HSBC Kinetic vs HSBC Business Account: Full Comparison

A complete head to head comparison for two HSBC account options for business: HSBC Kinetic vs Business Account, discover which is better for you.

Need a bank account for a brand new business, or looking to switch from your current bank? One of the main providers you’ll come across is Lloyds, one of the UK’s leading banks.

Lloyds has business banking services for customers of all kinds, from sole traders and freelancers to small businesses and huge multinationals.

In this guide, we’ll take a look at what’s on offer from Lloyds business banking, including account types, features and of course, fees. So, let’s get started.

You’ll have a choice of account types with Lloyds, depending on the size, type and nature of your company. These include¹:

Business Account for New Businesses - a dedicated account for startups or small businesses with an annual turnover of less than £3 million. It comes with a number of business support offers to help your company grow, plus a 12-month fee-free period.

Business Current Account - an account for larger, more established businesses with a turnover of £3 million or above. It comes with dedicated business support to help your business move forward, and you can also use it as a secondary business account (helpful if you’re setting up a new legal entity).

Designated/Undesignated Client Account - this is a specialist account for professional practices which hold client funds, such as accountants, solicitors and estate agents. It lets you hold your client’s money in secure, segregated accounts if needed.

Lloyds also has a number of community accounts, with specialist options for charities and social enterprises, charities, credit unions, clubs and schools.

Here’s a little more about the features and perks available with each Lloyds business bank account.

If your business trades internationally, you may be interested to know that Lloyds also offers a Commercial Foreign Currency Account². Available in a wide range of currencies, this lets you transfer money over from your standard business account - so that you can minimise foreign exchange costs and manage your exposure to exchange rate movements.

Lloyds Bank offers a full online banking service for all of its business accounts, from which you can:

If you’re a new or small business, the Lloyds Business Account for New Businesses is an ideal choice. Like many startup accounts from other banks, Lloyds offers a 12-month initial period free from standard banking fees. This is alongside business support tools, including business insurance, loans and card payment processing.

This should help you get your business off the ground and test out the account, without being weighed down by hefty banking fees.

Lloyds have a relatively simple online application process. But if you prefer, you can also apply or speak to an advisor over the phone, or pop into a local Lloyds branch to get more information.

The method for opening a business account with Lloyds is dependent on your specific business, and the type of account you’re opening. But here’s an overview of the process that should work in most cases:

You may also be able to open your new business bank account through the Current Account Switch Service, which offers a guaranteed switch time of 7 working days³.

The criteria to open a business account with Lloyds depends on your business account type, but you’ll usually need to meet the following criteria⁴:

To open an account, you’ll likely need ID verification for all the key individuals and company directors involved. Plus, full details for the business, including registered address and Certificate of Incorporation and/or registration documents with Companies House.

Now, it’s time for the important part - how much will a Lloyds business bank account cost you? Let’s start with the fees for local transfers and using your account in the UK:

| Fee type | Lloyds -Business Account for New Businesses⁵ | Lloyds - Business Current Account(depending on tariff)⁶ |

|---|---|---|

| Monthly fee | £7 (after free 12 month period) | £15 - £20 |

| Card payments/ATM withdrawals | Free | Free to £0.37 |

| Transfer fee - standing orders/direct debits | Free | Free to £0.37 |

Can I make international payments with Lloyds Bank? Yes, and you can set up most overseas payments through online banking. However, there are some charges attached, which vary depending on the transaction type.

To illustrate, let’s take a look at an example. Imagine your business needs to pay a supplier in the US, and you need to send over a payment of £1,000. Here’s how much it’ll cost you using Lloyds business banking, compared to an international money transfer specialist like Wise.

| Fee type | Lloyds | Wise⁸ |

|---|---|---|

| International transfer fee | £15 (if sent via internet banking, £28 if arranged in branch)⁷ | £4.16 |

| Total GBP converted | £985 | £995.84 |

| Exchange rate | 1.36728⁸ (mid-market rate + 2.6% mark-up₉) | 1.41720 (mid-market rate) |

| Amount received | $1,346.77 USD | $1,411.30 USD |

Another important thing to note about international transfers with lloyds is that you may also have to pay something called a Correspondent Bank Fee. This is payable if you agree to pay the recipient’s fees, and is £12 for payments to the USA, Canada and Europe, and £20 for the rest of the world.

| Fees | Lloyds | Wise |

|---|---|---|

| Receiving fee | £2 for payments under £100£7 for payments over £100⁷ | Free |

| Exchange rate | 2.6% mark-up | Mid-market rate |

If you plan to do business overseas, it’s crucial to have an account that can handle international transactions. This not only needs to be speedy and secure, but also low cost.

As you can see from the comparison tables above, it’s not just the transfer fee you need to watch out for. Banks such as Lloyds tend to charge a mark-up on the mid-market rate, which can make the transfer more expensive.

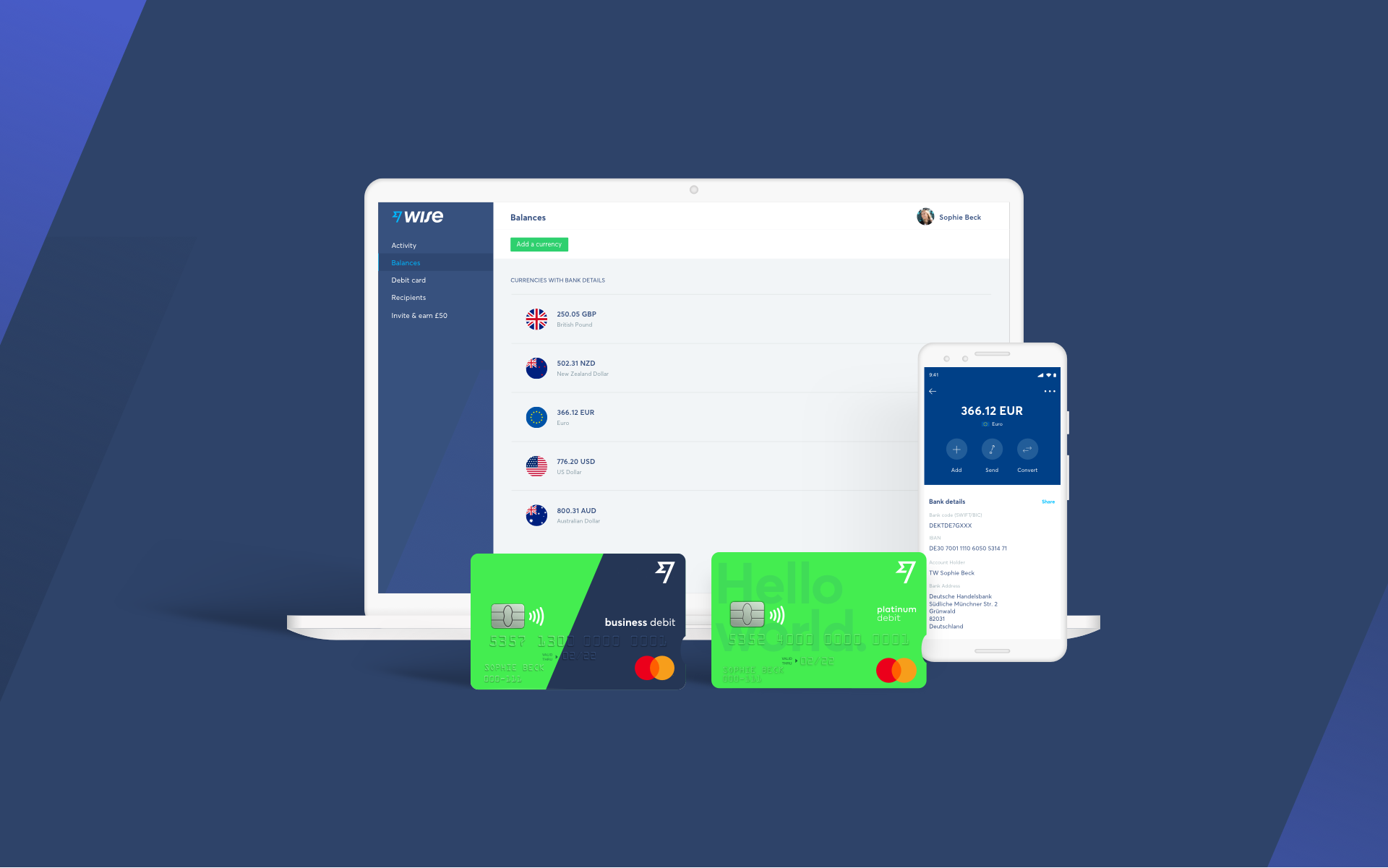

Take advantage of a Wise multi-currency account and you’ll get conversions without mark-up, plus low transparent fees, on all your overseas transfers. You can pay invoices in 70+ countries, make batch payments of up to 1000 at once and even get company debit cards for low-cost spending all over the world and become a business without borders.

Summary

So, that’s all you need to know about Lloyds business banking, including account types, features and fees - plus how international transfers work with Lloyds. You should be all set to compare Lloyds with other business banking tools, and see if it’s the right option for your company.

Sources used for this article:

Sources checked on 10-June-2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A complete head to head comparison for two HSBC account options for business: HSBC Kinetic vs Business Account, discover which is better for you.

Check a HSBC vs Barclays business banking head to head comparison for business in the UK. Rundown on fees, features and account options.

Doing business overseas? Discover the best multi-currency accounts in the UK to receive and send money abroad.

A comparison of Wise Business vs. Revolut Business, covering accounts, features, fees and more.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

A helpful guide on how to close a Revolut Business account, including a step-by-step guide.