Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Back in the good old days, if you wanted to buy a goat, you showed up with a few coins, gave them to Betsy and you were done. Since the birth of banking, in addition to getting yourself a nice loan, moving money through the banking system has become simpler and safer, too.

Have you ever wondered how does your money actually get from one bank to another? Let’s take a few paragraphs to explore this.

Let’s imagine a simple world with only two people – Anna and Carl. Here’s a short summary of what we know about them:

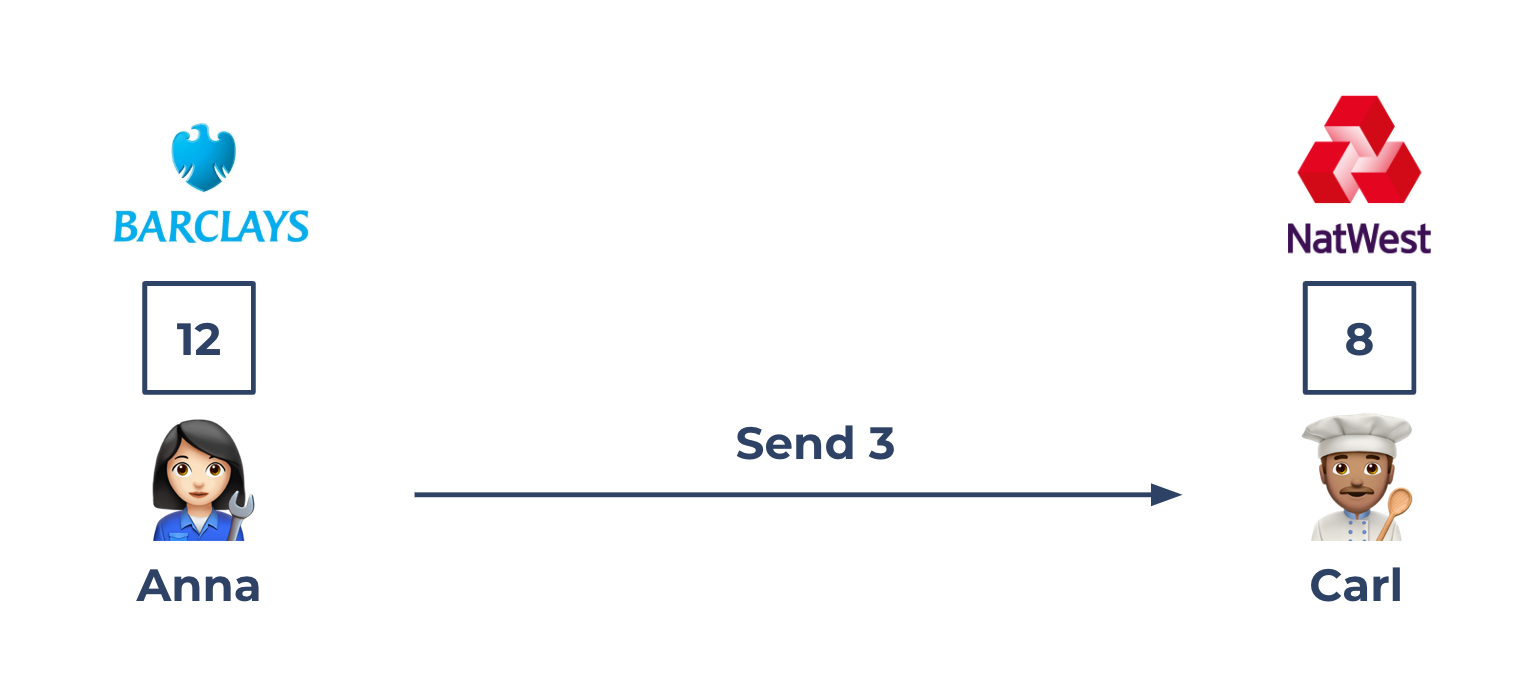

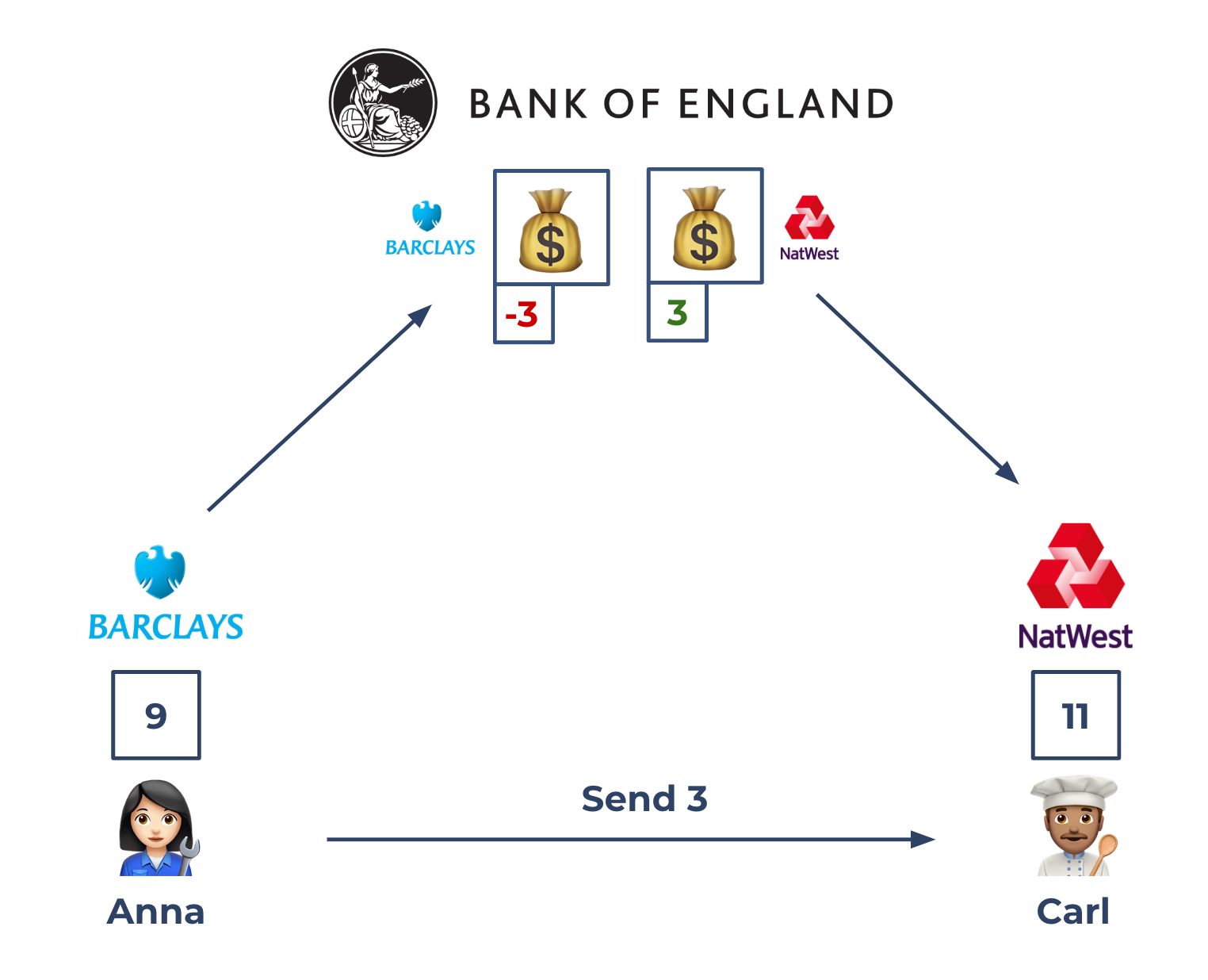

Now to the problem: Anna wants to send 3 coins to Carl using a bank transfer. How does it actually work?

Figure 1: Anna wants to send 3 coins to Carl

There are plenty of ways how banks can do it. The easiest scenario to start with is to imagine a world without any intermediary institutions, such as central banks or payment schemes.

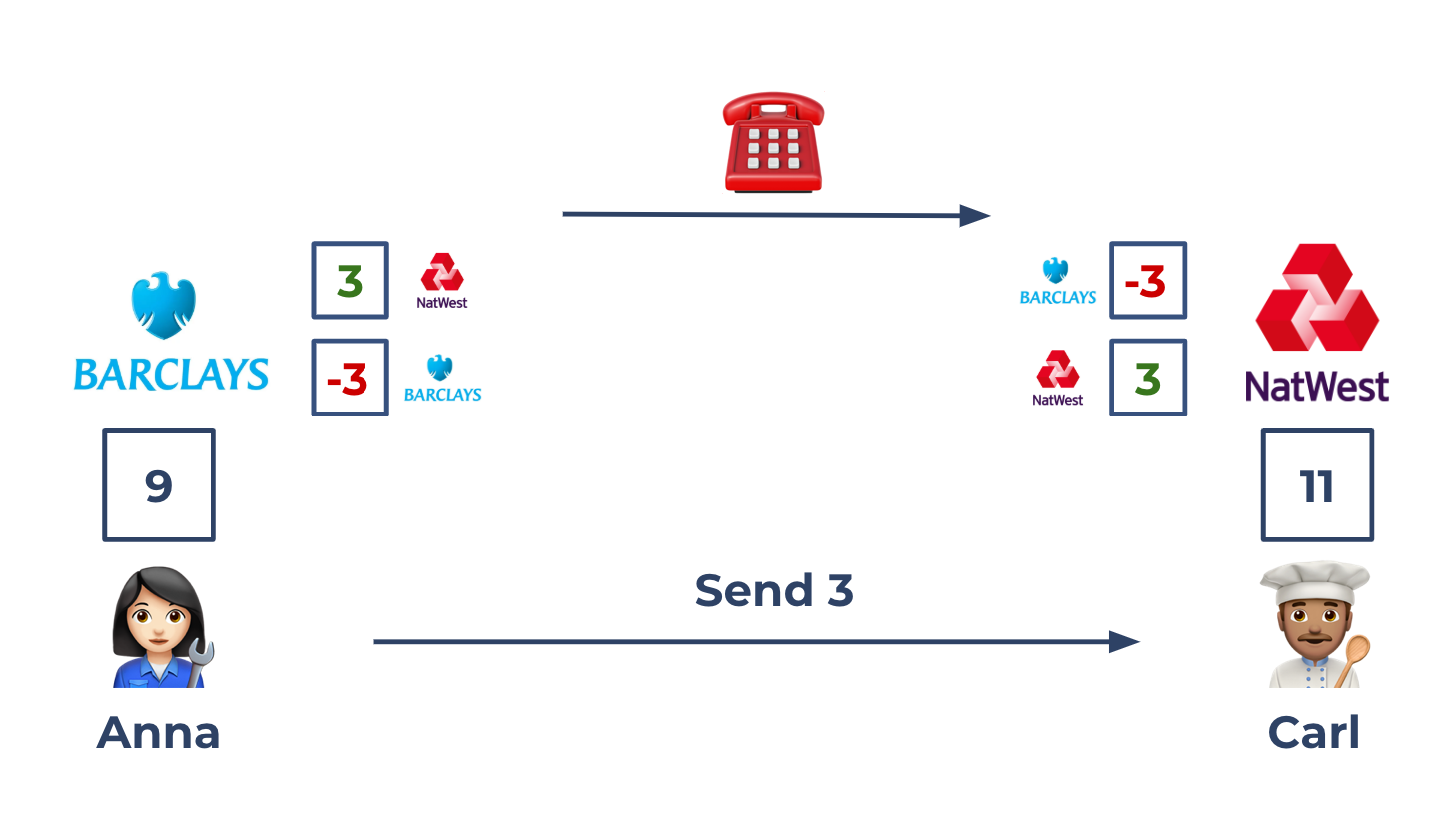

The key invention here is the following: the same way how Anna and Carl have accounts with Barclays and NatWest, banks can have accounts with each other.

Figure 2: Banks can have accounts with each other

Once this setup is in place, there are a few steps to moving Anna’s coins to Carl’s. Part I:

Figure 3: The transaction from Anna to Carl is completed, Barclays now owes 3 coins to NatWest

Whilst Carl can now go and spend his coins, the other half of the transaction has not been completed yet. The real coins are still sitting in Barclays’ vault, and at some point they need to settle this debt. Hence Part II: However way the banks decide to do that it’s really up to them. So let’s imagine that they each send horses to meet in the middle of the road to exchange the accumulated difference in coins, three in this case. And with that, the transaction has been fully completed.

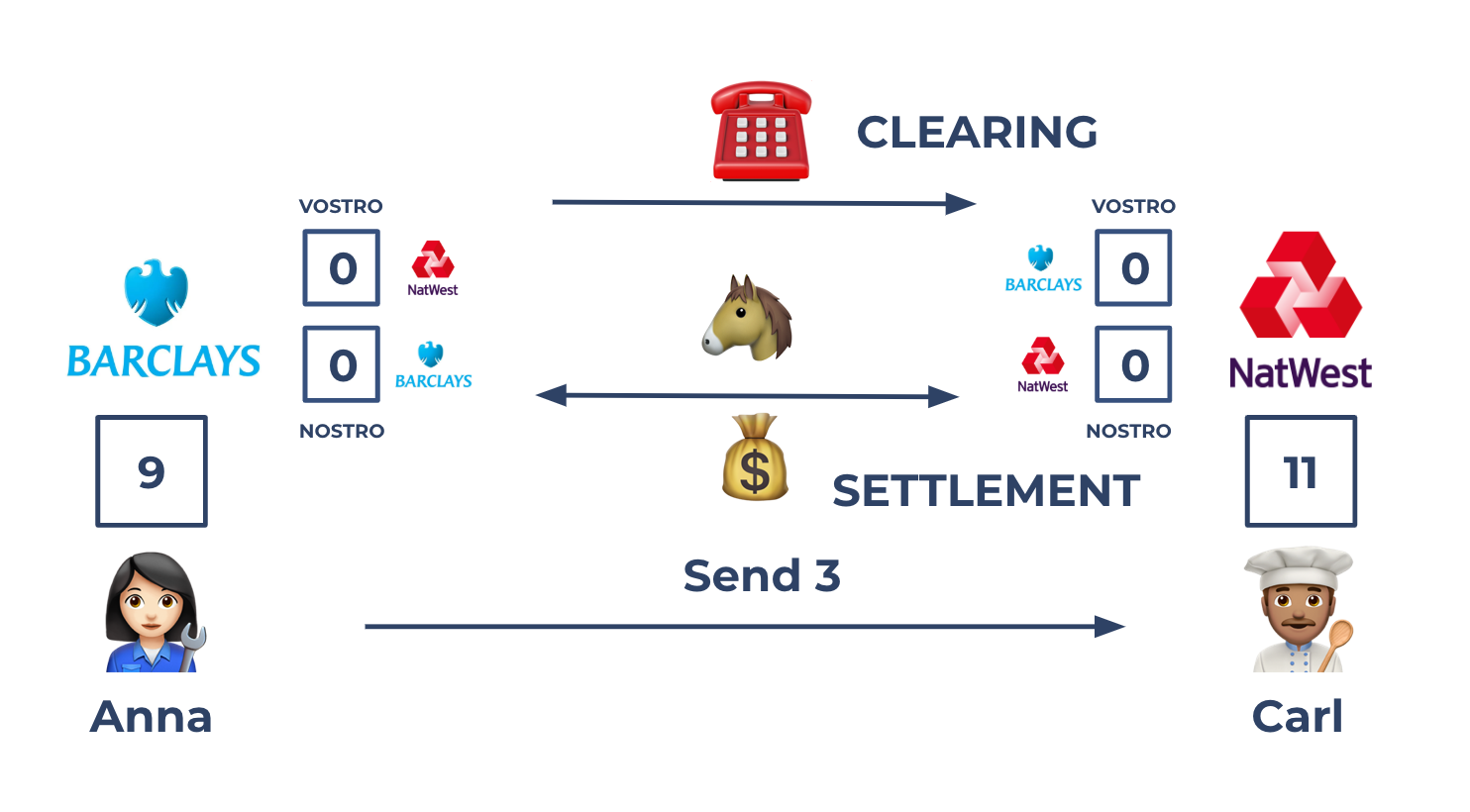

There’s even a bit of technical jargon that the banking system uses for the curious:

Figure 4: The basics of correspondent banking

And what you’ve just seen here is a very basic description of how correspondent banking works and how many banks (who aren’t connected to Wise, yet) send money internationally.

If you bank with Bank A in the UK and want to send money to a bank in Japan, Bank D, there is often a chain of several banks – from A to B to C to D – all of whom have Nostro and Vostro accounts with each other (A with B, B with C, C with D). They then use SWIFT to exchange the clearing messages and use local payment systems to settle the debts between themselves.

Sometimes the chains can get quite long with many banks in them, and the longer the chain is, the more expensive your cross-border payments will be. Pretty neat right?

Next we’ll look at how payments within one country (or one currency zone) move.

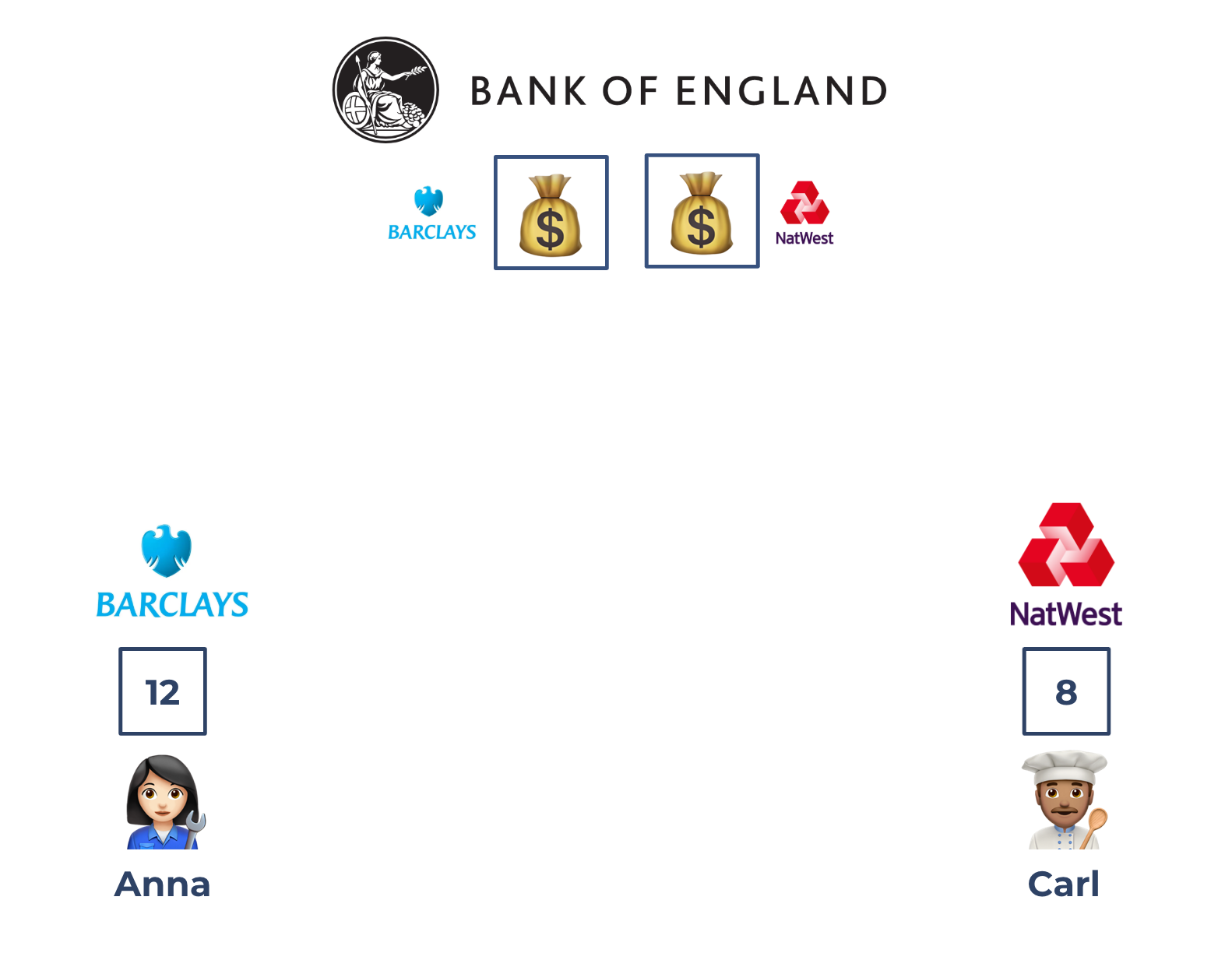

A Central Bank wears many different hats, one among which is to support commercial banks, such as Barclays or NatWest, to send money between each other. Because the Central Bank almost literally defines what money is, commercial banks will have accounts with a Central Bank, let’s say Bank of England, the same way how Anna and Carl have an account with Barclays and NatWest.

Figure 5: Commercial Banks can have accounts with a Central Bank

This world simplifies the situation for Barclays and NatWest quite a bit. For example, instead of each bank having to have an account with – and that could be quite cumbersome, if you have hundreds of banks in each country – each bank only has to have one account with Bank of England. Also, NatWest doesn’t have to worry about Barclays eventually paying up the debt.

The way how money then moves is quite straightforward:

There are a couple of really good upsides to this system:

The system is called Clearing House Automated Payment System or CHAPS for short.

Despite its clear upsides, CHAPS does come with some downsides:

Because of these downsides, CHAPS is mainly used to move really large payments, so you’d use it when you’re buying a house or when you need to move large sums of funds when running a larger corporation.

If it’s a Saturday afternoon and you need to pay a few pounds to your friend who paid for your saplings that you were planting over the weekend to save the planet (you are doing that, right?), CHAPS in its current form won’t do.

Hence, that’s why other payment schemes exist, such as Faster Payments.

Because CHAPS is expensive to use and works only during certain hours, alternatives have emerged. The introduction of Faster Payments brings the best of both worlds to the game:

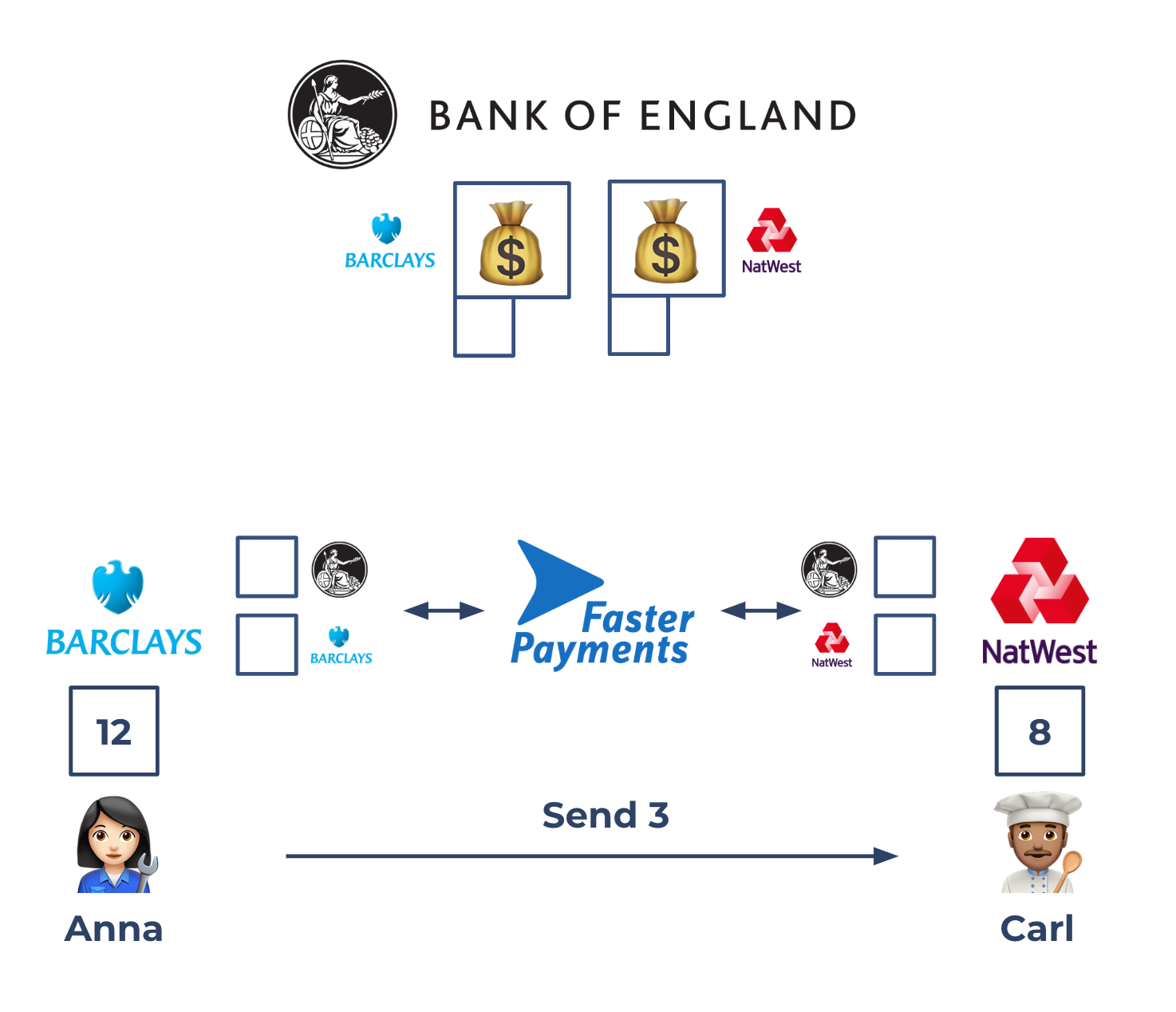

Figure 7: Faster Payments allows banks to send money cheaper and faster

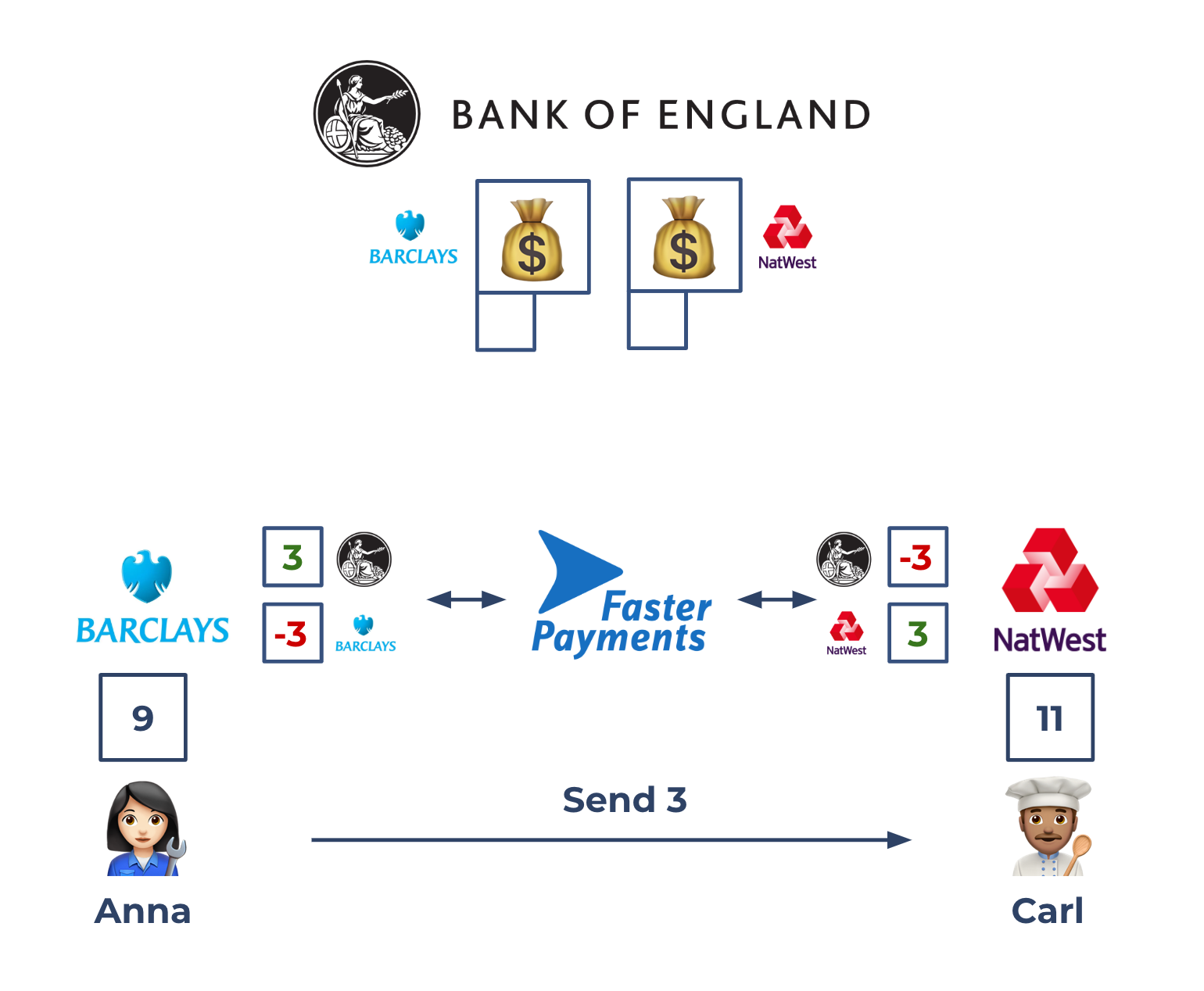

How would it look like for Anna and Carl? Part I:

Figure 8: Faster Payments helps banks with clearing payments

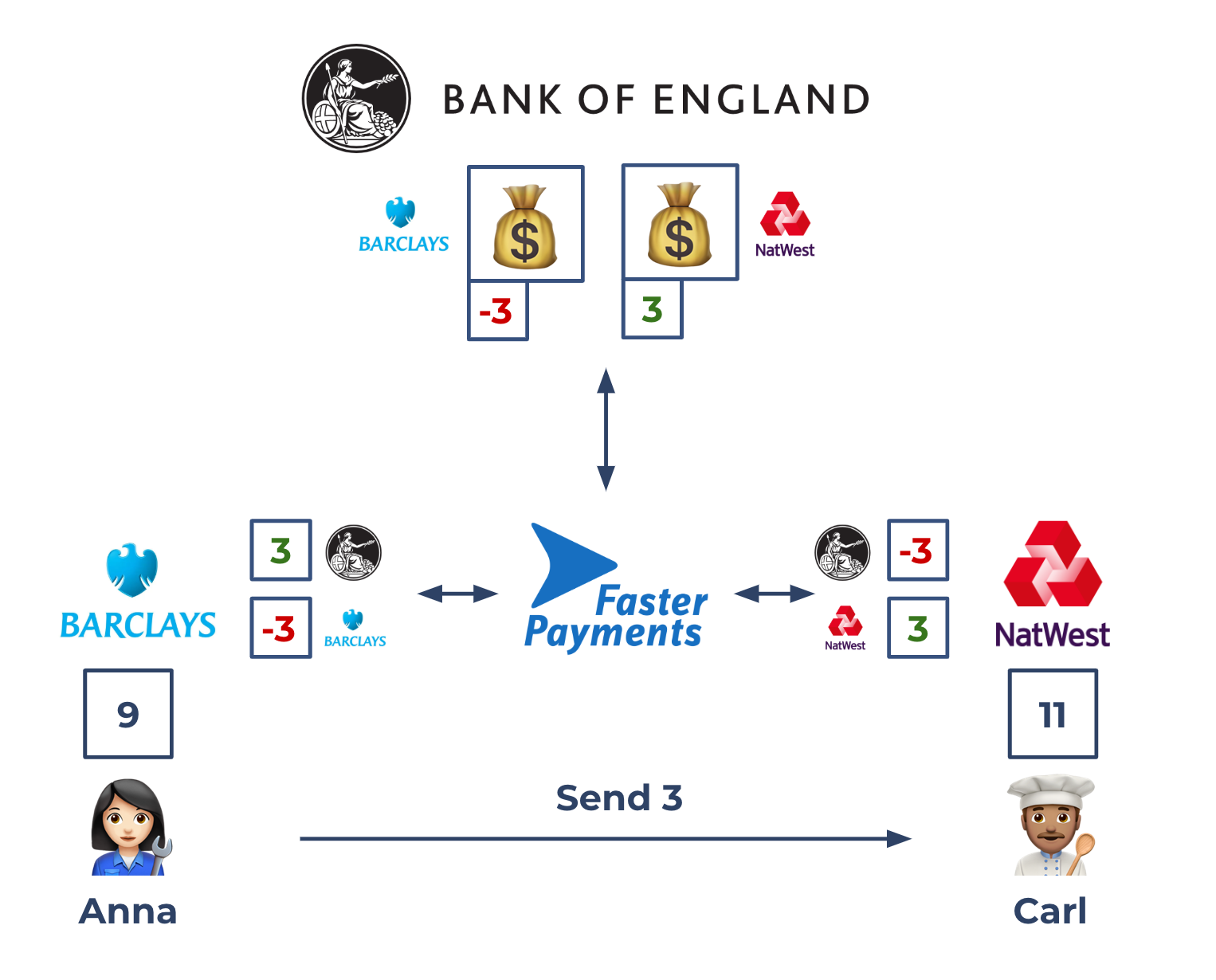

Part II involves the settlement. In addition to intermediating millions of payments each month, with money moving continuously, several times per day Faster Payments also helps the banks with settling the differences to ensure that everyone is always paid up.

Faster Payments do so by sending an instruction to Bank of England, indicating which payment institution should be debited and which one should be credited.

Figure 9: Faster Payments also helps with settling the differences by notifying the Bank of England.

The real world is a bit messier. For example, banks are required to commit dedicated collateral in Bank of England that helps Faster Payments to ensure that each batch of payments can actually settle and that no bank tries to send out more money than they have available on their Bank of England account.

The basic principle is exactly how it’s described here, and this clever system of moving money between banks through a payment scheme means that people get 24/7 instant payments at a low price, sometimes even for free.

If you’re a user of Wise, then you’ve probably noticed that international transfers are usually significantly more expensive than their domestic counterparts (even if they’re often claimed to be free – watch out for those sneaky rate mark-ups!). We however believe that because money is fundamentally just bits and bites sitting in a Central Bank’s SQL table, kind of how emails are. So if emails are free and instant, and if even domestic transfers can be instant and (almost) free – why couldn’t this be the story for international payments, too?

This where non-banks come in. Many non-banks, tech companies, fintechs, unicorns – however way you wish to call them – have figured out clever ways to navigate through the web of banking systems to offer noticeably more efficient ways to move money around the world than insofar was possible for consumers and small businesses.

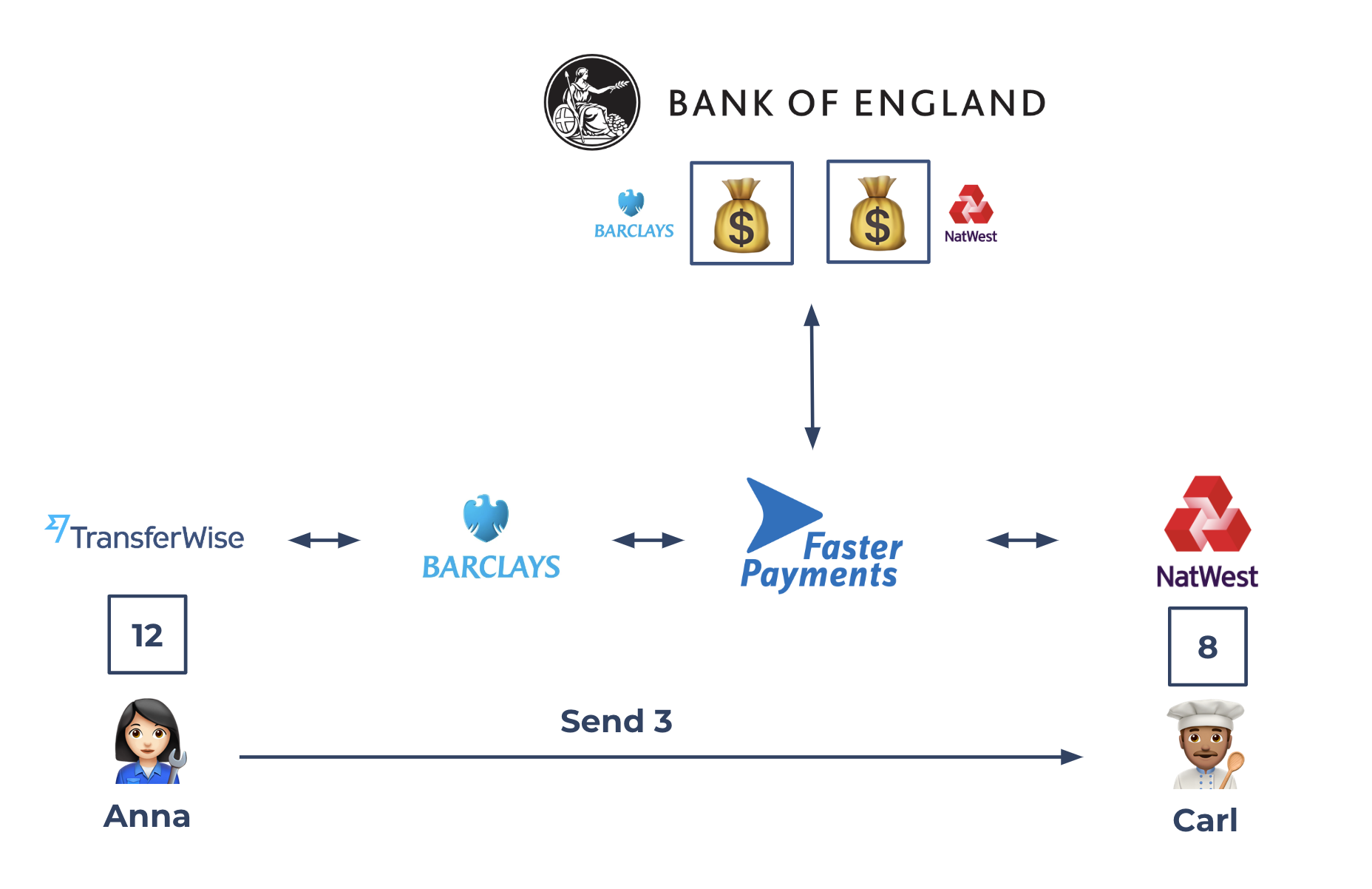

In most countries in the world, the story is as it used to be in the UK for Wise back in 2015: the only way for a non-bank to have access to the banking system is to be a customer of a bank. For example, one of the partner banks that Wise works with in the UK is Barclays.

Figure 10: Wise is a customer of Barclays who is connected to Faster Payments.

So in order for Anna, now a customer of Wise, to move money to Carl, Wise would then have to instruct Barclays, who instructions Faster Payments, who talks to NatWest, as well as Bank of England, to move three coins to Carl.

The benefits are very clear: Anna is now getting a better deal on her international transfer of 3 coins to Carl than she otherwise would have, and Barclays, NatWest, and many banks out there are enabling hundreds of the non-banks deliver these next generation services to millions of consumers and businesses around the world.

The downsides unfortunately are also quite evident. The more there are players between Anna and Carl, the higher their payment costs are. In addition, if there are technical inefficiencies in any of the players in the chain, Anna’s payment to Carl will be slowed down, no matter who ended up causing the delay.

Hence, the obvious next step is to ask – how can non-banks get closer to the payment scheme?

The challenge in most countries doesn’t actually come from the payment schemes, such as Faster Payments. If it were up to them, they probably would have welcomed non-banks to join the circle a long time ago. The crux lies in which institutions can have a settlement account with the Central Bank, e.g. Bank of England. At the moment, almost all countries require these financial institutions to be banks.

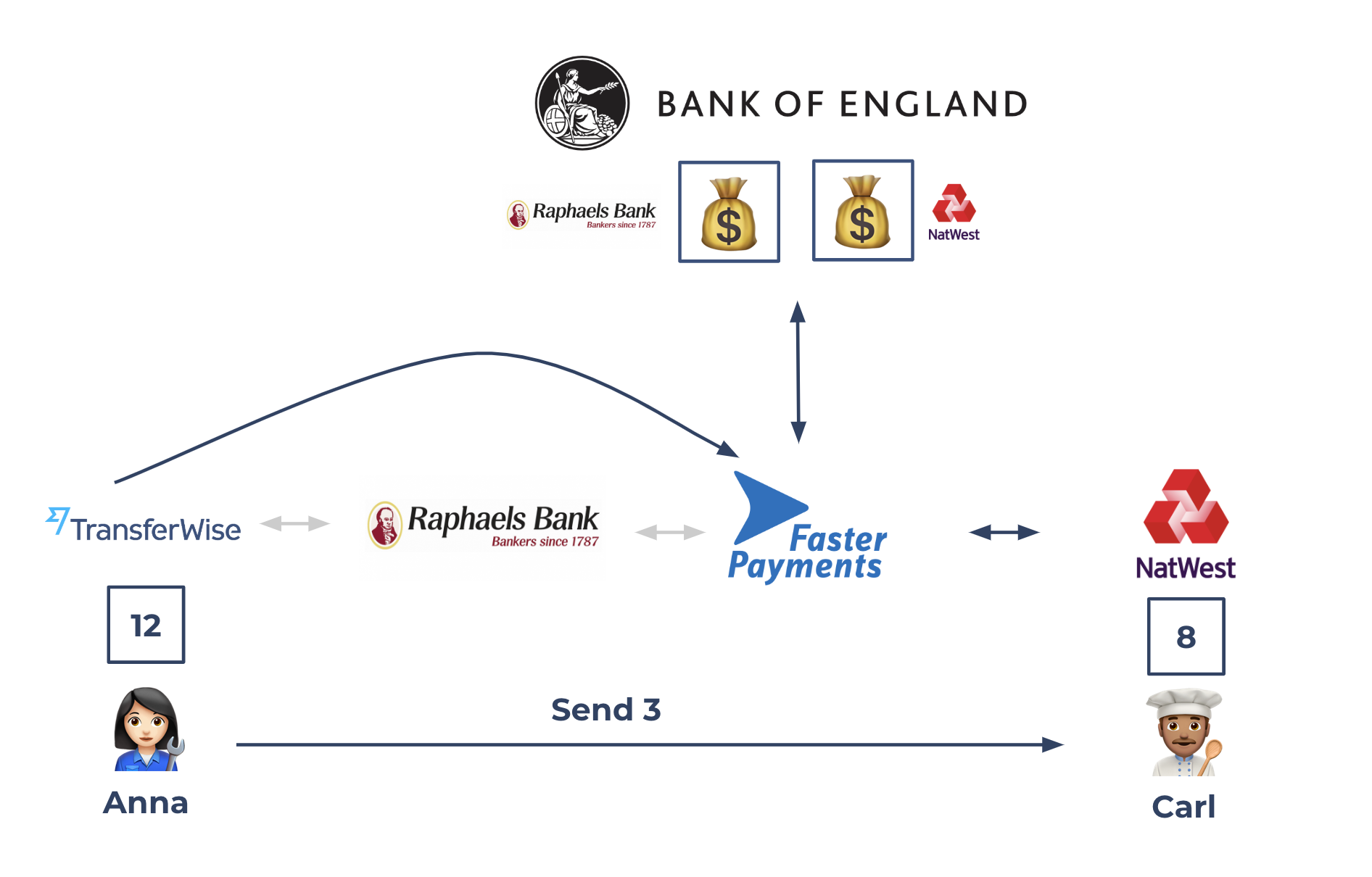

In late 2015, Wise stepped into a fruitful partnership with a small UK bank called R. Raphaels & Sons, or Raphaels Bank in short. Together with Raphaels Bank we figured out a clever way to get the best of all worlds – getting Wise closer to Faster Payments while still complying with all the rules.

We agreed to the following:

This was a great step closer. It meant that our pipes were set up as if we were a member of Faster Payments, while contractually, legally and from a compliance point of view Raphaels Bank, a bank with a license to go with it, was the member as well as a settlement account holder.

Figure 11: Wise is now connected to Faster Payments by partnering with Raphaels Bank

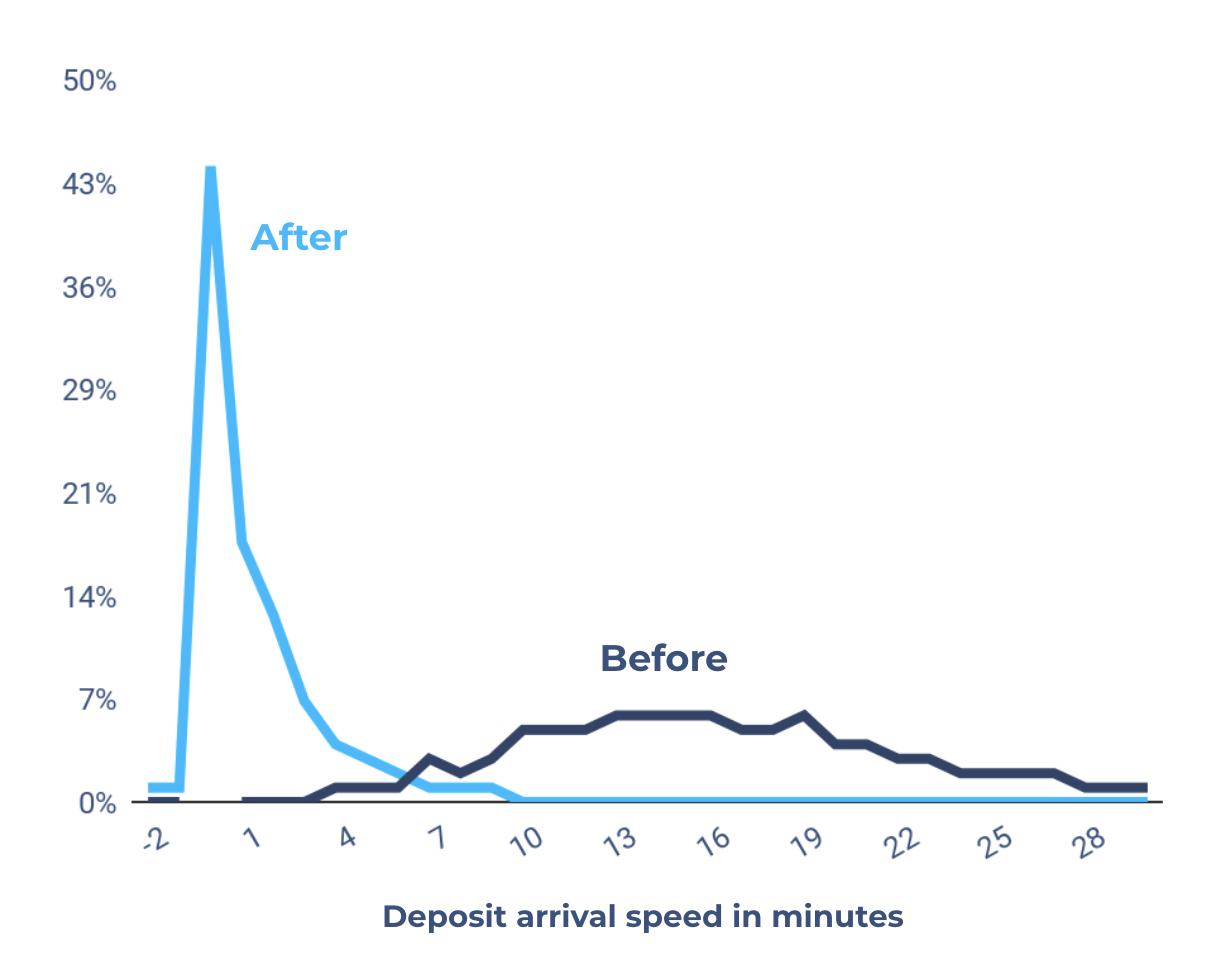

The benefits manifested quite quickly. In addition to seeing a significant reduction in cost, which we were able to pass on as a price drop for our customers, we saw a surprising improvement in the payment speed. We measured how long it took for customers like Anna to send their GBP deposit to Wise from the moment when they set up a payment until we received their funds. The results were incredible: the speed improved from an average of 15 minutes to about 15 seconds, despite the process being identical for Anna.

Figure 12: Payment speed before and after having a direct connection to Faster Payments

This clever model has now been turned into an official solution offered by Faster Payments. They’re calling it (with a long name) the Directly Connected Non-Settling Participantmodel, with the difference that the non-bank could also become a member of the scheme.

The story looks pretty good for Anna. Except for one tiny, but very important fact – we as a non-bank are still dependent on one additional player in order offer payment services to our customers. If we weren’t, we might not be faster, but we could be a touch more cheaper.

In addition, with non-banks becoming an increasingly more important type of player in the market for consumer, having all of them be dependent on a limited number of commercial banks can be the cause for a serious systemic risk. And of course it’s very hard for them to secure a good deal due to the limited number of banks willing to offer services to a competitor...

What can we do about it?

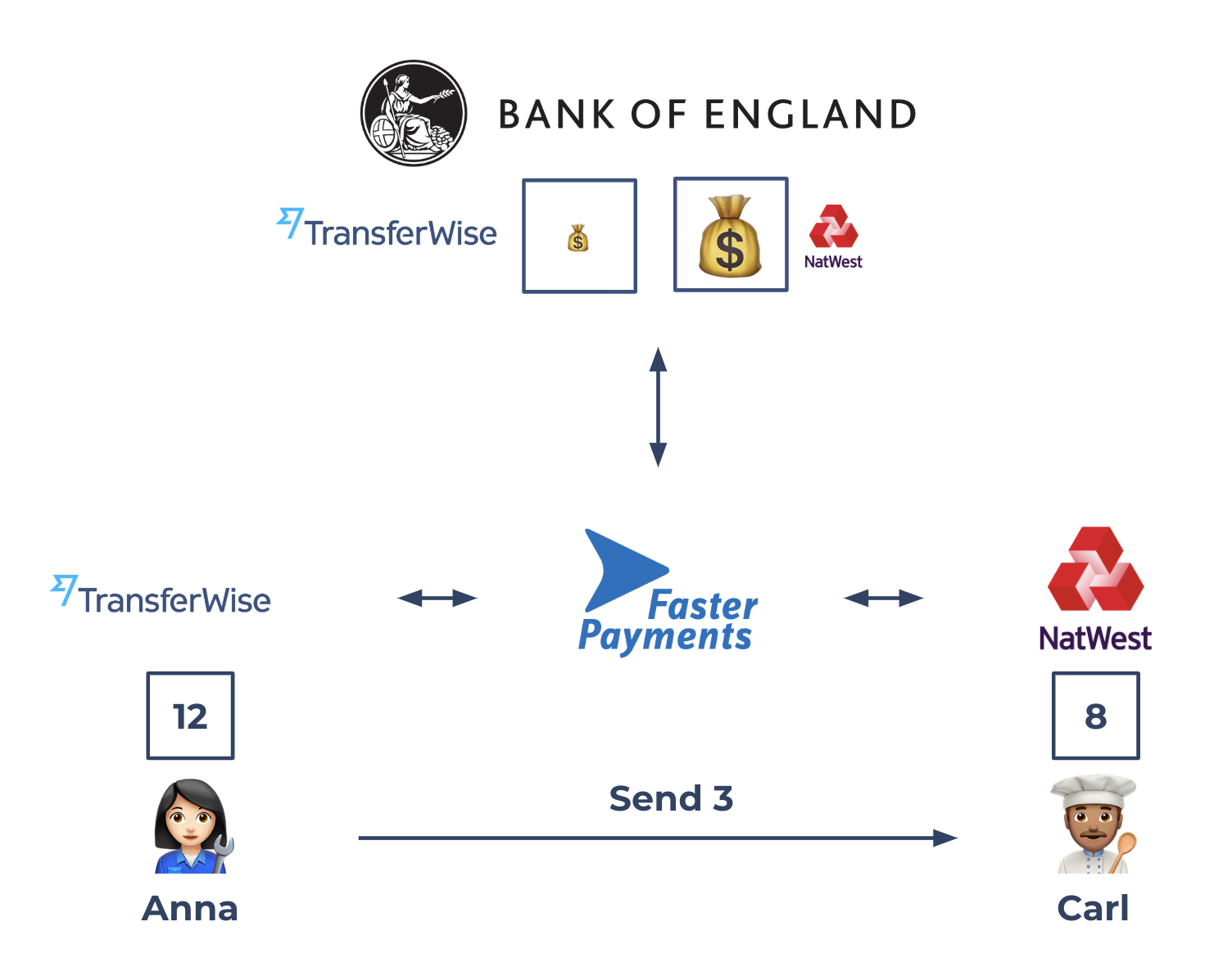

In July 2017, Bank of England announced that they are extending access to have an account to non-banks. This was a game changer for companies like Wise because it meant having the ability to move customers’ money without any third parties.

No time was wasted, we began to work. Since we had told Raphaels Bank of our ultimate wish to be directly connected right from the start, we immediately shared our plans with them, and they became a very helpful partner in order to get us connected as soon as possible.

The work we did together with Raphaels Bank, Faster Payments, Bank of England and many other institutions along the way resulted in Wise becoming the first non-bank to become directly connected both on Faster Payments as well as on Bank of England in April 2018.

Figure 13: Wise is the first non-bank Payment Service Provider to be connected to Faster Payments and Bank of England

We have now reached the pen-ultimate level of being able to process Anna’s payments to Carl as closely to the system as possible. The next level would be for the Bank of England to grant non-banks the ability to safeguard their customer funds at the Central Bank overnight, and they’ve shown initial signs of interest(!), but that is a topic for another day.

That said, the UK is still leading the world when it comes to improving access to one of the fastest growing groups of players in the payments industry, and with that the country is significantly improving the quality of service, speed, price and service resilience for all the Annas out there. It’s, thus, no surprise that the number of direct Faster Payments participants in the UK has exploded in the past several years.

Figure 14: FPS Direct Participants in 2015 vs. 2019

That’s the story in the UK. What about the rest of the world?

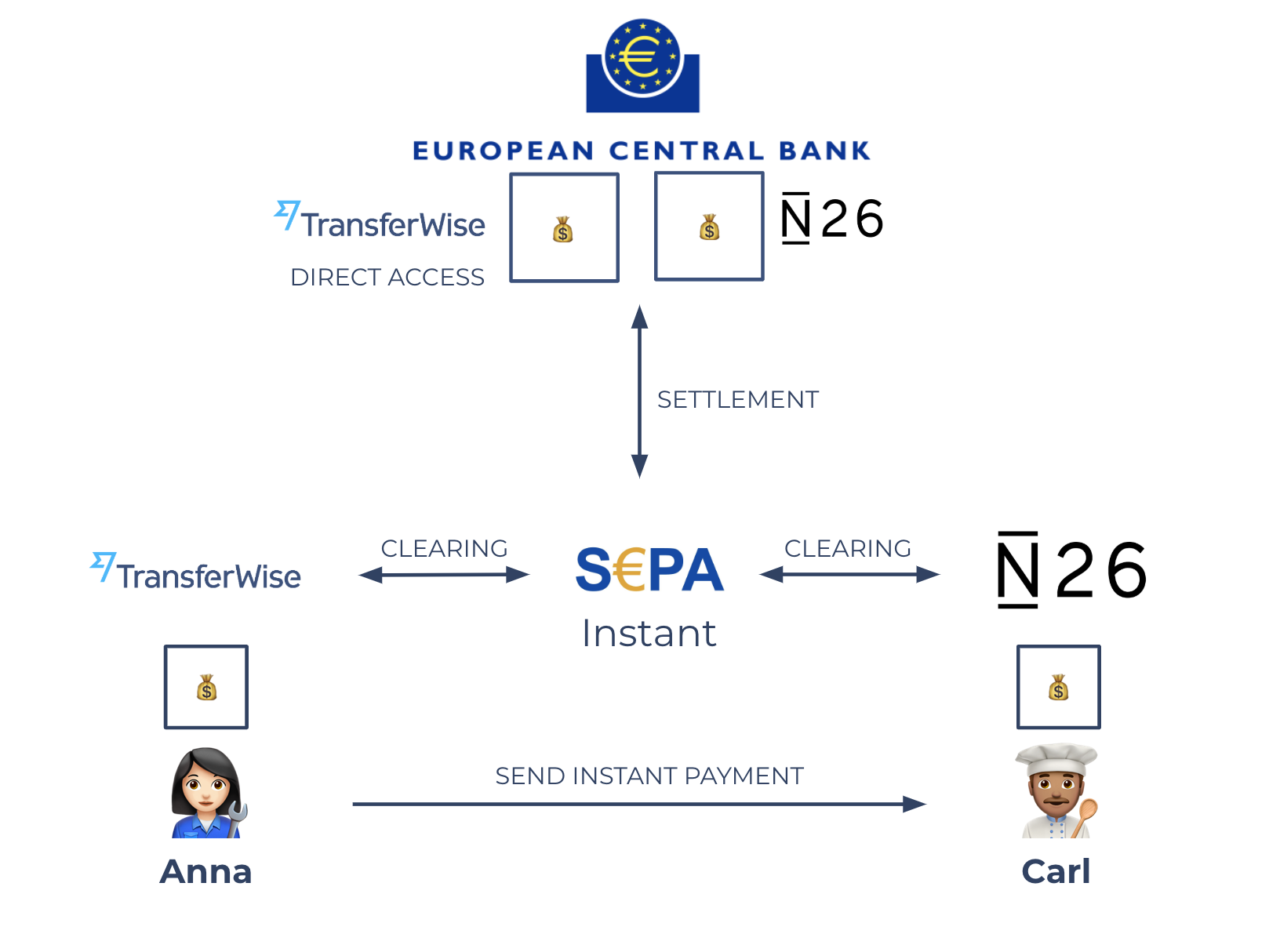

Most countries still have a very long way to in order to claim a victory for their Annas and Carls. For example:

We’re also seeing very interesting solutions and fascinating developments in Switzerland, Hungary, Canada, Malaysia, Japan, Brazil, Hong Kong, Singapore and many other countries around the world. And every time we speak to payment schemes, central banks and other interested parties in these regions, we can see and hear genuine hope and excitement, even if getting the change through is sometimes a challenge more difficult than moving a mountain.

It’s hard to miss the joy in these people’s faces when they see how these changes have a noticeable positive impact on the Annas and Carls of the world, their batteries are loaded instantaneously and we all take another collective step forward to a world where even international payments are instant, convenient and eventually free.

So, which of these countries will be the next to move?

Figure 15: Will the Eurozone be the next area to open up direct access to non-banks, or someone else?

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it)...