Transferring your international driver's license to the US: step-by-step

Your full guide to updating your foreign driver's license to the US.

Ireland is a place that attracts many Americans. Whether it’s family links past or present, the beautiful countryside, or the culture and sophistication of its cities, there’s something here that many people find irresistible. With so much going for it, Ireland often becomes more than a vacation spot and starts feeling like a place to call home.

If you’re able to think about settling down in Ireland, you may well be looking at buying a property there. Ireland is pretty open to foreigners who want to invest in the country, and you won’t encounter restrictions designed to stop you purchasing real estate here. You’ll still want to know the rules, though, to make sure that your property transactions are completed smoothly and quickly.

In this article, you’ll find a run-down of what you need to know before buying property in Ireland. We’ll cover rental as well as buying outright, and we’ll take a look at how costs vary in different parts of the country. Plus, if you do take the decision to buy, you’ll need to know about financing your purchase. We’ll show you ways you may be able to save on international transfer costs with services like Wise.

The cost of living in Ireland varies according to where you go. Dublin is generally the most expensive place to live, followed by Cork. Other cities can be quite a bit cheaper, meaning you can find the property to suit you in Ireland no matter what your budget.

It’s good to spend a little time looking into costs in the areas that interest you. Rentals, in particular, can be far higher in Dublin than any other major Irish city. That depends on the kind of property and where in the city it is, as you’d expect. If you’re working on a budget and you’re looking for something a bit cheaper, it could well be worth widening your horizons and looking at some of the smaller cities and towns.

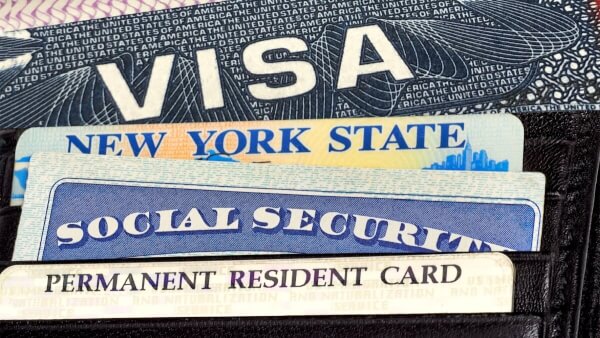

Owning Irish real estate doesn’t have many barriers as a foreigner. The trick is in getting through the buying process, since things like getting a mortgage can be hard if you’re not already established in Ireland. You’ll need to have proof that you’re eligible to live in the country, which generally means an appropriate visa. To avoid getting caught out at the last minute, it’s important to get advice well before you want to actually make the purchase.

To give you an idea, here are the average real estate buy prices for one-bed apartments in some of the most popular Irish cities. The figures show prices per square meter, rounded to the nearest euro (EUR).

| Area | City center | Outside of center |

|---|---|---|

| Ireland average | EUR 3,760 | EUR 2,500 |

| Dublin | EUR 5,672 | EUR 4,372 |

| Cork | EUR 2,450 | EUR 1,993 |

| Limerick | EUR 1,302 | EUR 1,225 |

| Galway | EUR 2,600 | EUR 2,017 |

| Waterford | EUR 1,750 | EUR 1,755 |

As you can see, it makes more difference in some cities than others whether you choose a city center location or one farther out. At the time of research (7th May 2019) it was even a little cheaper to live centrally in Waterford. That may not always be the case, so make sure you check on the latest figures before making your choice.

When you’re thinking about buying Irish real estate, you’ll have a better time if you remember a few things. One of those is that there are some charges and fees you may have to pay, especially if you use a bank that charges high foreign transaction fees. You’ll also need to think about the need to find a deposit, as well as paying legal fees for professional services. Since most banks charge for international transactions, there’s often going to be a markup on the exchange rate between dollars and euros.

If that sounds bad, then don’t worry as there’s good news: you may well be able to save on some of those costs. There are now alternatives to traditional banks, like Wise. With Wise, you get the bonus of the mid-market exchange rate – the one you’ll see on Google, without the extra markup banks are likely to add on. There’s also a simple, no-fuss fee structure: you pay one low, upfront fee and that’s it. This can work out a lot cheaper than using a bank, yet you can still have peace of mind as your money is protected with bank-standard security.

If you’re planning on moving to Ireland for some time, or on making a lot of international payments, you may want to check out the Wise borderless account. This is set up from the get-go to work with a bunch of different currencies, including US dollars and euros. You’ll get personal bank details for the US, Australia, New Zealand, the UK, and the eurozone. You can switch between them as much as you want – again, using the mid-market rate – and pay just one low fee. You can hold dozens of currencies at once and make international payments easily. Ideal when you want to buy a property in Ireland!

An option that appeals to quite a few people is buying property in Ireland to rent out. If you choose carefully, you can end up making a pretty good investment that’ll earn you a nice income. You’ll be in line to get the money paid by people renting your property, but there could be more. If the real estate you purchase increases in value, it’s possible you’ll also benefit from capital gains.

Ireland is a country that’s very appealing to overseas investors, since its laws allow foreigners to purchase real estate very easily. The Irish government wants people to invest in the country, so it makes the investment climate very attractive. In fact, there are no restrictions on the kind of property you can buy there. Even so, there are details of Irish real estate law that you won’t be able to handle yourself, so it’s important to get advice from a qualified professional inside the country. The amount you pay for that will be well worth it, and will save you a load of hassle.

If you think investing in Irish real estate is something that’s right for you, you’ll want to know what kinds of rental yields you can expect. Below, you can find a guide to average monthly rents in some popular Irish areas. We’ve looked at some different property types to give you a better idea of how the numbers stack up. The figures are rounded to the nearest euro.

If you’ve invested in rental property in Ireland, your tenant is probably going to be paying rent in euros. The good news here is that you can open a Wise borderless account and get paid without any fuss. You won’t pay any international transfer fees, either, because the Wise account lets you receive funds as easily as if you had a conventional bank account in Ireland. You’ll also easily be able to transfer your funds to US dollars, for just one low, clear fee and using the fair, mid-market exchange rate. To make it even simpler to use your rental yield, you can also sign up right now for a linked debit card.

Although there aren’t many legal barriers to owning Irish property as a foreigner, that doesn’t always apply to getting a mortgage in the first place. Some banks will turn you down if you haven’t been a resident in Ireland for an extended period of time, often six months but sometimes considerably longer. That doesn’t mean they all will; the Irish banking market is very competitive, so be prepared to shop around.

It’s really important to have a full banking history from your most recent US bank. You’ll need to be able to show you can keep up with the loan, as well as giving evidence for where your current funds came from – job records are the best way of doing that. You’ll also have to give the bank evidence that you’re able to make long-term, regular repayments, so rental or savings evidence will be needed. Note that checking accounts – called “current accounts” in Ireland – are often not enough. You’ll probably need to set up a savings account, so do this well in advance of your application.³

Although in some cases you can get a mortgage for Irish real estate while living in the US, you may have a tough time. European Union rules impose extra restrictions on transactions outside the euro currency zone, and this has led to many banks ceasing to offer mortgages to anyone not earning in euro.⁴ You may still get lucky, but be prepared to have to talk to a lot of banks.

If you’d like to know about Irish mortgages in more detail, take a look at our in-depth guide.

Construction in Ireland suffered badly during the years around the 2008 financial crash, with very large falls in activity. It took until 2013 for the sector to return to growth, but since then the balance has been consistently positive.⁵ In the first nine months of 2018, Ireland as a whole saw an increase of over 27% in housing construction.⁶

There’s a substantial difference in activity between regions. Dublin is unsurprisingly the heartland of construction activity, with Cork also doing well. Other population centres, such as Waterford, Limerick, and Galway, have been lagging well behind the leading two cities. Experts predict a rise in the near future, but with an emphasis on commercial property rather than housing units. If you’re in the market for property in Ireland, it’s well worth keeping an eye on the latest figures as they appear.

It’s hardly surprising that so many people find Ireland a great choice as an expat destination. It’s both lively and beautiful, and you won’t need to learn a new language to live there. Just remember that its real estate rules aren’t the same as those you’ll find back home. Before you start on the journey to purchasing your dream property, make sure you’re eligible and all your paperwork is in order.

Once you’ve gotten that sorted, you’ll still need to find a cost-effective and simple way to handle things like deposit payments and legal fees. This is even more important when you’re making international transactions. The rates that banks offer you aren’t always that great, so it may be worth checking out specialist providers to pay for real estate – like Wise, where you’ll get the mid-market exchange rate all the time, plus easy, low-fee international payments.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your full guide to updating your foreign driver's license to the US.

Stretch your dollars when studying abroad, use Wise.

Everything you need to know about international schools in Manila, Philippines.

Selling property abroad? Check out our guide to maximize returns with these strategies from experienced tax specialists.

Understanding the best study abroad scholarship opportunities for US citizens.

Get ready to study abroad with our guide.