Receive money from abroad in India

Learn how to find the right IFSC code for banks across India, and get a faster and cheaper way to remit money with Wise.

IFSCs (Indian Financial System Codes) are used by Indian banks to identify bank branches when processing money transfers. This means that you’ll need to use an IFSC code to transfer money to India from abroad, or from one Indian bank to another through NEFT, RTGS or IMPS networks.

The IFSC code for each bank branch is assigned by the RBI (Reserve Bank of India). You can find the right code to use on the RBI’s website, or by searching for your bank on this page.

If you’re sending money to India with Wise, all you’ll need is your recipient’s IFSC code (identifying the bank branch) and their account number (identifying the individual account).

IFSC codes are usually made up of 11 characters. The first 4 characters identify the bank the code is associated with (like State Bank of India, or ICICI Bank). The last 6 characters identify an individual branch for that bank.

Choose your bank from the list, and we’ll show you IFSC codes for its branches.

We maintain and update this list regularly, but you should always check that you have the right IFSC code with your bank or recipient. Using the wrong code might result in your payment being cancelled, or being sent to the wrong destination.

Trust us to get it where it needs to be, at the best possible exchange rate.

When sending money internationally, there are a few big things you need to look out for. Banks add hidden fees to the exchange rates they offer, often without even telling their customers. And with each bank sending your money at their own pace, who knows when it will arrive?

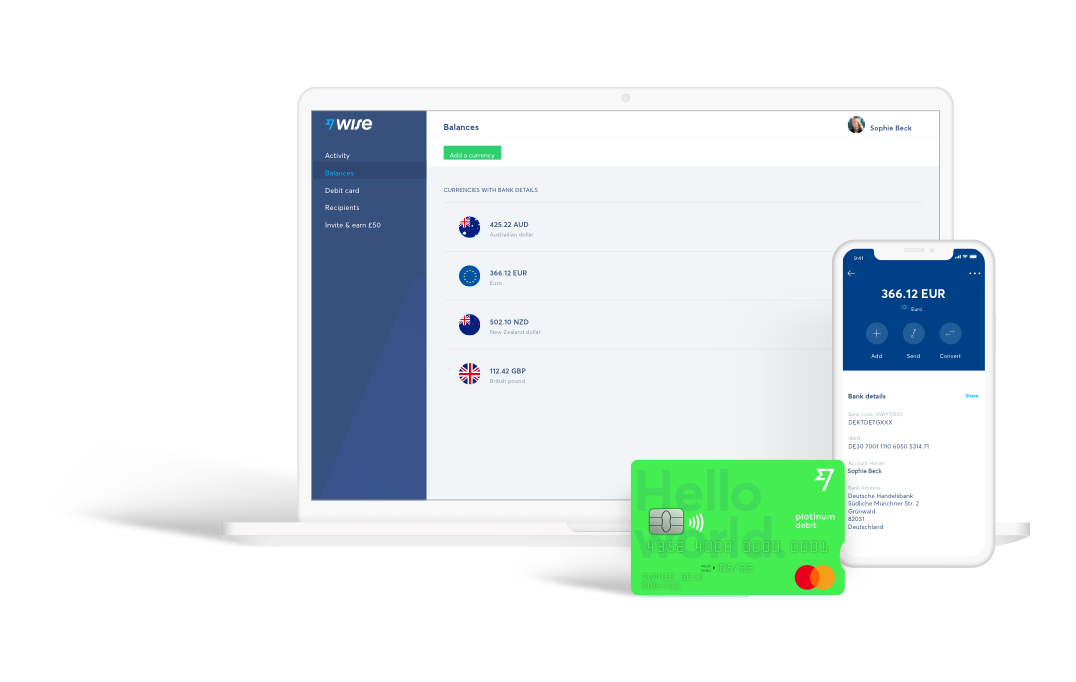

Wise gives you the real, mid-market exchange rate — the same rate you’ll see on Google, in fact. No hidden fees. No surprises. Just a much better deal. And because your money never crosses any borders, your recipient gets it sooner.

Our efficient process lets us transfer money faster and cheaper — passing the savings onto you.

Join over 5 million people who save when they send money at the real exchange rate.

| NEFT | RTGS | IMPS | |

|---|---|---|---|

Min. transaction | No limit | Rs. 2 lakh | No limit |

Max. transaction | No limit | Rs. 5 lakh | No limit |

Transaction speed | 2 hours or next day | Instant or next day | Instant |

Operational hours | Monday – Friday: 8 A.M to 6.30 P.M Saturday: 8 A.M to 12 P.M | Monday – Friday: 9 A.M to 4.30 P.M Saturday: 9 A.M to 2 P.M | 24/7 |

You can usually find your bank’s IFSC and MICR codes in your cheque book, or on the front page of your passbook. If you don’t have either of these to hand, search for your bank on this page instead.

IFSCs and MICR codes have a very similar purpose — they both help to identify individual bank branches in India. They differ in how they do this, though.

IFSCs (Indian Financial System Codes) are issued by the RBI (Reserve Bank of India) to identify bank branches within the country. Every branch has one, and you can use them when sending money online to someone in India.

MICR (Magnetic Ink Character Recognition) codes also help to identify bank branches, but they’re only used when processing cheques. These codes are machine-readable, which means that banking systems can quickly identify the destination branch when you deposit a cheque. You won’t need to use an MICR code when sending money online.