China income tax rate for foreigners: how to calculate?

Check out how the Chinese tax system works for expats working in China. How to calculate China's individual income tax rate and corporate/business tax rate?

China provides numerous opportunities for foreigners with skills and talents looking for jobs, as well as for any foreign individuals or organizations to establish a business in China. To work in China, it is advised you have a comprehensive understanding of China's social credit system. How does it work? What are the penalties and rewards in the so-called Chinese social credit system? How does the system impact expats in China?

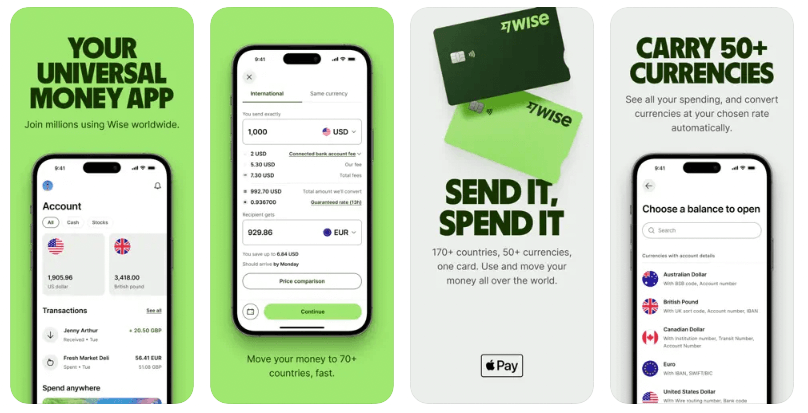

Here’s a helpful guide to the social credit system in China. What’s more, Wise, an international money transfer provider is introduced for individuals and companies to send money out of China. You can also create a Wise multi-currency account to receive, convert, and hold different currencies conveniently and affordably.

Send money home using Wise today

Unveiled in a State Council plan from 2014, China's social credit system (SCS or SoCS Chinese name: 社会信用体系) is an important part of China’s socialist market economic system and social governance system. It is based on laws, regulations, standards and contracts, and covers a network of credit records and credit infrastructure for members of society¹.

Key areas of focus in the construction of China's social credit system include political integrity, business integrity, social integrity and judicial credibility.

The system also establishes a mechanism of rewards and penalties, with the aim of improving the sense of integrity and creditworthiness of Chinese society as a whole.

China’s credit system establishes a mechanism for sharing personal credit information through the collection, collation, preservation and processing of individuals' basic information, credit information, and other information reflecting their credit status. The types of personal information handled by the credit collection system mainly include basic personal information, credit transaction information and public information².

Adverse information in a personal credit report is retained for five years from the date of termination of the adverse behaviour or event.² Positive information is an individual's credit asset and is always displayed on the credit report.

At present, there are three versions of personal credit reports,suiting the proposes of three different institutions or individuals:²

There are three ways to enquire about your social credit report²:

Fact: The Credit Reference Center of People's Bank of China merely keeps records. They do not assess personal credit. However, the personal credit record includes details regarding past-due or overdue payments as well as loan and credit card repayments over a predetermined length of time³.

The so-called “blacklist" usually refers to a bank's record of late payments or defaults on an individual's credit report, which can directly affect an individual's ability to obtain a loan from a bank, among other things. This is essentially the same as credit rating in the west.

As we previously stated, those who come to work in China on visas from other countries should pay attention to China's social credit system, as government agencies and credit granting organizations, including commercial banks, may look at your credit report.

Like Chinese citizens, foreign nationals can also check their personal credit reports at a local branch of the People's Bank of China, from the Credit Reference Centre, or online via an authorized commercial bank.

If you are a foreign company operating in China, your business will be registered as a tax-paying entity and get a corporate social credit score.

Tax authorities will collect a wide range of indicators to score and evaluate the credit level of taxpaying entities - individuals and businesses and upgrade or downgrade them according to actual measured changes.

Corporate tax credit scores are divided into four levels on a percentage basis, with grades A, B, C and D for scores of 90 or more, 70 to 90, 40 to 70 and less than 40, respectively. Grade D can also be determined by direct judgement on the basis of tax offences, e.g., evasion of tax payment, evasion of tax arrears recovery, providing false declaration materials to enjoy tax incentives, etc⁴.

For grade A credit taxpayers, the tax authorities will take the initiative to announce the list for commendation, increase the amount of special invoices and ordinary invoices on demand.

Enterprises that have been awarded grade A credit for three consecutive years will be given a green channel or specialized personnel to assist in tax matters.

Taxpayers rated as grade B credit are subject to normal management, while grade C credit taxpayers are subject to strict management.

If it is determined to be a grade D tax credit, the enterprise will be subject to strict audit and supervision in the use of invoices, export tax refund audits, and tax assessment, and the penalty for violation of the law will be higher than that of other taxpaying organizations.

The tax authorities will also notify the relevant departments of their list and recommend that they be restricted or prohibited from doing business, investment, financing, and so on.

In addition, enterprises with major tax offenses such as tax evasion, tax fraud, and tax on false invoices exceeding a certain amount will be included in the “blacklist”.

The ‘blacklisted’ enterprises will not only have their names, taxpayer identification numbers, organizational codes, registered addresses, the main facts of the violations, the legal basis for the penalties, the administrative treatment, and the administrative penalties imposed, but also the names, genders, and identification numbers of the legal representatives and the financial staff of the enterprises, as well as the information of intermediary institutions and practitioners who are directly responsible for the major tax violation cases will be made public as well.

When working or doing business in China, you will likely want to transfer earnings out of China -- in which case you can use Wise without going to a traditional physical bank.

Founded in 2011, Wise is competent and efficient in international money transfers and helping over 16 million users to send money to 160+ countries, including China -- while reducing operating time and mitigating risk. Wise not only simplifies your transaction process but ensures low fees by adopting the mid-market exchange rate.

Wise also provides money receiving, currency holding and converting service in China, and allows you to get 9 currency account details including AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY and USD. Open a Wise account today to quickly and easily send money abroad from China online! Wise also has a very convenient English app which you can download from either Apple store or Google Play.

With Wise app, you can check exchange rate changes over time and set up alerts when the exchange rate reaches a certain point that fits your interest. You can also set up repeat payments, this function is perfect if you have some transfers that need to be paid regularly, such as paying your landlord etc.

*This service is provided in partnership with a licensed third party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out how the Chinese tax system works for expats working in China. How to calculate China's individual income tax rate and corporate/business tax rate?

A popular digital payment methods in China, Alipay can be an essential for any expats in China. You might need to know how to add Alipay to Apple Pay.

There are many benefits to being a permanent resident in China. But foreigners need to meet the requirements to apply for a Chinese permanent residency.

Is there an English version of Taobao? How to change Taobao to English? Learn from this step-by-step guide plus the relationship between Ali Express and Taobao.

With our guide on how to buy from Taobao, you can easily find items you want and buy them, and find out if you can buy from Taobao directly as a foreigner.

How to open a Bank of China account as a foreigner? Here’s a complete guide with instructions how to open an account online and onsite.