Orange Money international money transfer guide [2024]

Everything you need to know about sending money abroad with Orange.

If you’re a foreign worker or an expat, there may come a time when you need to send money to a friend or family member in your home country. The US is the top country in the world for outward remittance, followed by Russia and Saudi Arabia. The top countries for inward remittance are India, China and the Philippines.¹

Regardless of where you’re from, if you need to remit to your home country, Wise may be able to save you money. But more on that later — first, the basics of overseas remittance.

The basic word remittance can be defined in multiple ways. Cambridge dictionary defines it thusly:

an amount of money that you send to someone or the act of sending payment to someone²

Merriam Webster’s definition is a little more broad:

transmittal of money (as to a distant place)³

In essence, a foreign remittance would then be money that’s being sent over international borders.

American manufacturing companies normally pay for purchased overseas goods via foreign remittance.

There are many situations in which money is remitted abroad. For example, US businesses often buy bulk product from China and must make a payment remittance when they purchase goods.

Most foreign remittances can be broken into 4 different use cases:

Some social scientists believe the global implications of foreign remittance are much larger than we think, because the practice is so common. According to Investopedia:

In 2014, $583 billion in USD was transferred between countries — $436 billion of which was received by developing countries.¹

People in developing countries who often receive foreign remittance are more likely to have bank accounts, which may contribute to the economic development of those countries. And personal remittances sent following a natural disaster often surpass official aid.

There are many methods of sending a foreign remittance⁴ from the US. You can use:

That’s a lot of ways to make an international money transfer. However, some of the simplest and most common methods of sending a remittance payment are:

We’ll explore these more common methods below.

Wise is a fast and secure way to send money overseas. Plus, money is sent at the mid-market exchange rate, or the same rate you see on Google — not a marked up rate like many banks and other transfer services use. All you pay to use Wise is a small, fair transfer fee, usually 0.5-2.5%. The fee is spelled out upfront, so there are no surprises when it comes to what it costs to send money.

Let’s say you’re in the US and need to send a $1,000 foreign remittance to India. Here’s what that might look like with Wise:

| You send | Transfer fee | Foreign exchange rate | Recipient in India gets |

|---|---|---|---|

| $1,000 USD | $8.94 USD | The actual rate, with no hidden fees or markups | 64,547.74 INR† |

† Pricing example taken March 7th, 2018

And here’s what it might look like to send a similar remittance to China:

| You send | Transfer fee | Foreign exchange rate | Recipient in China gets |

|---|---|---|---|

| $1,000 USD | $20.28 USD | The actual rate, with no hidden fees or markups | 6,207.41 yuan† |

† Pricing example taken March 7th, 2018

As you can see, Wise has low fees, and it’s transparent about what you have to spend to send your remittance.

Most banks have at least one method for transferring money overseas. Although many American banks limit international services or eliminate them completely.

Not only that, but there are a lot of reasons remittance in banking can be a complex and expensive process. Many US banks require you to go to a branch in person to make an international transfer, at least your first time. For some banks, if they allow international transfers at all, they may still require you to come in person every time.

For banks that allow the convenience of ordering a transfer online or by phone, fees can be very high — up to $50 or more for some banks. Plus, banks tend to mark up the exchange rates on international transfers just so they can make an extra profit off your need to send money. And when international transfers are sent via SWIFT (as most of them are), the money often passes through 1-3 intermediary banks, each of which can charge a fee.

You can see how this adds up, fast.

If your recipient doesn’t have a bank account, sending remittance in cash may be your only option. For this, you may want to use a service like Western Union, which allows the recipient to pick up cash at an approved location.

However, fees for cash pickup can be high — often much higher than transfers to a bank account — and Western Union also notes online that it

> makes money from currency exchange⁵

That means that, despite advertising fee-free or low fee transfers, Western Union is clear that they do make money when they exchange your money from one currency to another. That may not seem like a big deal, but this is often where many transfer services make the bulk of their profit.

If your recipient can receive a bank transfer instead of cash, you may be able to save using Wise over Western Union.

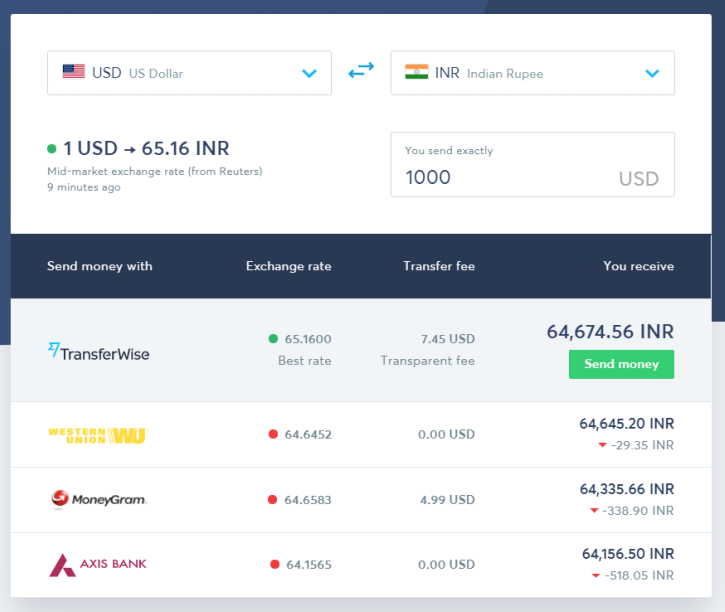

Let’s say you need to remit $1,000 USD to India. Here’s what that transaction‡ looks like if you compare Wise and Western Union with several other providers on March 9, 2018:

‡ Data taken March 9, 2018 approximately 9:00 GMT. Find live updates on how much it costs to send money to India with Wise compared to Western Union.

Now let’s look at the cost of sending $1000 to Brazil and compare Western Union with Wise and Cambio Real.

‡ Data taken March 9, 2018 approximately 9:00 GMT. Find live updates on how much it costs to send money to Brazil with Wise compared to Western Union.

Tax implications for remittances vary depending on what country or state you’re sending the remittance from, the purpose of the remittance, what country it’s going to, whether you’re sending a personal remittance or remitting as a business entity. A qualified tax professional licensed in your country can help.

For businesses and those whom are self-employed, the IRS notes the following:

Most types of U.S. source income paid to a foreign person are subject to a withholding tax of 30%, although a reduced rate or exemption may apply if stipulated in the applicable tax treaty. For more details on the rules for proper withholding and information reporting of U.S. source income paid to foreign persons, refer to NRA Withholding.⁶

For more information, however, it really is best to consult your accountant to ensure the information you’re taking into account is correct. If you’re still curious and want to get a head start on the research, you may start reading through the pages on NRA Withholding⁷ and US Withholding Agent Frequently Asked Questions.⁸

If you need more information about the specifics of remittance, check out these articles:

With this information in hand, you should have what you need to choose a remittance method that’s best for you. Good luck!

| ----- |

| This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date. |

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about sending money abroad with Orange.

What is Ria and how does it work?

Your full guide to international Amscot wire transfers.

Your full guide to M-Pesa international transfers.

Your complete guide to Pangea Money Transfer safety

Your guide to understanding and avoiding wire transfer scams