Wise ACH vs wire guide

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

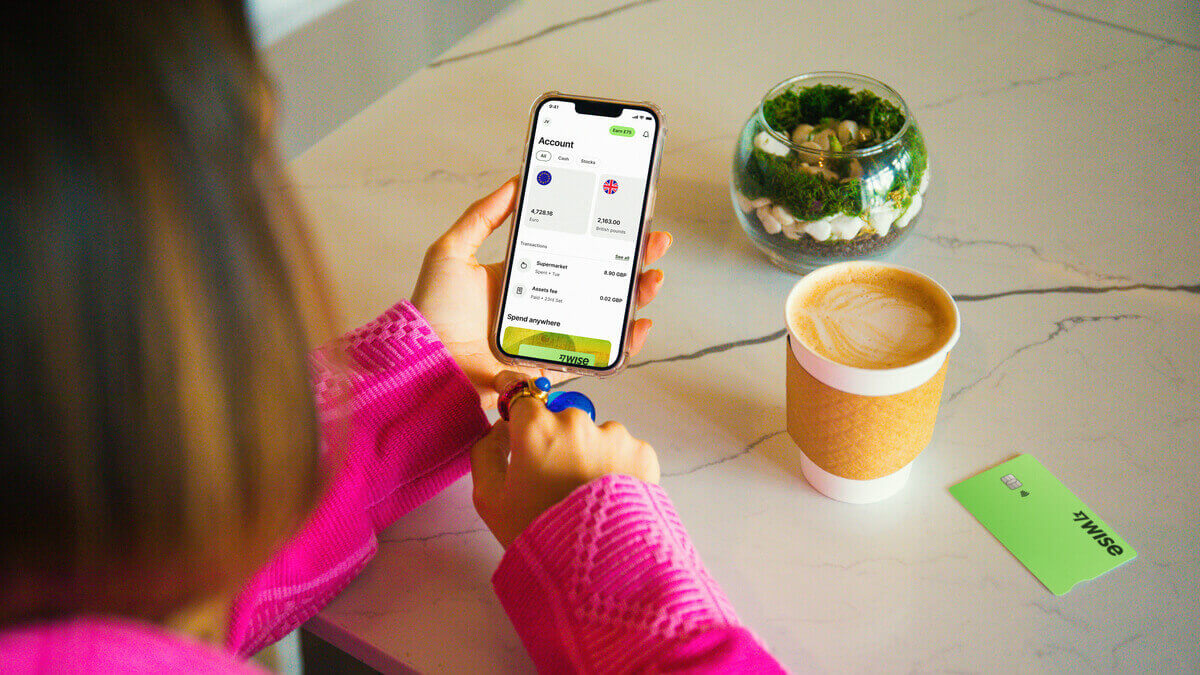

If you’ve registered a multi-currency account with Wise you can use it to send, spend, hold, exchange and receive dozens of currencies.

But with all things concerning money, it pays to be cautious - if you’re considering making a Wise payment to someone, you may be concerned about what details the recipient will see when the payment is processed.

This guide covers all you need to know, including the measures in place at Wise to keep customers, their accounts, data and money, safe.

Wise isn’t a bank - it’s a MSB (money services business). In the US, Wise is FinCEN registered, and holds a license as a money transmitter in its own name in many states. In other states and US territories, Wise operates through a partnership with Community Federal Savings Bank¹.

As a global business, Wise is also overseen by 14 other regulatory bodies¹ in different countries and regions.

So what can you do with Wise? Wise offers multi-currency accounts and international payment services to personal and business customers in the US and in many other countries and regions globally.

You can hold 40+ currencies in a Wise account, get paid with local account details in USD, GBP, EUR and other major currencies, and send money to 160+ countries for deposits to a bank or Wise Account. Currency conversion uses the mid-market rate with low fees from 0.42%*.

While Wise is not a bank, it offers lots of handy ways to manage your money day-to-day, even across currencies. It must also adhere to very strict local and global guidelines about customer privacy and security - this guide walks you through how that works.

Privacy in financial transactions is important for security and to make sure your personal and financial data is safe - as well as your money.

It’s important to be mindful that criminals around the world look for ways to get access to financial records and accounts, making it crucial to use a properly licensed and supervised provider for every transaction.

Wise complies with US Federal and State law when it comes to customer privacy - and must also follow similar guidelines everywhere else in the world it offers services. Let’s walk through some of the details.

Wise protects your personal information with all necessary measures required by Federal law. All data entered via the website or Wise app is protected.

Wise staff, and third parties working with Wise, are not allowed to use customer data for anything other than their work.

Wise collects various pieces of customer data to process a transaction, comply with law, and maintain account security.

Wise only shares information according to its privacy policy - generally when required to practically process a payment, respond to court orders or requests from credit bureaus, and to share Wise products with you.

Want to know more? Wise is transparent with its privacy policy, which is easy to understand and digest.

| You can read it in full before creating your account |

|---|

If you send money with Wise, the recipient can not see your account details. In fact, this privacy flows both ways - there are also ways you can send money to someone without needing them to share their bank details with you.

That can be easier and it means no sensitive data is shared as well.

If you want to send money to someone without getting their bank details there are a couple of options:

|

|---|

When you send money to someone with Wise they don’t see your account details. Instead they’ll see the following information:

|

|---|

In some cases you can send money to someone with just their name in your phone contacts or their email address.

Or if you’re planning on sending money using the recipient’s bank details, you’ll need to ask for:

|

|---|

Some overseas payments may need slightly different information - you’ll need an IBAN for Europe, for example, and a sort code for the UK.

Your recipient will be able to guide you on this depending on where in the world they are.

| Tips to ensure your privacy with Wise (and any other payment provider) |

|---|

|

Wise secures customer’s accounts with 2 factor authentication, and has a dedicated fraud team running automatic and manual fraud prevention protocols 24/7.

If you have money with Wise - either held as a balance in your account, or as part of a payment that’s in transit, it’ll be safeguarded by being held in leading commercial banks, separate from Wise’s own operating capital.

| Never send money to someone you don’t know and trust. Exercise caution and don’t feel pressured into making a payment if you’re unsure about it. |

|---|

Let’s walk through some final important questions about privacy and security at Wise.

Yes. While you need to exercise caution whenever you’re asked for personal or financial information, Wise is a safe, reputable and regulated provider which protects customer data according to Federal and international law.

| Read all about Wise's safety features in our guide |

|---|

Wise Accounts are protected by 2 factor authentication to make sure no individuals aside from the account owner can get access to the funds.

If you’re concerned your account has been compromised it’s important to get in touch with Wise right away to block payments and help you decide what next steps to take.

Keep in mind that, due to the way direct debits work, if you have authorized a merchant, they will be able to deduct an amount from your account.

If you’re worried about your account being compromised you can freeze any Wise cards you have in the Wise app, change your password, and get in touch with Wise.

The Wise service team will be able to investigate and help you work through what next steps are needed based on the situation.

Wise stores all financial and customer data securely, and doesn’t share payment information with the recipient. The recipient will see who sent them money, how much, the date of the payment, any reference you’ve added, and a transaction number.

The transaction number is a unique code which relates only to this payment and which can be used to identify a particular transaction if there’s ever a question about it.

Privacy is very important when making financial transactions. Keeping your account safe and secure means your money and personal data is protected.

Wise uses industry level security to protect accounts and transactions, and complies with Federal, state and international law to keep customer information safe.

If you send money with Wise, the recipient does not see your account details - making this a safe, speedy and low cost way to get your money moving.

Sources:

Sources checked on 03.19.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Learn all about how the Wise card compares to no FTF ones.

Can you use a Wise Account to convert money you earn?

See how the Wise card compares with Chase Sapphire in our complete guide

Not sure if Instarem or Wise is the best option for you in the US? Check our guide and find out.

Find the best options of getting cash from your Wise account.