8 tips on sending money from China with Wise

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

Ukraine has its own local currency: Ukrainian hryvnia. It’s the currency most people use in their day-to-day lives in Ukraine, but it has been volatile in the past. A fluctuating exchange rate can hurt people’s finances, so sending or holding euros or dollars can help Ukrainians manage their money.

Sending euros or dollars to Ukraine with your bank is painful. Those transfers go through the so-called SWIFT network and can take days to arrive. And on top of the sender’s bank fee, there are likely to be unexpected charges, including:

From today, Wise is enabling lightning fast transfers when you send EUR or USD to personal PrivatBank accounts. Once Wise has your money, paying out euros or dollars to PrivatBank recipients will only take a few minutes — and happen 24/7. For now, these payments will have a limit of the EUR/USD equivalent of 300.000 UAH per payment. That's roughly 10.000 EUR or 11.000 USD.

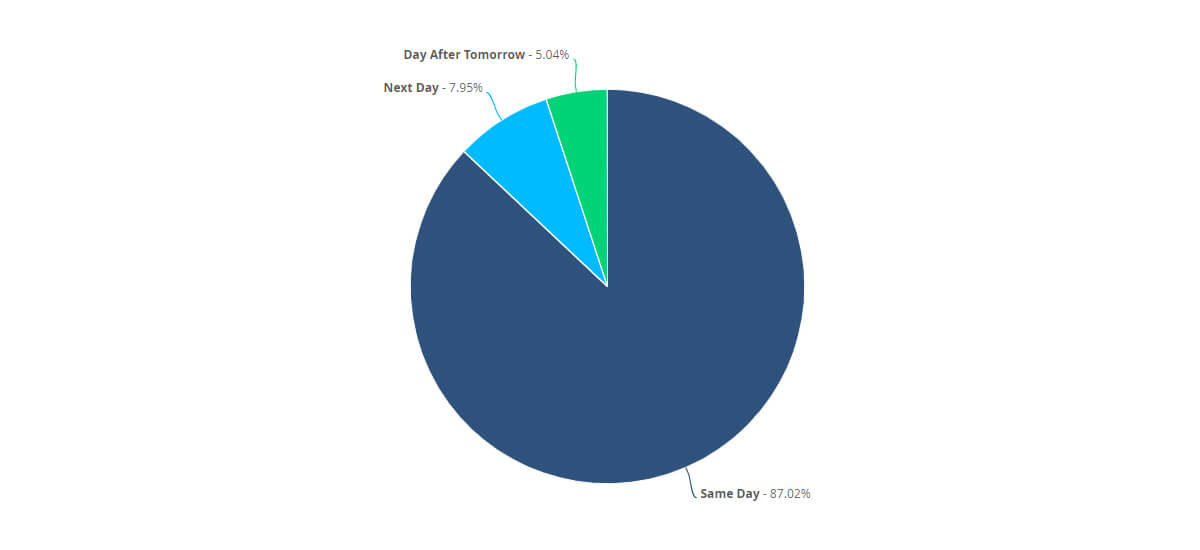

For you — our customers — this means that 87% of all EUR and USD transfers to personal PrivatBank accounts will happen on the same day (mostly within minutes).

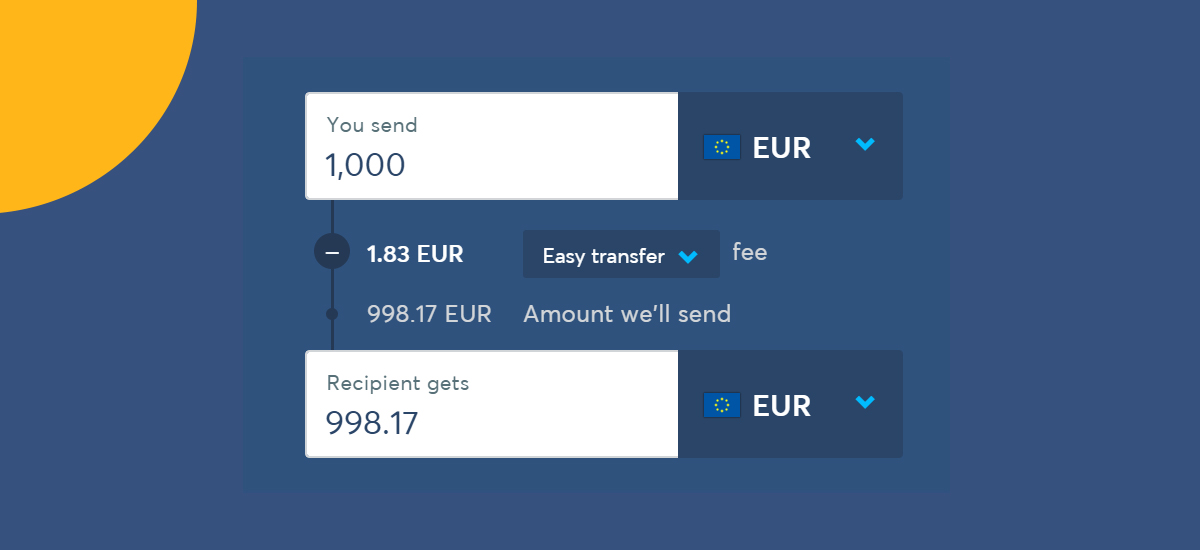

We’ve put an end to unexpected fees when you send EUR or USD to Ukraine — which means more savings for our customers. Let’s say you’re sending €1000 to PrivatBank in Ukraine. If you’re sending via a SWIFT transfer, your bank might charge you €15. A bank handling the transfer in the middle might take another €12 more. So, now there’s €973 left. And then PrivatBank might take another 1% (€9.73) for receiving the transfer. What comes out on the other side is €963.27. That’s effectively €36.73 lost in fees.

But, sending €1000 to a personal PrivatBank account with Wise comes with a low, transparent and upfront fee ranging from €0.63 to €4.12 — depending on the method you choose to pay in. So that’s around €30 extra for you — time and money saved.

To send EUR or USD to personal Privatbank accounts with Wise, select EUR or USD in the lower field — this is the currency you want to receive. You can send from whichever currency you wish, Polish złoty, British pounds, euros, etc. — just select it in the upper field. We’ve used EUR for both the sending and receiving currency in the above example.

Next, we’ll ask you to fill in recipient details. Enter the recipient’s Ukrainian EUR or USD IBAN. If the IBAN belongs to a personal Privatbank account in euros or dollars, there will be no unexpected charges and the recipient will receive the money quickly.

Onwards!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

Hi Affiliates, Since we last updated this page, Wise has undergone some changes. We’re no longer called TransferWise, and have undergone a rebrand -...

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

Today, we’re introducing big changes to the way Wise shows up to the world. It’s inspired by what makes us different: you. The people who shape us today — our...

10 million people and businesses gained access fast, cheap international payments powered by Wise in 2022 The new year is in full swing - resolutions are in...