Transferring large amounts with First Direct

Check out our helpful guide to First Direct transfers for large amounts, including transfer times, limits and how to set up your first payment.

I work in the Comparison Team at Wise.

We exist because, in general, people don’t understand how they’re charged for international money transfers. So we spend our time making it easier for people to shop for them. We do this by collecting and displaying the cost of moving money in a standardised way.

In this post we’ll go through some of the data we’ve collected over the past year or so and highlight some of the practises that make the cost of a transfer so hard to understand.

Before you know what to look out for, you need to understand how you can get charged.

euros you get = (pounds you send - fees) * exchange rate

Or

euros you get = (pounds you send * exchange rate) - fees

Once you look at the formulas, it doesn’t look very complicated. But if it’s so easy to work out how much money you’ll receive, why is it so difficult to know if you’ve got a good deal?

The root of the problem is that it’s difficult to know what you should reference the quoted price against. Which is why we use the mid-market rate at Wise. It’s easy to look up on Google, and makes it easy to understand how much you’re being charged.

cost = (pounds you send * mid-market rate) - (euros you get)

Now, while this is again a straightforward calculation, the assumptions we as consumers start to make based on our understanding can lead us into believing that we’ve got a good deal when, really, we haven’t.

Money transfer organisations are under no obligation to keep the amount they charge predictable. This forces the burden of diligence on the customer.

To help you make an informed decision, we’ve put together 4 things to watch out for when you send money abroad.

The first thing you should check when sending money abroad is how the exchange rate compares to the mid market using Google, XE or an equivalent. But this is doubly important if you see the phrases like “0% Commission” or “Zero Fees.”

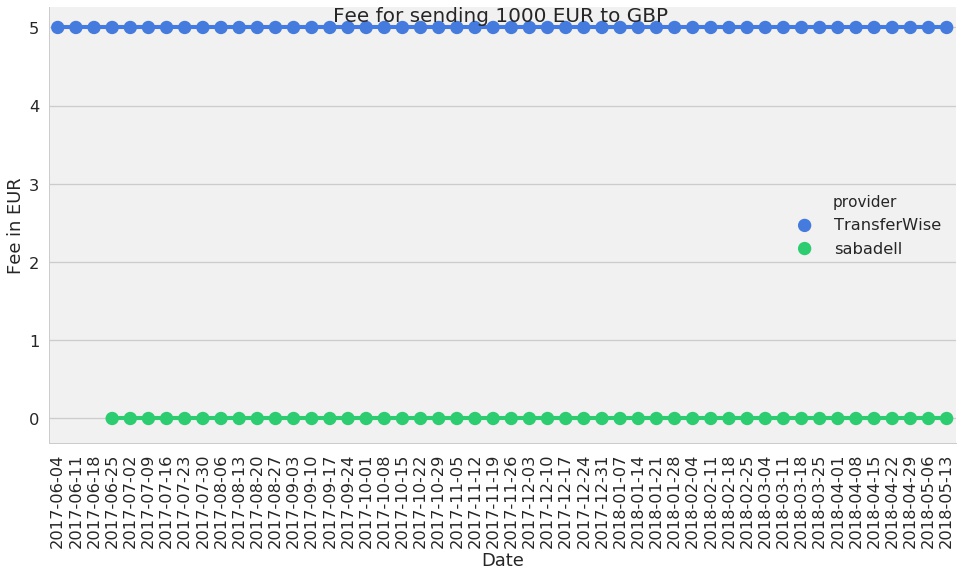

Banco Sabadell is a Spanish bank that offers 0 fee bank transfers.¹ At first glance, their price appears in the image above appears to be much lower than the €4.98 upfront fee from Wise.

But, if you look at the graph below, you’ll find that assumption is only based on the stated fees.

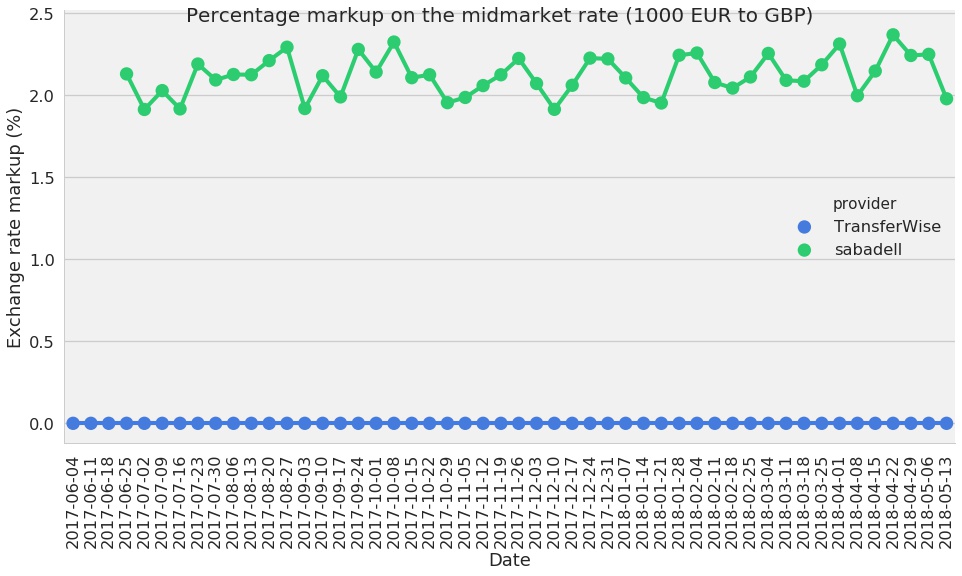

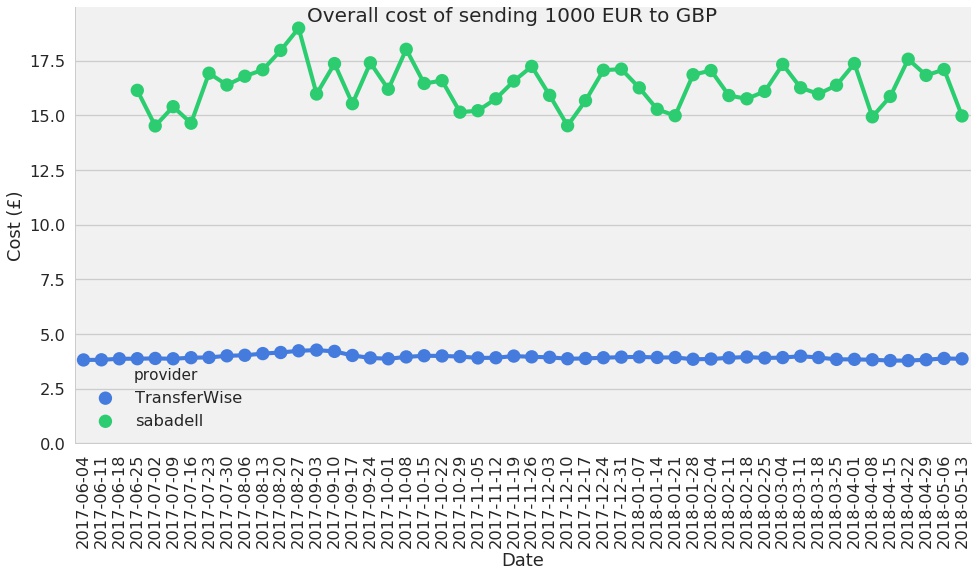

Because when you take a deeper dive into the numbers, you find that Sabadell has a markup of 2% over the mid-market rate. And suddenly it becomes clear, when you look at the overall cost of moving the money, that the exchange rate markup is where they make money on their “0 charge for currency conversion (GBP to Euros).”¹

Now, in the image above, we can see a couple of things.

The reason that this comparison is difficult to make for most consumers is that a lot of providers hide their rate and fee structure behind logins, and it takes a bit of manual labour to suss out the markup. Sabadell is banking on the fact that you won’t make the effort.

At Wise, we communicate when we change our pricing structure, even though we’re not obliged to. If a provider does change their fee structure over a short period of time, there’s not much you can do. Unless you have historic data, you may not even realise they’ve added an additional charge.

There are warnings out there, but then again, they are always out there, and often in fine print. There’s no indication of when or why charges will be added.

For example, Western Union’s disclaimer, posted on many of their website pages, states:

Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice.²

Or take this quote from Western Union CEO Himet Ersek from their Q1 2018 earnings call transcript. On the competitive pricing landscape he says (emphasis mine):

We will definitely look at the prices. We may have to do some pricing actions around the competitive locations, but that – we have been doing that street corner pricing, weekend pricing, different band pricing, next day pricing. We have been doing that for many years and we will continue to do that.³

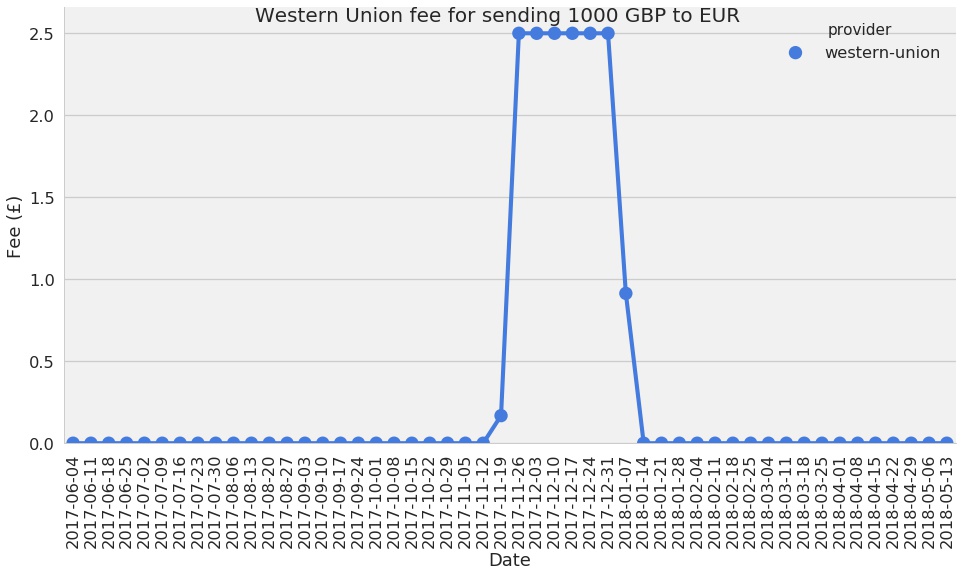

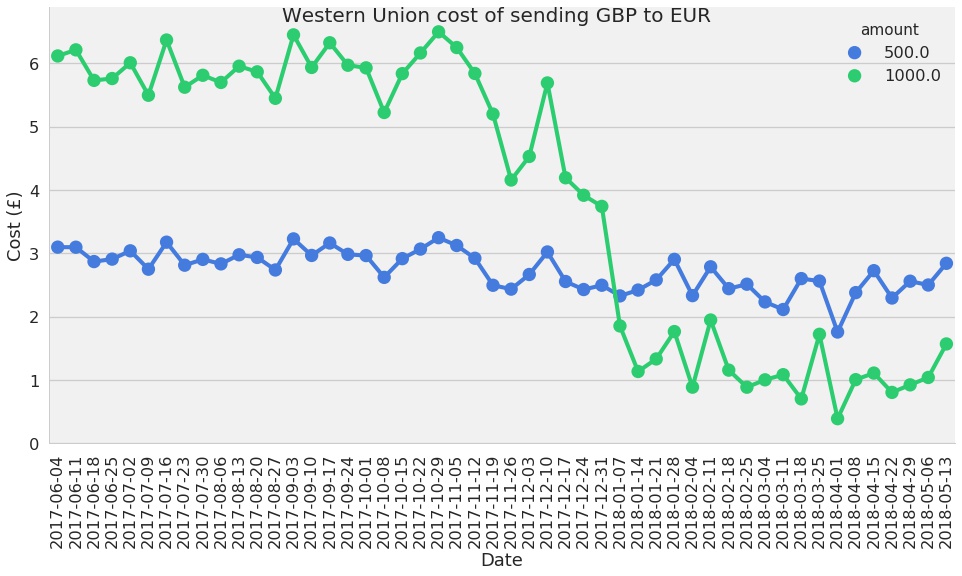

Here, in the image above, you can see Western Union added a £2.50 fee onto the cost of sending a 1000 GBP to EUR transfer for a few weeks. That’s it.

But what’s wrong with this practise? It capitalises on human behaviour. Most of the time, this charge isn’t there. So regular customers will assume they’ll be charged the same amount they always have. But that isn’t the case during the price spike. They get charged £2.50 more.

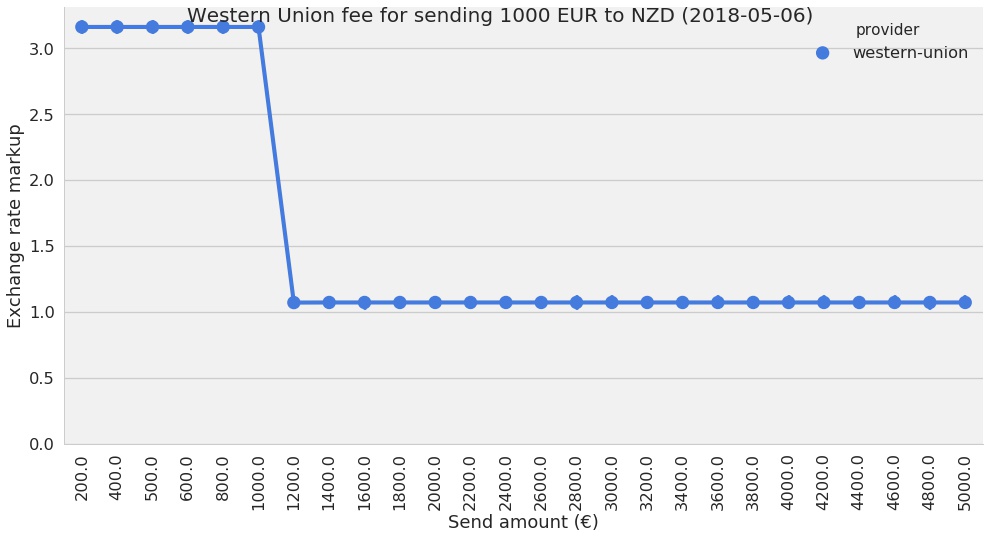

It’s also worth noting that the exchange rate markup can change with the amount you’re sending. This might be the ‘band pricing’³ Western Union’s CEO mentioned in the previous section. Above, Western Union halves their exchange rate markup if you’re sending over 1000 EUR to NZD.

These exchange rate markups can also appear at any time. In the time period above, Western Union dropped the price — both fee and rate markup — on sending 1000 GBP to EUR. If you were a regular customer who’d previously learned that it was the same price to send two lots of £500 as it was to send one of £1000, then perhaps you’d gotten used to sending your money in smaller amounts. But, since January 2018, if you sent two £500 transactions then it would have cost you nearly 6 times as much to send money your normal way. But without any forewarning, you wouldn’t think to expect it.

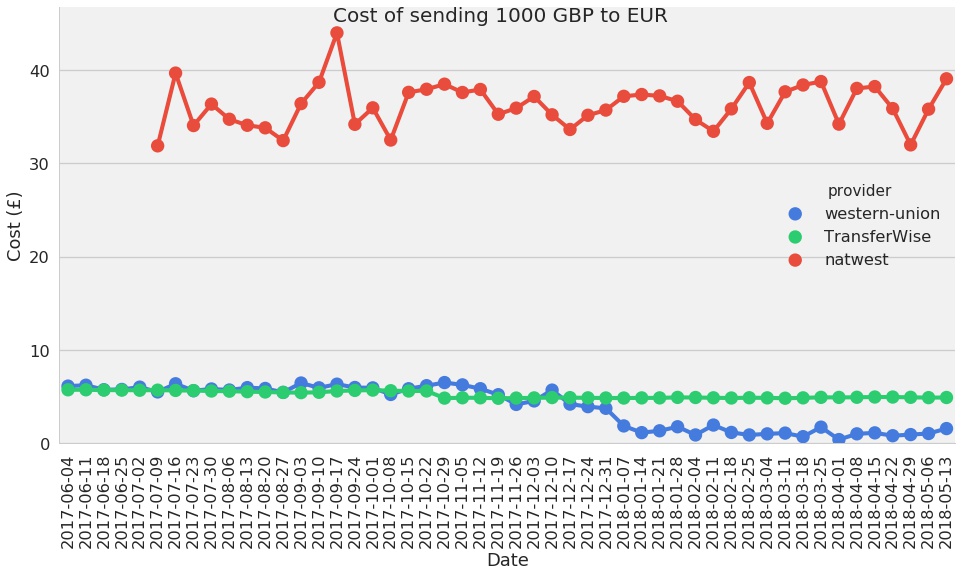

Western Union has a really low cost for sending 1000 GBP to EUR. In fact, they’re consistently cheaper than Wise on this route when sending up to 4000 GBP to EUR — the limit that we check for. We recommend anyone who is exclusively trying to maximise their savings to use Western Union on this route.

To show you a bit of the price difference above, I’ve included a bank, NatWest, as a reference point to show you how much of a gulf the costs can be between banks and alternative providers like Wise and Western Union.

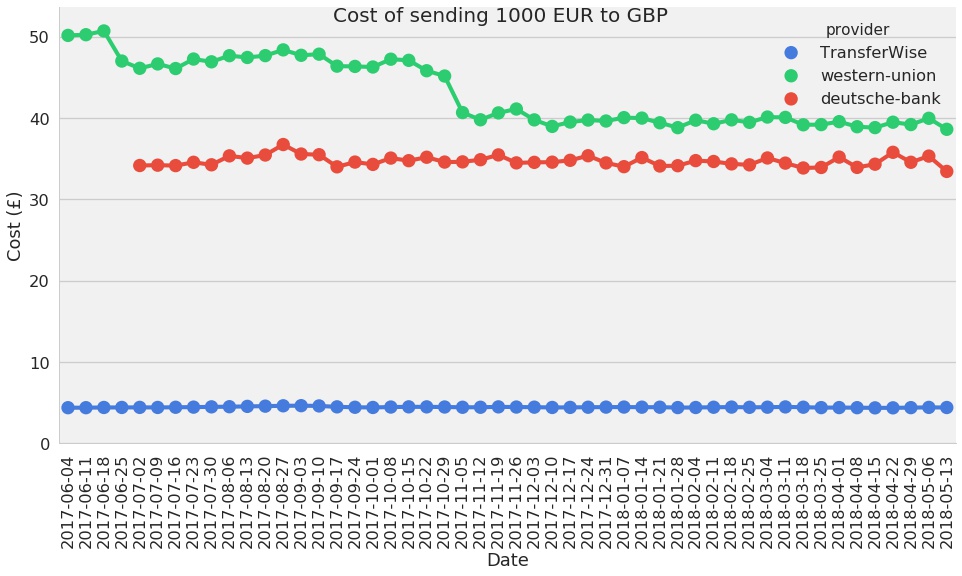

However, even though Western Union is consistently cheaper sending from GBP to EUR from 1000 to 4000 GBP, when you switch the route the other way around, sending 1000 EUR to GBP, you’ll see a different story.

Looking at the numbers above, Western Union charges roughly 6 times more on the EUR to GBP route than the GBP to EUR route. It’s gone from being the cheapest in one direction, to more expensive than a bank, Deutsche Bank, in the other.

We know that doesn’t have to be the case, because Wise is effectively the same cost in both directions.

This raises a question. Why are people in places like Germany and Italy charged 6 times more to send money to the UK than people sending in the opposite direction?

It can be hard to shop for an international money transfer because it takes a lot of work to make sure you’re getting a good deal.

This shouldn’t be so. If the data is presented openly, the arithmetic isn’t hard. That’s why we built our comparison product. And we highly recommend checking it out, or using a similar service like Monito, before you send money abroad.

Because if one thing is clear about the money transfer market, it’s that you can’t make assumptions about how you’re being charged.

Marcus Atkinson

Comparison team, Wise

At Wise, we haven’t yet managed to make sending money across borders sustainably free. That’s why we’re still charging our customers. But we try to make our pricing as simple as possible. And we avoid things like cross subsidisation, so that customers can see how close we’re getting to making things free.

Obscuring the cost of a transfer via an exchange rate markup, or having a time-dependant aspect to the cost only makes customers’ lives more difficult.

We believe that there’s already too large an opportunity to charge more “because you can” in the industry. So as long as we have the data, our comparison tables will always show you who’s the cheapest.

As a note to other money transfer providers, if you’d like to expose an API to us to get featured on our comparison widget, please get in touch at comparison@wise.com

If you’d like to join us on our mission click here!

We base our price comparisons on data we’ve taken from other providers’ websites on specific dates.

Some providers don’t make their fees and exchange rates publically available. In those cases, we use their service for bank-to-bank transfers — just as if we were customers — right until the point of paying. We do this multiple times, and we enter different amounts of money to find out the cost on various amounts and currency routes.

Sources

| ----- |

| This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our helpful guide to First Direct transfers for large amounts, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to Revolut large payments, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to PayPal large amounts transfers, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to Afro International money transfers in the UK, including fees, exchange rates, transfer times and more.

Check out our helpful guide to PassTo money transfers in the UK, including fees, exchange rates, transfer times and more.

Check out our helpful guide to UBL UK money transfers in the UK, including fees, exchange rates, transfer times and more.