Remitbee full guide

Dive into an in-depth exploration of Remitbee, understanding what it is, its service offerings, associated fees, and how it stands out in the online money trans

Getting a student checking account is a smart way to manage your money while you’re at school, college or university. You’ll be able to make and receive payments easily, and may even earn cash back or rewards on purchases.

Check out this handy guide to the student checking account options available from SunTrust.

| Table of contents: |

|---|

You can get an Essential Checking Account with SunTrust, which comes with a student waiver, meaning no monthly fees for up to 5 years. You can only access this waiver at the point you open your account - it can’t be set up later. However, you’ll qualify for the student waiver as long as you are at high school, college, university or a technical/trade school and can show you’re actively enrolled in an eligible course.¹

To avoid any regular fees, you’ll also need to sign up for online banking rather than having paper statements mailed to you.²

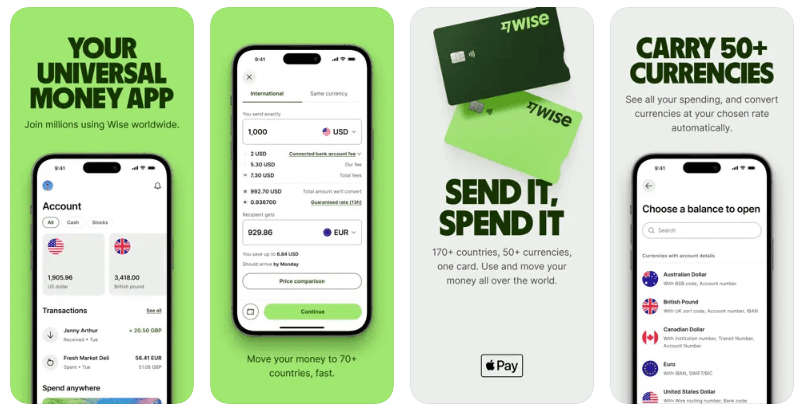

| Wise lets you make low-cost international payments, hold a balance in 40+ currencies, and get a multi-currency mastercard with no foreign transaction fees. Plus you’ll get the mid-market rate on all transactions. Take a look and see if you could save today. |

|---|

SunTrust’s student product is the Essential Checking Account, which offers some good student perks and a student fee waiver which means you could avoid service fees for up to 5 years. Here are some other features of the account.³ ⁴

You can use your SunTrust student account to make digital payments using Apple Pay or Samsung Pay, as well as accessing online and mobile banking and bill pay.

You can get SMS and email balance alerts, and will benefit from fraud protection and credit monitoring to keep your identity and your money safe.

You’ll be able to make fee free ATM withdrawals from 2,000 ATMs and 1,200 branches in the SunTrust network. You’ll also get a fee waiver for the monthly service charge, and there’s no fee for your parents to transfer money from their SunTrust account to yours should you need it.

It’s good to note that there are still some transaction fees you’ll want to be aware of - more on that a little later.

One key cost to look at is around international and domestic wire payments. Some domestic wire payments come with a fee of up to $15 per incoming payment and $25 for each outgoing. International transfers are even more expensive - expect to pay $25 for an incoming international transfer, and $50 to send a payment to someone overseas.

If you need to send or receive international payments, consider using a specialist service like Wise to benefit from lower costs and better exchange rates. You can open a Wise multi-currency account for free online. Hold multiple currencies, receive payments for free, and send money all over the globe using the mid-market exchange rate, for a low, transparent charge.

See if you could save with Wise

Depending on the way you use your account you may also benefit from cash back on credit card spending, including a cash bonus if you add your credit card cash back directly to your student checking account.

You’ll be able to opt for overdraft protection to make sure you don’t get caught out by unexpected fees after overdrawing your account.

If you do not select overdraft protection, and your account goes overdrawn, you’ll pay a fee per transaction of $36. However, if you choose overdraft protection, you’ll be able to link your account to another deposit account, credit card or line of credit to cover the shortfall. In this case, you’ll only pay an administrative fee of $12.50 for overdrawn transactions.

You may also choose to have your card decline any charge which may cause your account to become overdrawn - which cuts the chance of overdraft fees entirely.

To open an Essentials Checking account with SunTrust you’ll need to fulfil their eligibility requirements and provide a $100 minimum opening deposit.

To benefit from the student fee waiver when you open a SunTrust Essentials Checking account, you’ll need to be enrolled in an active program at high school, university, college or a similar institution.

The fee waiver is available for up to 5 years. After that time you’ll revert to the regular Essentials Checking account and pay the monthly fee required unless you qualify for a waiver via a different route.

Although SunTrust offers a waiver for some key account costs, you’ll still find there are transaction charges for things like using an ATM overseas or sending a wire payment.

Here are some of the charges you’ll want to think about - get the full product details from the SunTrust website before you sign up.

| Service | Fee |

|---|---|

| Account opening | No fee - but a $100 minimum deposit |

| Monthly maintenance fee | $7 - waived for students for up to 5 years |

| Paper statement fee | $3 - avoid this by signing up to paperless statements |

| Overdraft fee | $36 per item, to a maximum of 6 per day |

| Overdraft protection | Sign up to overdraft protection and pay only an administrative fee of $12.50 per overdrawn item |

| Domestic wire transfers | Incoming - up to $15Outgoing - up tp $25 Some wire fees are waived for student accounts - for example, if parents pay into their student child’s account Some additional fees may apply to both domestic and international wire transfers, such as notification fees and any costs associated with tracing missing payments |

| International wire transfers | Incoming - up to $30Outgoing - up to $50 |

| ATM withdrawals | SunTrust network ATMs are free for withdrawals, although there are fees to get a statement via an ATM ATMs from outside the SunTrust network cost $3 per transaction within the US, and $5 per transaction internationally |

As a student, you’ve got a great opportunity to access low fee accounts which can make it easier to spend and save day by day - as well as building your credit history.

Choosing the right account at the outset can make life a lot easier. Take a look at the features and benefits of a few different account products to help you decide. And don’t forget - sometimes having a specialist account such as the Wise multi-currency account alongside your student checking account can make it even easier to save money.

Sources checked on 15 June 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Dive into an in-depth exploration of Remitbee, understanding what it is, its service offerings, associated fees, and how it stands out in the online money trans

In this article, delve into our MAJORITY review. Explore insights and opinions about its services, features, and alternatives.

Learn about Deriv Currency Accounts, their features, benefits, and how to open one. Discover a new way of participating in forex trading with Deriv.

Learn about foreign currency savings accounts, their benefits, drawbacks, and how to open one. Discover the best banks for these accounts and how to manage fore

Explore the process of opening a foreign bank account, the advantages, the required documentation, and important considerations.

Learn the intricacies of US foreign currency accounts, how to open one, and the advantages they offer. Find out which US banks provide this service and their fe