Transferring large amounts with First Direct

Check out our helpful guide to First Direct transfers for large amounts, including transfer times, limits and how to set up your first payment.

Ever since the creation of Bitcoin and other cryptocurrencies, the landscape of both currency and finance in general has changed. Cryptocurrencies are entirely digital, aren’t produced by a bank or an organisation and aren’t regulated by any central institution.

But, what exactly is cryptocurrency? What technology does it use? Why are people either scared or evangelical about Bitcoin and its cousins? Let’s dive in and see if we can answer some of those questions.

Regular money, or fiat currency, is regulated by a network of financial institutions and banks. Bitcoin, on the other hand, isn't regulated nor centralized. It has a large distributed network of computers running special software. Whenever a bitcoin transaction occurs, the network registers the sender's and receiver's virtual addresses and amount transferred onto a ledger – like a record. Each record is sent to all the network’s computers so they can independently verify the transaction. These records are then collected into batches, called blocks. Each of these blocks are then added to the existing chain of blocks, called a blockchain. Once a block has been added to the blockchain, it effectively becomes immutable - it cannot be modified or tampered with.

Cryptocurrencies are digital currencies that use blockchain technology to do all the things we do with regular money – send, receive, buy and sell. There are hundreds and hundreds of such currencies, the most well known of which is Bitcoin. In this article, we’ll use bitcoin as an example of using a cryptocurrency to send money abroad.

Unlike regular money, no one central authority governs the bitcoin transactions. Every computer on the Bitcoin network verifies the activity on the network in a public and transparent way.

Bitcoin was originally designed to ensure that no more than 21 million bitcoins would ever exist. New bitcoins are currently released at a rate of about 12.5 new coins every 10 minutes. But that won’t always be the case as the rate at which they are released halves after every 210,000 blocks are added to the blockchain. Today, around 16 million bitcoins have been released to the network.

Transferring money from one country to another using traditional banking methods can be both slow and expensive. Usually, when you send money abroad, it goes from your bank to the recipient's bank using a SWIFT transfer. Several banks are generally involved. Not only does each bank take their own fee, but one of them also converts your money from its original currency to your recipient's currency. When the conversion is done, banks use their own currency exchange rate that’s worse than the mid-market rate. This means banks normally make money themselves when they convert your money. Essentially, there’s a fee hidden in poor exchange rates.

Another way of sending money would be to use bitcoin, or any other cryptocurrency that uses blockchain technology and is geared towards value transfer.

To do that, you and your recipient first need to have a Bitcoin wallet where you can send and receive bitcoin. Once both of you have wallets, you will then have unique IDs that act as an address from where you can send and receive bitcoin. From there, to send a transfer to your recipient, you put in your recipient’s unique ID, put in the number of bitcoin you’d like to transfer, and hit send.

When sending your bitcoin, you’ll be able to designate a fee that will be given to those verifying your transaction. Sites will often display or set a recommended fee in order to have the transaction verified within a reasonable time frame, but you can also increase this fee to speed up the confirmation time. Those who verify bitcoin transactions are more likely to push your transfer through quickly if they make more for doing so. At the moment, the average transaction confirmation time is around 17 minutes.

You should make sure you do your homework on how much your wallet site charges. Some add their own fee on top while others choose to deduct it from the transaction. In addition, it’s important to pay attention to the details because some work on a percentage basis while others charge a flat fee. Confusing the two can get quite costly.

Though bitcoin and other cryptocurrencies can sometimes be cheaper than sending money through banks, there are still a number of drawbacks worth considering.

If sending bitcoin is so simple and cost-effective, why don't we all get rid of our bank accounts and use bitcoin instead? Switching to bitcoin isn’t so simple.

Cryptocurrencies weren’t built to act as a supplements for regular payments, they were meant to replace them.

If you’re primarily making payments in regular (fiat) currency and not cryptocurrency, then sending money using cryptocurrency isn’t the most cost-effective, or often even the fastest option.

Here are some reasons why.

First, transfering money through cryptocurrency sometimes makes money transfers more expensive and risky if you wish to ultimately make payments in regular currency. Suppose you’re sending money from the US in dollars to your recipient in India who will then spend in rupees. But using bitcoins.

In that scenario, there will be two total conversions: from dollars to bitcoin, and then again from bitcoin to rupees. Which means, if the market is volatile, you could lose money on an exchange rate not once, but twice.

As you may have noticed in the news, the cryptocurrency market has been prone to large swings. In addition, that also means the bitcoin you have stored in your wallet may either gain or lose value by quite a bit in a matter of a few weeks.

Bitcoin isn't known for being user-friendly. If you have to send money using bitcoin from one person to another, both you and your recipient first need a wallet address, which can be created on any number of bitcoin exchange or wallet sites. Not all sites are created equal. And not all of them are easy to manage.

Receiving money into your bank account is much more convenient for most people. Most of us already have a bank account and can spend our regular money with our debit cards. Bitcoins, at this point, are still harder to spend.

There are places adopting direct bitcoin spending, but these are rare. Usually, it’s hard to spend your bitcoin unless you convert it to regular currency first, and risk running into poor exchange rates with a volatile market.

Considering bitcoin transactions often go through in very little time, you may find it odd that transfer speed is listed as a downside. The problem is that if you want to use your quickly transferred bitcoins for payments in regular currency, you’ll still need to use an exchange to convert bitcoin into say dollars or pounds. Since a bank transfer typically takes at least a few hours, the overall speed of the transfer is immediately affected. If speed is what you're looking for, in some cases it might just be faster to skip the bitcoin step altogether and send the money via more conventional methods. Further, some banks might not even accept money related to cryptocurrencies because they have a policy against it.

One question we get a lot at Wise is if we use cryptocurrency “under the hood” to move money internationally, or if we are planning to. The answer to both questions is “no”. It is important to understand where our costs come from when sending money abroad.

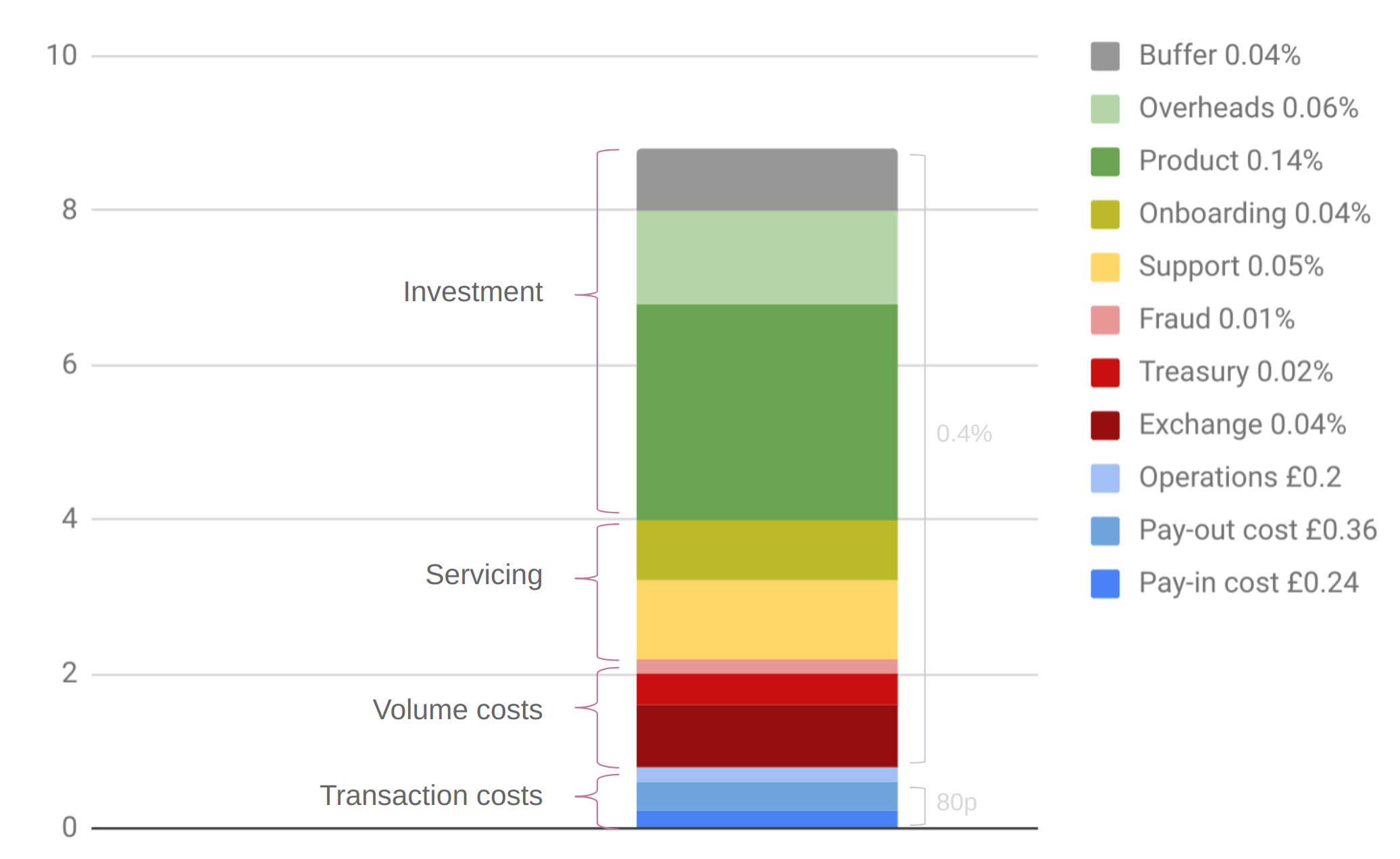

Recently, our co-founder and CEO, Kristo Käärmann, wrote about why we have fees and what our costs are. The key takeaway is that transaction settlement across multiple parties, one of the main benefits of cryptocurrencies, is not a huge contributor to cost for us. Our biggest cost factors are verification, pay-in costs to send money to Wise, pay-out costs to send money to the recipient in another country, fraud, customer support and product (building the infrastructure, website and mobile apps).

The only cost that cryptocurrencies could potentially drive down would be operations, and that cost is the smallest overall contributor to our fees. We still need exchange and treasury to ensure we have enough fiat to send out funds in the recipient’s country.

Like the blockchain technology that cryptocurrency related payments use, Wise also uses a non-traditional method for sending and receiving money. But that’s where most of the similarities end.

Wise has built a local banking network across the world. If you’re sending pounds to euros, you pay pounds into our UK bank account, and we pay out to your recipient from our euro account. As much as possible, money doesn’t cross borders. That makes our transfers much faster and cheaper than most traditional providers.

Unlike cryptocurrency, Wise is licensed by local financial regulatory bodies of each country, such as the FCA in the UK, FinCEN in the US, or the MAS in Singapore. Wise accepts money from bank accounts belonging to the sender, and transfers are normally paid into the Wise system using a debit/credit card or a local bank transfer. Wise then sends money to the recipient’s bank account in an accredited bank in the receiving country. To ensure your money’s safety the entire process is strictly governed by the same financial laws that regulate banking institutions. Keeping your money safe, cutting down on international fees, and helping to prevent misuse of the money sent and received.

If you’re looking for a fast and cost-effective way to send money internationally, Wise could be a great option. And with the Wise borderless account, you can store, send, receive and organize your money in dozens of currencies internationally, without high fees and with the real exchange rate. Just a small, fair charge when your money moves between currencies.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our helpful guide to First Direct transfers for large amounts, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to Revolut large payments, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to PayPal large amounts transfers, including transfer times, limits and how to set up your first payment.

Check out our helpful guide to Afro International money transfers in the UK, including fees, exchange rates, transfer times and more.

Check out our helpful guide to PassTo money transfers in the UK, including fees, exchange rates, transfer times and more.

Check out our helpful guide to UBL UK money transfers in the UK, including fees, exchange rates, transfer times and more.