Using your Bankwest debit card abroad. The lowdown

When it comes to travelling abroad, there's nothing worse than an unexpected surprise, especially when it's extra fees, lost cards or blocked transactions....

A year after launching the Wise Platinum Debit Mastercard in Australia, our customers have saved themselves a whopping $2.6million (over $7000 a day) in fees when spending in another currency shopping online with overseas retailers and on international travel (pre-pandemic). This is compared to if they'd used their bank issued card.

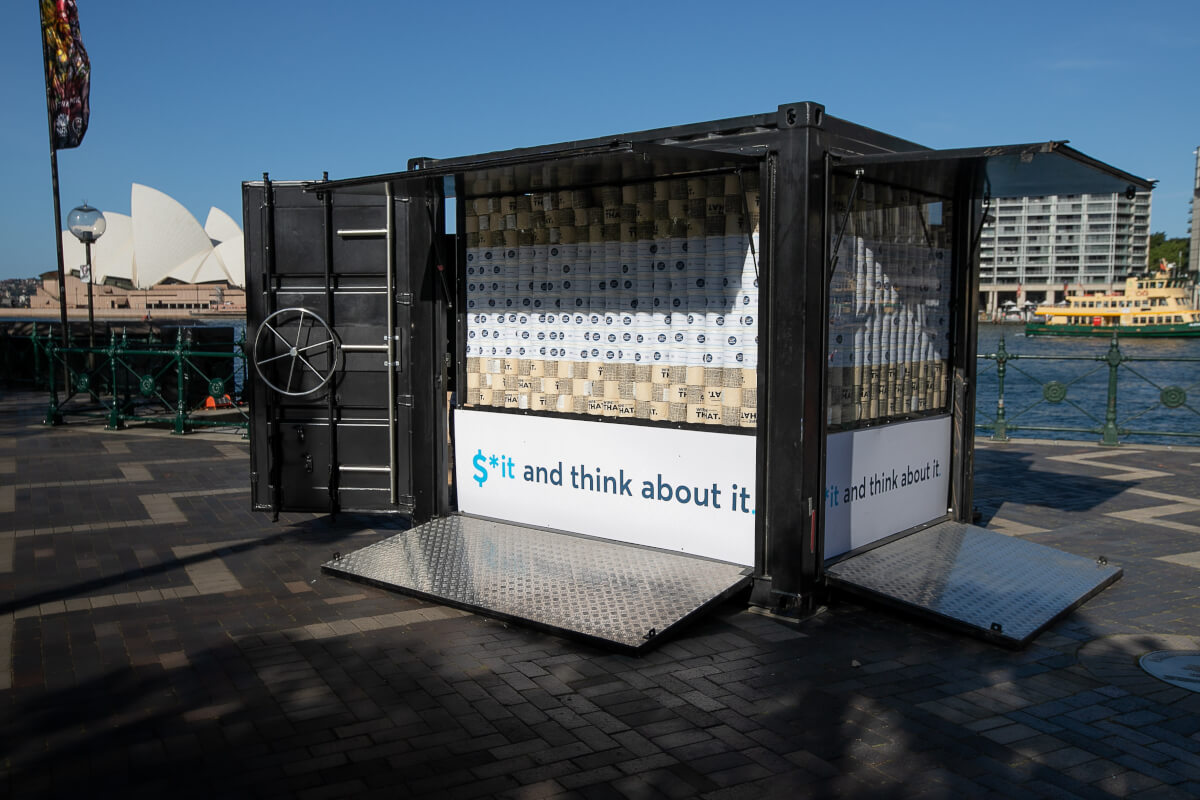

To celebrate, we built a giant transparent vault in Sydney's Circular Quay, filled it up with one of a kind Wise loo rolls, some stuffed with cash.

But why?

A survey of 1000 Australians showed that while 60% claimed to know which fees their banks charge them, most were unable to correctly answer which fees these were. We’re on a mission to help put an end to that.

Since Aussies value saving loo paper a fair bit, we’re asking them the next time they use that precious paper, to instead "$it And Think About’" the other precious paper they could be saving because it's time to stop flushing your cash down the toilet on international card fees and exchange rate markups.

Which fees should you watch out for when paying in a different currency using your bank card?

The Wise ‘loo roll vault’ has opened in Circular Quay, for one day only (30th September). Not only will lucky passers-by score some free toilet paper, but randomly placed rolls will also include a wad of cash – $145 – reflecting the average saving each Aussie Wise Platinum Debit Mastercard holder made in hidden international card charges over the past year.

Click here to find out more about the Wise Platinum Debit Mastercard.

About the Research: Wise commissioned PureProfile to conduct a consumer survey in September 2020 to help understand how much Australians really know about hidden international card fees. The consumer survey was a nationally representative sample of 1,000 consumers, carried out online.

Competition Terms & Conditions

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

When it comes to travelling abroad, there's nothing worse than an unexpected surprise, especially when it's extra fees, lost cards or blocked transactions....

When you travel abroad, it is crucial to have an easy and cheap way to access your money. Sometimes it can be hard to know if the debit card you have already...

Is there anything better than being able to use points collected from everyday purchases to pay for your next holiday? For those who make consistent...

If you frequently travel with Virgin Australia, domestically or internationally then you’re no doubt familiar with their Velocity frequent flyer program. A...

If you are a loyal Qantas customer that regularly travels with them domestically or overseas, you may already be a member of their frequent flyer...

Frequent flyer programs are attractive to people who fly often as they can get some benefits back in exchange for the money spent on flights. Some frequent...