Karakon

When the second civil war broke out in Sudan, my father decided to send my brothers and I to Ethiopia, both for protection from abduction, but also because...

Our mission at Wise is to create money without borders — instant, convenient, and eventually free.

To keep everyone’s money safe, we make sure all customers are who they say they are. One way we do this is by asking them to take a photo of their passport or ID card.

Which some of our customers find annoying at times — rightfully so because that part is not instant. Or convenient. Or free.

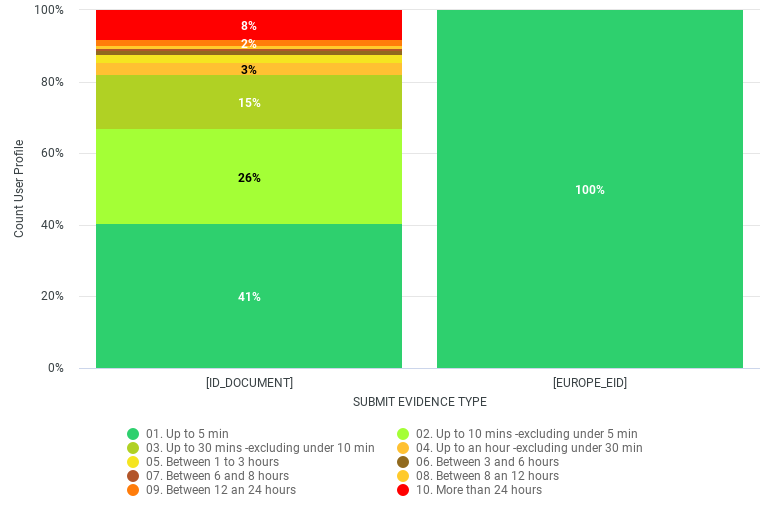

Speed: Only 40% of customers get this done in 5 minutes. 26% of customers take 5-10 minutes. 15% take longer than one hour.

Convenient: Customers don’t always have their ID document nearby when we ask them to take a photo of it. That’s why we see people giving up on Wise at this point. And when they finally get a hold of it and take that photo, the photo quality might not be good enough for us to verify them successfully. This is the number one reason we cannot verify you successfully today.

Cost: We use a hybrid approach of humans and algorithms deciding whether your ID document can be verified. This is not free. So we have to include this as an extra cost in the fees you pay to send, hold, receive money with Wise.

Thankfully, some countries have gone ahead and created electronic identities (eIDs). They’re like physical ID documents (passports, ID cards) — without the physical part. Instead of showing a physical card, you just need a phone/ laptop to prove that you are who you say you are.

Scandinavia is ahead of the rest of us here. Most Swedish people use BankID, an electronic identity built by Swedish banks, to prove their identity. We know from our Swedish customers that this is more convenient, and feels safer than taking a photo of their physical ID cards — which are still a lot easier to fake than an electronic ID.

We wanted to see what happens if we give our customers eIDs as a verification option, starting with Sweden.

Now, when a Swedish customer reaches the point where we ask them to verify their identity, they have a choice. They can choose to take a photo of their physical ID card, or they can verify themselves via BankID instead.

Almost 80% of people opt for BankID at this point — showing a clear preference over physical IDs.

But how do they really do on speed, convenience, and cost?

Speed: 100% of customers opting for BankID take less than 5 minutes from the moment we ask them to prove their identity to the moment they’re successfully verified via BankID. They always have their phones nearby, and verifying yourself via BankID only takes a few clicks.

Convenience: When customers choose BankID over ID, we see 8% less people giving up on Wise before submitting their identity proof. And out of all submitted BankID data, we can also successfully verify 9% more customers, since bad photo quality is no longer an issue.

Cost: All of this happens at a 42x lower verification cost on our side. These are cost savings that we can pass on to our Swedish customers.

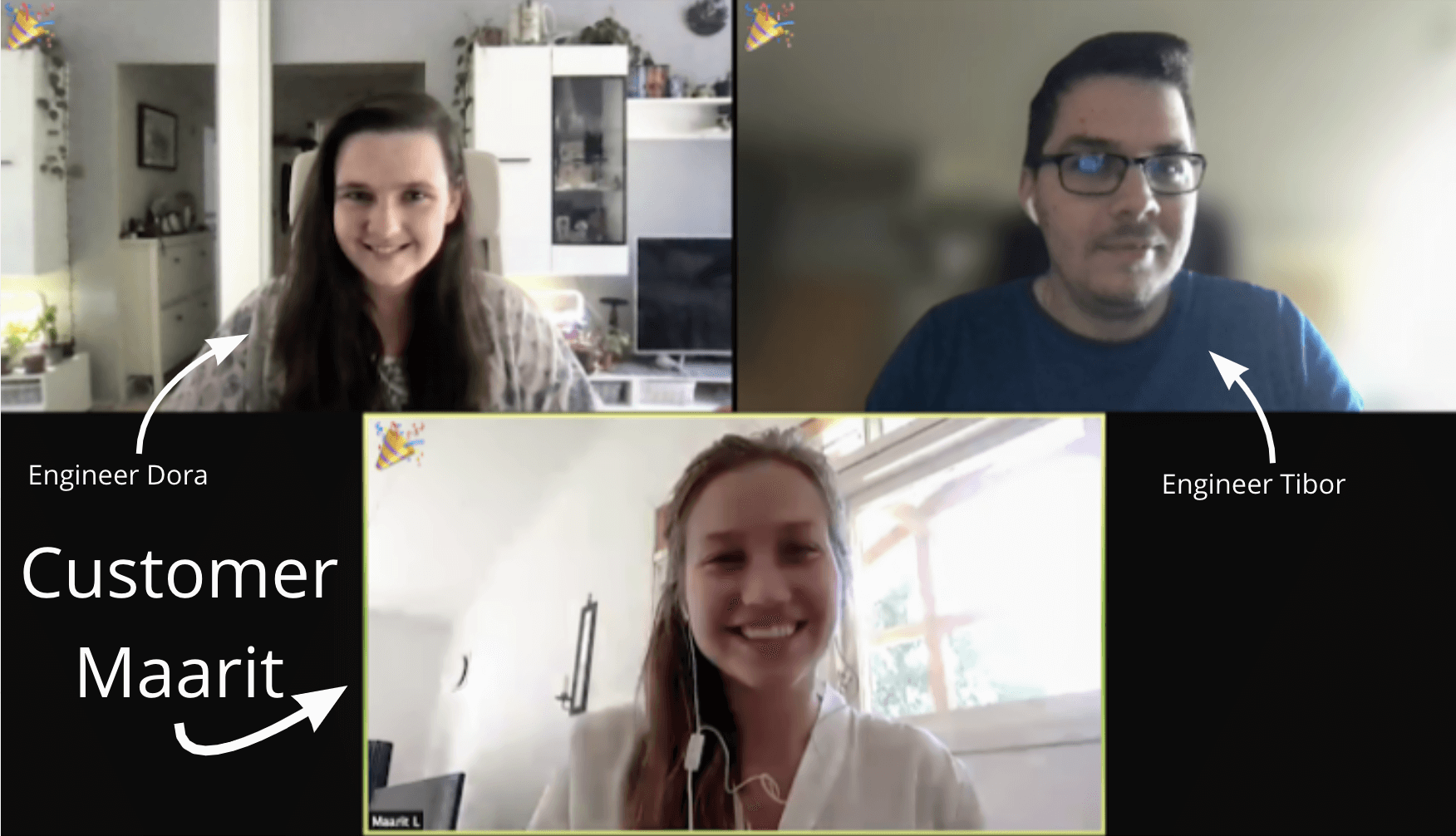

All of this makes our Swedish customers happier. As happy as Maarit, our first Swedish customer successfully verified via Swedish BankID. This is her, together with Dora and Tibor, the two engineers who got BankID live for our Swedish customers:

Next we’ll look at adding eIDs for customers from other countries too.

Tell us on Twitter which eID we should launch next and why!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

When the second civil war broke out in Sudan, my father decided to send my brothers and I to Ethiopia, both for protection from abduction, but also because...

Of about 70 people in our family, nearly everyone was killed by the Khmer Rouge. They targeted anyone who could be a threat, who didn’t conform to their...

I come from a fairly privileged background in Pakistan, as both my parents had white collar jobs. We weren’t really rich though. Whenever we asked for...

I have a lot of precious memories from Syria, especially from my first year at university, which was wonderful and eye opening. I was following my passion in...

When I was 2 years old, my mum left to go to the US so that she could support us, as there were no jobs in Zimbabwe. She and my father had already separated,...

I come from a long line of politically active family members who were active socialists in Chile in the 1970s. When the coup led by Augusto Pinochet occurred,...