Venmo doesn’t work in Japan: Find alternatives

Venmo is not yet available in Japan - learn more, and find an alternative way to make your international payment, here.

This guide covers all you need to know about Western Union in Japan, including the Western Union rates and fees you’ll pay when sending money. We’ll also touch on an alternative service as a comparison - Wise for quick, cheap international transfers from Japan, which uses the mid-market exchange rate.

| 📝 Table of contents |

|---|

Send money with the 'real' rate

To get started with Western Union Japan you can visit their website and model the payment you want to make¹. This will show you the services available, as well as the fees and exchange rates on offer for your specific country and currency.

You might notice that Western Union is advertising a 0 JPY fee for some transfers. However, there’s likely to be a footnote alongside the headline offer - here’s what Western Union says:

“Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice.”

This means that Western Union may add a markup or margin to the exchange rate they use for your transfer. This is still a fee - but it’s harder to spot.

Let’s look at an example transfer to see what this means in practice - say you’re sending 100,000 JPY to a bank account in the Philippines:

The Western Union transfer fee you’ll pay is 0 JPY. So far, so good.

However, the Western Union exchange rate for your payment is 1 JPY = 0.4565 PHP, compared to the mid-market rate (the ‘real’ rate) of 1 JPY = 0.459617 PHP.²⁺³

If you send 100,000 JPY with the Western Union exchange rate, a recipient gets 45,653.31 PHP. But with the real rate, at that time, 100,000 JPY is worth 45,961.70 PHP.

| JPY to PHP | 100,000 JPY | Possible cost in the exchange rate | |

|---|---|---|---|

| Mid-market rate | 1 JPY = 0.459617 PHP | 45,961.70 PHP | --- |

| Western Union | 1 JPY = 0.4565 PHP | 45,653.31 PHP | 308.39 PHP |

(23:07, GMT+2, 2020 Nov 10)

The difference is because of the markup on the rate - and shows the profit Western Union makes on the payment. ‘0 JPY transfer fee’ doesn’t mean ‘no fee’.

As you can see from our example above, banks and providers often markup their exchange rates. You are paying not just transfer fees but also a markup within the exchange rates used for your transfer.

Checking transfer fees is not enough. Always compare an exchange rate offered by banks or providers with the real rate, which you can find on Google or by using an online currency converter. If there’s a difference, that probably means the provider adds a markup to their exchange rates.

The good news is that not all providers add a markup to the exchange rates they use. Meet Wise.

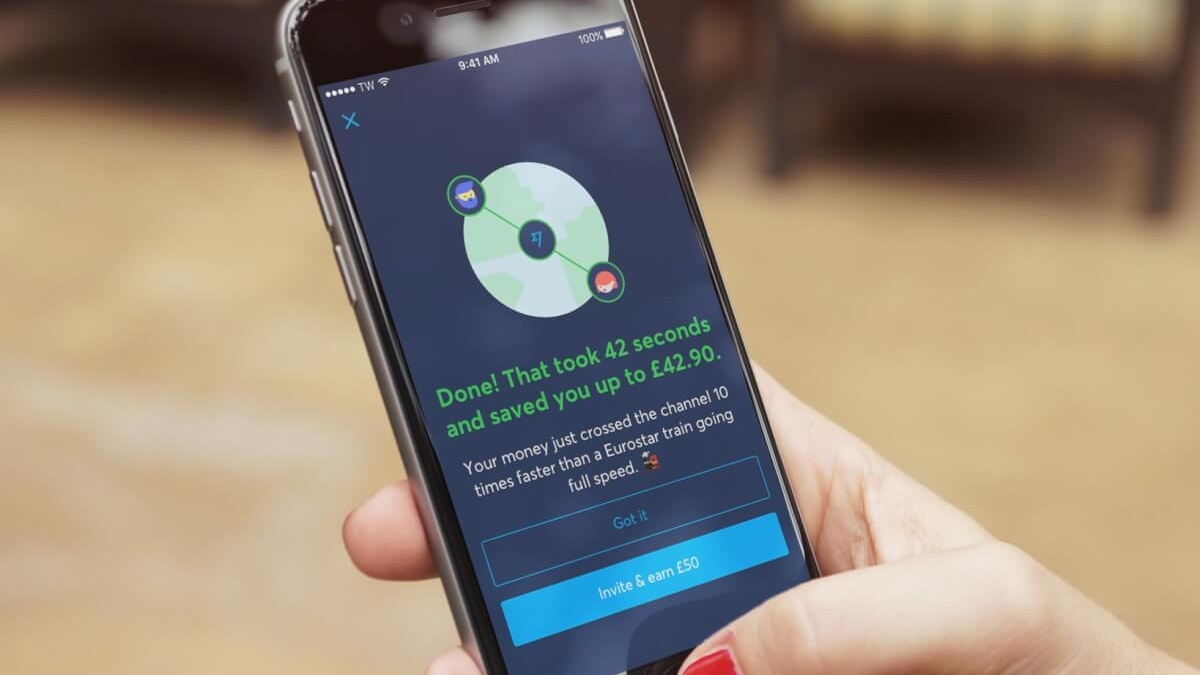

With Wise, you can send money from Japan to 60+ countries with the mid-market exchange rate without any markup. You’ll only ever pay a simple upfront charge, so you can clearly see how much your transfer costs, and what your recipient will get in the end.

To send money with Wise,

And that is it! You can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Do you also receive money from abroad to Japan? You can receive money for free to a Wise multi-currency account with the UK, US, Europe, Australia, New Zealand, and Singapore’s bank details. Just as if you had a local bank account there. You can also hold your money in 50+ different currencies, and switch it using the mid-market rate and transparent fees whenever you want to!

|

|---|

Get a free multi-currency account🚀

Let’s take a look at your options for sending money from Japan through Western Union.⁴

To send money online for the first time, you’ll need to have your identity verified.⁷

Once your identity has been checked you can make the first money transfer. However, for the second transfer you’ll need to verify your address, too. To do this:

After verifying your address your account will be up and running and ready to make more regular payments.

To send money using Western Union Japan in person at an agent location, you’ll need the following:⁸

You can find your most convenient branch or agent for Western Union Japan using the Western Union location finder tool. Search using the service function and address field, to make sure you can find an agent which offers the services you need.

When you set up an Western Union money transfer, you’ll receive a Money Transfer Control Number (MTCN). You’ll need to give this number to your recipient if they are going to collect the payment in cash. This number can also be used by both you and the recipient to track the payment online.

To see how your payment is doing, head to Western Union’s transfer tracking page[6]. Enter the MTCN and the sender's name, you’ll get an update on the expected delivery time for your transfer.

You can get in touch with Western Union Japan in the following ways:⁹

If you decide to send money with Western Union, don’t forget to take a look at the true overall costs including the exchange rate markups applied for your payment. Check out an alternative provider like Wise, which always gives you the mid-market rate and fair, upfront transfer fees.

See if you can save with Wise👀

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venmo is not yet available in Japan - learn more, and find an alternative way to make your international payment, here.

All you need to know about Smiles Remit, right here. Learn more about Smile Remit fees and rates, the documents required and processes involved.

Read before you send a GoRemit international transfer - all you need to know about GoRemit fees and the Shinsei Bank exchange rate.

All there is to know about Kyodai Remittance Japan, including the Kyodai Remittance rate and how to use the Kyodai Remittance card.

All you need to know about MoneyGram Japan international transfers including the MoneyGram fee, MoneyGram exchange rate, and send process

Read this if you’re thinking of sending a payment with Japan Remit Finance (JRF) - all you need to know about rates, fees and payment options.