Orange Money international money transfer guide [2024]

Everything you need to know about sending money abroad with Orange.

USAA customers planning to go overseas may consider wiring money abroad, but understanding international currency transfers and the details involved can be tricky.

This guide can help you on some of the details with USAA international transfers.

Keep in mind, though, using an alternative provider like Wise may help save money and energy – but more on this later.

USAA typically charges a $20 fee per transaction for outgoing wire transfers. For international transfers, there is an additional $25 wire service fee due to correspondent banks¹. Therefore, the total cost of an international wire transfer with USAA would amount to $45¹. However, it's important to note that USAA does not charge any fees for incoming wire transfers².

To sum it up, wire transfer fees for USAA are as follows:

| USAA Bank Transaction | Fee¹ |

|---|---|

| Outgoing international wire | $20 per transaction |

| International wire service fee | $25 per transaction |

| Additional fees² | Intermediary or recipient banks may take fees out of a wire transfer. USAA notes on their website that “Additional fees can vary based on the receiving financial institution”. It's best to contact them to see if there are additional fees expected. |

Since USAA isn’t an international bank, they process international wire transfers through the Bank of New York Mellon.

Often, an intermediary bank like the Bank of New York Mellon or any other correspondent bank used to make the transfer, will convert your money into the correct currency for the recipient, and this conversion generally isn’t done at the mid-market rate.

So apart from comparing the fees being charged, be mindful of the exchange rates being used to convert your money as well, as this can bring about a significant change in the amount of money being received by your recipient.

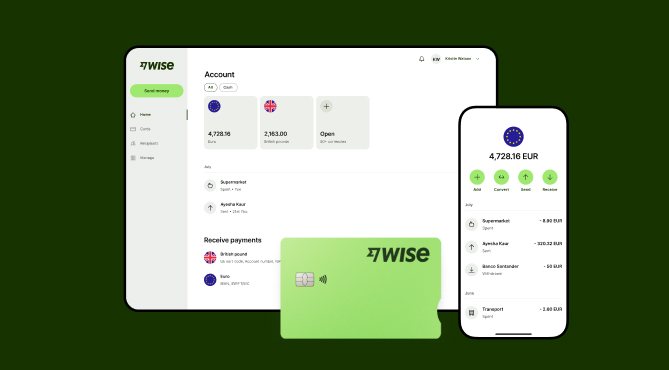

Wise eliminates confusion, markups, and hidden fees when transferring money. With Wise, money is transferred locally, avoiding international transaction fees and intermediary bank charges.

We provide fair and cheap money transfers, using the mid-market exchange rate.

Let's compare an example of transferring $1,000 to a pound sterling bank account in the UK using USAA and Wise:

To see how much you can save with Wise, let’s have an example.

Let’s say you want to transfer 1,000 US dollars to a pound sterling bank account in the UK. Here’s what that would look like using USAA and Wise.

| Provider | Fee | Exchange Rate | Total Cost |

|---|---|---|---|

| USAA¹ (USA) | $20 + $25 international wire service fee | Exchange rate + markup | $45 + exchange rate markup + likely fees from intermediary and recipient banks |

| Wise | $6.93 | Mid-Market exchange rate - same one you find on Google | $6.93 (via ACH pay-in method) |

Wise looks cheaper from this scenario.

But fees aren’t the only reason to consider an alternative to bank transfers. When banks handle international transfers, they often mark up the exchange rate by an average of 4-6%. There are also normally 1-3 intermediary and recipient banks, who can each charge fees.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

To wire money from your USAA Checking or Savings account internationally, you need to call 210-531-USAA (8722) or 800-531-USAA (8722) from Monday to Friday, 7:30 AM to 3:30 PM (central time)². Make sure to note the 3:30 PM cutoff, so call before that time for processing².

| 💡 If you’re looking for a way to send money abroad without having to go through the hassle of making a phone call, be sure to take a look at Wise. A smart and fully online way of creating international transfers. |

|---|

Plan to have the following information on hand to complete your international wire transfer with USAA².

Have in mind that international transfers can only be requested through the phone.

USAA guarantees that wire transfers will arrive within 15 calendar days from initiation, processed the same business day if set up before 3.30 pm CT². If the transfer takes longer, contact USAA at 210-531-USAA (8722) or 800-531-USAA (8722) to open a wire investigation².

USAA's wire transfer limit is $10,000. For amounts exceeding this limit, contact USAA's customer support using the provided phone numbers.

To receive an international wire transfer into your USAA bank account, provide the sender with the details of Bank of New York Mellon and your personal USAA bank account. You'll need to provide your full name, personal address, USAA bank account number (savings or checking)².

| USAA SWIFT code (The Bank of New York Mellon) | IRVTUS3NXXX |

|---|---|

| The name of Bank of New York Mellon and their address | 225 Liberty St, New York, NY 10286 |

| Your bank name and address | USAA Federal Savings Bank, 10750 McDermott Freeway, San Antonio, TX 78288 |

| Bank of USAA account number | 8900624744 |

This payment method is called For Further Credit. Once Bank of New York Mellon receives the money, they will credit it to USAA, who will then add it to your personal bank account within their system. To ensure a smooth payment process, advise the sender to contact their bank for any questions or assistance in setting it up.

You can reach out to the USAA directly through their Support Center, by calling (800) 531-USAA (8722) or through twitter, at @USAA_help.

The processing times for wire transfers can depend on various factors. Domestic wire transfers are usually taking less than 24 hours. On the other hand, wire transfers can take up to 1-5 business days, as more factors can influence their duration.

No. According to USAA, a wire transfer may take up to 15 calendar days from the date of initiation.

No, Zelle is an app which facilitates the payment process between two parties, and allows these peer-to-peer transfers to happen in a matter of a couple of minutes.

Sources:

All sources checked on 25 May 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about sending money abroad with Orange.

What is Ria and how does it work?

Your full guide to international Amscot wire transfers.

Your full guide to M-Pesa international transfers.

Your complete guide to Pangea Money Transfer safety

Your guide to understanding and avoiding wire transfer scams