Aspire has the SMBs, now they can go global with Wise

Reinventing banking for 78M SMEs in Southeast Asia “We started Aspire with one thing in mind - serve small business owners with speed and simplicity. No long...

Today is an exciting step towards modernizing international banking in Asia.

We’ve brought Wise for Banks, our bank-friendly API integration, to Asia, enabling financial institutions to surface our best in class international transfer experience directly within their banking app to give their customers cheaper, faster, and transparent international payments.

All this is possible thanks to our powerful and easy to use API, which is the gateway to our infrastructure.

Aspire is reinventing banking for 78M SMEs - small & medium enterprises - in Southeast Asia, starting with Singapore. They serve a new generation of digital-savvy businesses with a mobile-first digital business account.

“We’re excited that small businesses and business owners using Aspire can now make international payments through our partnership with Wise. Wise and Aspire both share an ambition to build a new standard in banking and international transfers.” shared Aspire Co-founder and CEO, Andrea Baronchelli.

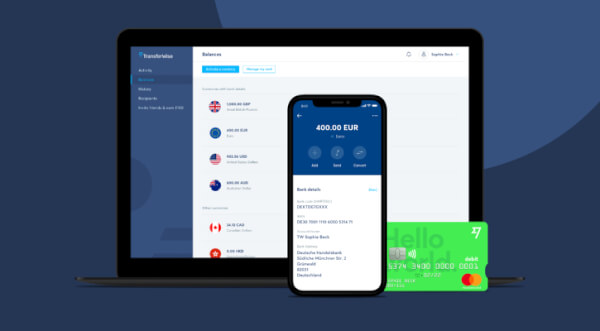

Wise for Banks, lets banks, credit unions, digital wallets, and other financial institutions offer their customers our much loved international transfers experience, with the added convenience of not having to leave their banking app. All transfers are sent using the real exchange rate you find on Google and cost the customer only a small, upfront fee.

By tapping into our API, more people and businesses can have access to better, fairer international bank transfers. Bringing this service to Asia is another step towards our vision of everyone getting fast, cheap, transparent international payments wherever they are, whatever they’re doing.

For our partners, they get access to Wise’s global payout network to banks and digital wallets in Southeast Asia (Thailand, Indonesia, Philippines), and more. The integration helps partners reduce operational costs and set a new payments standard for their users.

The integration with Wise makes Aspire the first neobank in Singapore to provide international money transfers with no exchange rate markups or other hidden fees.

Andrea adds: “Leveraging Wise’s open API allows us to do this without much additional and expensive build, enabling us to unlock cross-border payments for our thousands of customers quickly and easily.”

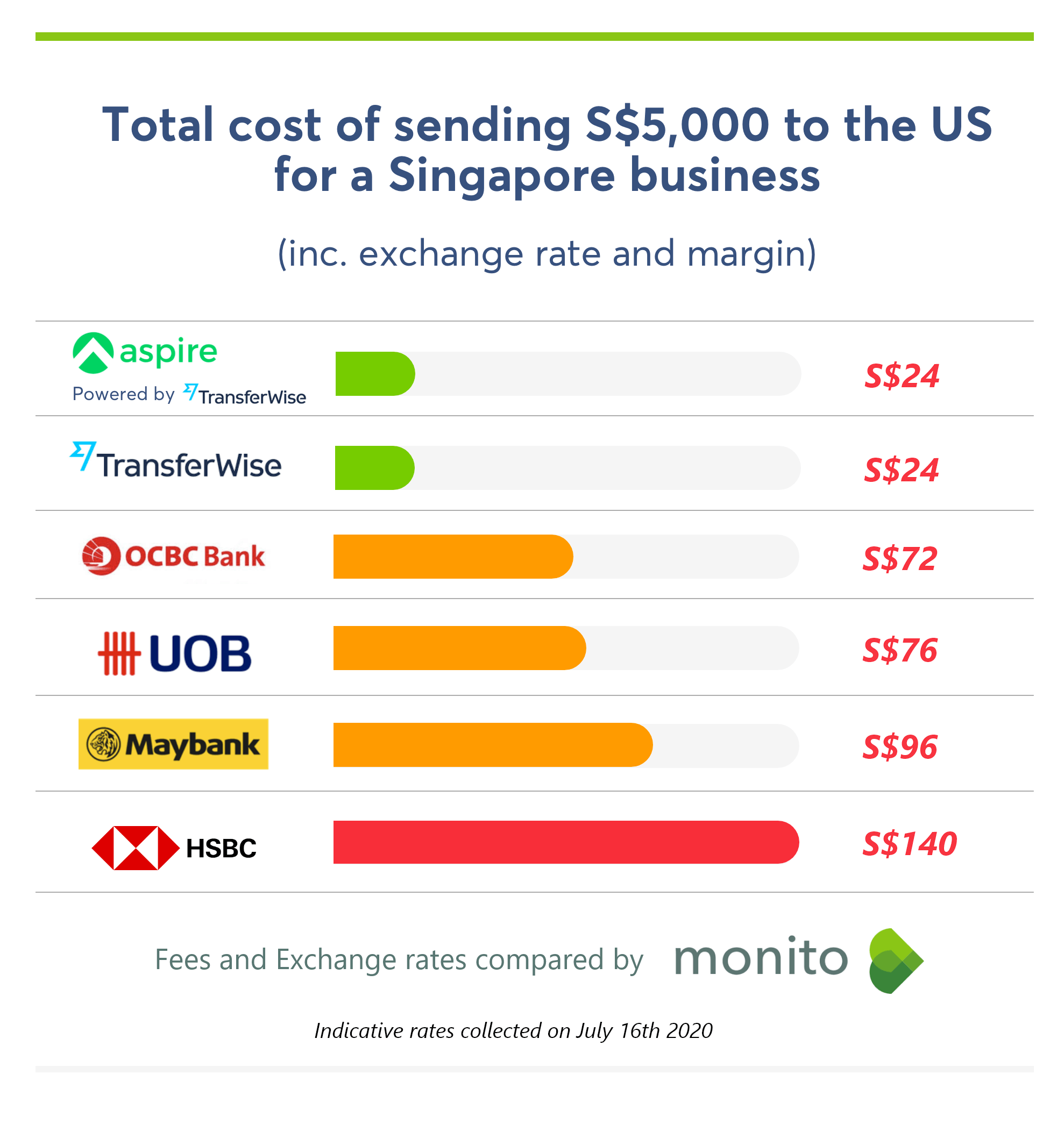

With local integration support, and just a few weeks of development effort using the Wise API, Aspire has instantly topped the comparison table on price — not to mention transparency and speed — against banks who’ve been at this for decades.

Overnight, Aspire has become 4x cheaper than its next bank competitor for sending money abroad.

We’re incredibly excited to work with trusted partners on four continents to make their customers lives significantly easier when sending money abroad. Surveys show that our partners’ users enjoy the convenience of our service and more than 90% using the integration would recommend using our service.

Wise for Banks has partnered with Monzo in the UK, bunq in the Netherlands, N26 and Mambu in Germany, Activo Bank in Portugal and LHV in Estonia, with Novo and Stanford Federal Credit Union in the US and EQ in Canada. In Europe, we're getting a bigger footprint with our new partnership with BPCE, France’s second largest bank, and Neon in Switzerland. We’ve also announced partnerships with Up! in Australia.

With open banking, and increase in transparency, our partners have set a new standard of user experience with our API integration. We look forward to building many more partnerships in the next few months as more banks put their customers first.

Ready to put your customers first and bring them the best way to move money? Say hello to our team at banks@wise.com

Price comparison data for Singaporean banks' international telegraphic transfer service (TT) are based on data obtained online on the respective bank's website, on tariff brochures and by calling customer support on 16/07/2020. Monito then compared the fees and exchange rates with XE's mid-market rate at the time of collection (or publication of the rates, when available) to calculate the total costs (S$ or %).

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Reinventing banking for 78M SMEs in Southeast Asia “We started Aspire with one thing in mind - serve small business owners with speed and simplicity. No long...

TransferWise 是一個讓您能夠以低費用、簡單輕鬆地匯款到世界各地的嶄新方案。 我們正為跨境生活、旅行、或做生意的人士建立一個更好,費用更便宜,更公平的系統。 使用 TransferWise 時,您會發現所收的費用保持在合理水平,並以實際匯率進行兌換。 匯率與大企業及銀行相同。 如您選用...