Chapter 1 of 5. Read the full report [here]https://wise.com/gb/blog/tag/future-of-finance).

Executive Summary

By Taavet Hinrikus, CEO and co-founder, Wise

Over the last five years, there has been an explosion of tech start-ups rapidly innovating in the finance sector. A number of new players are slicing off a service normally run by a bank and doing it much better - from SME lending to card payments, from wealth management to international payments.

Almost every financial service that is offered by a bank is now also offered - or soon will be - by a financial technology (fintech) company. For the consumer, this means that for the first time ever, there is a real alternative to the banks. Along with greater choice comes better services that are faster, better value and fairer.

Fintech is on the cusp of becoming a mainstream consumer trend. Although its impact on the industry is yet to be truly felt, expectations are high. But finance is one of the hardest sectors to disrupt. One of the main reasons for this is trust. The relationship we have with our banks is unlike one we have with any other service provider. Usually long-term, often for life, we remain faithful no matter what.

Most of us don’t question what a bank does. They make it hard for people to access money; even though it’s our money, they treat it as theirs. With no real competition, the banks have been the only option for all our financial needs for a very long time.

The banks have had no incentive to change and we, as consumers, had no alternative. The monopolistic environment created by the banks made it difficult for challengers to enter the market. The current disruptors are challenging the incumbents by introducing greater transparency - some do this out of a sense of fairness but it was also a necessity in order to compete.

That transparency brings greater freedom and greater choice for the consumer: the possibility of a different future.

So, now are we as consumers ready to break away from the banks?

We’ve asked people around the world about their current and future use of fintech providers in place of banks. In addition, we asked Wise users the same questions to see what the uptake by early adopters can tell us about mainstream adoption.

We’ve also looked at the recent industry analysis on the impact the disruptors have had so far. Based on what people have told us, the world of finance is about to change - for good and for the better.

In five years’ time, the financial services sector will look completely different with a host of new providers and innovative new services. In ten years, it will be transformed. The main shift will be in our expectations and behaviour as consumers; the result will be the true democratisation of finance.

Key findings

The fintech revolution

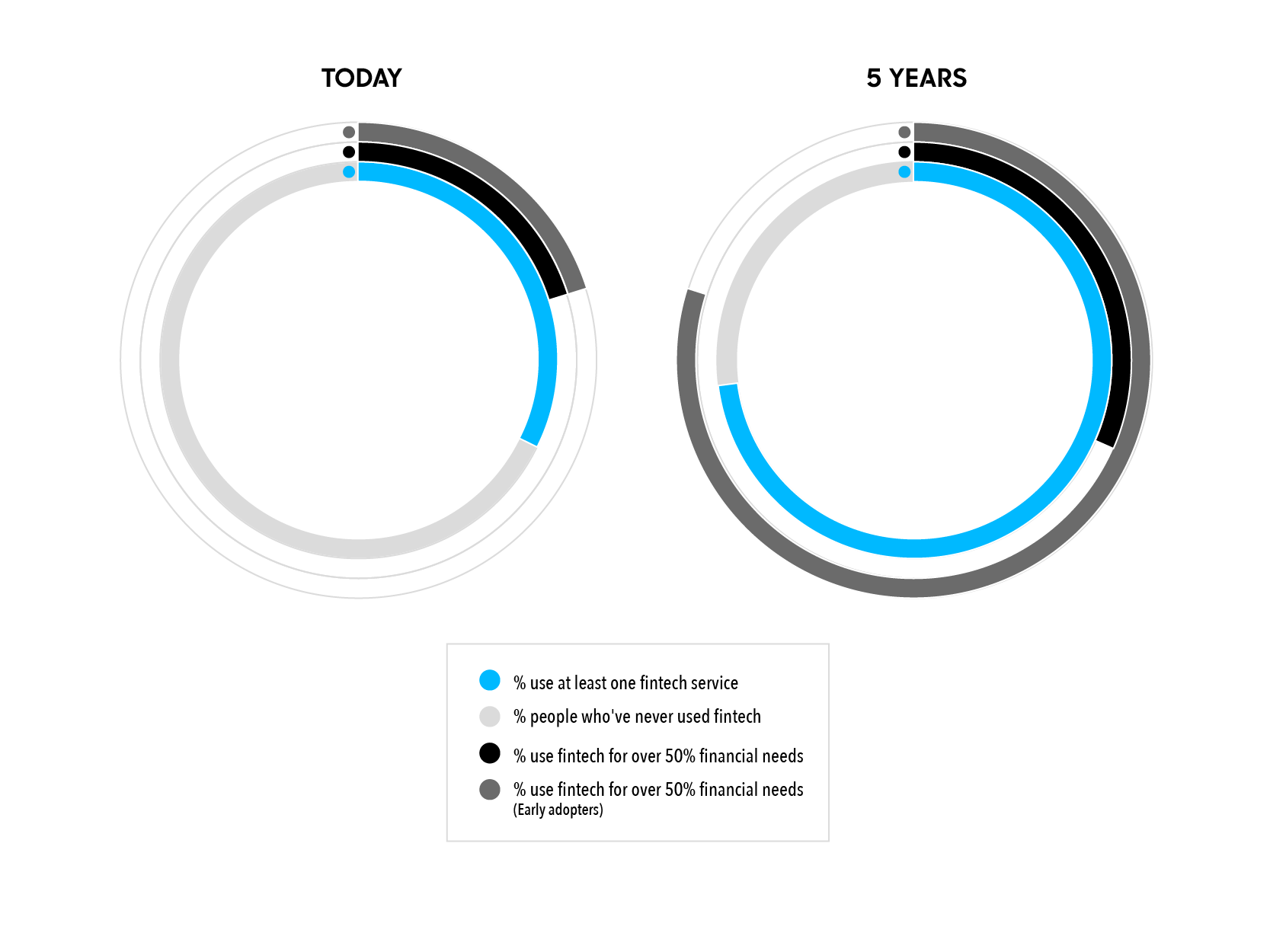

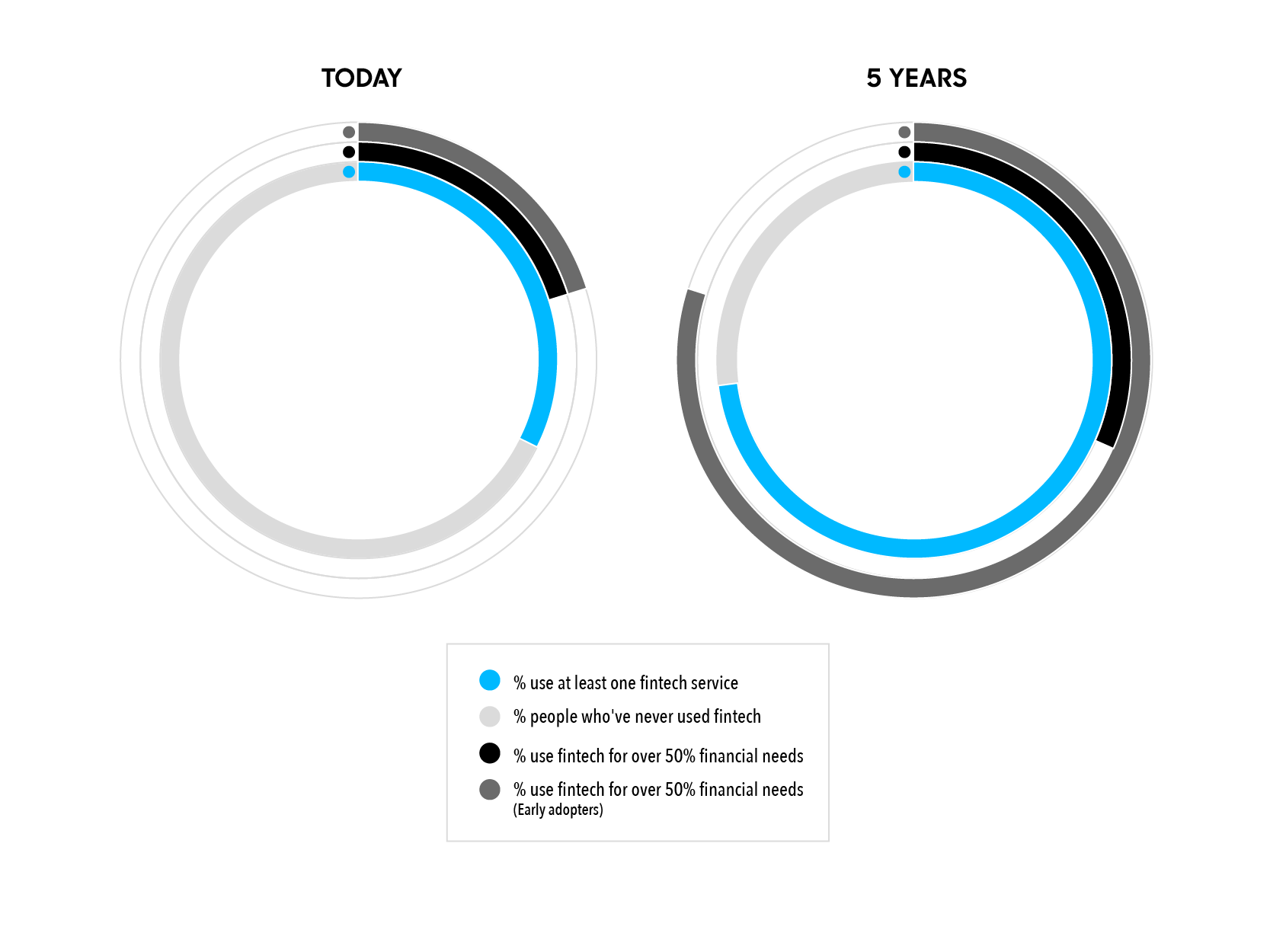

In 2015, 68% of people had never used a technology provider for financial services such as in-store payments, international money transfers, lending, wealth management, property investment. In five years’ time, half (48%) expect to use a technology provider for at least one financial service - and a third (32%) expect to use a technology provider for 50% or more of their financial needs.

In ten years’ time, 20% of consumers anticipate they will trust technology providers for all financial services from credit cards to mortgages.

Uptake of fintech over the next 10 years: early adopters compared to consumers

A revolution for everyone

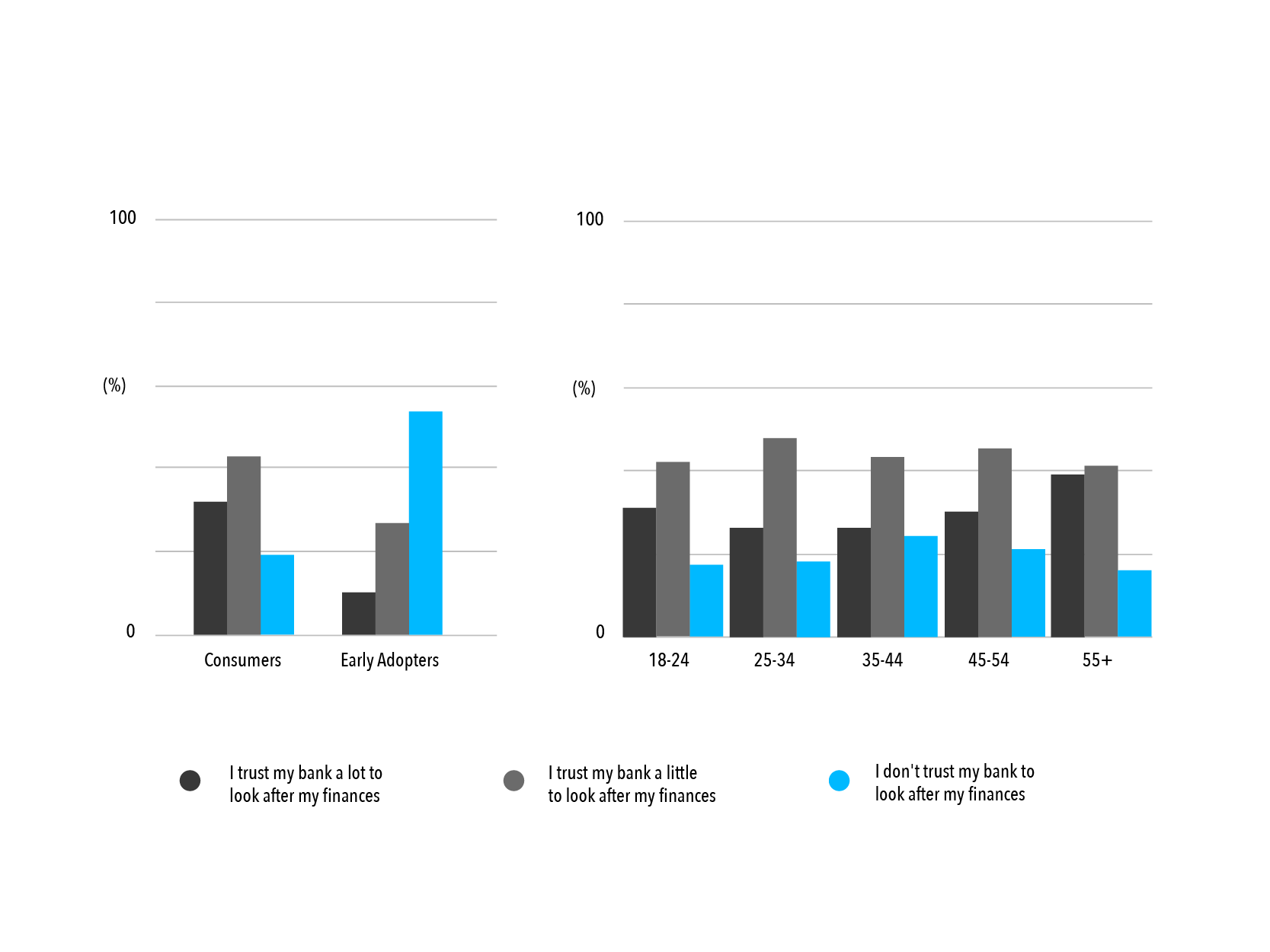

One of the most significant findings was that, for the most part, people from different age groups have similar views on technology providers of financial services.

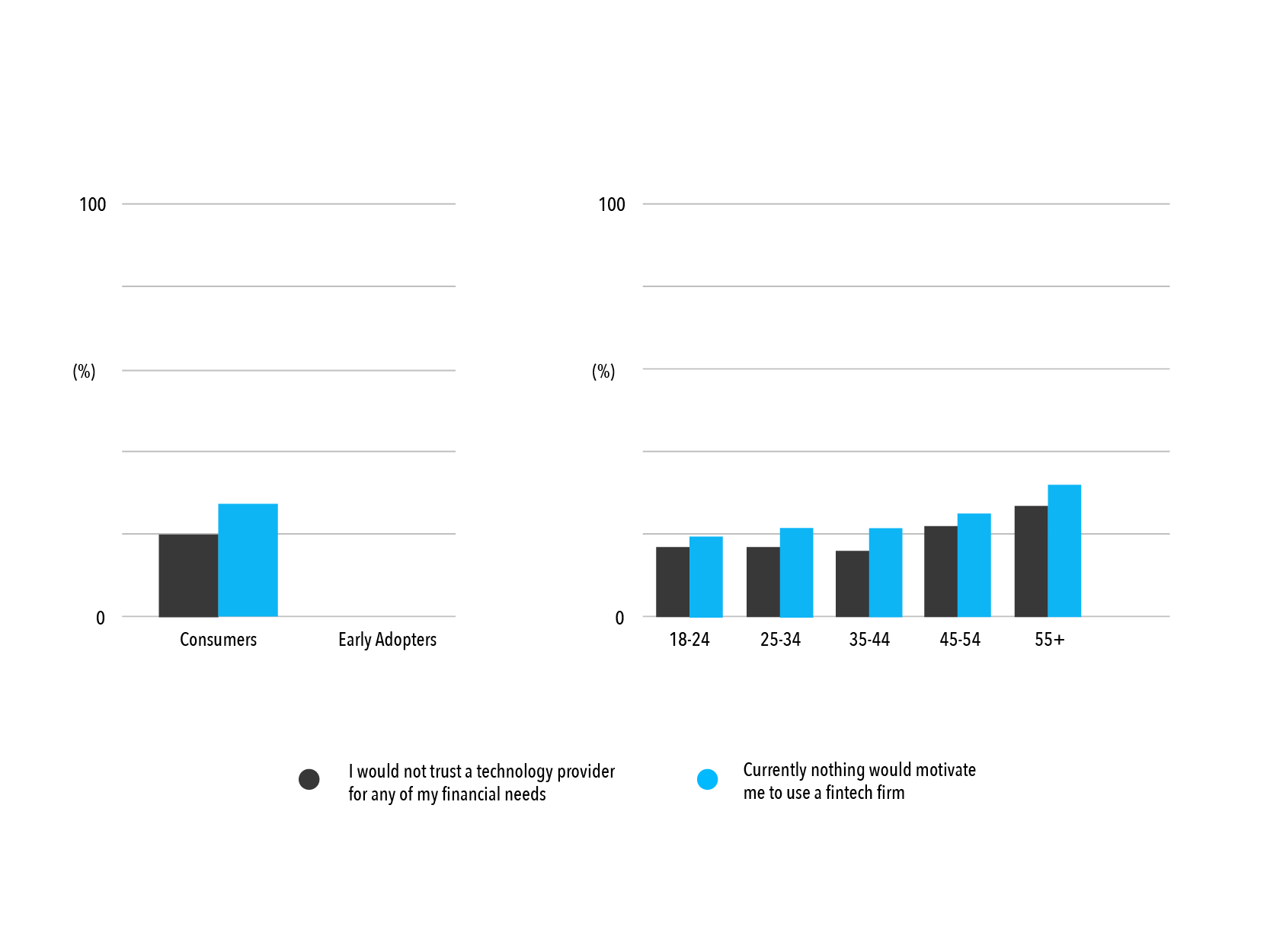

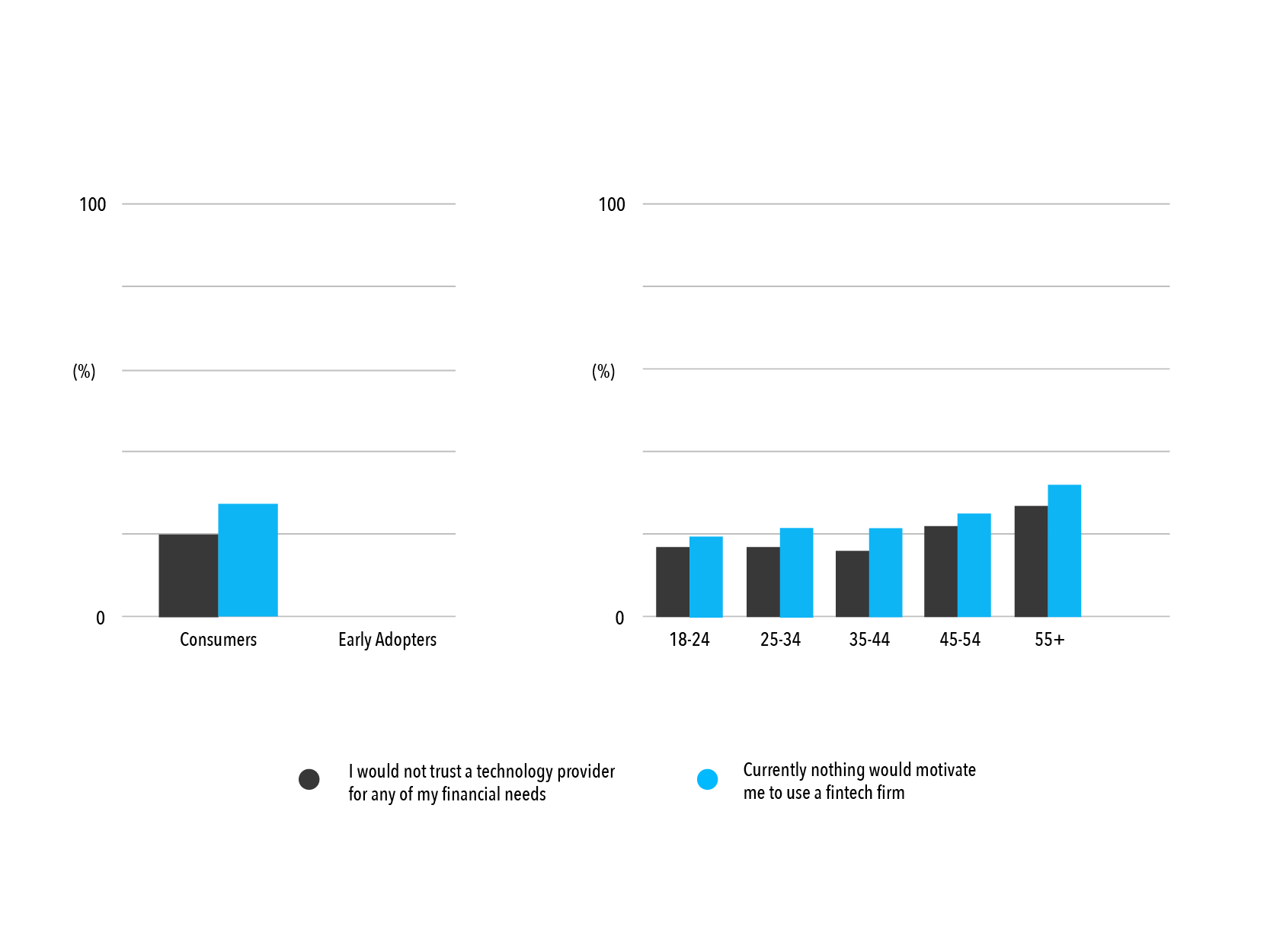

The age group with the least trust in the banks was those aged 35-44. The 55+ group were the least trustful of alternative providers with 25% (compared to an average of 17% across other age groups) saying they would not trust a technology provider for any of their financial needs.

The most significant difference was that 34% of those 55+ (compared to an average of 23% across other age groups) said that nothing would motivate them to use technology providers for services that their banks offered.

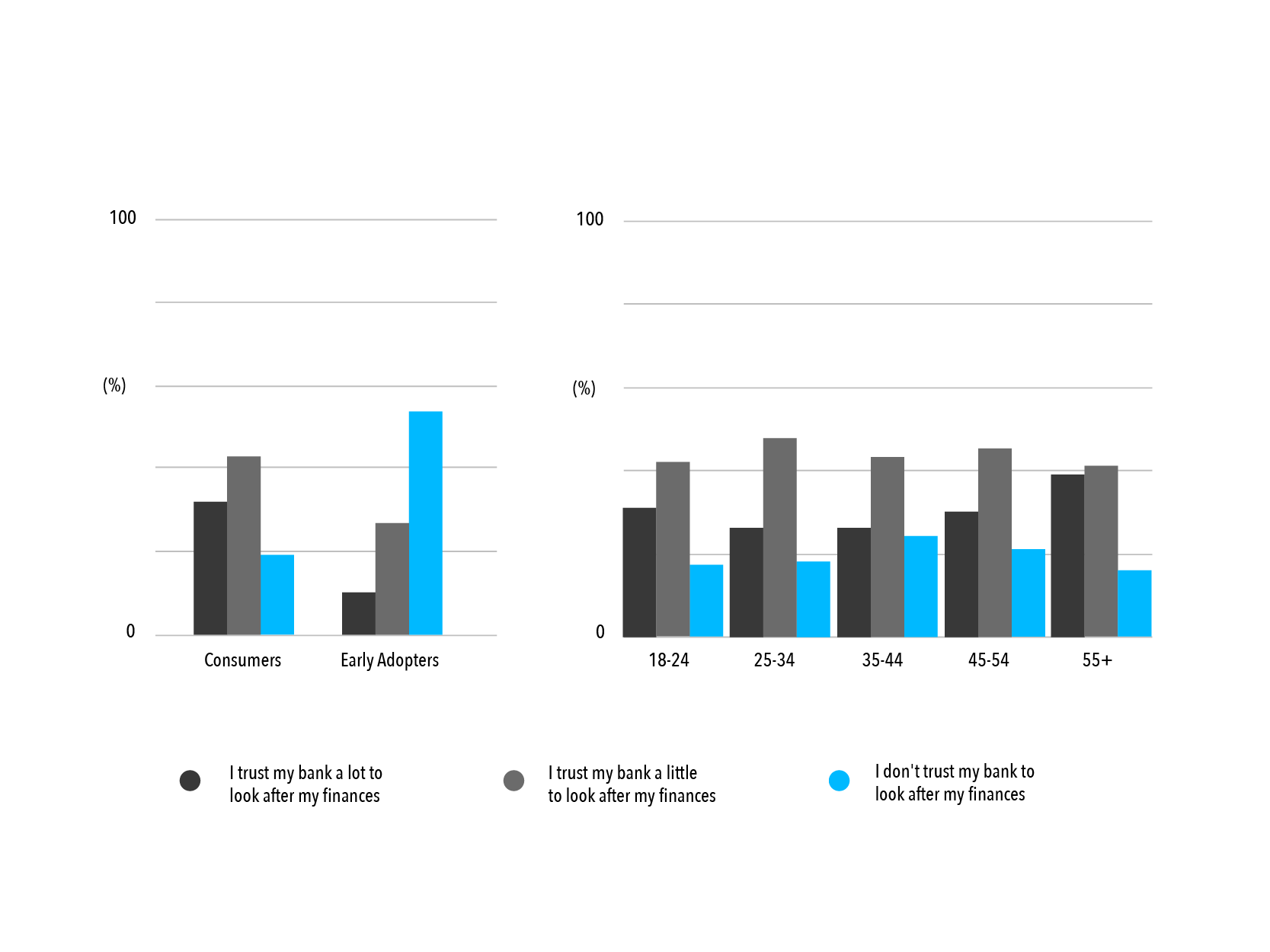

Consumers' trust in banks

Trust in fintech providers compared among consumers by age

Current use

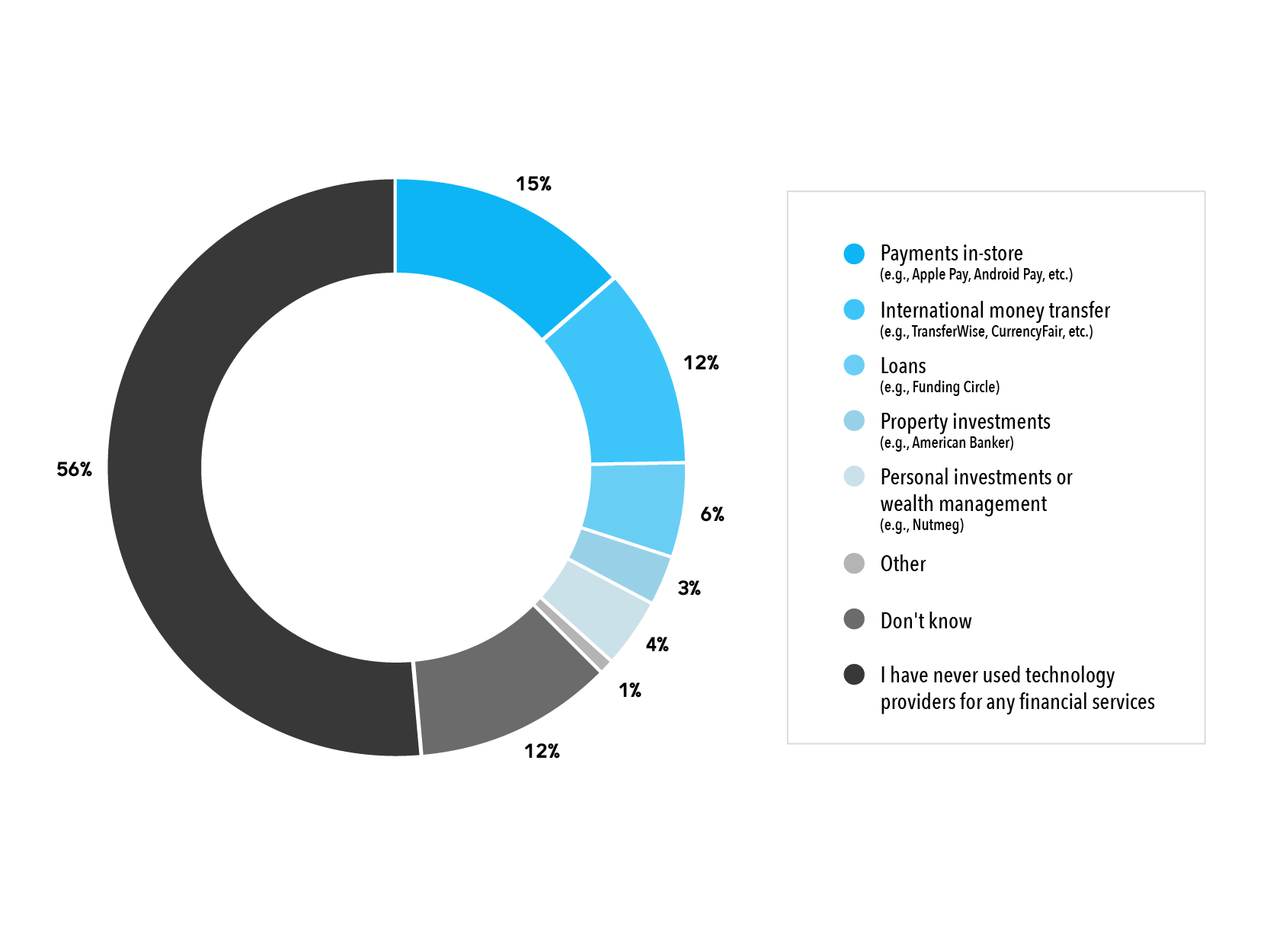

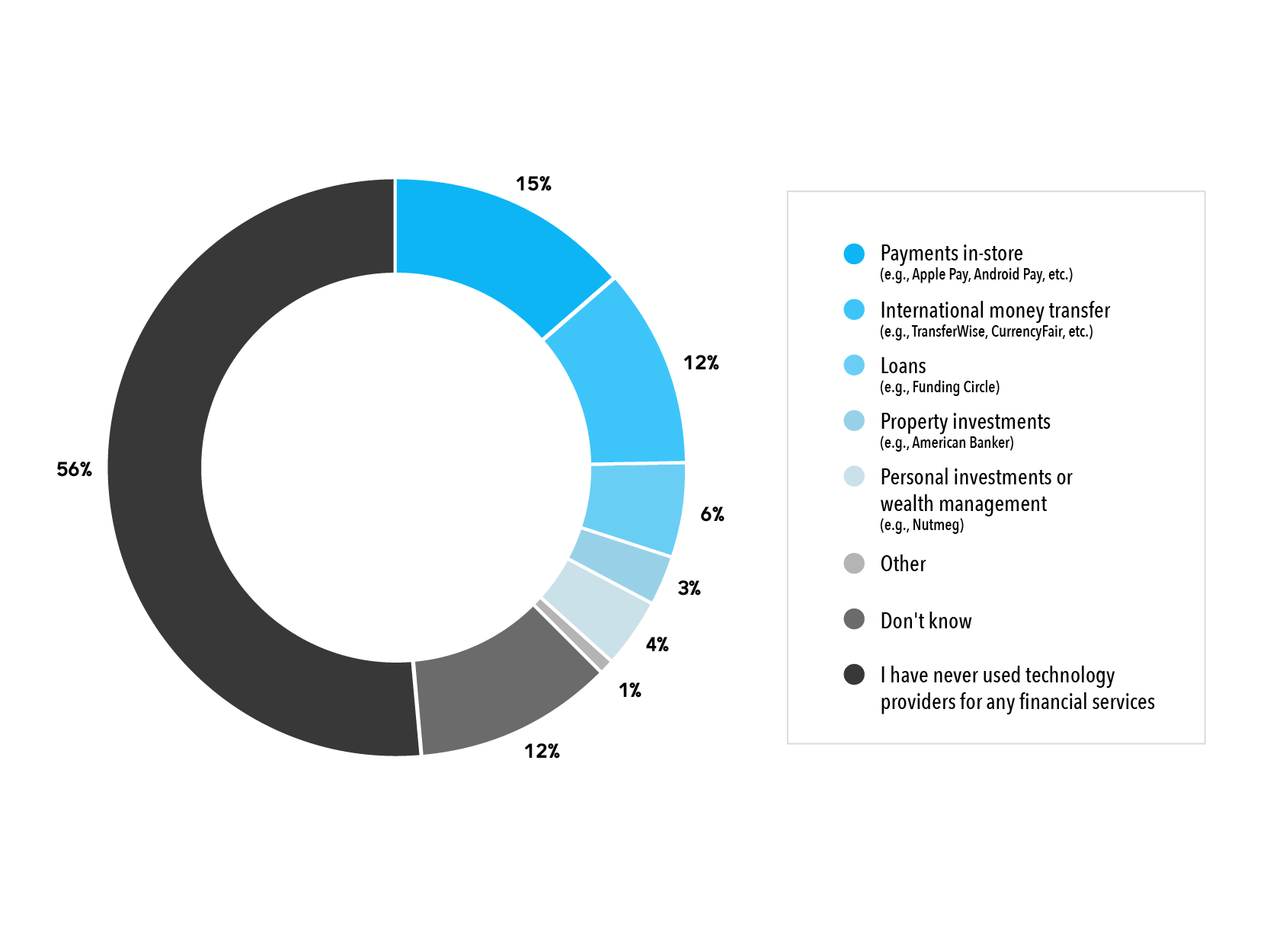

68% of those surveyed had never used a technology provider for a financial service. The most common experience of using a technology provider to date for a financial service was for payments in-store, with 15% having done so, using a service such as Apple Pay or Android Pay for example to pay for goods in a shop.

The next most common experience for using a technology provider was for international payments (12%). Then the numbers drop to single digits: 6% have used a technology provider for a loan, and 4% have have used one for personal investments or wealth management.

Percentage of people who have used a technology provider for a financial service

The reasons for choosing the alternative

There seems to be general ambivalence from consumers regarding their trust in the banks’ ability to look after their finances for them. Around a fifth (19%) don’t trust them at all and a third (32%) trust them a lot - the majority lie somewhere in between.

Lack of trust is significantly higher among early adopters who are almost 3x as likely not to trust a bank (54%). People are ready and willing to consider fintech alternatives. 73% of consumers say that they would consider using technology providers for services that they usually use their bank for.

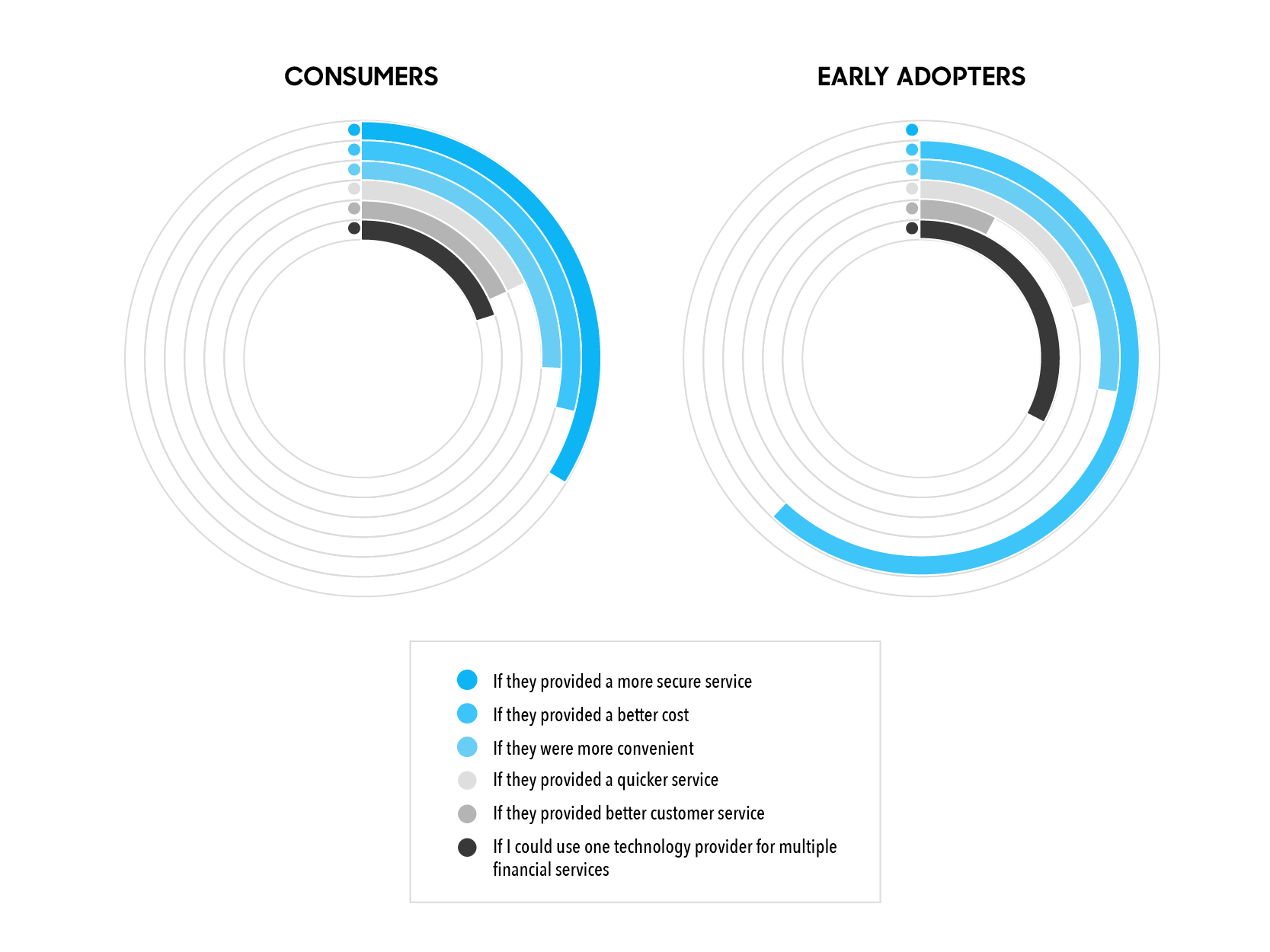

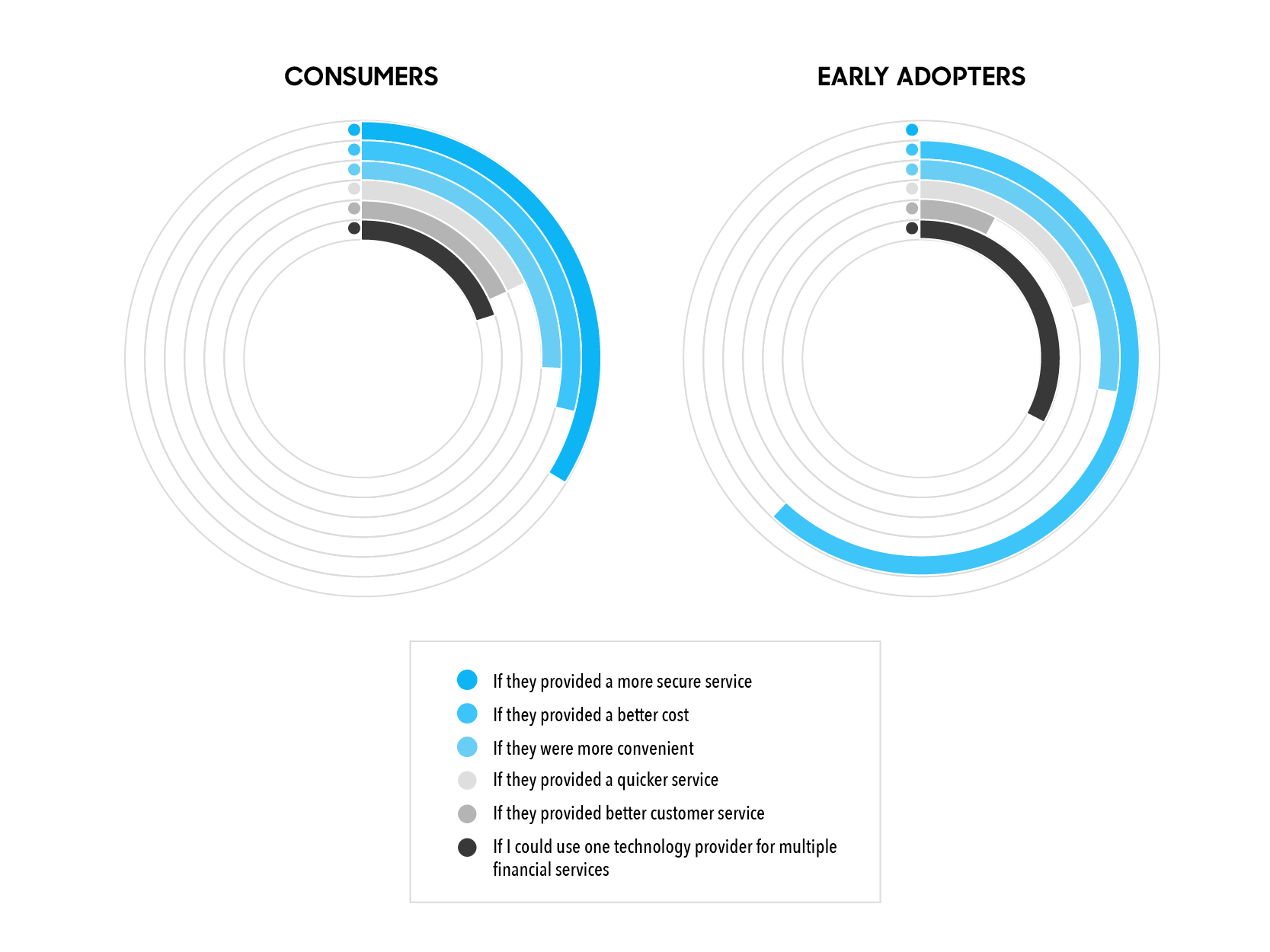

The five main factors that would prompt consumers to use technology providers for services that they usually use their bank for are:

- a more secure service than banks 34%

- a better cost than banks 29%

- a more convenient service than banks 26%

- a quicker service than banks 18%

- better customer service than banks 18%

Read the full report:

- Introduction and Summary - The Future of Finance

- Creating The Perfect Storm

- The Unbundling of The Banks 1.0

- The Unbundling of The Banks 2.0

- Conclusion: The Democratisation of Finance

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.