Share in the future of Wise

10 years down, and now over 10 million of you have joined our mission of money without borders. There’s also 2,400 Wisers across 15 offices working to make...

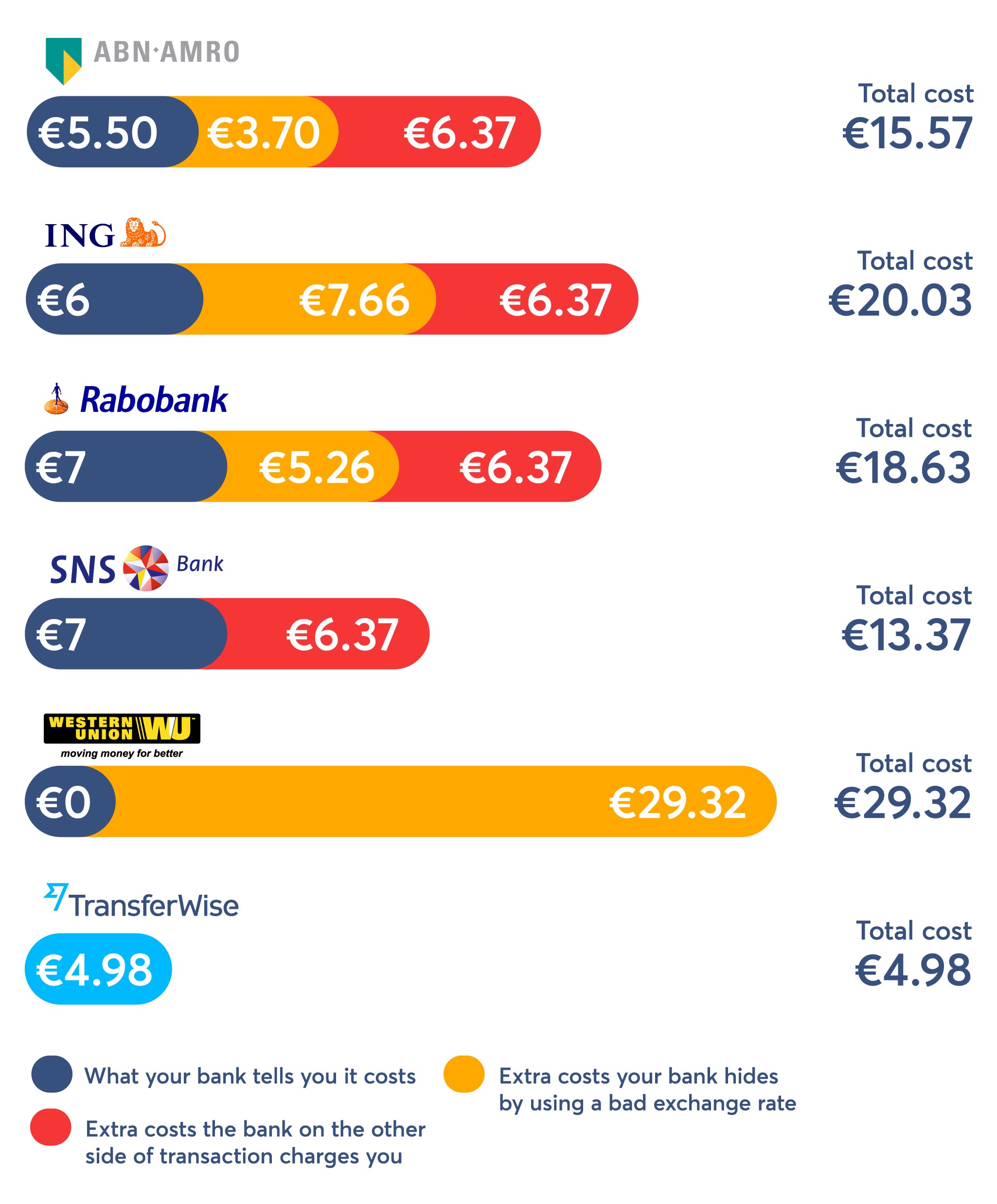

Typically, banks and brokers only show one flat fee when you send money abroad.

But the real cost is actually a lot higher. The banks hide extra costs in bad exchange rates, which are much lower than the real mid-market exchange rate you’ll see on Google. Research by YouGov for Wise shows that nearly half of Dutch people who’ve sent money abroad before have no idea they’re being given a bad exchange rate.

Nope. The bank on the other side can charge you an extra cost to receive the money. Something people who make regular payments weren't aware of: just 1 in 8 know they have to pay up on the other side.

Our research shows that Dutch people think charges over €5 to send €1000 abroad are unreasonable. So why would you accept what banks and brokers make you pay?

At Wise we're all about transparency. No hidden charges. No nasty surprises.

Wise uses the mid-market exchange rate that same one you see on Google and charges a low, transparent up-front fee. That's why it's cheaper.

It's only fair. It's your money.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

10 years down, and now over 10 million of you have joined our mission of money without borders. There’s also 2,400 Wisers across 15 offices working to make...

Still using a bank or broker to send money? Chances are you're overpaying. Traditional providers are deceptively expensive because they use bad exchange...

Still using a bank or broker to send money? Chances are you're overpaying. Traditional providers are deceptively expensive because they use bad exchange...

Still using a bank or broker to send money? Chances are you're overpaying. Traditional providers are deceptively expensive because they use bad exchange...

Hâlâ banka ya da komisyoncu aracılığıyla mı para gönderiyorsunuz? Şimdi para göndermenin daha akıllı ve ucuz bir yolu var. Eğer Avrupa'daki euronuzu...

Türkiye'ye hâlâ banka ya da komisyoncu aracılığıyla mı para gönderiyorsunuz? Şimdi para göndermenin daha akıllı ve ucuz bir yolu var. Eğer Türkiye'ye para...