Orange Money international money transfer guide [2024]

Everything you need to know about sending money abroad with Orange.

There are plenty of reasons you might want to make a payment electronically.

In any case, you may have come across the term telegraphic transfer, also referred to as telex transfer, T/T, TT or TT payment.

We’ll explain everything you need to know about the different terminology used, as well as the difference between telegraphic transfers and wire transfers.

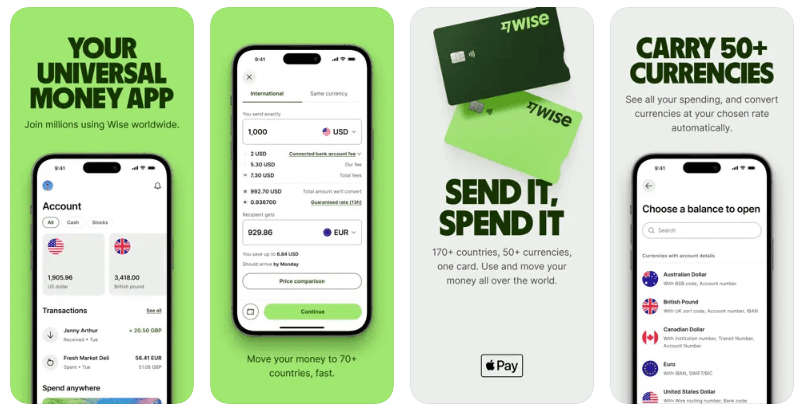

If you're planning to send money overseas, Wise can be cheaper and, faster than banks, and just as secure.

In simple terms, telegraphic transfers involve money going from a sender, and passing between several banks to reach their recipient.

Telegraphic transfers are typically more expensive than other transfer services because the banks which are involved in the transfer, also known as correspondent banks, set their own fees and processing times.

For that reason, transferring funds between individuals and businesses can become quite expensive and time-intensive - it will typically take 1-2 days for a transfer to be processed.

These correspondent banks all work together to form the Society for Worldwide Interbank Financial Telecommunication (or SWIFT) network - which we’ll come back to later.

This network is important because payments will only pass between banks that have commercial relationships with each other.

Although this method of payment is one of the oldest and most established services, telegraphic transfers aren’t without their weak spots.

Here are the pros and cons:

Pros

Cons

As with most payment services, there are a few different fees attached to this method of transfer including:

| 💡 You can find out more about telegraphic transfer fees and telegraphic transfer buying rates on our website. |

|---|

Before you continue, a word.

Banks and money transfer providers often give you a bad exchange rate to make extra profits.

Wise is different. Its smart new technology skips hefty international transfer fees by connecting local bank accounts all around the world, which means you can save by using Wise rather than a bank when you send your money abroad.

Check out how to make your first transfer with Wise. And give it a try.

Oh, and while you’re at it, check out Wise’s multi-currency account, where you can manage and send dozens of currencies all from the same account. You can also get the Wise debit card, which you can use to pay for goods and services all over the world.

While you may not be as familiar with telegraphic transfers, you've more than likely heard of wire transfers. To understand why there are so many different terms for the process of moving money from one account to another, you need to know a bit about the history of banking.

Bear with me - I’ll make it short.

As more people were moving more money, banks realized that they needed a globally recognized system to make sure all transfers ended up in the right place.

So, in 1973, SWIFT was founded. SWIFT is the network which sits behind thousands of banks, making millions of international money transfers every day. It offers a standardized, global way of safely sending money around the world - although the service comes with fees, which are payable by customers.

Telegraphic transfer is now used as a catch-all term for methods of moving money between accounts, both locally and internationally, while SWIFT payments - or international wire transfers - are specifically those money transfers which use the SWIFT network, to move money between accounts based in different countries.

There’s no singular process for making telegraphic transfers, as it varies between banks, but generally, the process is as follows:

Check online, or call your bank, to find out if they allow you to make telegraphic transfers online. If not, you’ll need to visit your bank in person.

If you're making your transfer online, you'll need to log into your online banking and look for the telegraphic transfer section. Banks refer to this service under different names, so look for something along the lines of ‘Telegraphic Transfer’, ‘International Payment’, ‘Wire Transfer’, or ‘Send Money Overseas’.

If you’re making your payment at the bank, the teller will assist you with the process. Be sure to take your bank details, as well as the recipient's details; you’ll need to provide their name and basic bank details - often an IBAN and BIC/SWIFT code, but your bank may also require their address, and even their bank’s address.

Check the cost of the transfer before you confirm. Your bank should be able to tell you the fee they’re charging, but bear in mind that the intermediary bank may deduct their fee directly from the payment as they process it.

Finally, once you're happy with the terms of the transfer, you can confirm it and your money will be on its way to the recipient.

Ultimately, telegraphic transfer, and the SWIFT system, is a sophisticated and important process that connects people all over the world. While it's secure and easy-to-use, the biggest drawbacks are its fees and the speed of payments.

This is one of the reasons why alternative transfer services such as Wise are worth considering. Wise always moves money at the mid-market rate, so there are never hidden fees from marked-up exchange rates.

You’ll just need to provide some of the same information you'd need to make a telegraphic transfer, and pay a small transfer fee that’s stated upfront, and your money will be on its way. It’s fast, easy, safe and is often significantly cheaper than a bank transfer.

💡 Did you know that Wise also offers a business account?

| Some key features of Wise Business include: |

|---|

|

Discover the difference between

Wise Business vs Personal

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about sending money abroad with Orange.

What is Ria and how does it work?

Your full guide to international Amscot wire transfers.

Your full guide to M-Pesa international transfers.

Your complete guide to Pangea Money Transfer safety

Your guide to understanding and avoiding wire transfer scams