Wise ACH vs wire guide

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Personal finance expert Emma Lunn explains 5 key finance tips that you need to know if you're moving to Singapore. From transferring your money to affording a meal out, here's what you need to know.

A global city and financial hub, Singapore was ranked the number one place in the world for expats to move to by HSBC last year.

It’s easy to see why when you consider that the city island state boasts a tropical climate, an efficient public transport system, and an unlimited supply of Instagram-worthy food options.

But before you pack your bags for one of Asia’s trendiest destinations, bear in mind that Singapore is one of the most expensive cities in the world – so it pays to get your finances sorted.

Here’s what you need to know.

Buying and owning a car in Singapore is an expensive business.

According to Numbeo, which tracks the cost of living around the world, a Volkswagen Golf 1.4 90 KW Trendline would cost about £19,000 in the UK – but more than triple the price at £67,000 in Singapore.

Much of the headline price is down to the Certificate of Entitlement (COE) – a document you need to own and drive a car in Singapore. Tax and insurance aren’t cheap either. Once you’re on the road you’ll need to pay Electronic Road Pricing (ERP) fees which are levied when motorists use certain busy roads during peak hours.

Rachael Lainé moved to Singapore with her family to set up a business distributing Salt-Water Sandals. She says:

“We are going car-free for now because it is insanely pricey. Taxis are plentiful and cheap in comparison (as is public transport) but we can’t take our dog with us on the bus or MRT (tube) so we have to find a friendly cabbie. I worked out that using cabs for an entire year is still cheaper than getting car – our kids think it's mad!”

Singapore is a regular at the top of cost of living surveys and much of the cost is driven by rents.

About 80% of Singaporeans live in Housing and Development Buildings apartment blocks and apartment owners often rent out spare rooms to tenants. However, some landlords impose draconian rules on tenants, such as not allowing cooking or visitors, so it’s important to understand the rules before you move in.

Condominiums or private apartments are a bit more pricey but often come with swimming pools, security, gyms, and tennis courts. Houses are rare, as land and space are scarce, and tend to be on the fringes of the city.

At some point you’ll probably want to exchange British pounds into Singapore dollars.

When doing so, it’s important to look at both the exchange rate and any fees. Using your bank might be convenient but it almost certainly won’t have the best exchange rate or lowest fees.

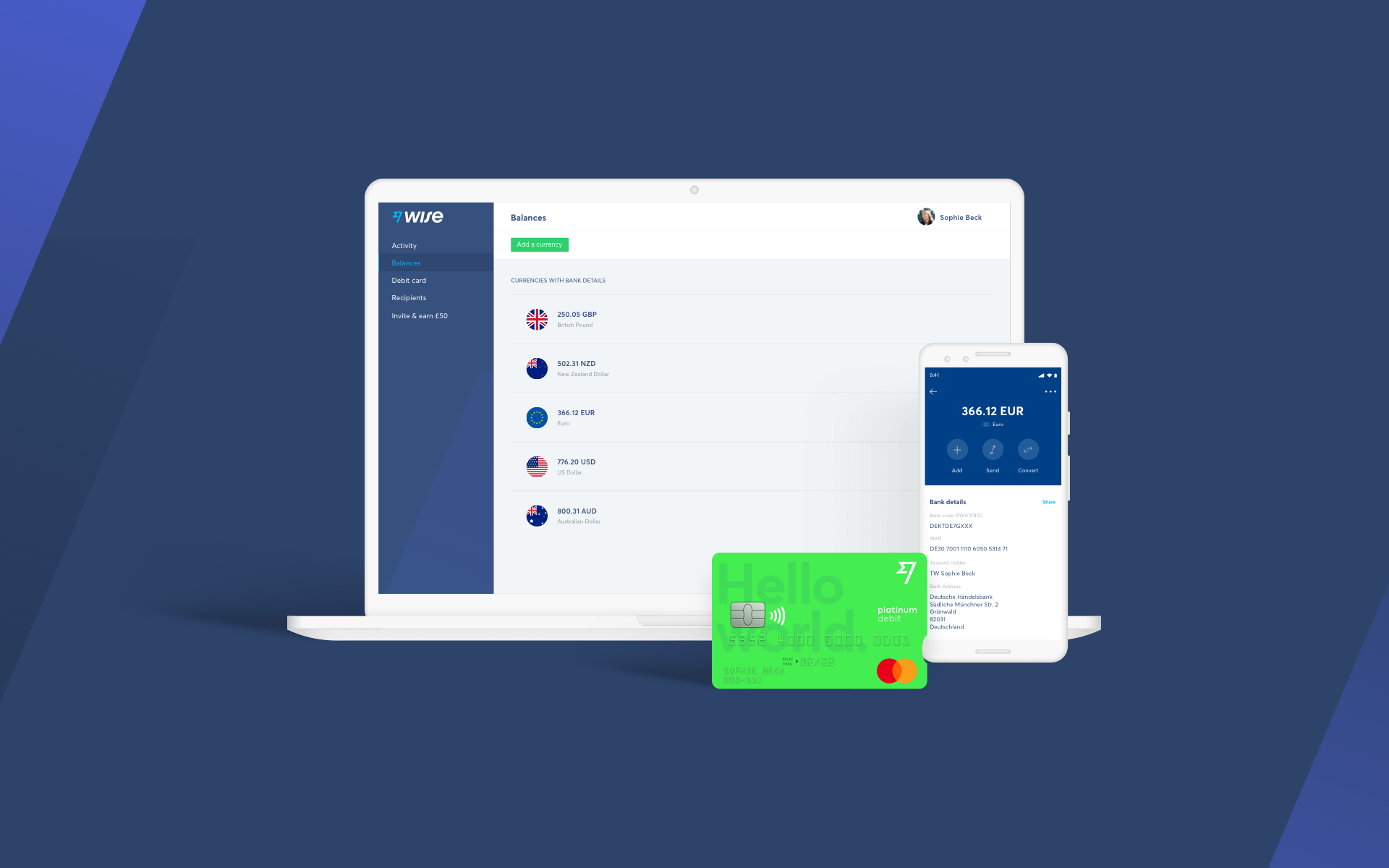

A Transferwise account might be the answer. It allows customers to quickly and conveniently switch between multiple currencies for a fair price, and you can hold and manage money in Singapore dollars, as well as more than 40 other currencies. A Transferwise account comes with a Mastercard debit card which means you can easily spend abroad in different currencies.

Due to increasingly tight anti-money laundering laws in Singapore, it’s become a bit more difficult for foreigners to open a local bank account over the past few years.

The biggest banks include the Developmental Bank of Singapore, Post Office Savings Bank, United Overseas Bank and Standard Chartered Bank. Fortunately, a Wise account lets you hold money in multiple currencies, making it easier to transition to your new home.

Whichever bank you choose there are two key documents you’ll need to open an account: Your passport and your employment pass (or study pass). You’ll need to obtain your employment pass or study pass before you arrive in order to legally work or study in Singapore.

Other useful documents when opening an account include proof of your address in Singapore, your rental agreement and a formal letter with proof of employment or study. Rachael says:

“Locally you can do these amazingly easy transfers via an app called PAYLAH mobile number to mobile number. You can pay for a cab that way.”

Singapore isn’t cheap and new arrivals may be shocked at the cost of some everyday items.

Rachael says things that cost a lot more include: alcohol, tampons, ground coffee, vitamins, cheese, and fresh good quality meat.

“As a result I stockpiled tampons on my last trip abroad and we’ve massively cut down on wine and cheese. A block of bog standard cheddar is around £6 to £8. Groceries are insanely expensive – I bought five pork chops and it cost me over £30.”

On the plus side, eating out is cheap if you eat locally in local hawker centres and food halls. Rachael explains:

“Eating locally you pay roughly £1.50 to £3 for a decent plate / bowl / curry / paratha and the choice is mind-blowing. That’s why 40% of local earnings are spent on eating out – they’ve figured out the fuss of buying ingredients and cooking and washing up just isn’t worth it.”

Another plus point is that Singapore has an array of cheap travel options that will have your friends back in Europe green with envy. Thailand, Vietnam, Cambodia, Bali, Philippines and Malaysia are all within a three-hour flight of Singapore, with return flights often under £50.

| Brit in Singapore? Wise can help you manage your money across borders more cheaply and easily. Join our 6 million customers at wise.com, or download our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Learn all about how the Wise card compares to no FTF ones.

Can you use a Wise Account to convert money you earn?

See how the Wise card compares with Chase Sapphire in our complete guide

Discover in detail whether your account information is visible to the recipient when you make a payment through Wise.

Not sure if Instarem or Wise is the best option for you in the US? Check our guide and find out.