South State Bank Business Account Review

This South State Bank Business Account review will cover all you need to decide if it's the best choice for your business!

The HSBC business banking accounts were discontinued in the United States in 2021.¹ Thouhg HSBC has discontinued their business account, known as Fusion in the US, they still offer specific, niche business products.

In this article, we will discuss HSBC's products and also talk about the Wise Business account as a way for international businesses to get a reliable, low-cost account that integrates into their way of working.

Looking to operate your international business with less fees?

Get a Wise Business account >>

Trustpilot: Great with 200,000+ reviews⁹

Accounting Integration: QuickBooks, Xero, Sage, Wave, and more

As HSBC offers more niche business products in the United States, it is important to note that there is an absence of certain key information that you will have to attain directly from their team. The information you might struggled to find are fees and specific criteria and information required for obtaining any of their products.

Let's go through the description of each product.²

HSBC's innovative business banking product focuses on early-stage and growing companies. Specifically, the companies that would take advantage of this product are looking for a hands-on approach from their bank regarding their financial management.

This account comes with a dedicated relationship manager and network of experts with HSBC that can assist these specific companies to access venture capital and investors, as well as influencers, customers, and additional global opportunities.⁴

| Features |

|---|

| Competitive interest rates |

| Simplified commercial cards program |

| Dedicated relationship management |

| Fraud Protection |

| Package Pricing: A Suite of Products |

Fees: It's important to note that products and services offered by HSBC for their business solutions in the United States can require that you reach out directly to them.

HSBC international expertise allows their clients to tap into their products for importing, exporting, and engaging in international trade. Let's go through some of their highlighted products and services in this area.

Use HSBC's knowledge to establish favorable terms with buyers and suppliers. In addition, you can get HSBC's tailored solutions, such as standby letters of credit. These standby letters of credit can be financial or non-financial and can be a lifesaver in markets where businesses are less comfortable with guarantees.

Importing can be a stressful thing for a growing business. HSBC's service can give you access to working capital and help you manage the rigors of importing. This includes improving your cash flow, terms with suppliers, and payments with buyers.

The Open Account solution puts HSBC's customers in contact with organizations that are in good standing. This helps their clients eliminate the time and potential pitfalls that go along with establishing relationships with unknown companies in different markets.

HSBC assists in improving just how you use your working capital. One of the main things they highlight is improving your supply chain and ironing out bottlenecks that slow down your access to funds and supplies.

As cash flow can either make or break a fledgling business, receivables finance helps companies manage through the crucial periods where their money is tied up and their payments haven't arrived yet. HSBC offers this service with up to 90% of invoice value coverage.

HSBC offers a few solutions related to exporting your goods. This includes export financing, letters of credit to ensure you get paid (even if it's not on time), and export documentary collections. Again, the services provided around exports taps into HSBC's focus on international markets. Both cash flow, supply chain management, and financing come into play with exporting as well.

HSBC offers commercial cards to various customers types. Let's take a look at which ones might be right for you.

The Global Commercial Credit Card is an all-in-one tool that allows you and your employees to manage and control your expenditures and global capital.

| Features |

|---|

| Optimize your corporate cards program with full visibility over employee spending |

| Online recording of transactions and account reconciliation |

| Commercial purchasing card |

| Virtual card |

| One card for purchasing, and travel and expenses |

The HSBC VIP Travel and Expense Card helps you move around the world without worrying about how you'll manage your expenditures and reconciliation after your trip ends.

| Features |

|---|

| Airport Lounge Access |

| Trip Delay and Cancellation Insurance |

| Complementary WIFI |

| Virtual card |

| One card for purchasing, and travel and expenses |

| Features |

|---|

| Comprehensive Benefits: Airport Lounge Access and ability to skip or get credit towards TSA PreCheck™ |

| Class Leading Rewards: Earn unlimited points which can be redeemed for a variety of purposes |

| Engaging Client Experience: Handle your account through one platform |

| Extensive Coverage & Protection: Insurance coverage on your baggage, mobile phone, rental car, trip |

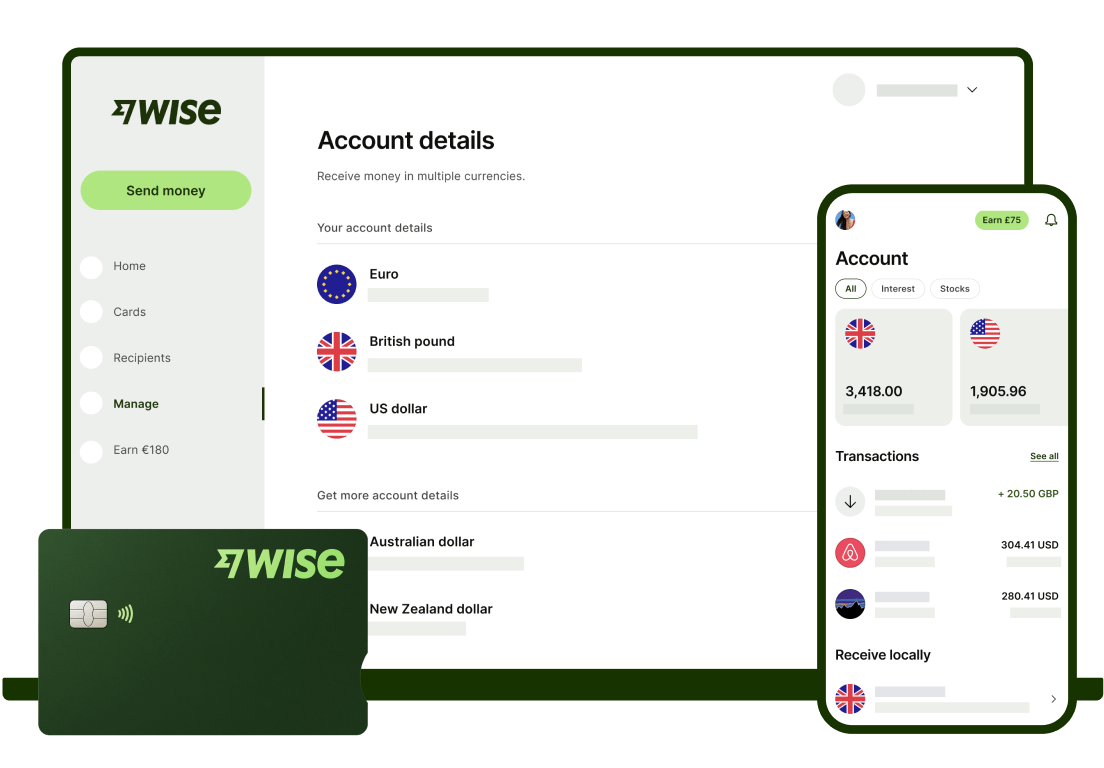

Wise Business, formerly Transferwise, is a banking alternative with a flexible, low-cost international business account. Their goal is to help you avoid the hassles that come with traditional banking through transparent pricing and global reach.

Key Features:

| Feature | Cost/Rate |

|---|---|

| Account Registration | $0 |

| Account Details (Receive Money like Local) | One-time payment: $31 |

| Sending Money | From 0.43% |

| ATM Fees >$100/month/account | 2% |

| Account Funding Transactions | 2% |

| Wise Debit Card | $5 |

| Converting Money | From 0.43% |

Looking to operate your international business with less fees?

Get a Wise Business account >>

Trustpilot Rating: Great with 200,000+ reviews⁹

Over 300,000 businesses use Wise every quarter

No monthly fees or No minimum balance requirement

Accounting Integration: QuickBooks, Xero, Sage, Wave, and more

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Payments, especially international payments, can be a challenge to both small and large businesses. They require attention to both the type of payment, security of the platform, and speed of their delivery. HSBC offers a few products and services that attention to alleviate these business issues.

HSBC assists clients in their collection of payments. Specifically, they offer a product that allows for physicall collection of funds. They allow you to collect cash and payments in multiple countries, and assist you in your electronic fund transfers and bill payments.

Global payables assists HSBC customers in simplifying their global payment processes.

| Features |

|---|

| Credit Transfers: Lowers your time to process paper checks |

| Account Reconciliation Services: Simplifies the process of manaing outgoing domestic and international payments |

| Check Outsourcing: Gives you a central location for managing the processing, mailing, and sending of checks |

| Positive Pay: Checks for fraud and validates check data to ensure correct information |

Make international transactions in multiple currencies with HSBC's solutions.

| Features |

|---|

| Commercial and treasury payments: Speedy electronic payments, both domestically and internationally |

| International letter of credit reimbursement |

| Payment settlement services: Helps you mitigate risk through settling FX transactions |

Go through your options for sending cross-currency transfers with Wise Business. Free account registration for our send money feature means that you only pay the mid-market rate on your transfer.

Let's take a look at what HSBC offers in terms of liquidity and investment services.

Gives you tools to make use of your excess funds. With reporting, you'll be in the position to take full advantage of your working capital.

HSBC offers tools to manage your funds. Let's take a quick look at their features.

| Features |

|---|

| Deposit Account: Gives the chance to earn interest on excess funds, through establishing a separate business account |

| Cash Concentration: Ensures that you aren't storing idle funds and losing the potential to use them effectively |

| Automated Investment Sweep: Opt in to a tool that sweeps your funds and puts them in the best position to use them wisely |

Under payment services at HSBC, all of their payment features are at your disposal. This includes credit cards, domestic, international payments, and FX payments. This service, in essence, is a combination of the ones described above.

While HSBC has lowered the amount of offerings to small and mid-size businesses over the past few years, there are still ways for businesses to use HSBC to get ahead. Specifically, HSBC targets innovative businesses with global ambitions.

Right now, it is difficult to figure out the exact prices that businesses will pay on HSBC's business products and services in the United States. HSBC instead asks their potential customers to reach out.

If you're looking for straightforward fees and prices, take a look at Wise Business fees and prices. Over 300k businesses use our international business products quarterly.

Get a Wise Business account >>

Sources:

1.Reuters - HSBC Exits Retail Banking

2.HSBC Business - Products and Solutions

3.HSBC Business - Innovation Banking Solutions

4.HSBC Business - Innovation Banking

5. HSBC Business - Guarantees

6. HSBC Business - Imports

7. HSBC Business - Open Account

8. HSBC Business - Working Capital

9. HSBC Business - Receivables Finance

10. HSBC Business - Exports

11. HSBC Business - Corporate Cards

12. HSBC Business - Corporate VIP

13. HSBC Business - Corporate World Elite

14. HSBC Business - Global Receivables

15. HSBC Business - Global Payables

16. HSBC Business - Clearing and Foreign Currency Payments

17. HSBC Business - Investments

18. HSBC Business - Liquidity Liability and Investments

19. HSBC Business - Payments

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

This South State Bank Business Account review will cover all you need to decide if it's the best choice for your business!

Whether you’re paying, receiving, or spending, managing multiple currencies should be the least of your worries. The following multi-currency accounts include n

Want to learn more about the best neobanks for business? We'll go through some of the online business accounts that can help your business operate more...

Looking for the best business account to withdraw to and spend your Airbnb earnings from? Let's go through the top accounts you can use for business.

Looking for info about Revolut Business rates? Let's take a look at the fees, plans, and alternatives out there. There are four Revolut Business plans...

Looking for the best banks and business accounts for Uber drivers? In this article, we detail some of the best ones out there for you, including their fees...