How to apply for Bank of China credit card: Types, fees and features.

Bank of China credit cards guide: apply requirments, hoe to apply, how many types of credits card does Bank of China have? Key features, fees and benefits of th

More and more foreign individuals and businesses are choosing to work and invest in Shanghai. When working in or registering a company in Shanghai, opening a Shanghai bank account is advisable and Shanghai Commercial Bank is an ideal choice.. So let's explore the requirements and steps to open a Shanghai commercial bank account, as well as its various fees and charges.

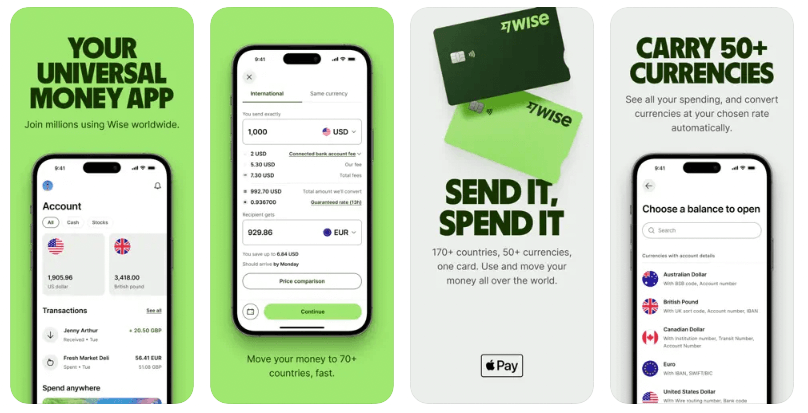

Foreign nationals in China may have been wondering about cheap and quick ways to make international transfers, while ensuring security. Wise, with is multi-currency account, is a convenient choice if you’re sending money from China or wishing to hold and convert currencies more affordably.

Send money home using Wise today

Incorporated in Hong Kong in 1950, Shanghai Commercial Bank (SCB) currently operates over 50 branches in Hong Kong, Mainland China and Overseas, with a business network spanning Hong Kong, Shanghai, Shenzhen, the United Kingdom, and the United States.

The Shanghai Commercial Bank offers a wide range of retail and commercial banking products and services, including deposits, loans, remittances, foreign currency exchange, credit cards, securities trading, international banking, insurance services, gold trading services, Renminbi (RMB) services, internet banking and mobile banking services, to meet the needs of its customers.

In the late 1990s, Shanghai Commercial Bank formed strategic partnerships with the Bank of Shanghai in mainland China and the Shanghai Commercial & Savings Bank in Taiwan to expand its business network in the Greater China region.

If opening a personal current savings account with SCB:

Note: Parents should bring their identity documents when opening an account for their children if they wish to open trust accounts.

If opening a joint current saving account with SCB:

No passbook savings accounts:

| Currencies | Minimum initial deposits amount |

|---|---|

| CNY | 100 |

| HKD | 1,000 |

| GBP | 1,000 |

| USD | 100 |

| EUR | 1,000 |

| AUD | 1,000 |

| SGD | 1,000 |

| NZD | 1,000 |

| JPY | 100,000 |

| CAD | 1,000 |

| CHF | 1,000 |

Passbook savings accounts:

| Currencies | Minimum initial deposits amount |

|---|---|

| USD | 100 |

| HKD | 100 |

Note: If you are opening another type of account with Shanghai Commercial Bank, such as a checking account, a student/child passbook savings account, a fixed deposit account, or a call deposit account, the minimum initial deposit amount may be different, click here to view.

Payment or transfer to other local banks via Quick Payment System via Corporate Online / Mobile Banking⁴:

| Services | Amount | Fees per transaction |

|---|---|---|

| Payment or transfer in HKD | HKD500,000 or below | Free |

| HKD500,000 or above and HKD1,000,000 or below | HKD5 | |

| Payment or transfer in CNY | RMB500,000 or below | Free |

| RMB500,000 or above and RMB1,000,000 or below | RMB5 |

Deposit services fees⁴:

| Categories | Unite | Fees | |

|---|---|---|---|

| Bounce (a check) | Due to insufficient savings in the account | Per card | HKD150 / RMB150 |

| Due to other reasons | Per card | HKD80 / RMB80 | |

| Autopay / Regular Funding Instruction | Create/modify automatic transfers | Per transaction | HKD50 / RMB50 |

| Processing / modifying regular allocation instruction | Per transaction | HKD50 / RMB50 | |

| Returned due to insufficient funds in the account | Per transaction | HKD150 / RMB150 | |

| Returned for other reasons | Per transaction | HKD50 / RMB50 | |

| Payment made using HKSCC Investor and returned due to insufficient funds in the account | Per transaction | HKD200 / RMB200 | |

| Unauthorised overdraft handling Fee (including temporary overdraft, overdraft and cheque credit) | Per payable date | HKD150 / RMB150 | |

| Stop payment of cheque | Instruction | Per card | HKD100 / RMB100 |

| Cancellation instruction | Per card | HKD100 / RMB100 | |

| Guaranteed Cheque | Self-insured | Per card | HKD100 / RMB100 |

| Bank guaranteed payment | Per card | HKD200 / RMB200 | |

| Cashier's cheque | To issue | Per card | HKD60 / RMB60 |

| To report lost | Per card | HKD400 / RMB400 | |

| To buyback | Per card | HKD40 / RMB40 | |

| Foreign bank payment cheque in foreign currency | Deposit cheque (for personal account only) | Per transaction | HKD50 |

| Bounced cheque (plus correspondent bank charges) | Per card | HKD80 | |

| Collection of cheques for bank payments in Shenzhen / Guangdong | HKD | Per card | HKD15 |

| USD | Per card | HKD100 | |

| Large amount of auxiliary coins deposited (Must be sorted and 100 coins or more per customer per day cumulatively) | On a cumulative basis | 2% | |

| Minimum charge | HKD50 | ||

| Deposit large amount of HKD banknotes (cumulative daily deposit of over 150 Hong HKD banknotes per customer) | On a cumulative basis | 0.25% | |

| Minimum charge | HKD75 | ||

| Deposit or withdrawal of foreign currency banknotes by T/T account | Cumulative amount per customer per day per currency transaction above the following: USD2,000 RMB15,000 JPY200,000 2,000 for other applicable currencies | On a cumulative basis | 0.25% |

| Account cancellation by the Shanghai Commercial Bank due to misuse of account | Per account | HKD150 | |

| Cancellation of account within 3 months of account opening | Per account | HKD150 | |

| Loss of passbook / seal | Per account | HKD100 |

Bank account service fees⁴:

| Categories | Unite | Fees | |

|---|---|---|---|

| ATM card | Shacom Card Annual Fee | Per card | HKD50 / RMB50 |

| Replacement of Shacom Card | Per card | HKD50 / RMB50 | |

| Withdrawal via JETCO ATMs in Macau | Per transaction | HKD25 | |

| Withdrawal via UnionPay networks worldwide | Per transaction | HKD20 / RMB15 | |

| Withdrawal via "Cirrus"/"PLUS" networks worldwide | Per transaction | HKD25 | |

| Low balance service fee | Any customer whose "Average daily combined balance" is less than HKD5,000 (or equivalent in foreign currency) | Monthly for each account | HKD60 |

Inward remittance service fees⁴:

| Categories | Unite | Fees | |

|---|---|---|---|

| Deposited in a Shanghai Commercial Bank account | Via Bank Electronic Clearing House System (CHATS) | Per transaction | HKD20 |

| Via wire transfer | Per transaction | HKD65 | |

| Transfer to other banks | Banks in Hong Kong / China / Macau / Taiwan | Per transaction | HKD220 |

| Other Overseas Banks | HKD270 |

Outward remittance service fees⁴:

| Categories | Unite | Fees | |

|---|---|---|---|

| Send wire transfer - submission to branch | HKD remittance | Remittance amount | 0.125% |

| Minimum | HKD180 | ||

| Maximum | HKD300 | ||

| Foreign currency remittance | Per transaction | HKD180 / USD23 | |

| Renminbi remittance | Per transaction | HKD180 | |

| Same day transfer to other local banks via CHATS - submission to branches | Per transaction | HKD180 | |

| Send wire transfer - internet banking submission | HKD remittance | Remittance amount | 0.125% |

| Minimum | HKD170 | ||

| Maximum | HKD300 | ||

| Foreign currency remittance | Per transaction | HKD170 / USD22 | |

| Renminbi remittance | Per transaction | HKD170 | |

| Same day transfer to other local banks via CHATS - submit to branches | Per transaction | HKD60 / USD8 | |

| Agency fee (if applicable) | Via the CHATS of Shanghai Commercial Bank | Per transaction | HKD250 / USD32 |

| Via wire transfer in USD | Per transaction | HKD250 / USD32 | |

| Via wire transfer in EUR | Remittance amount | 0.15% | |

| Minimum | EUR35 | ||

| Maximum | EUR300 | ||

| Via wire transfer in JPY | Remittance amount | 0.05% | |

| Minimum | JPY3,500 | ||

| Via wire transfer in SGD | Remittance amount | 0.125% | |

| Minimum | SGD50 | ||

| Maximum | SGD150 | ||

| Via wire transfer in other currencies | Per transaction | HKD250 | |

| Drafts / cheques | Issuance of drafts / cheques | Per transaction | HKD100 / USD13 |

| Return and Cancellation of drafts / cheques | Per transaction | HKD100 / USD13 | |

| Report loss of drafts / cheques | Per transaction | HKD200 / USD26 |

Note: We have listed above the most important service charges for deposits, domestic transfers, and international transfers through Shanghai Commercial Bank. Click here to learn more about the fees and charges for lending and overdraft, document enquiry, and securities services.

Currency exchange rate⁵:

When exchanging foreign notes or making international wire transfers for clients, Shanghai Commercial Bank uses a ‘marked-up rate’, which is set by the bank's own buy and sell price, in order for them to make a profit on transactions

International transfer fees:

If you are making an international transfer with Shanghai Commercial Bank, you can refer to the above inward and outward remittance service fees. Also bear in mind that the fees will include the bank's profit margin on the use of a marked-up rate.

Time to deliver transactions⁶:

Shanghai Commercial Bank's wide network enables it to send money quickly to any location in the world. Please check with Shanghai Commercial Bank for specifics as the time for the payee to receive the payment may vary due to time-zone differences and cut-off times of receiving banks.

Documents you need to to bring:

Whether you are making a international telegraphic transfer and submitting to a branch or transferring online, you will need to fill in an Application for Remittance⁷.

Shanghai Commercial Bank is a nice option to transfer money abroad from China. Alternatively, you can use Wise! Founded in 2011, Wise is an international money transfer app, now serving over 16 million people throughout the world. Benefits of sending money from China via Wise include the use of the mid-market rate, having a fully functional website and app, enabling users to send money to 160+ countries, including China.

Receiving and exchanging foreign currency are two more examples of how easy and affordable Wise's service is. There are more than 40 different currencies you can choose from to hold or convert at the mid-market rate. So you can receive RMB in China and USD in the United States. Make a Wise account to make fast and cheap international money transfers today!

*This service is provided in partnership with a licensed third party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Bank of China credit cards guide: apply requirments, hoe to apply, how many types of credits card does Bank of China have? Key features, fees and benefits of th