Louisiana Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you don’t know the rate, download the free lookup tool on this page to find the right combined Louisiana state and local rate.

Save with Wise when invoicing clients abroad.

If you're invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees. Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

- Amount of sales tax:

- 0.00

- Net amount:

- 0.00

What is the sales tax rate in Louisiana?

The base state sales tax rate in Louisiana is 4.45%. Local tax rates in Louisiana range from 0% to 7%, making the sales tax range in Louisiana 4.45% to 11.45%.

Find your Louisiana combined state and local tax rate.

Louisiana sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. That’s why we came up with this handy Louisiana sales tax calculator.

Simply download the lookup tool and enter your state, in this case Louisiana. Add your county or city - and the tool will do the rest.

How to calculate Louisiana sales tax?

To calculate the right sales tax in Louisiana you’ll need to add up the state, county and city rates for your location. The easiest way to do this is by downloading our lookup tool to get the detail you need in seconds.

Once you’ve found the correct sales tax rate for your area, you need to figure out how much to charge each customer on their purchases.

Use the sales tax formula below, or the handy calculator at the top of the page, to get the tax detail you need.

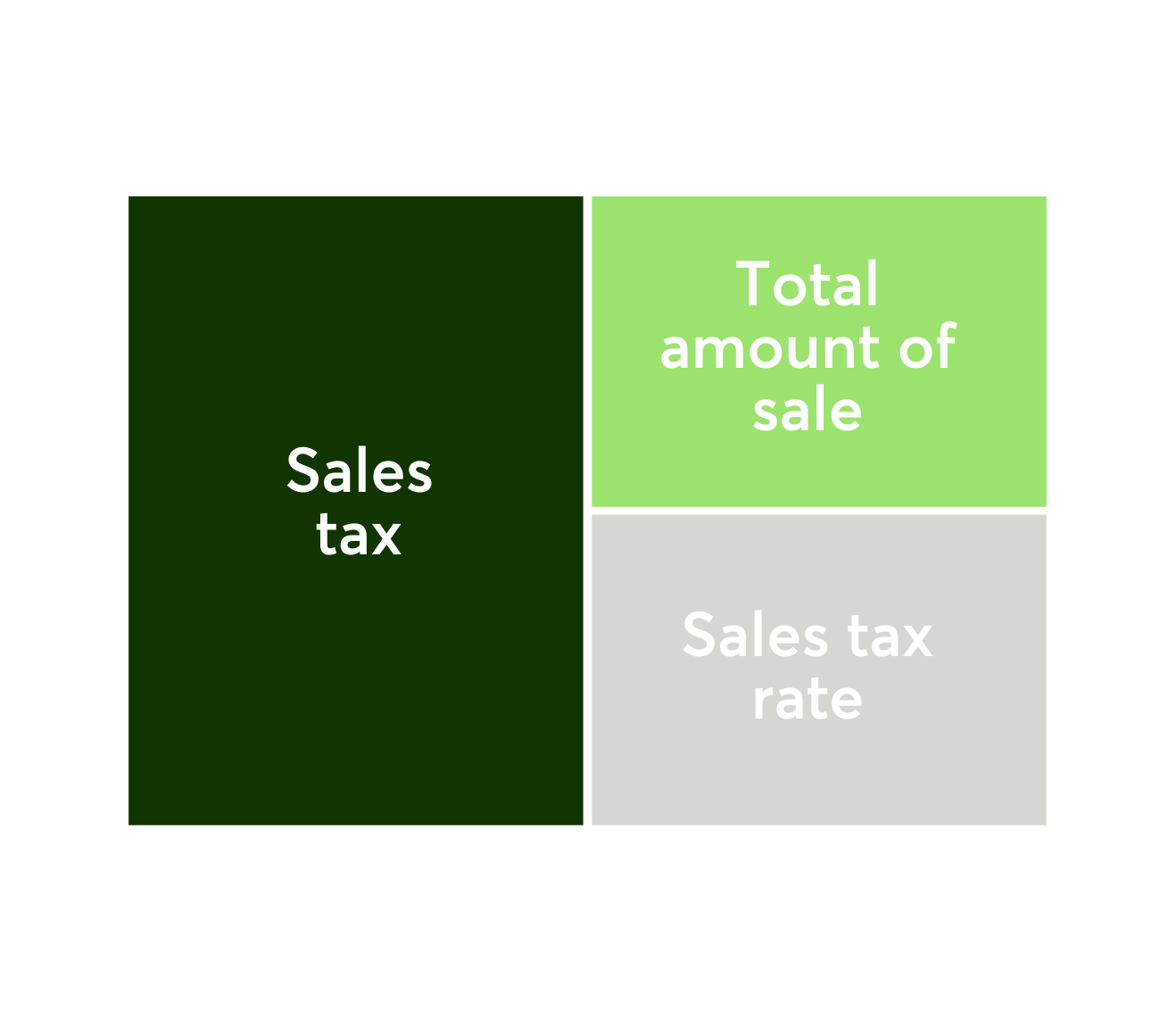

Sales tax = total amount of sale x sales tax rate

Wise is the cheaper, faster way to send money abroad.

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. We’ll always give you the same rate you see on Google, combined with our low, upfront fee — so you’ll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it's not only money you'll be saving with Wise, but time as well.

Learn more about Wise for Business→

Sign up now for free, and do business without borders.

Louisiana sales tax rates by city.

Louisiana sales tax rates by city.

| City | Minimum combined rate | City | Minimum combined rate |

|---|---|---|---|

Alexandria | 9.95% | Monroe | 10.44% |

Baker | 10.45% | Morgan City | 8.75% |

Baton Rouge | 9.95% | Natchitoches | 9.95% |

Bogalusa | 9.94% | New Iberia | 9.45% |

Bossier City | 9.45% | New Orleans | 9.45% |

Crowley | 9.95% | Opelousas | 10.2% |

Eunice | 10.45% | Pineville | 9.95% |

Gretna | 9.2% | Ruston | 12.2% |

Hammond | 9.45% | Shreveport | 9.05% |

Houma | 9.95% | Slidell | 8.7% |

Kenner | 9.2% | Sulphur | 10.2% |

Lafayette | 9.45% | Thibodaux | 9.4% |

Lake Charles | 10.2% | West Monroe | 10.44% |

Mandeville | 9.2% | Zachary | 9.95% |

Minden | 11.95% |

Louisiana sales tax rates by county.

Louisiana sales tax rates by county.

| County | Minimum combined rate | County | Minimum combined rate |

|---|---|---|---|

Acadia Parish | 8.7% | Ouachita Parish | 10.44% |

Ascension Parish | 8.95% | Rapides Parish | 7.95% |

Bossier Parish | 8.7% | St Bernard Parish | 9.45% |

Caddo Parish | 9.8% | St Charles Parish | 9.45% |

Calcasieu Parish | 10.2% | St John The Baptist Parish | 9.7% |

East Baton Rouge Parish | 10.45% | St Landry Parish | 10% |

Evangeline Parish | 9.45% | St Martin Parish | 7.95% |

Iberia Parish | 7.7% | St Mary Parish | 8.45% |

Jefferson Parish | 9.2% | St Tammany Parish | 8.7% |

Lafayette Parish | 8.45% | Tangipahoa Parish | 7.45% |

Lafourche Parish | 9.85% | Terrebonne Parish | 9.95% |

Lincoln Parish | 8.2% | Vernon Parish | 8.45% |

Livingston Parish | 8.45% | Washington Parish | 9.28% |

Natchitoches Parish | 9.95% | Webster Parish | 7.95% |

Orleans Parish | 9.45% |

Louisiana sales tax FAQs.

Save time and money with Wise Business

The easier way to connect with customers, suppliers and staff, and watch your business grow.