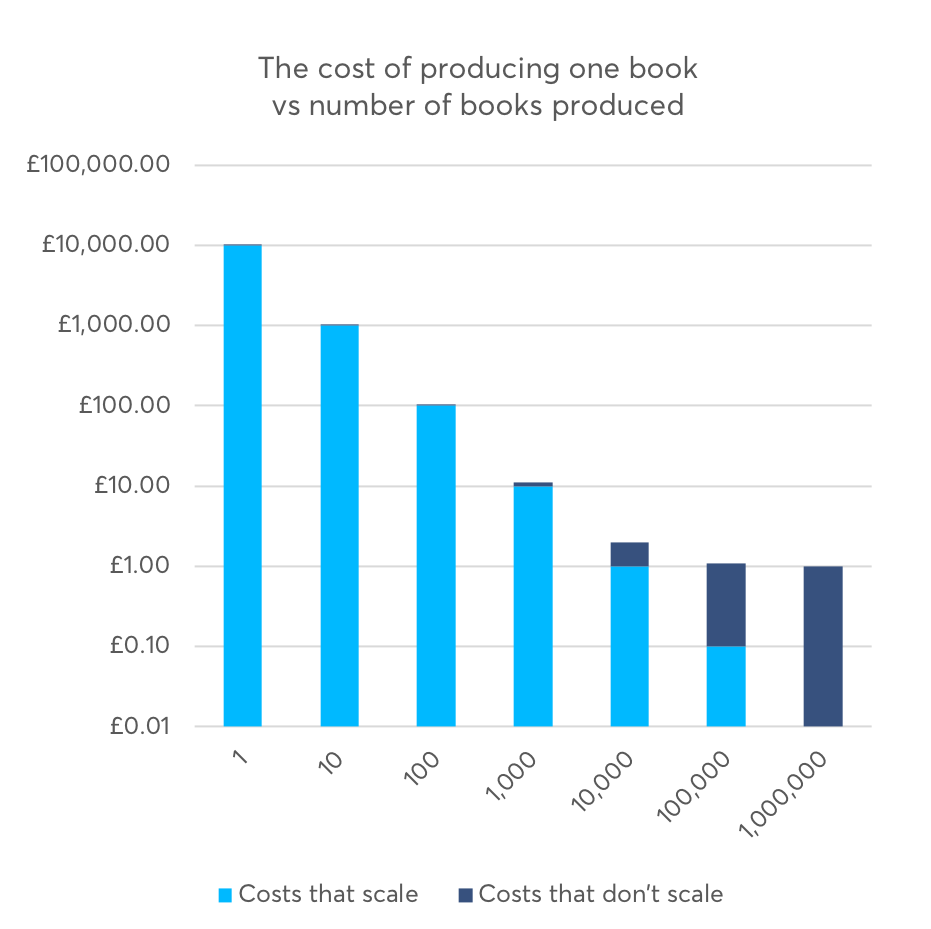

There are two types of costs associated with every transfer – costs that scale, and costs that don’t scale. To understand what “scaling” and “not scaling” mean, let’s look at a business that produces books.

In very simple terms, to print a book we need two components: machinery (a printing press with people to operate it) and raw materials (paper, cardboard, glue). Usually, machinery is very expensive, especially when you want a contraption that can produce a lot of books. Raw materials, on the other hand, are cheap. When you divide these costs per book, what’s cheap and what’s expensive is not that clear anymore – because it starts depending on the number of books produced.

Let’s assume the machinery costs £10,000 and raw materials cost £1 per book. If we only ever produce 1 book, then the cost of that book is £10,000 + £1 = £10,001, of which 99.99% is the cost of the machinery. It’s a no-brainer that you shouldn’t invest all this capital into the machinery if you only end up producing one book.

However, things get much more interesting when we decide to produce 100,000 books. The total cost then turns out to be £10,000 + 100,000 x £1 = £110,000. Thus the cost of producing one book is £110,000 / 100,000 = £1.10. Since we know that £1 is the cost of raw materials, the cost of the machinery per book has dropped from £10,000 or 99.99% of the cost when producing 1 book to only £0.10 or only 9.1% when producing 100,000 books.

Because the relative cost of the machinery drops as we grow the number of books produced, we say the cost of machinery scales. Because the cost of raw materials does not change when the number of books increases, we say the cost of raw materials does not scale.

From books to payments

As with books, Wise also has the same types of costs – ones that scale, and ones that do not. The costs that scale well are costs associated with the Wise machine — the engine that moves money automatically. The ones that don’t scale well are associated either with manual work, or with paying our partners for processing payments through their machines.

We recently learned that the majority of manual work, as mentioned above, is associated with moving money to and from other banks to Wise. We rarely do manual work if we’re moving money that’s already in Wise. In other words, if all of the world’s money moved through Wise, all payments would only be processed by machines. We’d only have costs that scale. On the flip side, almost all the costs that don’t scale have to do with people not yet using Wise, meaning we have to rely on third parties or middlemen to process our customers’ payments.

So, in order to get to free payments, we need to remove any costs that don’t scale, and have everyone processing their payments through Wise. Easy, right? Probably not, but let’s start anyway.

Let’s focus on payout costs

To devour an elephant, you need to take one bite at a time. So late last year, we decided to focus our efforts on the costs that happen every time we pay out our customers’ money in the UK, in GBP.

There are three main costs to consider here:

(1) The costs of running our machine. These costs scale well because they don’t depend on the number of transfers. 61% of the costs of each pay out.

(2) The costs that our partners charge for every transfer, also known as bank fees. These costs don’t scale well. Sometimes our partners are open to cost negotiations here. But it’s highly unlikely that they’d ever be willing to serve our customers free of charge. (24%)

(3) Manual processing costs. While some of these cost do scale, most of them don’t scale well at all. This means that as payment volumes grow, we also need to grow our team to handle them. (15%)

Costs that don’t scale well #1: bank fees.

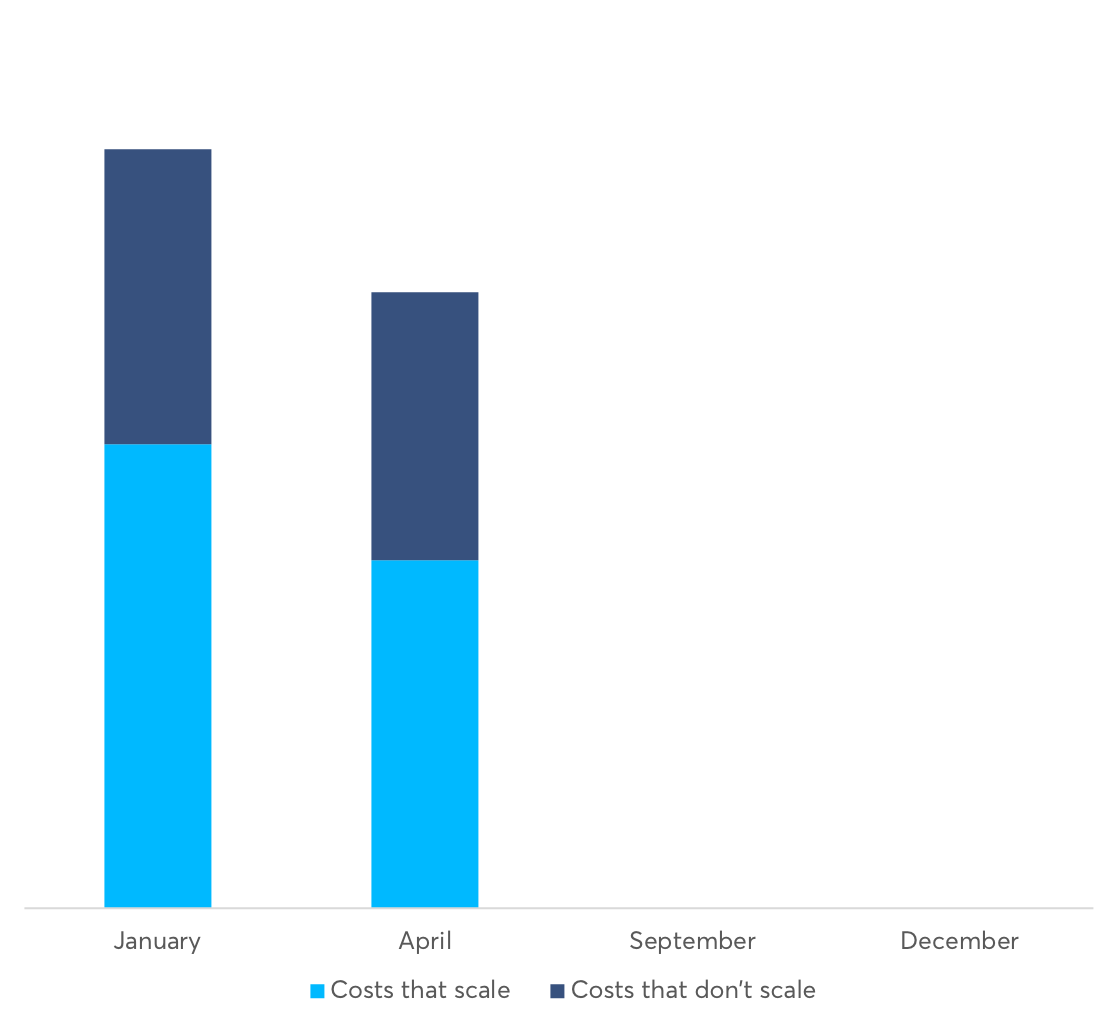

Given that this group of costs is the highest non-scaling fee we have, it seemed natural to start here. A prime opportunity arose in July 2017, when the Bank of England announced that they were opening up their settlement system to non-bank payment service providers. This meant that the UK’s non-banks could now process payments without having to rely on partner banks and, in turn, their fees.

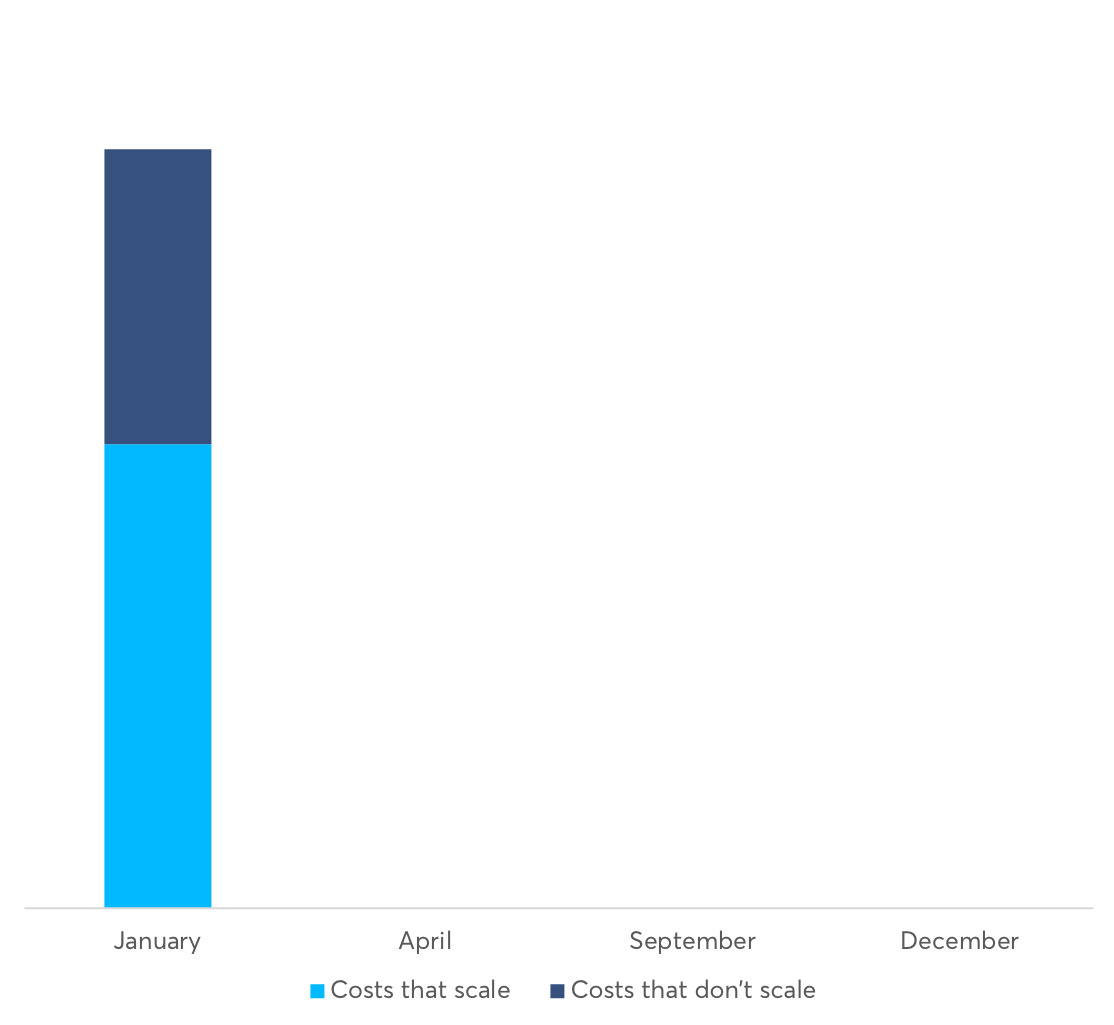

We didn’t hesitate to make the most of this. So in April 2018, Wise became the first non-bank payment service provider to join the Bank of England’s settlement system, and the first non-bank direct participant of the UK’s Faster Payments Scheme, the leading provider of instant payments in the country.

This means that we’re now in the same boat as our partner banks — we process payments direct through the Bank of England’s infrastructure. We no longer have to rely on those partner banks to process our customers’ money. In this sense, we consider partner bank fees a problem solved. For now at least.

Costs that don’t scale well #2: running our machine.

Whilst preparing for our launch with Bank of England, we spent time looking deeper into other parts of our payout costs — including the ones that we assumed would scale well. We learned something interesting.

It turns out that we paid 45% of our infrastructure cost to a single, third-party service. They provided a piece software that was key to running our connection with the Faster Payments Scheme. The industry calls it a Payments Gateway. In simple terms, it’s a program that translates payment messages between Wise and Faster Payments in a secure and consistent manner.

Upon deeper inspection, we learned that the cost of this software looked scalable, but it was actually anything but. It was fixed up to a certain volume of transfers. And should we grow beyond that volume, the cost would increase.

The GBP team’s engineers took this fact to heart. They looked into why we needed this piece of software in the first place, and eventually concluded that they had the skills to build their own version of the same software.

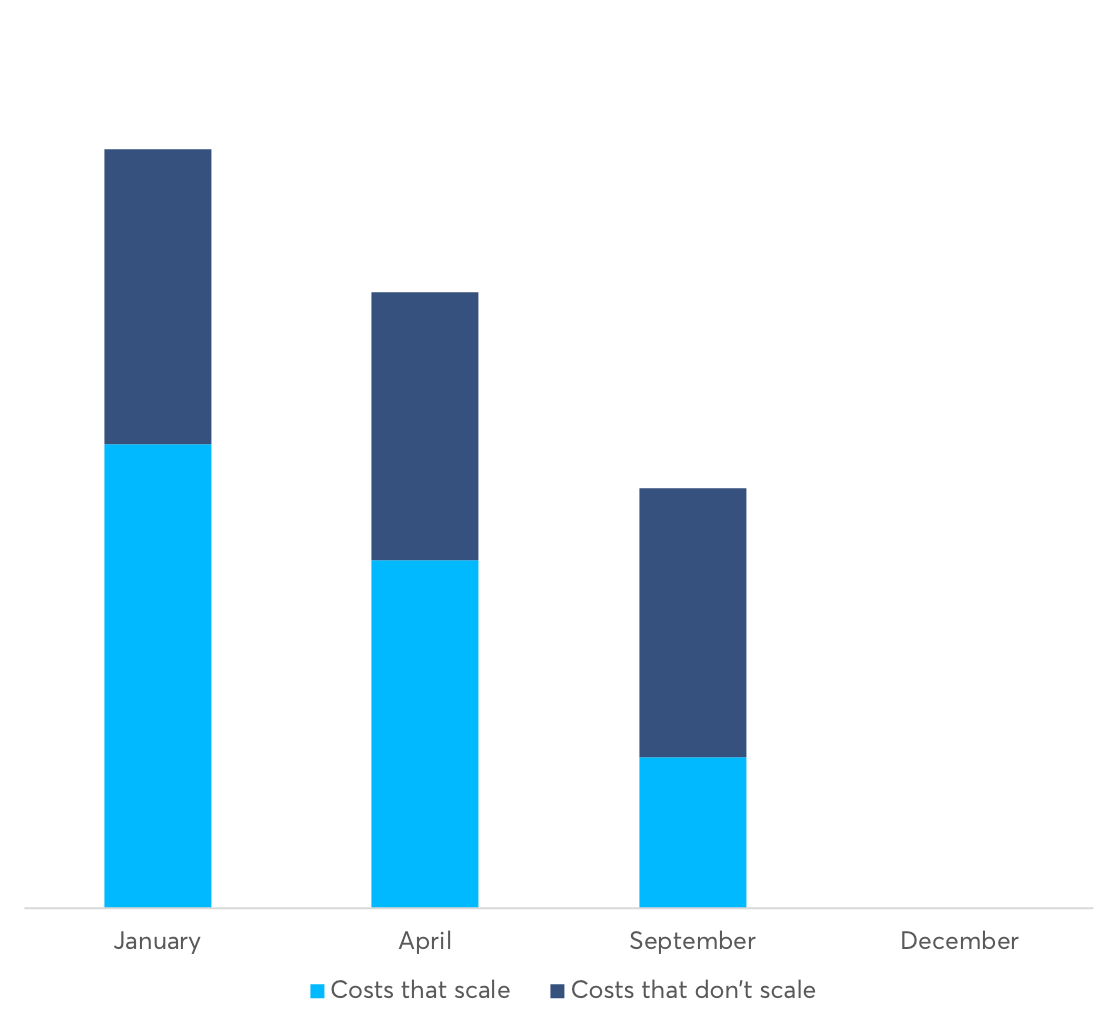

Project Stargate, as we called it, was born in parallel to our Bank of England quest. It saw daylight on September 10, 2018, when all of our UK traffic was migrated from the third party software, to our own invention. This three-hour open heart surgery was successful. And once the traffic lights went green, 45% of our fixed costs disappeared into the land of forgotten fees, at the flick of a switch.

Costs that don’t scale well #3: manual processing costs (and bank fees again!)

While our engineers were busy with Project Stargate, our dear Operations Team muscled up on their analytical skills, and decided to figure out how they could also contribute to driving down payout costs. They figured out a simple, yet clever way to understand where to look – they decided to measure where they spent their time.

Using a time measurement tool called Toggl, our operations invested one week every quarter understanding where their time was spent. Once the results were in, they split their activities into tasks that scale and tasks that do not – or in other words, the tasks we’d need more people to do if we grew payment volumes 10 times, and the tasks that could carry on as normal, regardless of how much we grew or how many people we had to work on them.

The results made it clear that our operations team’s non-scaling activities are:

-

Linking – an activity that matches incoming money with a Wise payment. The vast majority of this is automatic, of course. But there are some instances where our machine struggles to identify whose payment we’re dealing with. An instance of this could be if the name of the person sending money didn’t match a customer name.

-

Problem solving – any time we encounter any issue with a payment – for example, a business customer could be trying to set up a payment as a personal user instead of setting up a business profile – we manually intervene to help.

-

Payouts – many payout channels at Wise, including some in GBP, aren’t fully automatic. This is mostly down to limitations in our partners’ machines, and means payments are done in batches. These batch-based systems require our operations team’s manual intervention to pay out customer money.

But hold on. If we’re now directly connected to Bank of England and Faster Payments, why do we need manual batch payments?

That was exactly what our operations team asked when they looked at these results. Not only were manual payouts time consuming for the team – we were still paying expensive bank fees to a third party, even though we had a private jet to fly around with, so to speak.

Naturally, we quite quickly acted upon this learning and decided to make sure that we would use our direct connection for as many payments as we possibly could. There’s still a bit of work to be done on this front. But by December, most of our payouts used our direct Faster Payments channel. This dropped both our average bank fee component, as well as the time our operations team had to invest in payouts.

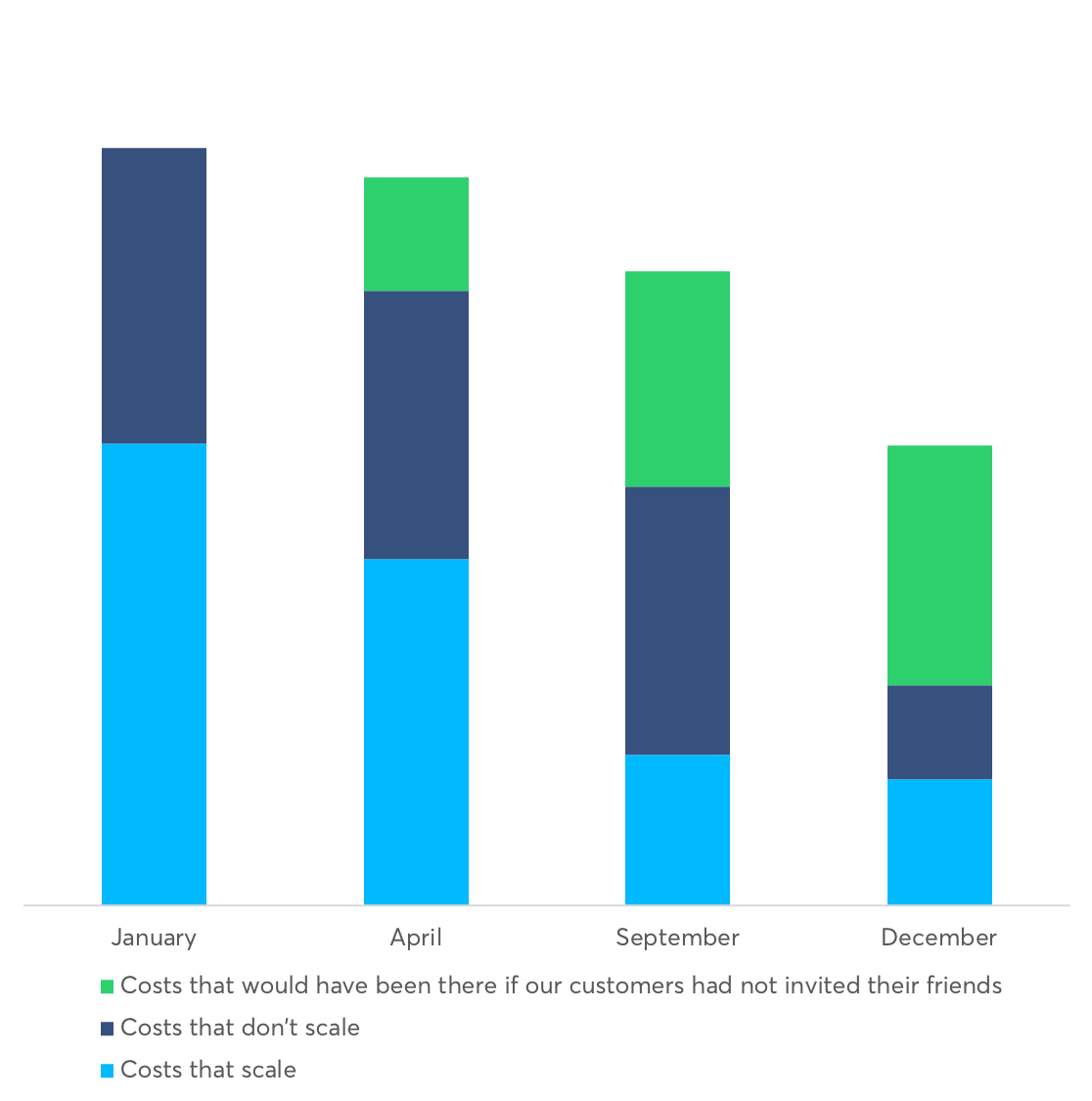

You have helped us scale!

When we look at our journey of 2018 in a nutshell, we can see a downward pressure on GBP payout costs due to different forces, many of which have been mentioned above in the form of active cost cutting. But there’s one more factor that we haven’t talked about yet – you.

Whilst we’ve been busy removing costs that don’t scale, you’ve actually helped us remove costs that do scale. You’ve done this by choosing to use Wise instead of your bank or a different service provider. Any time you’ve invited a friend, a business partner, a sibling, or that funky looking lady from the conference, you’ve contributed to our joint mission of instant, convenient, fair and eventually free payments.

As we continue to chip away at the costs that don’t scale, we need your help more than ever. The more payments that go through Wise, the smaller the share of the costs each payment has to carry. And that makes the service cheaper for everyone.

If they’re still undecided, you can make it easier for them by giving them their first payment with Wise free of charge.

What’s next?

2019 will mean an even more challenging year for us than 2018 ever was. Each additional cent that we remove from our costs naturally becomes increasingly more difficult. But the fruits of victory will taste sweeter than ever when we do reach these moments.

In late 2017 and in 2018 our cost reduction efforts resulted in a significant price drop for our UK customers and our customers in other regions. Whilst occasionally, due to our strong belief that every customer should pay their fair share of the cost, we may adjust some of our prices higher than they used to be, every person that walks through our office doors every morning does so to make sure that our mission of eventually free payments actually becomes an unquestionable reality.

It’s literally 7:48AM as we’re finishing up writing these words. This type of passion is the raw fuel that gives energy to the GBP team to continue to work hard for you. We will not stop until our efforts yield a better product, either by becoming more useful through new features – or by reducing costs enough that we can follow up with another price drop.

Until then, we wish you happy upcoming holidays and a wonderful new year!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.