A review of fees: Major routes got cheaper while some fees went up

We changed many of the fees on Wise this week. Some of you benefited as a lot of routes got cheaper, but some of you will also see an increase in some...

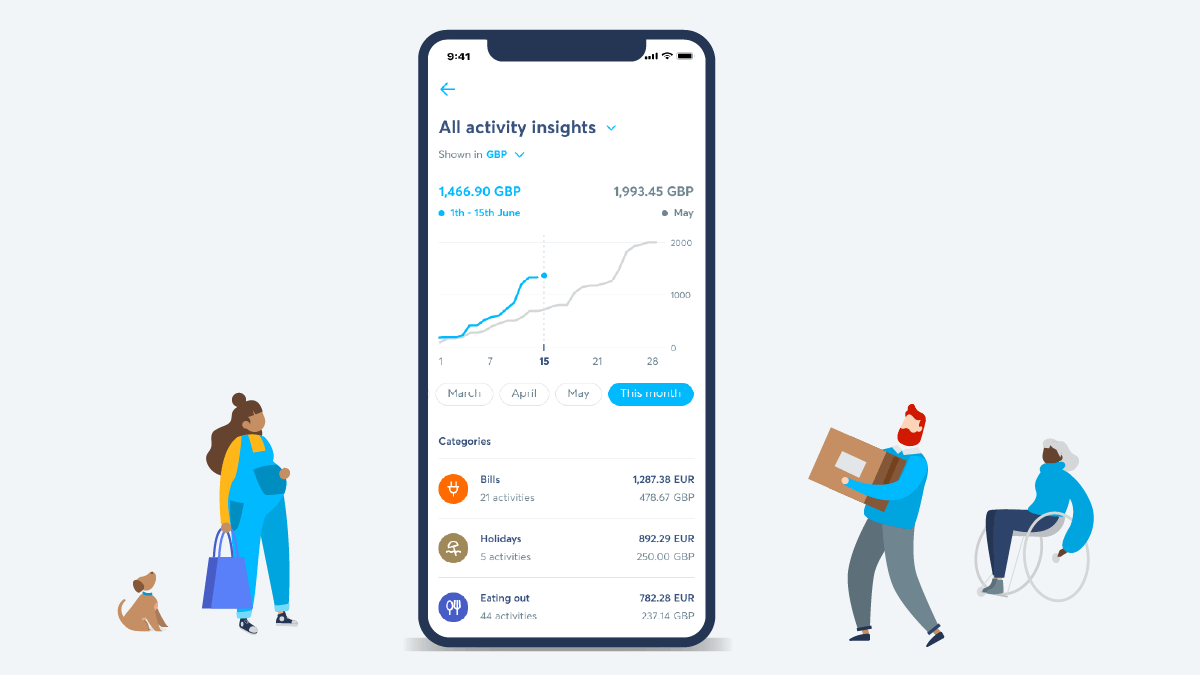

We believe in radical transparency, and not just when it comes to fees for sending money abroad. We believe your money should be clear and easy to understand too. That’s why we’ve launched categories and insights. So you can compare your sending and spending across months and categories. Because not everything needs to be viewed in isolation this 2020, especially not your money.

Your transactions will automatically be categorised into one of 15 categories: bills, eating out, education, entertainment, expenses, family and friends, general, groceries, health, holiday, income, pets, shopping, subscriptions, and transport. Phewf.

And you can always re-categorise a transaction later. Because even our auto-categorising can make mistakes.

Sometimes it’s good to reflect on months passed....not too much though. You can now look back and see where you spent, or didn’t spend, which categories you maxxed out on and which ones got less love.

As we’re big believers in money without borders, for people who live across multiple currencies, we’ve made it as easy as possible to see your spending insights by currency. That way you can actually see how much you spent in EUR or GBP or any of the 50+ currencies you can hold in your account.

This is on top of all the things you could do already, like:

Soon you’ll be able to filter your spending by where you’ve spent it — by country and by merchant. And our tech’s always getting smarter, so soon it’ll be able to remember any recategorisations you make, and mimic them for future spending.

And, of course, we’re bringing the feature to iOS, too.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We changed many of the fees on Wise this week. Some of you benefited as a lot of routes got cheaper, but some of you will also see an increase in some...

Kami meninjau biaya-biaya kami secara rutin untuk mencerminkan biaya sebenarnya dalam memindahkan uang Anda, sehingga Anda tidak perlu membayar lebih daripada...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

Hi Affiliates, Since we last updated this page, Wise has undergone some changes. We’re no longer called TransferWise, and have undergone a rebrand -...