Transferring your international driver's license to the US: step-by-step

Your full guide to updating your foreign driver's license to the US.

###Thinking of moving to America? You’re not alone. In fact, there are more than 590,000 Germans currently living in the U.S.(https://wise.com/us/blog/how-to-adjust-to-life-as-a-german-in-the-us)

But that doesn’t mean that making the transition is easy, as there are a lot of cultural differences between America and Germany.

Wise customers who’ve already made the move shared five valuable lessons that you’ll learn when you move to the U.S.

Sounds exciting, right? More shopping, more nights out, more gifts - none of the guilt.

Germans who move to America will enjoy paying less sales tax (about 10%) than they do back home (about 19%.)

However, cost of living and other contributions, such as healthcare can add up. Unlike in Germany, where regular contributions are higher but one-off costs are lower, in the U.S. it’s different. It’s common to have an employer sponsored healthcare scheme, which still requires financial contributions and fees for doctor visits, on top of any costs for medicine.

It might seem like a lot of Americans have multiple credit cards that they use to purchase things now and pay off later.

Cash is increasingly falling out of favour in the U.S. You can still get by if you want to use cash, but ATM fees are costly, and people are increasingly lured into spending money on credit cards in order to accrue points.

Anna, a German living in the U.S explains:

“Back home, people rarely use a credit card. If I don’t have cash on me, I use my debit credit card. But in America, my friends are always paying with their visas. Sometimes, it’s to earn points and other times it’s to buy things they can’t afford!”

In America, there are fewer restrictions on when stores can open, and Sundays are a popular shopping day.

It’s a far cry from Ruhetag (rest days)in Germany, when very few shops or offices are open. Berlin, for example, only allows for eight days of Sunday shopping per year.

Germans who live in America might be shocked to find out that many of their friends and colleagues pay steep fees to go to college and end up with vast sums of debt.

Moritz, an emigrant from Munich, filled us in.

“The education system in Germany seems to work. It allows students to focus on their studies instead of their debt and it allows them to choose a career out of genuine interest and not desperation. America may have some of the greatest schools in the world, but you sure do pay a price for them.”

If your American friend says it's 30 degrees out, you might want to think twice before grabbing your favorite pair of sunglasses and shorts.

While almost everyone else abides by the metric system, America’s one of three countries in the world that doesn’t.

They use feet, yards, miles, pounds and Fahrenheit instead of meters, kilometers, kilograms, tonnes and Celsius. This can make for a lot of confusion communicating things like the temperature, the distance between two points or how much something weighs.

Your bank might say it's "free" or offer a "fixed fee" to send money home but they routinely hit you with as much as 3% on the exchange rate mark-up they use.

Wise: save up to 8x when sending money overseas

Unlike banks, with Wise you don't pay a markup in the exchange rate when your money is converted into another currency. And you'll save even more by avoiding the international Swift fees and the intermediary banks, when you send and receive money abroad.

Check here and check how much you'd get with Wise.

It's cheap, fast, and you know exactly how much you pay and how much reaches the destination. With no unpleasant surprises.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your full guide to updating your foreign driver's license to the US.

Whatever your reason is for moving to the US, this guide aims to help you figure out the most important costs you'll face when you live there.

Find all you need to know about getting a personal loan for H-1B visa holders in this guide.

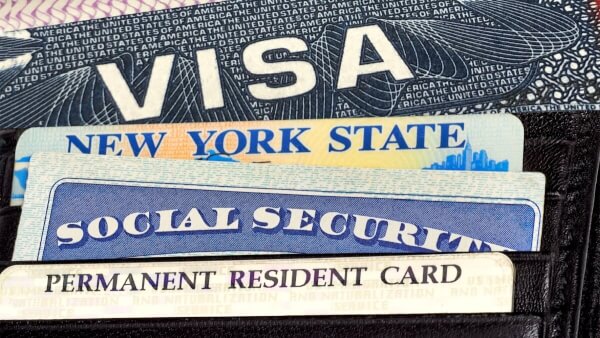

Everything you need to know about the US certificate of naturalization.

The US welcomes large numbers of new arrivals every year — and getting a great job to both gain experience and set down roots is a core part of the American...

Find out everything about dual citizenship, as well as whether the US allows it, in this handy guide.