Tarjeta Santander consumer: Guía completa

Descubre todo sobre la tarjeta Santander consumer: comisiones, requisitos y cómo solicitarla. También la alternativa más conveniente para ahorrar con tarjetas.

Tanto si piensas mudarte a Reino Unido como si ya estás viviendo allí, vas a necesitar en algún momento una cuenta bancaria. Antes era bastante difícil abrirla si eras nuevo en el país. Pero, afortunadamente, ahora es mucho más sencillo.

Aquí puedes ver qué necesitas para abrir una cuenta bancaria en Reino Unido, qué pasos debes dar, cuáles son los bancos más importantes y qué comisiones pagarás. También se presenta una alternativa online con tarifas mucho más bajas que los bancos tradicionales: la cuenta multidivisa de Wise.

Para abrir una cuenta bancaria en Reino Unido necesitarás dos tipos de documentos: uno para verificar tu identidad y un comprobante de domicilio. Ésto es así tanto si lo haces de forma presencial en una sucursal como si lo haces online. Confirmar tu identidad es fácil: solo necesitas tu pasaporte, carné de conducir o documento nacional de identidad (si eres ciudadano de la UE).

Para la prueba de domicilio tendrás que presentar otro documento separado. Cada banco tiene su propia lista de documentos aceptables. Aunque, en términos generales, suelen ser válidos:

Un contrato de alquiler o de la hipoteca;

Una factura reciente de servicios domésticos como la luz o el gas (de los últimos 3 meses);

Un extracto bancario o de tarjeta de crédito (de hace menos de 3 meses) no impreso directamente de Internet; o

Una factura de los impuestos municipales.

Si eres nuevo en Reino Unido es muy probable que no dispongas de ninguno de estos documentos. Algunos bancos pueden ser flexibles y aceptar otros como una carta de admisión en la universidad, un comprobante del Jobcentre Plus confirmando tu número de la Seguridad Social, o incluso una carta de tu empleador, siempre que se haya emitido no antes de los últimos 3 meses.

También otra forma: antes de irte a Reino Unido, pide en tu banco español que cambien tu dirección postal a tu nueva dirección en ese país. Puede que incluso puedas hacerlo tú de forma online.

Una vez hayas cambiado tu dirección, pide a tu banco que te envíe un extracto bancario a tu nuevo domicilio por correo. Así tendrás un comprobante válido.

Como norma general, los bancos de UK te permiten abrir una cuenta por Internet si tienes todos los documentos necesarios para verificar que estás residiendo allí. Si todavía no es tu caso, no te permitirán hacerlo, aunque hay algunas alternativas:

Abrir una cuenta internacional: los principales bancos del Reino Unido ofrecen cuentas offshore para extranjeros que puedes abrir de manera totalmente online. Su principal desventaja está en que suelen requerir depósitos iniciales de entre 25.000 y 50.000 GBP

“Mover” tu cuenta bancaria española: si tu banco actual tiene oficinas en UK, es posible que te permitan migrar tu cuenta o abrir una nueva allí de forma más sencilla

Utilizar un banco corresponsal: algunos bancos están asociados a redes bancarias internacionales y podrás utilizar uno en España para abrir una cuenta en UK de forma similar a la explicada en el punto anterior

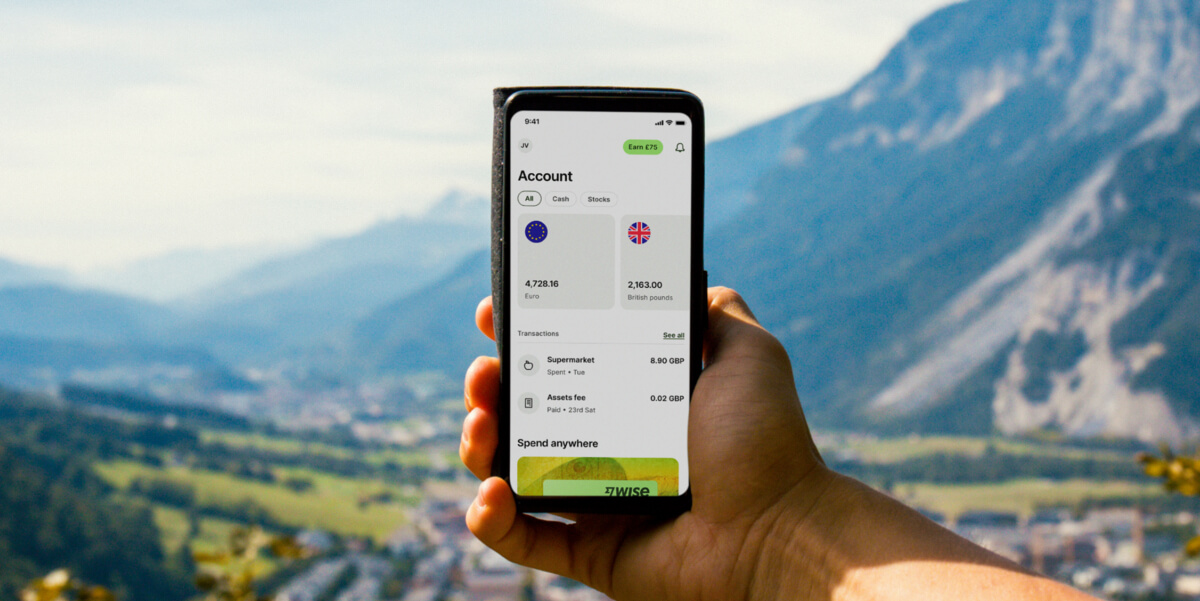

Si no te convence ninguna de estas opciones, puedes abrir unacuenta multidivisa con Wise. Tiene datos bancarios de UK y te permite manejar libras esterlinas, igual que cualquier banco de allí.

Las cuentas bancarias tradicionales mantienen dinero en una sola moneda y resulta muy caro utilizarlas internacionalmente. En cambio, la cuenta multidivisa de Wise tiene una solución para esto.

Con ella puedes enviar, recibir y gestionar tu dinero internacionalmente sin comisiones desorbitadas ni tipos de cambio más desorbitados aún. Sólo pagarás una pequeña comisión cuando conviertas tu dinero de una moneda a otra.

Lamentablemente, no hay una respuesta sencilla a esta pregunta. La industria bancaria en el Reino Unido es muy competitiva y muchos bancos tienen productos específicos diseñados para atraer a un público determinado.

Esto son muy buenas noticias. Tanto si eres estudiante, como trabajador o si tienes un negocio, podrás encontrar algo que cubra tus necesidades. Lo más importante a la hora de elegir es que tengas claro tus circunstancias personales y que te tomes tu tiempo.

Al ser nuevo en Reino Unido, no tendrás historial crediticio. Esto puede dificultar el proceso con muchos bancos

Los grandes bancos como Barclays, Lloyds, HSBC o RBS/NatWest tienen más experiencia con clientes internacionales. Además son más solventes

Tu nacionalidad y país de residencia previo pueden hacer que abrir tu cuenta en UK resulte más sencillo o más complicado

Antes de elegir banco, es recomendable consultar cómo de amplia es su red de cajeros y cuáles son sus comisiones

El sistema bancario de Reino Unido es amplio y cuenta con más de 150 entidades en activo². Cuatro de ellas son las más importantes y las que acaparan la mayor parte de la cuota de mercado: Barclays, Lloyds, HSBC y RBS/NatWest.

| Barclays | - Más de 1.500 oficinas por todo el país - Cuentas especiales para estudiantes y negocios - Cashback en tus compras con tarjeta - Atención al cliente a través de chat en directo en su web |

| Lloyds | - Alrededor de 1.300 sucursales - Líder en soluciones bancarias para PYMES y start-ups - Tienen una cuenta especial para recién llegados a UK - Descuentos en comisiones para las cuentas orientadas a negocios |

| HSBC | - Red de oficinas amplia en Inglaterra y Gales - Presencia internacional en más de 80 países - Destaca su cuenta para estudiantes - Las cuentas para negocios incluyen la asistencia de un gestor personal |

| RBS/NatWest | - La mayor parte de sus sucursales se concentran en Escocia - Red con más de 3.000 cajeros automáticos - Su cuenta de estudiante te ofrece descuentos en restaurantes - Cuentas de empresa sin comisiones durante los 2 primeros años |

Para hacerte una idea de lo que te costará mantener una cuenta bancaria en Reino Unido, puedes echar un vistazo a la siguiente lista de comisiones. Corresponden a la cuenta corriente de Barclays³, pero te servirán como orientación de lo que suele ser habitual en este país:

Recuerda que, siempre que hagas una operación en una divisa diferente de la libra esterlina, tu banco tendrá que hacer una conversión. En lugar de hacerla siguiendo los tipos de cambio oficiales (los que puedes consultar en Google), los bancos tradicionales utilizan tipos propios que llevan añadido un recargo. Esto hace que pagues una comisión adicional oculta en el tipo de cambio.

Fuentes:

1 Webs de NatWest y Lloyds, con las condiciones para abrir una cuenta internacional

2 Wikipedia – Lista de entidades bancarias activas en Reino Unido

3 Web de Barclays – Tarifario de la cuenta corriente

Comprobadas por última vez el 23 de agosto de 2023.

*Consulta los términos de uso y disponibilidad de productos para tu región o visita comisiones y precios de Wise para obtener la información más actualizada sobre precios y comisiones.

Esta publicación se proporciona con fines de información general y no constituye asesoramiento legal, fiscal o profesional de Wise Payments Limited o sus subsidiarias y sus afiliadas, y no pretende sustituir el asesoramiento de un asesor financiero o cualquier otro profesional.

No hacemos ninguna declaración ni ofrecemos garantía, ya sea expresa o implícita, de que el contenido de la publicación sea preciso, completo o actualizado.

Descubre todo sobre la tarjeta Santander consumer: comisiones, requisitos y cómo solicitarla. También la alternativa más conveniente para ahorrar con tarjetas.

Todo sobre abrir una cuenta Holabank: funcionamiento, costos y una alternativa segura para ahorrar en tus gastos diarios e internacionales: la cuenta Wise.

Conoce las formas de pagar con el movil en Imagin y una alternativa con aún mejores condiciones: la cuenta Wise

Conoce cómo puedes pagar con el movil con BBVA en España. También te contamos de la alternativa para ahorrarte las comisiones de los bancos tradicionales: Wise.

Descubre cómo activar tu tarjeta BBVA y una alternativa para ahorrar en comisiones ocultas: la tarjeta Wise

Descubre cómo cancelar una cuenta de BBVA paso a paso, los posibles motivos y los requisitos, además de una cuenta alternativa sin comisiones ocultas: Wise