Europeans have a €30 billion problem

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas...

You have €1,000 which you want to convert into GBP (£). You are given an exchange rate of 0.8671 GBP (£) to the Euro (€). There is an upfront fee of €9,50 applied to the transaction on top of the amount you wish to convert. The amount received in GBP will be £867.10. How much did you pay for the transaction?

Does this sound like a maths quiz? In fact, it’s what we all have to figure out when converting currency whether we’re on holiday or paying a supplier overseas. But it’s impossible to come up with the right answer because it’s missing a crucial piece for the solution: the mid-market rate. A piece of info that the banks rarely provide. Without that, we don’t realise there’s a charge in the exchange rate the banks give us.

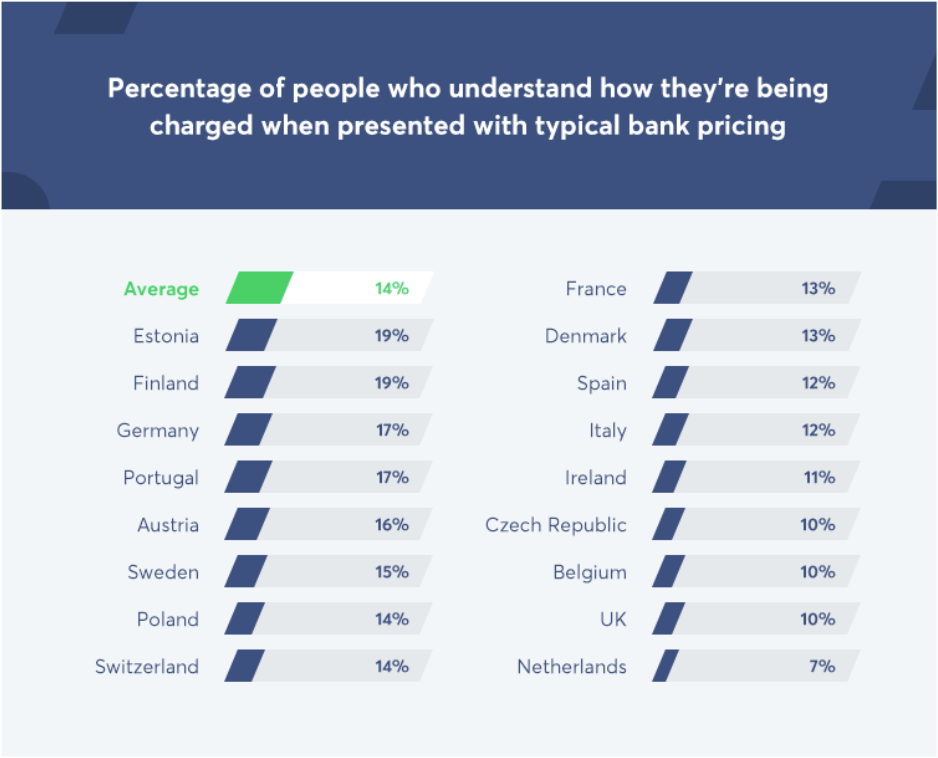

It probably won’t come as a surprise that, when we asked people across Europe to identify charges in an example of a bank transaction just like the one above, six out of seven people didn’t realise that they weren’t given enough information to be able to calculate the charge they would have to pay.

More worryingly, consumers were clearly not aware about how banks price these transactions : two-thirds of Europeans said they didn’t think the bank had put a “mark-up” on the rate or were simply not aware of what the mid-market rate was.

Europe-wide legislation, the second Payment Services Directive requires that consumers should know ‘the real costs and charges’. But the way in which this legislation is being written into laws in all of the member states means that banks and brokers can still hide charges in bad exchange rates.

There is no legal requirement on providers to show a rate comparison in the transaction nor to disclose the amount of the rate mark-up. This means that only a small minority of European consumers are able to accurately calculate the total cost of a transaction.

We want the European Commission to act to protect consumers’ rights. Here’s our White Paper on the subject but in brief, we think they should:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas...

Chancellor of the Exchequer HM Treasury 1 Horse Guards Road London SW1A 2HQ Dear Chancellor, We are writing to you to take this opportunity to stop hidden...

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

There should be nothing to hide Sending money abroad is a big deal for people living international lives. You might be supporting your family, planning your...

Help change the law! Last year, when sending money abroad, British consumers and businesses lost £5.6 billion in fees. Is it bonkers? Yes! Is it surprising?...

Today is World Consumer Rights Day. You may remember that we care - a lot - about banning hidden fees in international payments. But one of our other bugbears...