The Spanish education system: An overview

One important decision, if you’re moving to Spain with family, is how to ensure that your children have the best possible education. As an expat family, you...

An increased dose of sunshine, twelve national holidays and delicious tapas are just a few things to look forward to if you’re moving to Spain.

Spain ranks second in the world for overall quality of life, with an impressive 91% of expats justifiably content with available leisure activities. While Spain may shine in terms of safety, healthcare and making newcomers feel welcome, the country struggles in terms of employment statistics and economic performance.

So, whether you’re relocating to Spain for fairer weather or a change in career, preparation is key. This is especially true when moving to a country where The Law of Falta Uno applies when dealing with the local bureaucracy: however many documents and photocopies you bring, there will always be one missing.

Before you head to Spain, here are a few things you should do to get set up in your new country.

First thing’s first. Apply for your NIE (Foreigner's’ Identification Number). You’ll need the number to do anything that requires an official process, like renting property, getting a job, connecting to utilities or paying your taxes.

There are three ways you can go about applying for the NIE. You can either apply in person when you arrive in Spain, apply at the Spanish Consulate in your current country of residence, or hire an accredited representative in Spain with the correct legal powers to make the application on your behalf. If you decide to apply in Spain, contact your local police station for instructions on how to apply. If you need additional help, you can find the list of necessary documents, helpful tips and links to the NIE application form online.

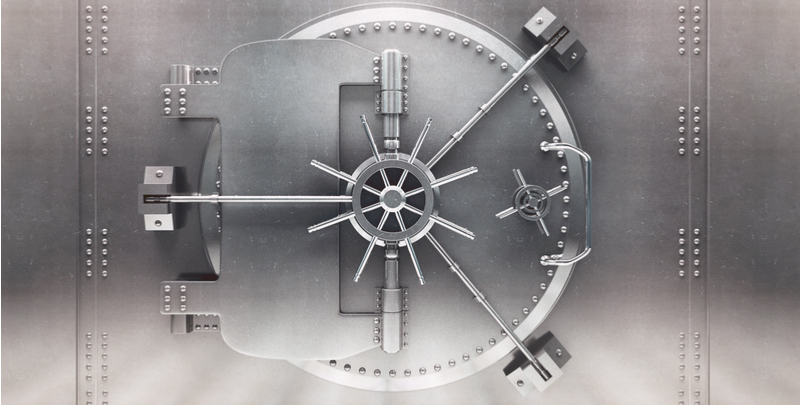

Now that you have your NIE, you’ll be able to open a Spanish bank account. These are available to both residents and non-residents of Spain.

Resident accounts have more flexibility and benefits, while non-resident accounts are easier to open. The catch with the non-resident accounts is that you can only apply if you plan to spend less than 183 days per year in Spain.

Take a look at BBVA, Banco de Sabadell, and Banco Santander. These are the top banks in Spain and have a solid reputation amongst expats.

Citizens of the EU and European Economic Area member states as well as Switzerland can come to Spain and work freely without needing a work permit. If you’re not a part of the EU like those from the U.S., Australia and Canada, you’ll need a Spanish residence visa, as well as a valid Spanish work permit. If you plan to work independently in Spain, you can apply for a work permit from the Spanish consulate or embassy in your home country.

Expats warn that it’s quite difficult to set up accommodation in Spain before arriving in town, so plan to stay at an Airbnb or a hotel while you sort out your living arrangements in person.

There are no restrictions on foreigners owning property in Spain, so if you’re looking to buy, check out Kyero or Right Move.

Idealista, with an up to date interface and detailed search options, is one of the best websites to find an entire apartment or just a room to rent. Websites Piso Compartido and EasyPiso cater to those just looking to rent.

With one of the highest unemployment rates in Europe, one in five people are without work, so finding a job in Spain may be a challenge. That said, the economy is improving, and there are many great resources for finding jobs.

You can start by setting up a profile and searching for work on English language job boards like ThinkSpain, Expatica jobs, Jobs in Barcelona, Madrid or Spain.

The Public State Employment Service - Servicio Público de Empleo Estatal (SEPE) has information on vacancies, training courses and advice on job seeking as well. It also provides information on positions that are difficult to fill in Spain.

If you need some professional help with your job hunt, consider reaching out to a recruiter like Adecco.

For tips on how to prepare a Spanish CV use a template online. To find out what to expect in a Spanish job interview, there are also some great resources online if you check around.

Want to skip battling your way through the unsavory job market altogether and set up your own business in Spain? There are three main options for setting up your own: as a sole trader, limited company or partnership.

The process of setting up a limited company is a bit complex. You can start by selecting a name and ensuring its uniqueness with the Mercantile Registry and applying for your Company Tax Identification Code (CIF). You can then follow the standard Spanish legal procedures to make sure all is in order.

You have a few different schooling options if you’re bringing your kids along on your move to Spain. Options vary between public, private, international and semi-private (colegios concertados) schools. If you want to dive in a bit more, Telegraph has an article on the differences between each Spanish education sector.

There are a number of factors to evaluate before making a choice – consider your child’s age, the anticipated length of your stay in Spain, your budget and the primary teaching language and curriculum that would best suit your child.

For schools that teach an international or foreign curriculum, see the European Council for International Schools (ECIS) and the National Association of British Schools in Spain (NABSS).

To sign your child up for school in Spain, you’ll need to register as a resident at the local town hall. After you’ve done that, make sure you have all the necessary documents and follow instructions online on getting your kid enrolled in school.

Above all, make sure you enjoy the sun, the food and the incredible new culture you’ll be greeted by in Spain. Viva España!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

One important decision, if you’re moving to Spain with family, is how to ensure that your children have the best possible education. As an expat family, you...

Keeping track of holidays in Spain can be an undertaking. The country only has a small handful of official, nationwide public holidays, but each region of...

Spain is a very popular expat destination. Every year, many people choose Spain as a perfect place to live, study, work or retire abroad. There’s a lot on...

With its incredible history, breathtaking views, welcoming locals, and distinctive cuisine, Spain can be a perfect destination for you and your fiancé(e) to...

Moving to a new country may be a huge undertaking, but there are a lot of great reasons to do it. Whether you’re starting a new job, studying abroad,...

The idea of living in Spain is a dream of many; zipping along the southern coast, stopping for paella and a sip of wine, enjoying Gaudi’s surreal architecture...