What is Merchant Services? Clear Guide

Unlock the power of merchant services for your business with our comprehensive guide. Learn about payment processing, POS systems, and how to choose.

In the current economic landscape, many small businesses are facing multiple hurdles to expansion. It is currently estimated the US inflation rate sits at 3.67% (Trading Economics), well below the estimated global inflation rate of 8.73% (Statista). However, customers and clients are still pulling back on spending as general operating costs continue to climb.

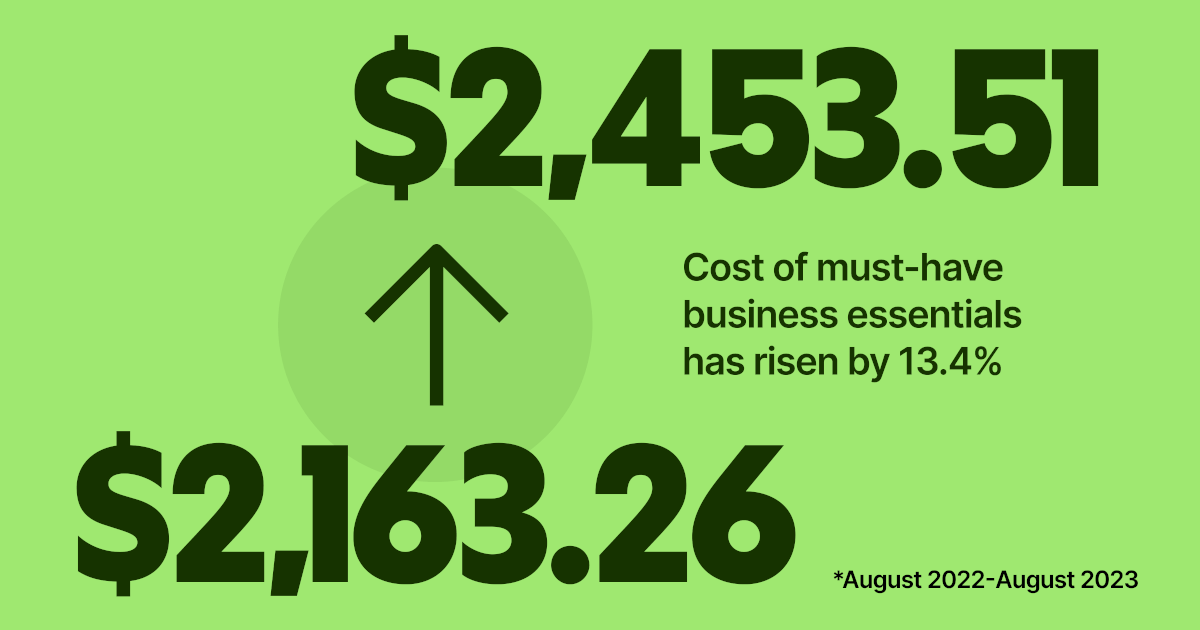

To assess how much US businesses are being impacted, we crunched the numbers on a list of 12 essential business items, which reveal that costs have gone up by 13.4% in the past year- equivalent to $290.25.

At Wise Business, we're focused on building a multi-currency account that helps businesses to grow internationally while tackling the rising costs of doing business.

That's why we’ve made it possible for eligible ** customers to earn 4.33% annual percentage yield * (APY) on their USD balance. Plus, when you opt-in to our interest feature, you keep instant access to your money and get passthrough FDIC insurance of up to $250,000 on your USD balance through our Program Bank *** .

A study by CNBC estimated a 13% increase in inflation over the past two years, with a 4.9% increase in food prices just last year. At Wise, our research has shown the cost of twelve essential items has increased by 13.4% in the last year. In August 2022, the basket of the following items cost $2,163.26, whereas the current price of the same basket is $2,453.51. Let's take a closer look.

🪑 The first item on the list is the standing desk. The rising popularity of standing desks among hybrid workers has been remarkable not only due to their potential benefits for health and posture, but also increased productivity. The cost of a height - adjustable desk has gone up from $159.87 to $248.87 (PC Mag).

💻 As companies shift away from desktops, laptops have become the preferred choice for employees. Laptops have been non-negotiable for hybrid workers, who enjoy working from their homes, coffee shops or shared working spaces. However, the cost of a new laptop by a leading brand has increased slightly, rising from $1,199 to $1,299.

On a positive note, businesses using 🧾 invoicing softwares for streamlining their cash flow or website domains to promote their services have not seen any increase in price, unchanged at $17 and $14.95 respectively in the past 12 months.

In contrast, the cost of high-speed internet for businesses has risen from $50 to $69.00, while a popular video conferencing solution remains steady at $15 per month. This is especially good news if your business is planning to expand globally or outsource employees from overseas in the coming months.

☕ If you and your team are running on coffee, there is unfortunately bad news brewing. Any type of coffee including coffee beverages in coffee shops, coffee beans or pods have experienced up to a 50% increase and coffee beans have seen a significant 20% price hike, resulting in the cost of 1kg of coffee beans increasing from $12.10 to $14.54 (Yahoo Finance).

🥛 And if you’re looking to optimise your coffee, oat milk has become a beloved option for many who prefer alternative milks. However, the price of a 48 fl oz bottle with no added sugar has recently increased from $4.29 to $6.49. 🍫 Likewise, a well-liked brand of mini chocolate cups, flavoured with peanuts, has unfortunately experienced a price increase from $4.19 to $5.49, so in-office snacktime might just have got more expensive.

🥤 While some workers like the kick of coffee, some enjoy a refreshing soda instead. There are too many brands to choose from these days but a 24-pack of a popular brand has seen an increase of 11% from last year to $13.18.

🪭 If you're renting out an office space, investing in an air purifier is highly beneficial. Not only does it help maintain clean and fresh air, but it also promotes a healthier work environment by removing dust, allergens, and other pollutants. The price of air purifiers has increased from $549.99 to $599.99.

🍹 Last but certainly not least, small business owners who treat their employees to a couple of Friday after work drinks, have seen a slight increase in the costs of a round of drinks. In bustling New York City, the prices have risen by 15-20% (NY Times), bringing the total for a round of 12 drinks to around $150. However, the value of fostering a positive work environment and showing appreciation to hardworking team members could make this kind of investment worthwhile.

Like their customers, businesses are facing a challenging economic landscape, with the cost of essential goods and services eating away at their bottomline. As a result many are looking overseas to tap new markets in order to build their business. At Wise Business, we understand the hurdles hindering your growth, particularly when expanding internationally. 🌎

That's precisely why the Wise Business account offers no monthly fees, multi-currency transactions at the mid-market rate and a seamless user experience. Trusted by more than 300,000 business customers globally, Wise Business allows you to send and spend in 40+ currencies to 160 countries around the world.

And if you’d like to earn 4.33% * APY on your USD balance while you grow, you can opt-in to our interest feature for Wise Business. When you opt-in to earn interest, you get added security of up to $250,000 in passthrough FDIC insurance on your USD balance from our Program Bank** (subject to change, certain limitations apply, see Program Agreement to learn more)

Your USD balance will be held with our Program Bank where Wise earns interest. We use a small portion of the interest we earn on these funds to cover our operating expenses and we pass the rest along to you.

The rate we can offer is dependent upon our Program Bank, and we’ll always let you know if there are any rate changes.

See our website for more details.

* 4.33% Annual Percentage Yield (APY) on USD balances is current as of 8/1/2023 and is subject to change see [Program Agreement](https://wise.com/us/legal/us-interest-program-agreement) for details** Feature not available to residents of New York or Alaska at this time. Please see eligibility criteria.

*** The current Program Bank is JPMorgan Chase Bank, N.A., see Appendix 1 of the Program Agreement for the most updated list of Program Bank(s). Eligible customers must opt in to the interest feature. Participants will have the balance of their USD funds held in their Wise Account “swept” into a Federal Deposit Insurance Corporation (“FDIC”) insured interest-bearing account at one or more participating banks (each, a “Program Bank”) that will hold and pay interest on the deposit funds. For more information on FDIC insurance coverage, please visit FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Bank(s) to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The Program is not intended to be a long-term investment option, checking or savings account, investment contract or security.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Unlock the power of merchant services for your business with our comprehensive guide. Learn about payment processing, POS systems, and how to choose.

Explore how foreigners can obtain an EIN to start or expand their business in the U.S. Learn the straightforward steps, requirements, and benefits.

Discover the essentials of a Foreign Limited Liability Company (LLC), including its definition, registration process, benefits, and state-specific compliance. I

Uncover the details of Wells Fargo Merchant Services fees with our in-depth analysis. Learn about transaction costs, monthly charges, and other fees.

Discover the essentials of paying independent contractors with our guide. Learn about payment methods, contracts, tax obligations, and best practices.

Dive into our in-depth GoCardless review, exploring its payment solutions, fees, pros and cons, to help you decide if it's the right fit for your business needs