The Wise Way to Send Money to Africa

Do you need to send money to Africa? Meet Wise, the smart new way to make international payments. Sending money internationally through a bank or broker like...

Making the hop from Canada to the US is an increasingly popular move.

In fact, it’s estimated that there are over 800,000 Canucks currently living in the US. It’s not that surprising – we all speak the same language (kinda) and have a love for sports.

So, we grabbed some Canadian Wise customers and team members for a chat to find out what their biggest surprises were when they moved to the US.

From getting used to your new insurance plan to dealing with imperial units – here are some obstacles you’ll meet as a Canuck in the US:

####What are these copper plated discs in my change?

Remember that little coin that Canada killed two years ago?

Well it’s back from the dead and it’s here to stay…for a while at least.

Due to the way the US loves to price their items (e.g. $19.95, $4.99, etc.) you will almost always get pennies in return. However, that is probably the only scenario they’ll ever be useful.

By the way, what’s up with all American bills being colored the same? And have you noticed how flimsy they are?

####Healthcare

Like quantum physics, the US healthcare system is based on the principal that the more you know, the less you understand it.

Even the customer service people at the insurance companies don’t really understand how any of it works.

What’s the difference between a deductible, copay and coinsurance? No one knows.

####Where are the milk bags?

Your milk now comes in jugs.

While it is something that you will have to get used to, it’s also something that most welcome with open arms. Jugs and cartons are just way easier to carry and pour, easier to store in your fridge and they come in various sizes. Just don’t try to wrap your head into just how much a gallon or half of gallon of milk is.

Long gone are the days that you accidentally cut off too much from the tip of the bag.

####There goes your credit card!

You just finished your meal and asked the waiter for the check, take out your card and wait patiently for your them to come back.

Now they say they need your card? And you’re going where exactly with it?

The strangest part is that your bill is not closed right in front of you. You have to write in the merchant copy of the receipt how much of a tip you want to leave and then at some point after you leave the restaurant they will finally charge your card for total amount.

So you’ve settled into your new life and now want to send a little money back home.

Well forget about using your bank. The 3% exchange rate markups, $40 wire fees and the fact that you have to wait 6 days to receive the money are just some of the ways your new bank will try to rip you off.

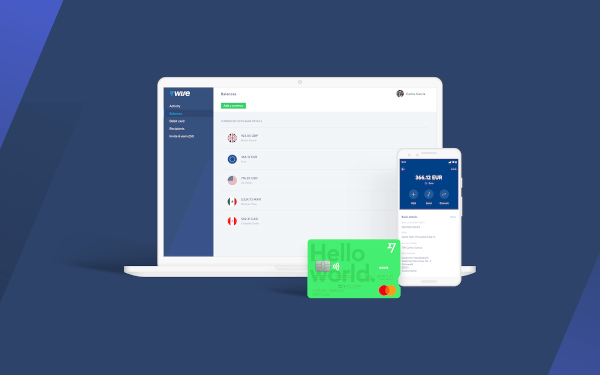

Save up to 8x when sending money overseas. Unlike banks, with Wise you don't pay a markup in the exchange rate when your money is converted into another currency. And you'll save even more by avoiding the international Swift fees and the intermediary banks, when you send and receive money abroad.

Check here how much you'd save with Wise.

It's cheap, fast, and you know exactly how much you pay and how much reaches the destination. With no unpleasant surprises.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Do you need to send money to Africa? Meet Wise, the smart new way to make international payments. Sending money internationally through a bank or broker like...

Planning a trip? Moving country? Don’t get stung by nasty fees and even nastier rates. Banks, brokers and PayPal are more expensive than they look....

Türkiye'ye hâlâ banka ya da komisyoncu aracılığıyla mı para gönderiyorsunuz? Şimdi para göndermenin daha akıllı ve ucuz bir yolu var. Eğer Türkiye'ye para...

ถ้าคุณยังโอนเงินกลับไทยด้วยวิธีเดิมๆ ผ่านธนาคารหรือโบรคเกอร์ เราอยากบอกว่า มันมีวิธีที่ถูกและดีกว่าให้คุณได้ลองนะ Wise จะช่วยให้การโอนเงินกลับไทยถูกลง...

คุณยังคงใช้ธนาคารหรือนายหน้า ในการส่งเงินไปยังประเทศไทยอยู่รึเปล่า? Wise เป็นอีกหนึ่งตัวเลือก ที่จะช่วยให้คุณส่งเงินปอนด์...

If you’re a small business in the US that operates overseas, Wise could save you a lot of time and money when you pay invoices in foreign currencies,...