Orange Money international money transfer guide [2024]

Everything you need to know about sending money abroad with Orange.

Although not a bank but a broker, Fidelity provides similar features to its customers through the cash management account option.

While Fidelity allows international transfers, online international wire transfers are not currently available.

In this article, you can learn about Fidelity's wire transfer fees, exchange rates, and transfer times.

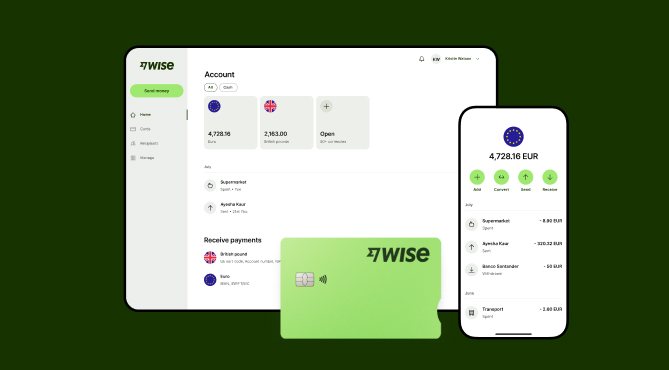

Consider Wise as an alternative provider – you may save money when sending money abroad.

While incoming wire transfers may be free with Fidelity, consider possible exchange rate markups and fees from sending and intermediary banks¹.

For outgoing transfers, Fidelity charges an undisclosed 'Fidelity fee'², and additional fees may apply from intermediary and recipient banks.

If you transfer money with different currencies, an exchange rate markup could be added to the international wire transfer fee.

Note that setting up an international wire with Fidelity requires speaking to a representative⁴.

The table below is based on the fees of a brokerage account:

| Fidelity international wire transfers | Fees |

|---|---|

| Incoming¹ | $0¹ + possible exchange rate markupⁱ + possible fees from sending and intermediary banksⁱⁱ |

| Outgoing (same currencies) | ‘Fidelity fee’² + possible fees from intermediary and recipient banksⁱⁱ |

| Outgoing (2 currencies) | ‘Fidelity fee’² + possible exchange rate markupⁱ + possible fees from intermediary and recipient banksⁱⁱ |

| ⁱ Exchange rate markups | See the next section "Fidelity exchange rates" |

| ⁱⁱ Intermediary/recipient bank fees | Fidelity notes, “The [intermediary] Bank may charge a fee for receiving wires.”³ These flat fees can range from $10-$50 and may be levied by up to 4 banks on top of Fidelity’s fees. |

In general, Fidelity wires the required amount in the foreign currency and debits the equivalent in US dollars from your account.

When sending money abroad with Fidelity, make sure to check their exchange rates if the recipient gets the money in a different currency.

If receiving money in another currency, Fidelity may credit you with the equivalent in US dollars.

| 💡 Unfortunately, Fidelity’s exchange rates aren’t publicly available, which means you’ll need to call a Fidelity representative to check the rate used for your currency pairing before committing to the transfer. |

|---|

Once you have the exchange rate that Fidelity offers for your specific wire transfer, you’ll want to use some calculations to see if you’re getting a good deal. To do that, you’ll want to compare Fidelity’s exchange rate with the mid-market rate using an online currency converter or by googling the currency pair.

If you're concerned about the costs and hidden exchange rate markups of transferring money abroad, consider alternative options like Wise.

With Wise, you'll pay a small, transparent fee and a percentage of the converted amount when sending money online.

Wise may offer the fairest exchange rate, similar to the one you find on Google, with no markup.

There are no hidden fees, and all transfers can be conveniently set up online. Visit our website to discover a cheap way to send money and see if you can get a better deal with Wise today:

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Officially, Fidelity provides two ways of making an international wire transfer:

Fidelity requires those setting up international wires to do so via a Fidelity representative. You should be able to do that at your local branch, or call 1-800-544-6666 to set one up.

Fidelity also offers you the option of filling out their Bank Wire Form and mailing it to one of their offices for processing.

To send an international wire transfer with Fidelity, you’re going to need either their Bank Wire Authorization form, or for sending foreign currencies, their Outgoing Foreign Currency Wire form.

| 💡 To send an international wire transfer with Fidelity, you’re going to need either their Bank Wire Authorization form, or for sending foreign currencies, their Outgoing Foreign Currency Wire form. |

|---|

Currently, Fidelity is not able to process international wire requests online. Which means if you want to send money directly through Fidelity, you’ll have to contact a Fidelity representative. However, there is a workaround which you can use to send money online internationally with Fidelity:

In general, international wire transfers take around 3 - 5 business days to go through.

However, the length of time it takes to make an international wire will depend on where your money is headed. Check the likely delivery time when you place the transaction.

As per the information provided on Fidelity's official website, bank wire transfers are subject to a daily transfer limit of $100,000 per client.⁵

If you’re expecting to receive an international transfer, then the sender will need some information. What’s needed will depend a bit on where they’re based, and whether the transfer is being sent in US dollars, or another currency — but you can expect to be asked for the following:

Don’t forget to also agree with the sender who will cover the charges applied to the transfer.

If you need a little more help, the easiest way to contact Fidelity is through the online chat feature, or by calling the customer services hotline for advice.

When you’re doing your homework on the costs of international transfers, you’ll want to look at both the upfront and intermediary fees, and the exchange rates applied. Compare the rate to the, mid-market rate to make sure there are no hidden fees — and don’t forget to ask about the likely intermediary charges if you choose to make a transfer with a traditional institution.

The real costs of international wire transfers can vary widely, so a little research could save you a lot of money. You can also find the cheapest way to send money on our website.

All sources checked on 25 May 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about sending money abroad with Orange.

What is Ria and how does it work?

Your full guide to international Amscot wire transfers.

Your full guide to M-Pesa international transfers.

Your complete guide to Pangea Money Transfer safety

Your guide to understanding and avoiding wire transfer scams