Wise ACH vs wire guide

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Personal finance expert Emma Lunn explains 5 key finance tips and tricks that you need to know when you move to New Zealand. From transferring your money to affording a night out, here's what you need to know.

New Zealand has long appealed to UK expats. It has a better climate than the UK, plenty of space, and there’s no need to learn a new language or to get the hang of driving on the opposite side of the road (Kiwis drive on the left).

New Zealand is also one of the safest countries in the world, with little threat of terrorism.

Auckland is probably the best place to head for if you need a job; while Queenstown, dubbed the “adventure capital of the world” is ideal for adrenaline junkies. Elsewhere there are miles of beaches and acres of countryside and mountains.

Whatever your reasons for moving to New Zealand, you need to get your finances sorted.

Most ex-pats will rent somewhere to live, at least at first.

Rents tend to be expressed in weeks, not per month, and are payable every 2 weeks.

Costs vary according to location – Auckland is the most expensive city. Most properties will be let on a standard agreement written by the Department of Building and Housing, on either a fixed term of periodic basis.

You’ll need references as well as a bond (deposit) which is normally four week’s rent. The bond is held by Tenancy Services Centre (similar to the UK deposit protection scheme) and refunded at the end of the tenancy provided the property is undamaged.

You’ll need your passport, proof of your address in New Zealand, and a visa, to open a bank account in New Zealand.

The biggest banks are Westpac, ANZ, Bank of New Zealand and ASB.

You’ll get an EFTPOS (electronic funds transfer point of sale) card with a current account – this is essentially the same as a debit card so you can pay by chip and pin, contactless (known as “Tap and Go”) and also get cashback at many places.

In general, cash withdrawals are free from your own bank but there will be a fee for transactions if you use an ATM owned by a different bank.

At some point you’ll want to exchange British pounds into NZ dollars.

When doing so, it’s important to look at both the exchange rate and any charges. Using your bank might be convenient but it almost certainly won’t be the cheapest option.

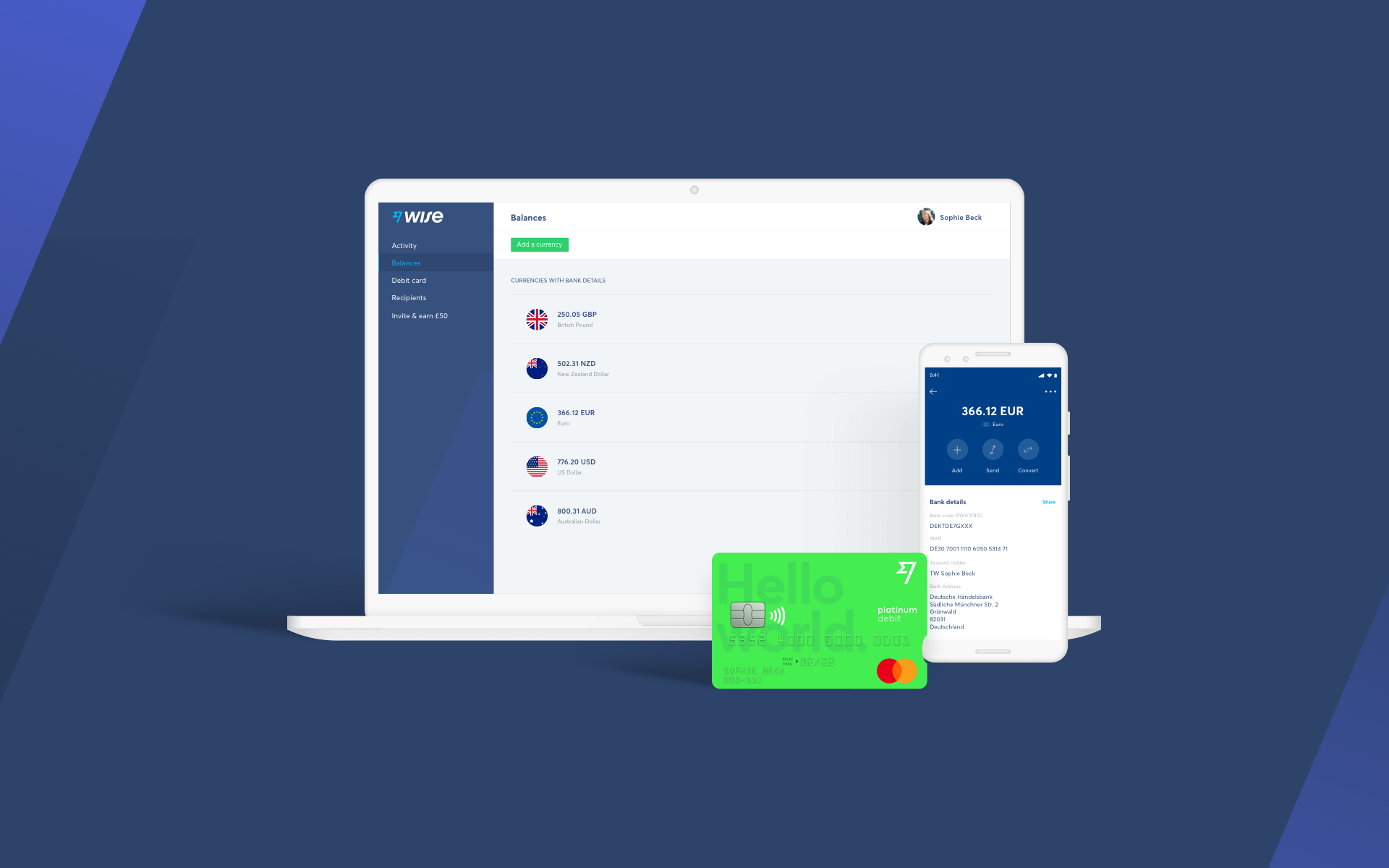

A Transferwise borderless account might be the answer. It allows customers to quickly and conveniently switch between multiple currencies for a fair price, and comes with a snazzy green Mastercard debit card which means you can easily spend abroad in different currencies.

You’ll get local bank account details for both the UK and New Zealand (plus Australia, Europe and the US) – so you can get your Kiwi salary paid into your Transferwise account if you want to.

Leona Oliver has been living in Taupo, Waikato for the past year with her partner.

She was shocked at the cost of groceries when she first arrived in New Zealand.

“For the weekly shop we spend about double what we did in the UK. There are only three major supermarkets, and no Lidl or Aldi driving costs down. Food is also a lot more seasonal so you shop accordingly to get the price down. I have found items such as women’s shoes much more expensive but at the same time there is much less of a drive towards consumerism. The pressure to look a certain way or have a particular brand isn’t there and I actually spend less on clothes and make-up than in the UK.”

As a fitness fanatic, one thing Leona has found to be cheaper in New Zealand is getting sports injuries treated – appointments for osteopaths, physiotherapy and sports massage are all half the price of the UK.

Even if you look well over 18 (the legal age for drinking alcohol in New Zealand), expect to be asked for ID when entering licensed premises.

Unless you have some Kiwi-issued ID such as a New Zealand driving license, you’ll need to carry your passport.

Alcohol laws are strict in New Zealand – you can be turned away, or ejected from, a venue for appearing drunk even if you’re not causing any trouble.

If you go out for a meal in New Zealand it’s normal to pay at the counter on the way out – not call the waiting staff to bring the bill.

| Brit in New Zealand? Wise can help you manage your money across borders more cheaply and easily. Join our 6 million customers at wise.com, or download our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about using Wise for USD transfers and paying via ACH vs wire

Learn all about how the Wise card compares to no FTF ones.

Can you use a Wise Account to convert money you earn?

See how the Wise card compares with Chase Sapphire in our complete guide

Discover in detail whether your account information is visible to the recipient when you make a payment through Wise.

Not sure if Instarem or Wise is the best option for you in the US? Check our guide and find out.