Canada Tax Codes Explained - Guide for UK Employers

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Welcome to our guide to invoicing an Irish company from the UK. Since the UK left the EU, you might be wondering how invoicing and getting paid by EU and EEA clients now works.

We’ll cover questions like: what currency does Southern Ireland (Republic of Ireland) use for invoicing? Do you charge VAT on sales to Southern Ireland (Republic of Ireland)? And how does the process of invoicing an Irish company from the UK work?

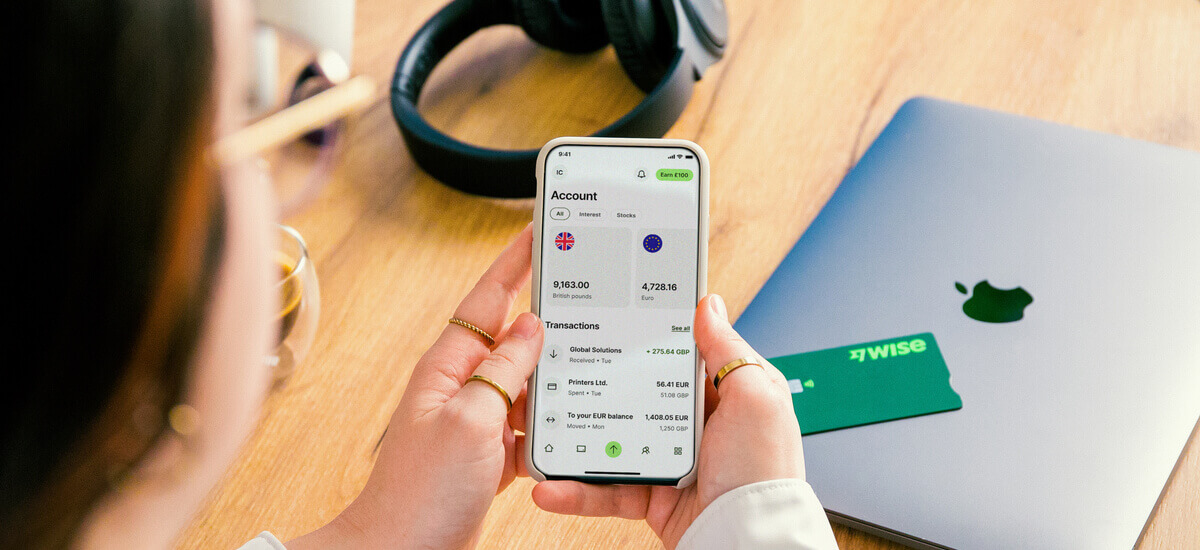

Plus, to make it easier for your business to get paid by Irish companies and customers, we’ll touch on Wise Business which offers an easy to use international account with low fees and the mid-market exchange rate.

💡 Learn more about Wise Business

As a close neighbour with strong cultural links, the Republic of Ireland is a major trading partner with the UK. Trade between the countries accounts for about 5% of total UK trade annually, making Ireland the UK’s 5th most important trading partner globally¹.

Goods are actively traded from the UK to Ireland and vice versa, with over 37,000 UK businesses registered as exporting to Ireland. Commonly traded goods include medicines, chemicals, and pharmaceutical goods, with consumer manufacturing also playing an important role. If you’re a UK business involved in exporting to Ireland in any of these sectors - or indeed, in any other field - you’ll need to figure out how to invoice Irish companies from the UK.

Preparing overseas invoices can be a little more complex than billing UK customers. Laws and conventions aren’t necessarily the same, and you’ll also need to consider the currency you need to bill in. As the Republic of Ireland is in the EU you’ll also need to bear in mind how EU rules impact invoicing, including the use of e-invoicing for public procurement and some sectors like energy and water².

This guide walks through the basics of invoicing an Irish company from the UK. You can also learn more about invoicing EU customers as a UK business in our handy full guide.

When you invoice an Irish customer you’ll need to take into consideration the laws and conventions in Ireland and in the broader EU to make sure your invoices are legally compliant.

Irish invoices are usually expected to include the following information³:

- Date of issue, and a unique invoice number

- Name and address for supplier and customer, plus any relevant business registration information

- Quantity, type and price of goods or services supplied

- Any relevant VAT information

- If the billing currency is not EUR, the cost in EUR using the Irish Central bank selling rate on the date of invoicing

Some other details may be needed if you’re selling to the government or involved in public procurement, or if your business is EU registered for example. Double check all the relevant details before you prepare your invoice to make sure your customer can pay you easily.

| Get a full guide on how to create payment terms on invoices |

|---|

The local currency of the Republic of Ireland is the Euro. If you’re invoicing a business in Southern Ireland, it’s likely to be most convenient to have your customer pay you in EUR.

You can open an international business account from a provider like Wise Business to make it easy for your client to send you payments. Just add your local EUR account details which come with your Wise account to have customers pay your company in euros quickly and easily, with no charge to you.

Once you have euros in your account you can switch back to GBP with the mid-market exchange rate or hold a EUR balance for later payments to EU based suppliers and contractors.

Get started with Wise Business 🚀

VAT (Value Added Tax) is imposed on certain goods or services when they’re supplied to or consumed in the UK. When you export goods you may be able to zero rate the VAT which applies to your goods, depending on the exact circumstances. This system is used where items would usually be subject to VAT, but because they’ll not be consumed in the UK the VAT can be applied at a percentage rate of zero⁴.

If you’re exporting from the UK you’ll need to get guidance on whether or not you can zero rate your invoices for VAT. It’s helpful to note upfront that the arrangements for exporting to the Republic of Ireland or elsewhere in the EU from Northern Ireland may differ from that applied if you’re exporting from elsewhere in the UK.

VAT rules can vary, which means it’s crucial to double check all the rules for your specific situation. Unless otherwise noted, this guide refers to export from Great Britain rather than from Northern Ireland.

If you’re not sure about how to charge VAT on goods or services being traded between the UK and Ireland you’ll need to get some professional advice to make sure you’re not falling foul of the law.

In both jurisdictions there are times when you will need to charge VAT, and mechanisms for reducing or waiving VAT paid in some circumstances. In the UK, if you’re importing services from Ireland you might be able to account for VAT through a reverse charge⁵ for example, while Irish businesses might use a call off stock process⁶ if they’re planning on exporting goods to another EU member state.

As the scenarios in which these rules apply can be somewhat complex, ask a customer agent or shipping service to help you navigate your own import or export obligations.

Check out Wise Business for easy ways to get paid by customers in the Republic of Ireland.

Open a Wise Business account online or in the Wise app, to hold and exchange 40+ currencies and get local account details to get paid in foreign currencies like Euros and US dollars just as easily as you do in pounds.

Add your account details in EUR to your Irish invoices, and your customer can make a payment on their local currency with no charge to you to receive the money to your Wise Business account. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Wise Business account have no ongoing fees or minimum balances, making them a low cost and convenient way to invoice in Ireland and beyond.

Get started with Wise Business 🚀

Invoicing Irish customers is a little more complicated than billing a UK customer - but it doesn’t have to be a headache with Wise Business. Use this guide to get all the basics - and get individual support from an import/export agent if you need it. And when it’s time to get paid, use Wise for easy and cheap ways to receive euros and other currencies from customers around the world.

Sources used in this article:

Sources last checked March 27, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Looking to scale your business in Scotland? Check out this guide to business grants in Scotland from start up funding to government business grants and more.

Seeking funding for your business? This guide signposts what grants are available for small businesses in the UK and tips to help ensure application success.

Looking to scale with a business grant? This guide outlines opportunities for business grants in Wales - from start up funding to Welsh government grants.

If you’re a UK employer with employees in Germany, check out our guide on German tax codes. Learn about tax laws in Germany, income tax brackets and more.

Considering starting a business in Croatia? Read this guide on Croatia company registration. Learn how Wise could help you save when doing business in Croatia.