New look, same old Wise: Don't let scammers trick you

Today, we’re introducing big changes to the way Wise shows up to the world. It’s inspired by what makes us different: you. The people who shape us today — our...

Welcome to the Wise Mission Update, our quarterly report on how we're keeping true to our mission of building money without borders: making money move instantly, transparently, conveniently, and - eventually - for free.

There are now 8 million of you powering our mission, moving over 4 billion pounds a month. Here’s what we delivered in Q3 to bring us closer to our mission.

Last quarter was a busy one for us... we shipped over 30 changes to our product that moved us closer to achieving our mission.

Here are the highlights.

On price, we dropped our average fee to 0.74% and fees were lowered for 76% of our customers at the end of the quarter.

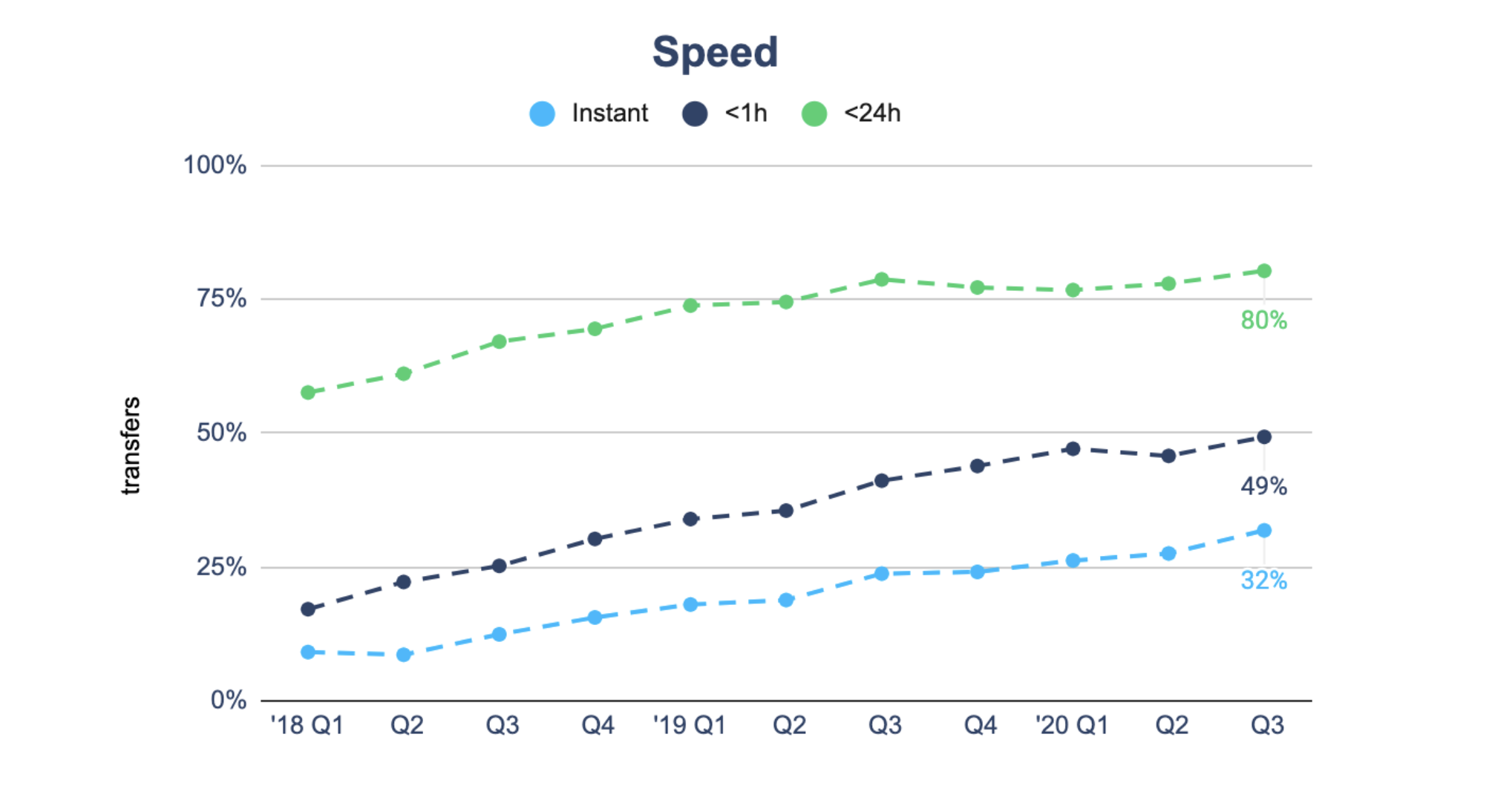

On speed, 32% of payments are now instant (up 4%) – thanks to a direct integration to Hungary’s central bank and improvements to transfer speed in the US. Half of all payments now arrive within an hour.

New features around the world. We rolled out a more convenient way to save money, bank account details in Hungary, the multi-currency account in Japan (debit card coming soon!), and direct debits in the US.

For businesses, you can now send from the UAE and integrate with FreeAgent accounting software (adding to existing QuickBooks and Xero solutions). We went live with Australia’s fastest growing neobank, Up!

We’re continuing to fight for transparency around the world – putting banks across Europe and Australia on notice and starting a fight in the US for more transparency in payments.

In Q3, 32% of transfers with Wise arrived instantly –– i.e., money left your bank and arrived in the recipient’s bank account, in a different country, and in a different currency in less than 20 seconds. That’s up from 28% in Q2.

Three significant improvements drove the change.

We integrated directly with Magyar Nemzeti Bank, the central bank of Hungary. This direct connection allows us to speed up your payments just as we sped up payments in the UK with our Faster Payments integration. We can now receive and send transfers below 10 M HUF instantly. As a result, more than 75% of payments to Hungary are delivered in less than 20 seconds - what we define as instant.

This is the second central bank integration we’ve done. Each integration takes three to five years and (most of the time) requires changes to the regulatory rule book. These integrations are worth the effort as it gives you the fastest speed at the lowest cost – it’s the clearest way we can make meaningful progress towards becoming truly instant.

We also significantly sped up Automated Clearing House (ACH) payments from the US. This works by starting ACH transfers immediately after your authorisation. We started rolling this out in July and now 17% of ACH transfers from the US are instant.

We also completed an integration with the Financial Process Exchange (FPX) in Malaysia which helps speed up payments for customers sending money from Malaysia. About 60% of users sending money from Malaysia use FPX, meaning your money reaches Wise in less than two minutes from your Malaysian bank. 75% of transfers sending money to Malaysia now arrive in less than one hour.

The other aspect of payment speed is estimating a delivery time for your money, with accuracy. When you make a transfer we estimate when the money will arrive to the recipient’s account. This quarter our delivery estimates remained accurate (or early) 90% of the time.

The average price for using Wise decreased this quarter from 0.75% to 0.74%.

It’s important for us to track our average price as it shows us a broad picture of where we are making progress.

This quarter we lowered fees for 76% of our customers. If you send money from the US or the UK anywhere in the world, or from any other country to many Asian countries, the price of transfers is now lower by an average of 15%. For some routes, the fee will drop up to 30%.

(But, we also had some routes that went the wrong direction - we increased prices for users sending money to Switzerland and the Philippines.)

The price drop was driven by two things. Over the last couple quarters, we built better and faster integrations to payment networks in Thailand, Pakistan, Sri Lanka, and Japan.

We also delivered a lot of efficiencies in our operational teams by improving our machine learning models, our verification processes, and our Know Your Customer (KYC) checks that stop the bad guys from using Wise. These improvements lowered our costs and we can now pass that savings on to you.

These price drops are fundamental toward getting us closer to our mission of making transfers eventually free. We can make these changes as more people and businesses switch from their banks and PayPal to Wise.

Over time, there are three ways we can lower prices.

This quarter we rolled out our multi-currency accounts for personal and business users in Japan.

Users in Japan can now get their own account numbers in the UK, Eurozone, US, Australia, New Zealand, and Singapore - to pay and get paid like a local living in these countries.

Due to local regulations there is still a 1 million JPY limit when sending money using the balance of your account.

The next step is bringing the Wise debit card to Japan. We will open a beta program soon. If you want to get one of the first neon green cards in Japan, join the waitlist.

The direct integration with the central bank of Hungary that helped us improve our overall payment speed also enabled us to launch Hungarian bank account details.

Personal and business users can now receive forints straight into your Wise account — just like a local. This means you can get paid, receive money from friends and family, or send forints to yourself.

Since the launch thousands of customers have activated their bank details and billions of Hungarian forints have been received in salaries, invoice receipts, and other income.

This quarter we also launched Romanian account details for customers in Romania and the UK.Thousands of customers have activated their RON account details, sending and receiving millions of Romanian leu.

It’s been a while since we announced support for a new language, but now our customers can use all of Wise—from our website, Android, iOS all the way through to customer support—in Traditional Chinese. 升呢!

Last quarter, we brought Wise to expats in Dubai, Abu Dhabi and the other united emirates. Sending from AED was one of our most requested routes for consumers; now, businesses in Emirates can also send AED. Hundreds of businesses in the Emirates have already switched to paying internationally via Wise.

We had some bad news last quarter for users in Africa as we closed transfers to Uganda and Tanzania due to unreliable integrations. We have now reopened those routes as we improved our local setup.

For users across Asia, there were a number of improvements. We increased the limits for users sending money to Korea from $1,000 to $5,000. We also opened the ability to send USD to India and have already seen users send several million dollars to recipients in India. If you live in Malaysia, you can also now send money to China, a highly requested destination.

Last quarter, we rolled out microdeposits for users in the US which lets users connect their Wise account with banks and third party services (like banks, PayPal, Venmo, Stripe, online brokers, and more) and withdraw USD from these services straight to their Wise account.

We’ve now rolled out direct debits for customers in the US. You can automate payments from the same types of services via direct debits from your Wise account. Already, tens of thousands of users have connected their accounts and set up several million pounds worth of direct debits from their USD accounts.

Right now, this is only live for users in the US, but we will soon expand this to users around the world. You can get on the waitlist here.

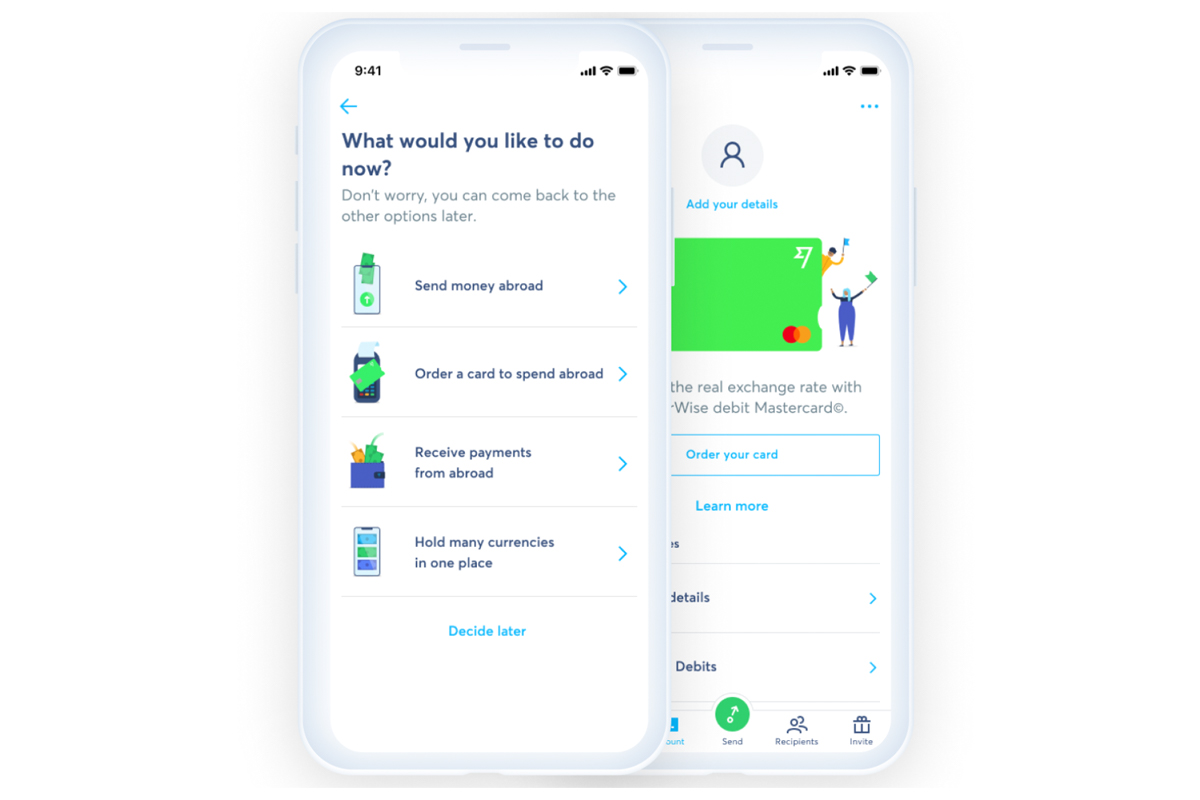

This quarter we made it easier to activate your account details and order a debit card once you’ve signed up to Wise.

It’s now easier on our apps to quickly find and get started with whatever that might be - whether it’s to send money, activate local bank details to receive in another currency, or order a card. Over the last few months on Android, 11% more users were able to find the product you were looking for within 30 seconds of registering your account. We are in the process of rolling out the same experience for iOS and web.

We also improved navigation on mobile web to bring it in line with our apps experience. This made it easier to find the features you needed to use - already we’ve seen a 24% increase in users being able to easily open a balance with Wise on mobile web.

For some users, it wasn’t clear how to use your bank details, so we redesigned them to include more information about how they work and how long payments take. The next time you’re asked to share your EUR or USD bank details, it should be much easier to understand what to do.

We also increased the loading speed for the process of sending money. For example, in Australia it now takes almost four times less time to set up a transfer.

Earlier this year we made it easier to recover your account when you were locked out and could not get authentication messages to your verified mobile number.

This quarter we made the process even easier by adding the ability to get recovery messages to WhatsApp. We also added the ability to add a secondary phone number to your account in case you have multiple phone numbers around the world. Already, we’ve seen tens of thousands of users easily get into their accounts with Whatsapp.

This quarter we increased the reward amount if you invite friends to Wise. Now, for most users, if you invite three people to use Wise the reward is £75, up from £50.

We also started a trial of rewards for recipients in the form of free transfers up to £500. Now if you’re sending money to a friend, you don’t need to proactively invite them to use Wise - we do it for you automatically. Recipients get an automatic invite for a free transfer when we send them an email confirming the funds have arrived.

Customers that use Wise as a primary account have given us feedback for some time that they need a way to separate their savings from their day to day spending balances and card transactions.

This quarter we began a small rollout of a solution called Jars.

Jars are an easy way to set money aside from your balances. They’re the perfect place to save for a holiday, or stash away money where you can’t spend it. Now you get a more private, clearer picture of how much money you're keeping with Wise and for what purpose.

This is currently in a limited beta and we’re working on rolling it out more broadly in the coming quarters.

Most people and businesses have to submit documents for review when they first start using Wise. We know it matters a lot how fast we can review your documents and get you on your way to completing that first transfer.

This quarter our verification experience remained steady from last quarter - for both businesses and personal users.

Last quarter we mentioned that we were expanding chat support in North America and Europe. We’ve continued to expand the availability of these support channels for more users in both regions this quarter, however we have not (yet) seen a significant improvement in our resolution time for most customers.

This quarter, we solved 67% of our customer contacts within 24 hours.

We made the Wise debit card even more convenient to use this quarter.

While we’re all still in various stages of lockdown, we know lots of users are shopping online. You can now look up your card details in the Wise app and website - super handy if you want to complete a purchase but don’t have your card within arm’s reach.

Almost half of debit card users log on to the web periodically, so we’ve also improved the web experience of managing your debit cards - bringing feature parity with what was already available in mobile apps. You can now quickly replace your cards and manage spending controls on the web.

Lastly, another improvement for business card users. Business Admin users can now order additional cards for their teams. This is currently in a (very) limited beta, but will roll out more fully in the coming quarters. Want to be part of it? Just fill in this survey.

This quarter we announced another integration to make accounting easier for SMBs - this time with FreeAgent. You can now sync your Wise Business account directly with FreeAgent - just like the integrations already available with QuickBooksandXero.

And if you do your accounting in another program that’s not yet integrated with Wise, you can now download your accounting statements to work with.

The FreeAgent integration works over our open API and is an example of the type of solutions we can bring to market because of Open Banking in the UK. Already several thousand businesses are using the solution.

With these three integrations and our new accounting statement feature, 21% of our business users who have a balance now use one of our three accounting solutions (Xero, QuickBooks, FreeAgent). Join the thousands of businesses already managing their money with Wise.

This quarter our integration with Australia’s leading neobank Up! went live. Up’s 250,000+ users can now send money abroad to 48 currencies without leaving the Up app -- at the same price and speed as if they were using Wise directly.

There are now 12 Wise for Banks partnerships live across four continents.

Whether you’re starting a business or watching what you spend day to day, we now have new guides and tools to help you make informed financial decisions.

This quarter, we published over 400 articles in 12 different languages and built dynamic calculators to help you. Find out how much income tax or VAT you will pay this year or how much PayPal and eBay take from your profits if you’re an online seller.

We also designed an easy-to-useinventory management template to join our existing suite of tools, like our invoice, cash flow, income statements, and balance sheets templates. These should help you get your new business up and running in no time.

Our average uptime through Q3 was 99.91%. This is the highest it’s ever been - there was less than one hour a month when customers couldn’t complete transfers.

A lot of work has gone into making Wise this reliable and it’s a long way from Q2 2018 when we had to write postmortems about why we were going down.

We are now consistently hitting close to 99.95% uptime most weeks. Our migration to AWS is now fully complete. We are getting better at finding and addressing problems before they impact customers and, when we do have issues, we are resolving them faster so that you aren’t as badly affected.

Transparency in pricing is one of the reasons Wise was founded and it’s long been something we’ve fought for around the world. People have a right to know how much they are really paying when they send or spend money abroad.

CBPR2 is a new EU regulation that mandates banks and other financial services disclose exactly what it costs for you to send money abroad. We’ve been calling out the banks that aren’t playing by the rules. The worst offenders are NatWest and HSBC. Both banks are still not following the rules and NatWest took advantage of the pandemic to increase their hidden fees even more. We need your help to hold more banks to account - see how you can help.

The US financial system is outdated in a lot of ways - and transparency is no exception. That’s why this quarter we launched a campaign to push for action.

Every year Americans lose over $8.7 billion dollars to hidden exchange rate markups and only 9% of the Americans can identify the true cost of sending money abroad.

We want Congress to act to protect consumers and small businesses from this ripoff. If you want to support this cause, sign our petition and we’ll keep you updated on the progress.

Last year, the Australian Competition and Consumer Commission (ACCC) acknowledged how banks’ non-transparent pricing harms Australians.

Since then, the country’s banks have not done anything to address the exorbitant hidden fees Australians face - which are some of the worst in the world.

Luckily, some members of Parliament - like Andrew Leigh - continue to push banks for accountability on transparency in international payments.

We thought it was only fair that we do our part to remind banks that they should deliver transparency for customers.

We continued to work fully remote this quarter and are back to offices in Tallinn, Singapore, London, Budapest, and New York (with safety restrictions in place). We still shipped more releases than ever.

Through the lockdown we’ve been actively hiring and we have onboarded 286 new Wisers since we started working remotely. We have 143 open roles right now. We’re looking for a VP Sales, a Head of Brand, Head of Paid Acquisition, a Data Protection Team Lead, as well as many roles in engineering and product. Come join us.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Today, we’re introducing big changes to the way Wise shows up to the world. It’s inspired by what makes us different: you. The people who shape us today — our...

Today, we’re changing our name from TransferWise to Wise. Our customers now need us for more than money transfers. Sending, spending, and receiving money...