Operating Profit Margin: Definition, Formula and Calculation

Check out our guide to understand operating profit margin and how to calculate it. Also learn how it can be used to show the health of your business.

Cashplus prides itself on its reputation as a technologically innovative ‘non-bank’, and even won awards for its banking solutions.¹

It’s particularly suited to small businesses, with one business current account specially tailored to the needs of startup and smaller enterprises.

In this guide, we’ll look at the Cashplus business bank account in more detail. We’ll cover the features and perks of the account, plus the fees you need to know about.

We’ll also show you how a multi-currency account could save you money on international transactions.

Cashplus has one main current account for businesses, designed to be as simple, straightforward and time-saving as possible.

The Cashplus Business Account offers the following:²

What’s more, Cashplus promises a fast online application with no credit check required. You’ll get an instant decision and if accepted, you’ll get an account number and sort code right away.²

The Cashplus business bank account comes with a business Mastercard, which should arrive between 3 and 5 days once your application is approved. As an added perk, this will be personalised with your company name.⁴

Should you need it, you can also apply for a Cashplus business credit card⁵. This has a representative APR of 29.9% (variable) and no annual fees. Initial credit limits are up to £3,000, and you’ll also get up to 56 days’ interest-free credit on your purchases (subject to conditions).

The Cashplus business credit card is contactless, and offers flexible repayment options and itemised billing. This should make it easier to track and manage your business expenses.

Lastly, you can add up to 20 additional Business Expense Cards to your account with Cashplus⁴.

International payments with Cashplus are a little… complicated.

Cashplus provides an inbound international payments service for business customers, but only for transfers sent in GBP or Euros.⁵ You’ll need to get hold of the IBAN number or SWIFT code first though, which could require a call to customer services. And there’s a flat fee to pay, no matter the amount or currency of the payment.⁶

One big issue to watch out for with Cashplus business accounts is money in a particular currency being sent to the wrong currency account. For example, USD being sent to your Cashplus Euro account. This could mean extra currency conversion fees⁶, which means you receive less of the money.

Sending money abroad with your Cashplus business account is also more difficult. Your account will be in GBP only, but you can add a USD and Euro travel card for free. This means you can send money to the US and many European countries through card payments.⁷

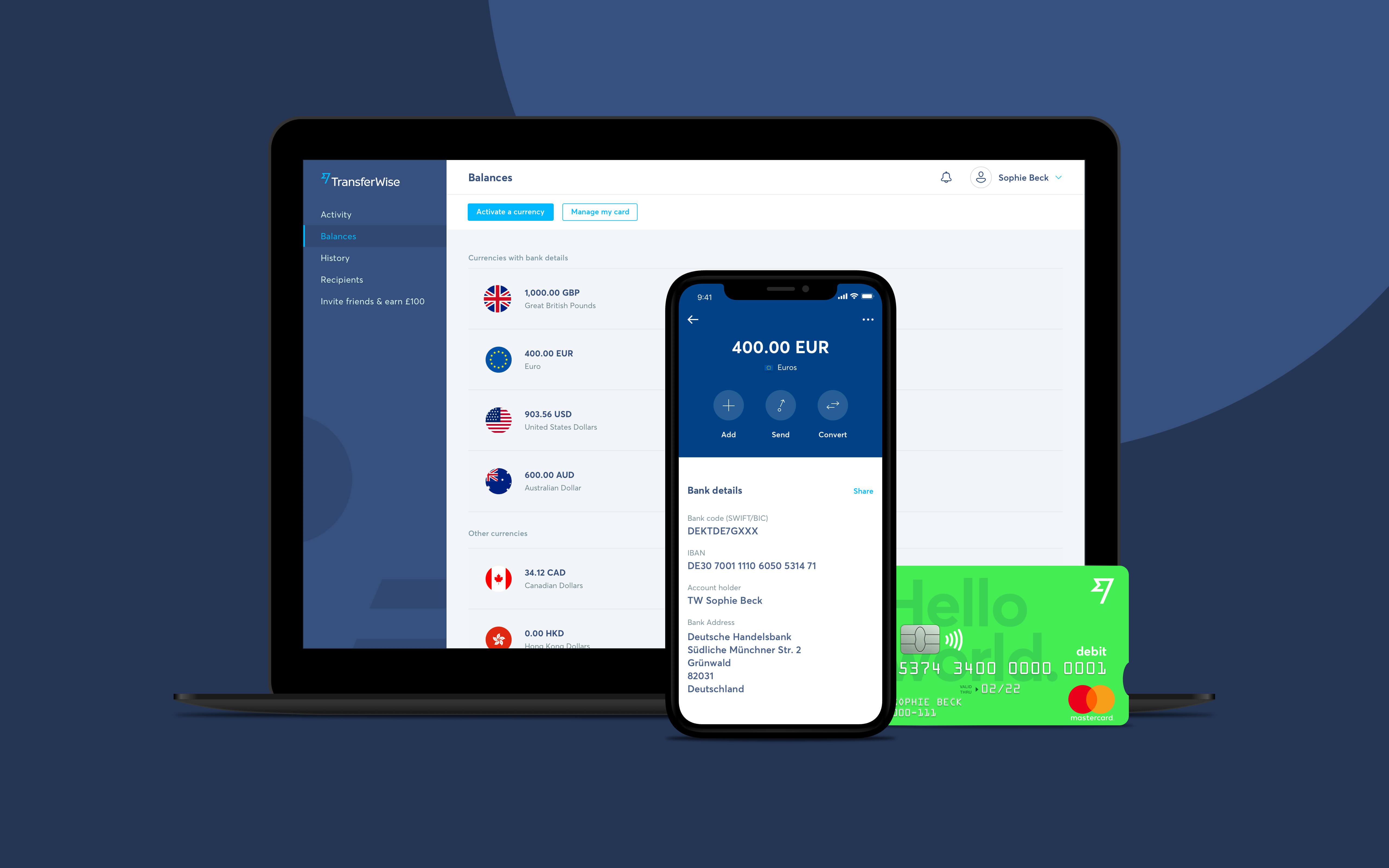

For international transactions, you can check out Wise and take advantage of the real exchange rates and receive payments in more varied currencies seamlessly and for free using the multi-currency account.

One of the major plus points with Cashplus business bank accounts is how simple they are. This extends to the fees and charges too, most of which are nice and easy to understand.

Here are the key fees you need to know about with Cashplus:⁸

| Service or transaction type | Fee |

|---|---|

| Annual account fee | £69 |

| Cash deposits (at Post Office) | 0.3% of total deposit |

| Electronic payments within the UK (including Direct Debits, Faster Payments and standing orders) | Free for first 3 transactions a month£0.99 per transaction afterwards |

| International transfers – only available through US or Euro Travel card | No purchase transaction fee for transactions in same travel card currency⁹ |

| International transfers - receiving | £15 flat fee |

| Business debit card transactions | Free (UK only) |

| ATM withdrawals | £2 for UK£3 for non-UK |

If your business trades globally or plans to in the future, you need international transfers to be as easy and cheap as possible. You don’t want to be stung by unexpected fees, limited to just one or two currencies, or have an expensive mark-up added to the exchange rate.

Luckily, there is an alternative to banks that could save you money. Open a Wise multi-currency account and you can send and receive money worldwide at the click of a button. It’s as simple as possible, and you’ll always know exactly what you’ll be paying before you send – with absolutely no hidden fees.

Wise, you’ll only pay a small fee to send money internationally, and you’re guaranteed the real, mid-market exchange rate. The same goes for converting currencies, and there are low to zero fees to receive money from abroad.

You’ll get a Wise debit card to cover business expenses, and you can even integrate your account with Xero and Quickbooks software for seamless money management.

So, that’s it – everything you need to know about the Cashplus business bank account. It’s a great option if you need all the main features of a business current account but have a poor credit history. After all, it’s easy to open and there are no credit checks.

Cashplus offers a simple, everyday solution for business banking, and the fees are easy to get to grips with. But it may not be the best option for international transfers, which can be a little limiting and confusing with Cashplus.

If you need this service, it could be a smart idea to use a dedicated solution like Wise instead and save yourself some money.

Sources used:

Sources checked on 22-January 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our guide to understand operating profit margin and how to calculate it. Also learn how it can be used to show the health of your business.

‘Wise Platform’ has hit the ground running in 2024, entering the year with a total of over 85 partners globally and a number of exciting announcements. Over...

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Looking to scale your business in Scotland? Check out this guide to business grants in Scotland from start up funding to government business grants and more.

Seeking funding for your business? This guide signposts what grants are available for small businesses in the UK and tips to help ensure application success.

Looking to scale with a business grant? This guide outlines opportunities for business grants in Wales - from start up funding to Welsh government grants.