ATMs in Pakistan: Credit cards and fees

Pakistan is the proud home of the world’s highest ATM (at a height of 15,397ft), but you’ll be relieved to know that there are ATMs in the major cities as...

While Pakistan is often avoided because of political instability, a trip to this South Asian jewel will offer a different insight to that shown in the media. Dig deep enough, and you’ll find a stunningly beautiful country steeped in history, and filled with a rich culture and tradition.

As a plus, Pakistan is also very cheap to visit. You can easily get by on just $100 USD a week!

But how do you get your hands on enough money to enjoy this unique experience to the fullest?

Read on to find out all there's to know about banks and money in Pakistan.

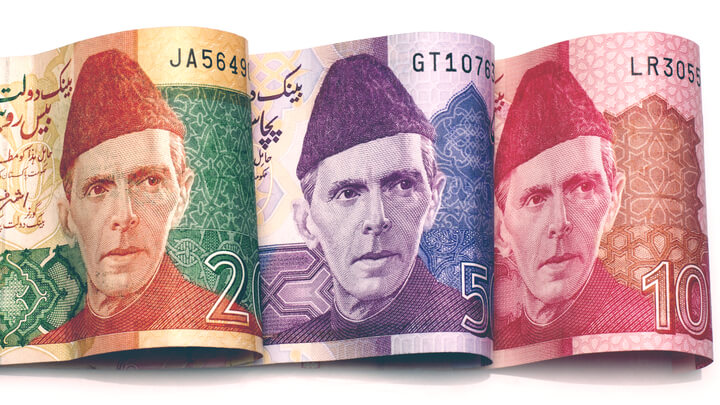

The official currency of Pakistan is the Pakistani Rupee (PKR). It has been a free floating currency since 2000, and its exchange rate fluctuates daily.

Rs1 is made up of 100 Paisa. However, Paisa are no longer in circulation. And as of 2013, they're no longer accepted as a form of payment.

Rupees are available in coins of Rs 1, 2 and 5. Banknotes come in denominations of Rs 10, 20, 50, 100, 500 and 1,000. 5,000 rupees notes exist but are rarely used. In 2005, old banknotes were phased out in favour of new, more secure notes. Always make sure you have the newer, undamaged notes, as otherwise they won’t be accepted.

As is the case in India, in Pakistan large values of Rupees are referred to using distinctive terminology: 1 lakh means Rs100 thousand; and 1 crore means Rs10 million.

US Dollars and Euros are the easiest and most reliable currencies to exchange in Pakistan. It’s best to exchange your money once you arrive in the country, as you’re unlikely to get a good rate at home.

International airports have 24-hour exchange bureaus. However, the exchange rate at airports are often unfavourable; and they’ll add a 3% commission or even more on top. Hotels that have foreign exchange services offer equally unfavourable deals.

The larger cities have a range of exchange bureaus, usually clumped together in the same district. The best place in Lahore to change your money is at Charing Cross on the Mall Road or at the Anarkali Bazaar. In Islamabad, head to the so-called blue area (the financial district), where you’ll find various exchange bureaus and banks.

English is widely spoken in the larger cities; and is the official language used by the major banks. However, banks offer rather poor rates, even when compared to exchange bureaus. This makes using an ATM the quickest, cheapest and most convenient way to get hold of cash.

While some banks and exchange bureaus may claim they don’t charge any fees or commissions, they’ll usually make up for this by charging you an unfavourable exchange rate. Always check the mid-market rate - the real exchange rate - before exchanging money, so you’ll know whether you’re being offered a good deal. You can use this handy currency converter to check the most up-to-date rates.

If you’re exchanging US Dollars, make sure they're recent notes. Dollar bills printed before 2005 won’t be accepted. You should also make sure both the notes you exchange and the Rupees you’re given are undamaged. Torn or marked notes cannot be used or exchanged in Pakistan.

Using travellers’ cheques in Pakistan is challenging at best. Some of the larger banks and premier hotels in the bigger cities may accept them, but there’s no guarantee. And other than these places, there’s practically nowhere else in Pakistan where you can cash them.

Even if you do find somewhere to cash your travellers’ cheques, the fees will probably be too high to make it worth your while. Exchanging cash or using an ATM are your best options.

Pakistan is very much a cash-based society; and card payments are neither popular nor widely accepted.

Visa is the most commonly accepted form of card payment. However, MasterCard and AmEx are also accepted, primarily in higher end shops and hotels. Make sure that any credit cards you have are chip-and-pin enabled; and always have enough cash on you as back up.

When you do use your card, you may be offered the option of paying in your home currency. You should refuse and choose to be charged in Pakistani Rupees instead. Transactions performed in your home currency will be worked out using Dynamic Currency Conversion, which results in a bad exchange rate.

Before you leave home, you should always let your bank know where you’re travelling to. Unexpected transactions in a foreign country - especially one as volatile as Pakistan - will immediately arouse suspicion. Chances are your card will be blocked, leaving you without access to your money.

ATMs are the quickest and cheapest way of getting cash. Conversions are performed using the mid-market rate, which means you’ll get the best exchange rate possible.

However, your bank back home may charge fees - usually a foreign currency fee and an ATM transaction fee. Some Pakistani ATMs may also charge a usage fee.

Visa is the most commonly accepted card, although Standard Chartered ATMs also readily accept MasterCard. To ensure your card will work, look for the Plus (Visa), Cirrus or Maestro (both operated by MasterCard) signs on the ATM.

ATMs are widely available throughout Pakistan. However, those in more rural areas are notoriously unreliable. If you do intend to leave the city, make sure you get enough cash out before you go.

Pakistan has frequent power cuts. You should stick with major bank ATMs or risk losing your card halfway through a transaction. Standard Chartered, MCB Bank and Bank Alfalah have backup generators to ensure a smooth transaction in the event of a blackout. Use these convenient locators to find the nearest ATM:

ATMs in Pakistan only accept cards that are chip-and-pin enabled. If your card only has the magnetic stripe at the back, it won’t work.

As mentioned above, remember to always make withdrawals in the local currency, i.e. Pakistani Rupees. If you choose to perform the transaction in your home currency, the ATM will make up an unfavourable exchange rate using Dynamic Currency Conversion.

MCB Bank (Muslim Commercial Bank) is Pakistan’s leading retail bank. It also has the largest and most reliable network of ATMs in the country. Meezan Bank, which recently took over HSBC in Pakistan, is the leading Islamic bank.

Although many foreign-owned banks have recently pulled out of Pakistan, Standard Chartered remains a solid and consistent presence with a large network of branches and reliable ATMs throughout the country.

Here’s a list of the most popular retail banks in Pakistan:

| Bank | Website |

|---|---|

| Al-Habib Bank | https://www.bankalhabib.com/ |

| Allied Bank of Pakistan | https://www.abl.com/ |

| Bank Alfalah | http://www.bankalfalah.com/ |

| MCB Bank | https://www.mcb.com.pk/ |

| Meezan Bank | https://www.meezanbank.com/ |

The following international banks have branches in Pakistan:

| Bank | Website |

|---|---|

| Citibank | http://www.citibank.com/pakistan/consumerp/customerserv/branch.htm?id=8/ |

| Industrial and Commercial Bank of China | http://www.icbc.com.cn/icbc/海外分行/卡拉奇网站/en/default.htm/ |

| Standard Chartered | https://www.sc.com/pk/ |

Ask your home bank if they've partner branches in Pakistan; as you may save on ATM transaction fees or even make withdrawals for free.

Better still, if you’re visiting friends or family in Pakistan, use Wise to make a quick and easy bank transfer to send money to Pakistan using the real mid-market rate. You can then use a local card to get money out without incurring foreign currency and international transaction fees.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Pakistan is the proud home of the world’s highest ATM (at a height of 15,397ft), but you’ll be relieved to know that there are ATMs in the major cities as...