Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

By: Francis Sloan, business product designer

The Wise business product has come a long way since its launch a few years ago. Since then, we’ve been working hard to make it faster, cheaper and easier for businesses to move money around the world.

Our success so far has been down to our amazing customers. It’s their feedback (positive and negative) that helps us decide what problems we should be focusing on next. Here’s a sneak peek at a few we’re working on right now.

Since we launched the borderless account, the number one thing our customers have asked for is a debit card. Good news…we’ve started beta testing, and hope to launch it in the UK and Europe in the coming months. With the card, businesses will be able to pay bills, set up subscriptions, and spend money abroad in multiple currencies. We’ll keep you updated on our progress.

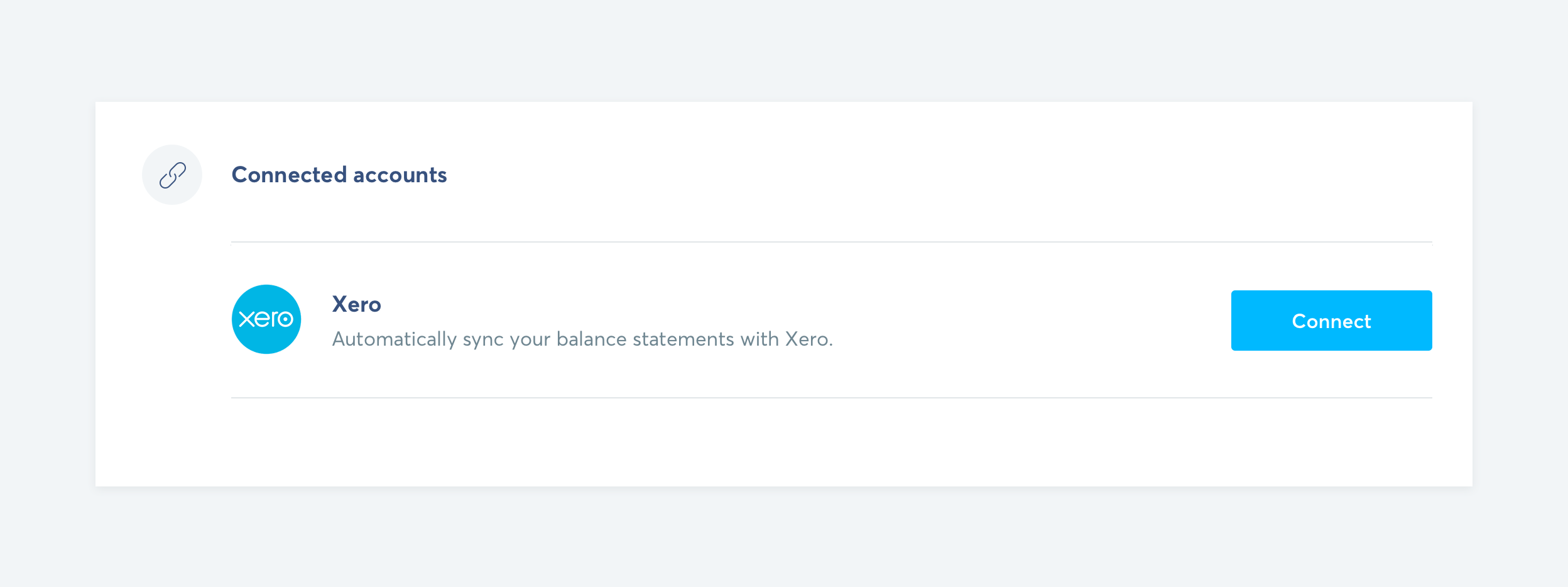

As a business, tracking and managing your finances across different platforms can be a nightmare. That’s why we’re working with Xero on an integration that will automatically sync your balance activity each day. Saving you lots of time and keeping everything neat and tidy.

We’re in development mode right now but hope to release the beta in October. In the meantime, you can manually export your activity from the account page, and then import it to Xero or any other accounting software.

Connecting your accounts will only take a few clicks.

We know that many businesses require multiple people, such as employees, contractors or external accountants to have access to their Wise account. We’re working hard to make that happen, and have an especially passionate team working on it. We’re still in the early stages – we’ve been testing UX designs with customers to get feedback – and are hoping to have more of an update by the end of this year.

We already have banks such as Monzo using our API, and we’re excited to now open it up to businesses looking to automate their payment processes. We’ll also release a new sandbox environment and refreshed docs to make implementing our API even easier.

In the coming weeks, we’ll be inviting customers to start testing the API and expect to release to everyone soon after. We’re very excited to see what people will build.

Since launching batch payments a year ago, businesses have made over one million transfers with the feature. With such incredible volume, we’ve gotten some great suggestions on how to make it work even better. We’ve released an updated version to a small number of customers and we’ll be rolling it out to everyone in the coming weeks. Get ready for things like on-screen errors, template instructions, and the ability to review transfers before finalising a payment!

There’s a new team at Wise that’s all about improving the mobile experience for business customers. You may have noticed we’ve already fixed a bunch of bugs and launched a new onboarding experience. The next time you use the app, let us know if you have feedback to make it even better.

Concepts we’re testing to make it easier to switch between accounts. Get in touch if you’re someone who needs this and has thoughts on how to make the experience better.

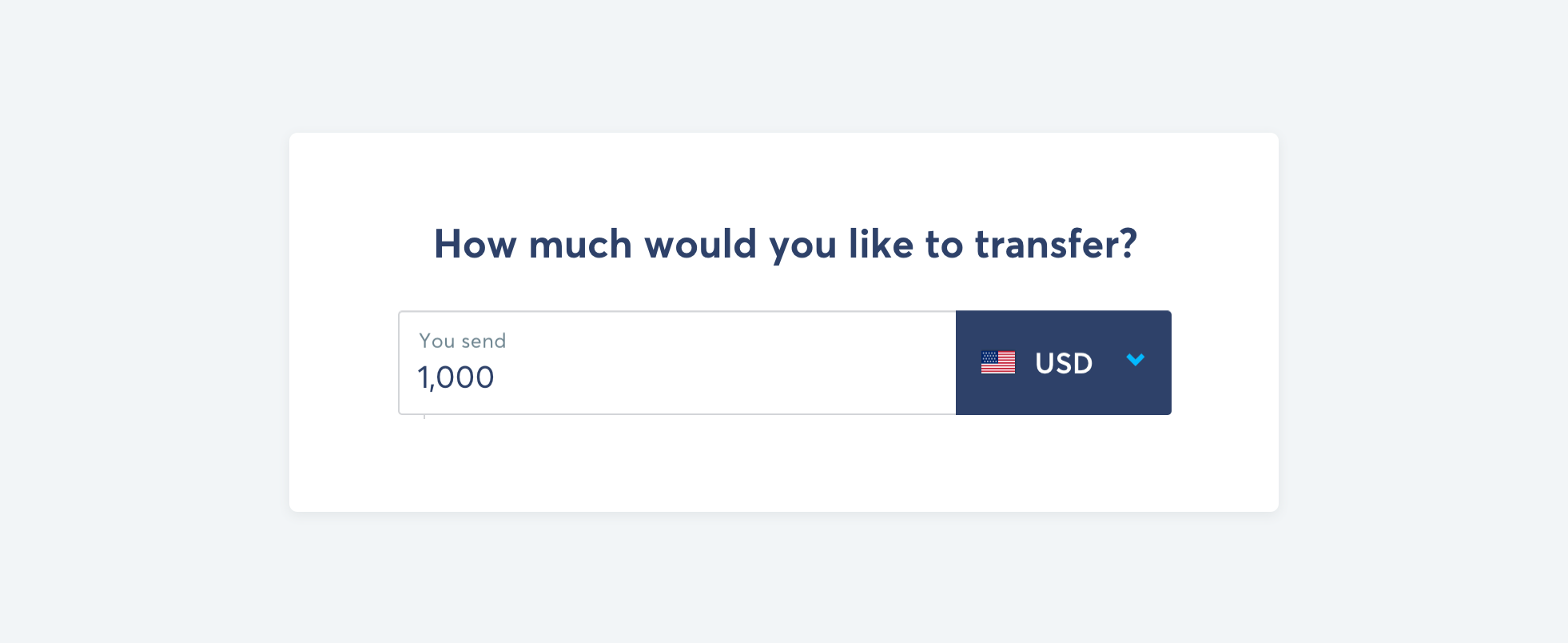

Now businesses can use our desktop calculator to send US dollars to accounts around the world. So if you have vendors in countries like China and Hong Kong that want you to pay them in USD, you can – as long as their account is USD-denominated.

Use the calculator as you normally would when sending USD. Just make sure to update the country of your recipient in the next step – it'll default to the US.

Soon you'll be able to make direct debits with your account. This means you could give your bank details to utility or credit card companies to pay recurring bills electronically. We want to make Wise the best possible alternative to international banking, so we know this is a big one.

That’s all the updates for now – thanks for reading.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it)...