Canada Tax Codes Explained - Guide for UK Employers

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Foreign currency account is essential, especially for business owners. A foreign currency account enables you to access and receive payment from international clients outside your continent and country without stress or having to break a sweat.

In this article, we will look at the importance of a foreign currency account, how and where to open one.

Foreign currency account is also called a borderless account, as country borders or laws do not limit it. A foreign account allows you to easily receive, send and hold money in different currencies. For a lot of consumers and businesses, having a foreign currency account with a bank is luxury as it's both expensive and only a few qualify to have it.

The major cost of a foreign currency account comes from the international transactions that you send and receive, and the currency exchanges you make. It is not a secret that most banks’ exchange rates and international transfer fees are not the cheapest. An international transfer alone can cost 3% - 6% on fees plus a receiving fee charged by the recipient’s bank. This is why a lot of people are switching to alternative solutions like Wise.

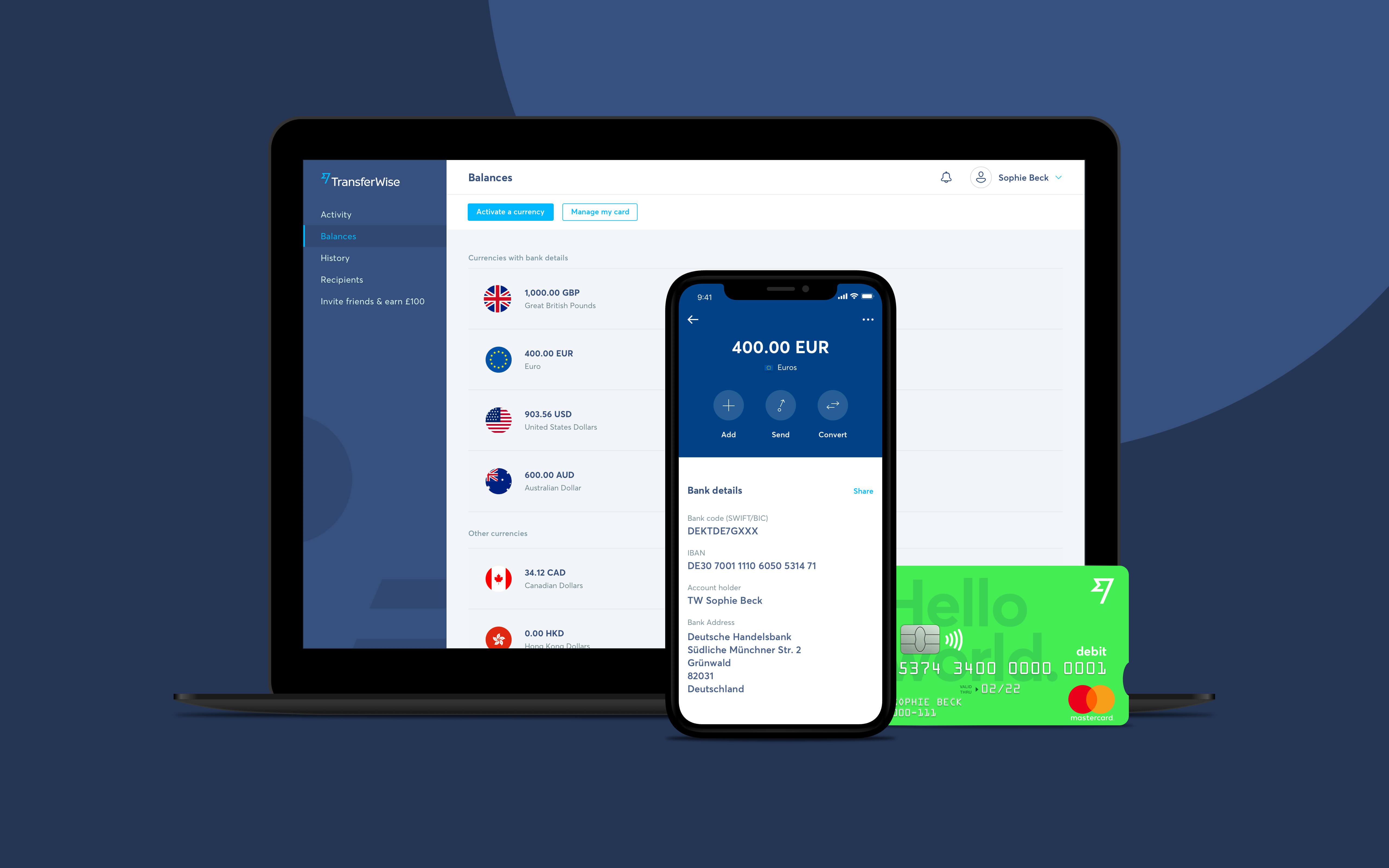

Wise offers a multi-currency account without borders that supports all capabilities and more of a foreign currency account. International transactions are optimised so that the total fees can be reduced to 0.75% on average. This means saving over 5% on foreign transaction fees.

A foreign currency account can be used for both personal and business needs. For a regular consumer, having a foreign currency account can come in handy when traveling which helps them hold money in the local currency of the country they’re travelling to. It’s also quite useful for making purchases and paying for subscriptions in different currencies.

However, a foreign currency account is specially useful for business as they deal with payments and receivables in different currencies. This includes paying overseas vendors and suppliers and receiving payments from clients. With a foreign currency account, businesses can bill their customers in their local currency which brings convenience to their customers, thus more sale. The account also avoids having to open local bank accounts in different countries as the available currencies can be managed all in one local bank account.

It also helps reduce currency risks as you can easily convert between currencies whenever you want in order to protect your money. However, to fully take advantage of this benefit, you need to choose the right bank/provider who will convert your money at a reasonable price so you won’t end up paying more on exchange rate mark-up and hidden fees.

One of the peculiarities of a foreign currency account is that it affords you a benefit of a streamlined transaction, allowing you to avoid the some charges associated with conversion rates. Switching currencies just got as easy as it can be; however, not every currency is allowed in a foreign currency account. Most banks only offer these currencies:

Aside from the fact that a foreign currency account can save you stress, money, and time. Like any other financial account, they are not exempted from risks. Below are the advantages and disadvantages of foreign currency accounts.

Pros

Cons

Opening a foreign account is not so different from the typical bank account; you will need your details, financial information, other government-issued ID, or international passport. You can do this online or through a bank branch. However, some banks may require you to be physically present in the branch but some operate fully online. Many banks all over the world allow people to open a foreign currency account, and if you are not sure of which to use, you can ask your friends or family for a recommendation. Here are the names of banks that provide foreign currency accounts:

You may begin the opening process online or contact any of their representatives to get your international bank account opened right away.

Quite a lot of distinctive features exist for foreign currency accounts, as it is more preferable to a regular bank account, whether for personal needs or business needs. If you have any difficulty settling for any international bank account, a little research may be helpful.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Looking to scale your business in Scotland? Check out this guide to business grants in Scotland from start up funding to government business grants and more.

Seeking funding for your business? This guide signposts what grants are available for small businesses in the UK and tips to help ensure application success.

Looking to scale with a business grant? This guide outlines opportunities for business grants in Wales - from start up funding to Welsh government grants.

If you’re a UK employer with employees in Germany, check out our guide on German tax codes. Learn about tax laws in Germany, income tax brackets and more.

Considering starting a business in Croatia? Read this guide on Croatia company registration. Learn how Wise could help you save when doing business in Croatia.