Working Remotely From Another Country: US Guide

Embrace the flexibility of remote work with our guide on working remotely from another country. Gain insights into legal considerations and optimize your remote

Freelance for a living? Here are five crucial tips that will help you save money and give you peace of mind.

Sarah Li Cain is a expert freelance finance writer. A seasoned international traveler, she has since written extensively on how to save money and look after the accounts as a freelancer.

How can you maximize your savings as a freelancer?

Now that you’re responsible for handling the finances, you’re going to face paying out of pocket for new expenses.

These include healthcare, bank fees (especially if you have international clients) and even invoicing software.

Read on to find out five money essential money saving tips you can implement today.

1. Get Your Taxes in Order

You’re responsible for paying taxes since you’re technically your own employer.

You’ll need to pay estimated quarterly taxes and file a Schedule C with the IRS with your annual tax return, including gross income and business expenses.

Ensure that you pay estimated taxes on time or potentially face penalties. You can use a federal tax calculator to determine the correct amount to set aside. Many freelancers like myself use bookkeeping software that can calculate estimated taxes. All I need to do is keep up to date with my invoices and I can pull up a schedule C in my accounting program.

If you have multiple sources of income or have a complicated tax situation (like I did when I was a U.S. resident living in China), it’s best to consult a tax or legal professional. They could save money, especially if they can help you maximize deductions.

2. Saving Money on Invoicing

When I worked with international clients, I had to worry about exchange rates and losing money to fees.

Prevent losing money due to exchange rates by quoting your rates in USD. That way, you’re essentially getting paid the same no matter what your client’s currency rate is.

Also, minimize as many fees as possible. Invoicing through places like Paypal may seem convenient, but you risk paying hefty service fees. I wish I had a service like Wise years ago when I started freelancing. They only charge you a flat fee to transfer money and you get the real exchange rate, the one you see off xe.com. You can also create and send your invoices by using our downloadable free invoice templates, and use a freelance contract template to make your work official.

3. Setting Up a Separate Bank Account

One of the biggest mistakes I made was not separating my finances when I started out freelancing.

For tax purposes, your personal income is different from your self-employed income. If you mix your finances together, you could be at risk of getting audited by the IRS, especially if you haven’t kept up to date with your bookkeeping or taxes.

Save yourself the heartache by opening a separate bank account. If you’re still a sole proprietor, opening a personal bank account should suffice for now. I opened up a personal checking account a few years ago and still use that. There are many that do not have any fees and even offer debit cards.

For those who have filed an LLC, you’ll need to open a business bank account. Chase and Capital One are popular among freelancers and offer a myriad of services, including no-fee banking. Some banks offer business credit cards that have cashback or rewards points.

4. Finding Suitable Healthcare

Luckily for freelancers, there are a few organizations that help provide affordable healthcare.

NASE is an organization that provides support for those who are self-employed. One of those perks is affordable health insurance. Membership fees are a maximum of $120 and includes health insurance premiums based on your state and plan.

Freelancers Union also has affordable health insurance options. They group members together to keep the costs down. It’s free to join and they have a ton of other resources to help you thrive as a freelancer.

5. Maximize Tax Deferrals

Putting money aside in retirement accounts is a great way to help you reduce taxable income.

You can contribute you pre-tax earnings into plans such a solo 401k or SEP IRA. Not only will you pay less income taxes, but it’ll also help you earn interest in your money.

Those who want to maximize their contributions can opt for a solo 401k. Many freelancers also hire their spouse as an “employee” so they can essentially double their savings. Paying less taxes and earning interest on your money? Sounds like a win-win to me.

Freelance for a living? Sign up for Wise and try the new Borderless account

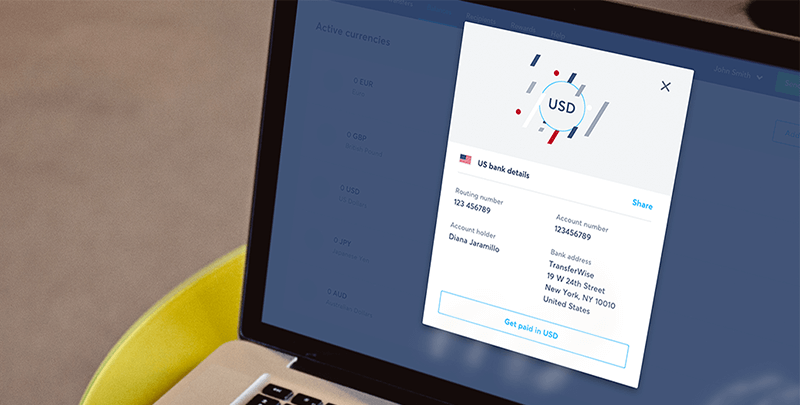

Wise makes sending money internationally far cheaper and easier.

Wise lets you avoid the terrible exchange rates that banks commonly use, and only charges a small upfront fee.

And the new Borderless account makes managing money in multiple countries better than ever. It's a cinch to set up and lets you get paid from any country more easily and cheaply.

Once you've been paid, you can convert your money to the currency you need. There couldn't be a simpler way to save on those international invoices.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Embrace the flexibility of remote work with our guide on working remotely from another country. Gain insights into legal considerations and optimize your remote

Looking for a good time-clock app for your small business? No problem. Let's take a look at the best free and paid apps for you and your team.

Money-making apps consist of a few categories: Long-term freelancing apps, short-term task apps, delivery and taxi apps, and apps to sell your stuff.

1) Wise: Independent Contractor Account 2) Wonolo: Freelance Job Platform 3) TurboTax: Tax app 4) DoorDash: Deliver App 5) Fantastical Calendar: Free App

As long as you know how to market your skills and rates, you'll be able to profit quickly from Upwork. Let's jupm

Best Cards for Self-Employed and Freelancers: There are various cards from Ink, Chase, Capital One, Wells Fargo, and Bank of America. Find the best one for you