Wise ACH vs wire guide

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Moving to Australia? Catherine Treyz, writer and American abroad, breaks down 5 important tips that will help set you up for financial success.

Like many American populations abroad, it’s hard to pin down exactly how many Americans live in Australia. But recent research indicates that Australia is home to a sizeable American diaspora.

Perhaps it is the temperate climate, vast beaches, common language, and excellent healthcare that is attracting so many Americans to Australia. Whatever your reason for moving, here are 5 financial tips to make your time Down Under easy to navigate.

Australia is home to one of the world’s most well respected universal medical care systems, Medicare.

But don’t expect to have it as an American expat. If you’re on a temporary visa, you will likely have to take out a private health insurance plan.

Like most countries, no two private health plans are exactly the same. So, it will be important to research if you’re about to move or planning to switch if already in Australia. But it’s important to note that, if on a private plan and receiving treatment in a public hospital, you may have to pay for the hospital costs. In other words, in addition to budgeting for health insurance payments, leave a buffer to handle additional medical expenses.

It is almost inevitable that you will need to dip into your American savings while in Australia -- that’s where Wise can help.

When asked over social media, several American expats recommended always checking the exchange rate. One American even said she only sends money from her US accounts when the US dollar is at its highest. Theresa, a US military veteran who now calls Australia home, stresses understanding how long transfers take to occur. She said she lost out on buying a house because a money transfer took longer than expected.

“Get the details sorted!”

She continues to transfer money regularly as her retirement still goes into an American account.

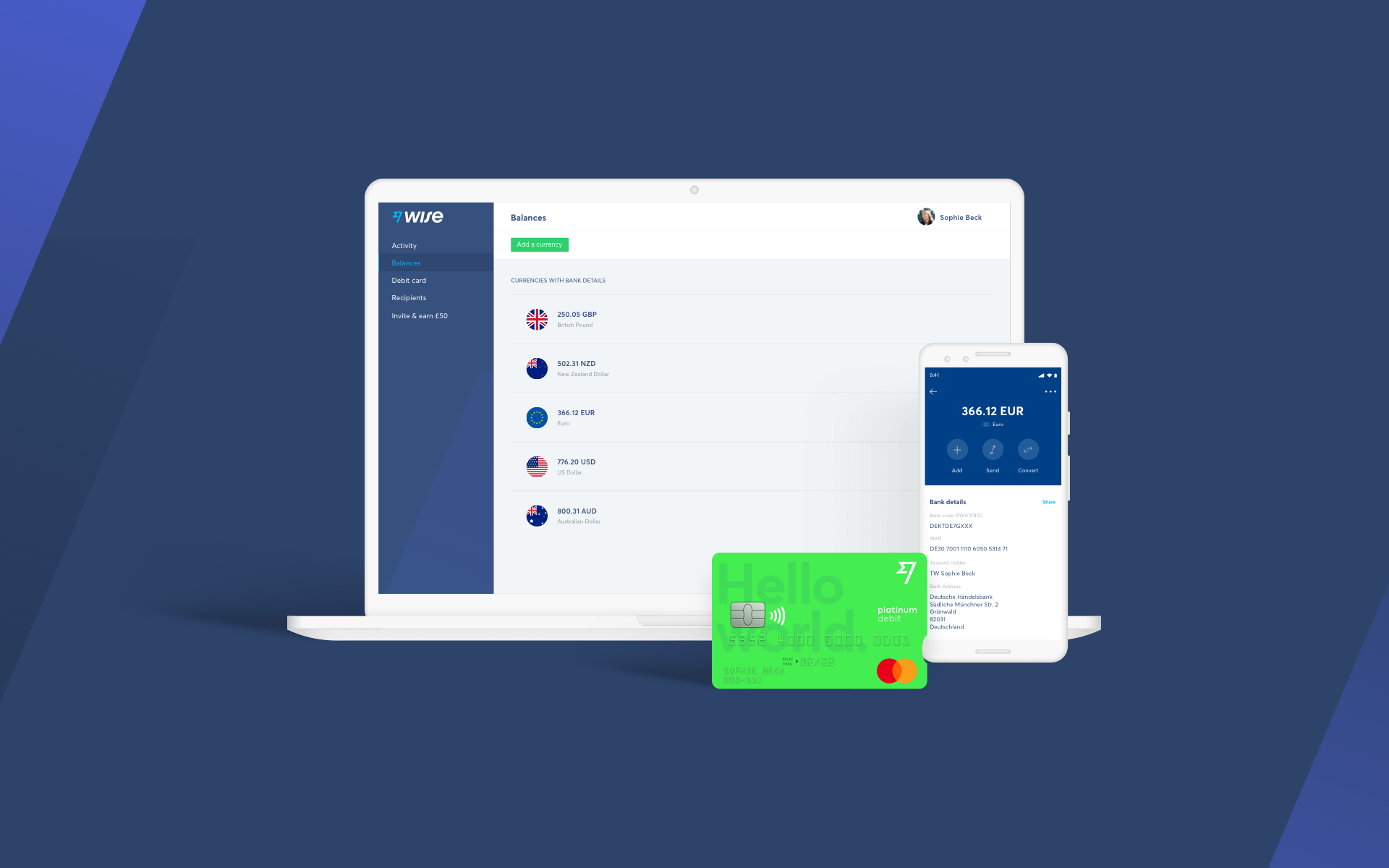

Luckily, Wise provides both an affordable and fast alternative to traditional bank transfers. All it takes is just a few clicks. Sometimes your money will even be in your Australian account faster than a Qantas flight between Sydney and Los Angeles. Wise also eliminates the hidden costs that are notoriously associated with traditional bank or wire transfers. Recently, Wise started to provide borderless accounts that allow account holders to receive and convert currencies in one spot, which may be helpful if, for example, you’re a freelancer and invoice international clients. You can also create and send your invoices by using our invoice generator, or the downloadable free invoice template in Word, PDF or Excel.

It’s difficult to address finances without talking taxes. While living in Australia, it’s highly advised to meet with a tax adviser for professional advice.

With the introduction of the Foreign Account Tax Compliance Act (FATCA), US citizens and Green Card holders living in Australia must file taxes to both American and Australian authorities. Speaking with a tax professional in the States, Australia, or both, will help you manage your taxes properly.

If you don’t file your foreign income with the US, there’s the risk of racking up expensive penalties. There are certain mechanisms in place that seek to limit double taxation, but it is still highly advised to speak with professionals on tax matters, since each individual’s situation is unique.

While cost of living differs depending on which city you’re in, Australia is an expensive place to live.

Be prepared for New York-level expensive (Wise has previously compiled a guide on living costs in Australia). So, it’s important to budget even down to your groceries.

Nina, an expat blogger in Australia, recommends becoming acquainted with stores and how and when they discount certain items. She writes in her blog:

“I know Woolworths and Coles often put their bread on sale after 7 or 8 pm, and I always look out for the sales signs.”

She also recommends scoping out local markets for even cheaper produce.

It goes without saying, but I’ll say it anyway: Australia is really far away.

Its distance from the States makes it more important than other places to strategically plan your travel home or elsewhere. Look for the best travel deals and, if possible, book them a few months in advance.

Because “Oz” is so far, you’ll also need to manage your time. Trips outside of the country will likely average a week or two.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Learn all about how the Wise card compares to no FTF ones.

Can you use a Wise Account to convert money you earn?

See how the Wise card compares with Chase Sapphire in our complete guide

Discover in detail whether your account information is visible to the recipient when you make a payment through Wise.

Not sure if Instarem or Wise is the best option for you in the US? Check our guide and find out.