Where to exchange currency without paying huge fees?

Going abroad and in need of foreign currency? In this article, we'll explore where to exchange currency - from good deals to the places you should avoid.

Want to send money internationally? You could use your bank, but it could be faster and cheaper with an online transfer service.

One option new to the US is SentBe. But what is it, how does it work and how much does it cost? Read on for our full SentBe review, covering everything you need to know.

We’ll also look at an alternative - Wise. You can send money worldwide with Wise, for low fees and great exchange rates.

SentBe is a financial technology company specializing in international money transfers. It’s based in Korea and launched in 2015, but only recently launched in the US early in 2023. It also serves customers in Korea, Singapore and Indonesia.

SentBe works with over 40 partners to offer its money transfer services, including remittance companies such as Moneygram and Ripple.¹

You can send money with SentBe through its website or mobile app, available for compatible Android and Apple devices.

From the US, you can send money to 50 countries worldwide.¹

As it’s newly launched in the US, SentBe’s website and customer information doesn’t yet have a lot of detail on fees and terms for US customers.

It does charge transfer fees, which are likely to vary based on how much you send, the destination and the currency.

To give you a rough idea of transfer fees with SentBe, it costs 5,000 South Korean won (approx. $3.74 USD) to send money from South Korea to the US.²

For exact costs, you’ll need to sign up with SentBe and start setting up your first transfer. You should be shown relevant fees and exchange rates in the app or online.

Although it’s tricky to find information on fees for sending money from the US, SentBe does provide details of the exchange rates it uses to convert currency.

These are available for all currencies here on the SentBe homepage.

A useful thing to note here is that looking at SentBe’s exchange rates, it’s likely to be adding a margin onto the mid-market rate. This is the rate that banks use to trade currency with each other, and is generally considered to be one of the fairest you can get.

Providers like SentBe make money from currency conversion in this way. But what it means for you is that the transfer is more expensive. Less of your money reaches your recipient.

If you want better exchange rates with no margin on top, use Wise to send money internationally. It’s a great alternative to SentBe, and could even work out cheaper.

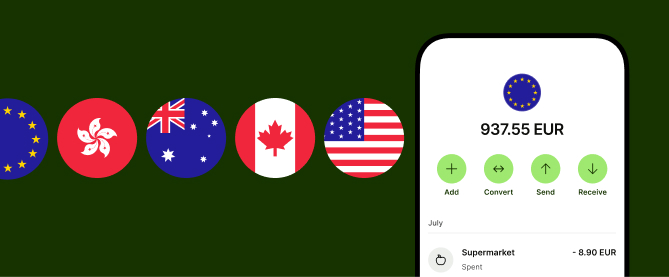

Wise is a money service business, offering a multi-currency account, international money transfer services and a debit card.

Open a Wise Account online and you’ll get all these fantastic benefits:

It’s quick, easy and free to open a Wise Account online. And there’s even a handy Wise app, so you can manage everything from your phone.

See how much you can save with Wise:

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

To send money with SentBe, you’ll need to sign up for an account on its website. Alternatively, download the app from the App Store or Google Play Store, and create an account that way.

You’ll need to verify your phone number, identity and linked bank account.

Then, you should be able to send your first transfer in just a few steps. You’ll have a choice of payment and delivery methods, and should be able to see the fees and exchange rates that will apply for your transfer.

So, is SentBe legit and safe to use? It’s a pretty new service here in the US, so it doesn’t have much of a track record you can check out. There isn’t a lot of information available on its website, and it’s not very transparent when it comes to fees or what security measures it uses.

However, this isn’t to say SentBe isn’t safe to use. You may just need to be cautious, and take steps to protect yourself when using the service. A good start is to read the terms and conditions available on the SentBe website before signing up. If unsure, stick to an established provider instead.

Good to know - SentBe is registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business.³

Also, if you use its Wallet service, your money will be federally insured by the National Credit Union Administration (NCUA) through SentBe’s partnership with Moov Financial and Veridian Credit Union.³

After reading this, you should have a better idea of what SentBe is and how it works. If you’re comfortable sending money with a relatively new company, it could work out to be a cheap and convenient way to make your transfer. Just be cautious - as you would with any kind of money app or service.

If unsure, go with a trusted name like Wise, where information on fees, exchange rates and security measures is available upfront - before you even sign up.

You can send money to Korea using your bank (although watch out - it could be expensive) or a money transfer platform like Wise, Western Union, SentBe or Remitly.

Remitly isn’t available in Korea, but you can use it in the US to send money to South Korea.

You can use a money transfer service like SentBe to send money from Korea to the Philippines. It supports transfers from South Korean won (KRW) to Philippines pesos (PHP).

A trusted online money transfer service like Wise is usually the quickest, safest and cheapest way to send money internationally - especially compared to using your bank.

Yes, Wise takes security extremely seriously. As well as being strictly regulated, Wise has the following security features:

Sources used for this article:

Sources checked on 15-Aug-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Going abroad and in need of foreign currency? In this article, we'll explore where to exchange currency - from good deals to the places you should avoid.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Unlocking Nala Money Transfer: Explore this service's features and benefits in this article. Discover seamless ways & alternatives to send and receive funds.

In this article, dive into a Paysend vs Wise comparison. Discover the distinctions in features, costs & benefits of these international money transfer services.

Exploring the PayPal Savings Account: In this article, delve into a comprehensive review. Discover insights into its features, benefits & more.