Where to exchange currency without paying huge fees?

Going abroad and in need of foreign currency? In this article, we'll explore where to exchange currency - from good deals to the places you should avoid.

If you’re already a USAA®¹ customer, you may be wondering about whether there are USAA money market accounts you can use to grow your nest egg. This guide covers all there is to know. We’ll also look at Wise as a handy option if you need to move money for investments from one currency to another, with mid-market rate currency conversion, and low cost overseas payments.

A money market account can be a good way to grow your net worth, with lower risk compared to investing in the stock market, and higher rates of interest than some regular savings accounts.

However, if you’re wondering - does USAA have a money market account? - the bad news is that there’s no specific money market account from USAA available at the time of writing.

That said, there are some good alternatives to USAA money market savings account products, including²:

While there’s no USAA money market deposit account, there was a USAA money market fund, until relatively recently, when Victory Capital® acquired this part of USAA’s business³. Now you can choose money market fund products from Victory⁴, if that’s your preference - although these do have notable differences to money market accounts, which you’ll need to learn about.

As there’s no money market account on offer at the moment, there’s no live USAA money market account interest rate available. However, at the time of writing, the interest rates for other USAA savings products are as follows:

| 💡 Rates, fees and deposit requirements correct at time of writing - 21st June 2023. |

|---|

Interest rates do change frequently, so double check before you open a savings product from USAA so you have the most recent information to hand.

While there’s no current information available for the USAA money market account minimum balance, this account type usually has a relatively high minimum deposit requirement compared to other savings accounts. If you’re thinking of sticking with USAA and choosing a different savings account, you’ll need to know the minimum deposits for their live account options:

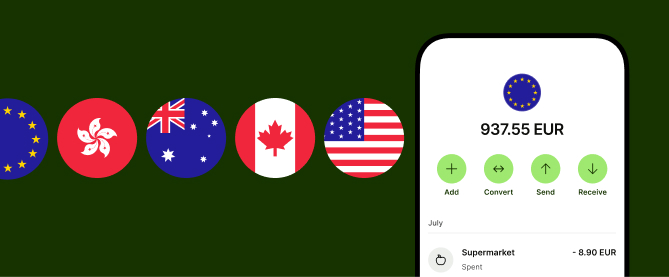

If you’re looking to save or invest in the US, but you hold money in foreign currencies, you’ll need a low cost way to switch back to USD. Meet Wise. Wise is a financial technology company specializing in low cost currency conversion, international payments and multi-currency accounts you can operate with just your phone.

With the Wise Account, you’ll get all these brilliant benefits:

It’s quick, easy and free to open a Wise Account online. And there’s even a handy Wise app, so you can manage everything from your phone.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

So, there’s no USAA money market account available at present - but you can still access money market accounts from other providers like Sallie Mae®⁵ and Discover Bank®⁶. USAA also has its own savings products which we’ve discussed earlier - or you may want to look into alternative savings vehicles like certificates of deposit if you don’t mind locking away your funds for a while.

Before you sign up for any new savings or investment product you’ll want to research the best high yield savings accounts out there, and get some independent advice if you’re unsure. And if you’re a USAA business account customer, looking for a way to make the most of your company's excess funds, you could also pick a business savings account which can help your unused capital to grow until you need it.

There’s currently no USAA money market account you can open as a new customer. However, if you need a money market account specifically, other providers do offer this product - or USAA has a few different savings options, including accounts for younger people, or for those looking to invest 10,000 USD or more.

Shop around to find the right option for you - at USAA or elsewhere - and don’t forget to take a look at Wise if you need to convert funds from overseas before you invest here in the US.

Victory Capital acquired the USAA Asset Management Company - which had previously offered money market funds - in 2019. At present Victory offers several money market funds - with performance information for each available on the Victory website.

At the time of writing, the USAA savings account with the highest available APY is the USAA Performance First. You’ll need to deposit 10,000 USD at a minimum, and the interest you can earn depends on the value of your balance.

All sources checked on 24 July 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Going abroad and in need of foreign currency? In this article, we'll explore where to exchange currency - from good deals to the places you should avoid.

In this article, explore Sentbe: Its Features and Benefits. Discover how this service streamlines transactions & check out a great alternative option.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Unlocking Nala Money Transfer: Explore this service's features and benefits in this article. Discover seamless ways & alternatives to send and receive funds.

In this article, dive into a Paysend vs Wise comparison. Discover the distinctions in features, costs & benefits of these international money transfer services.