If you’re a teenager or young adult planning on opening a bank account for the first time - or if you’re thinking about opening a kids bank account for a family member - you might be wondering: what is the minimum age to open a bank account in Singapore? This guide has you covered - read on for all you need to know about opening a Singapore bank account for a child or young adult.

What is the minimum age to open a bank account in Singapore?

To open most standard bank accounts in Singapore as a sole applicant you’ll need to be 16 or older.

If you want an account for a child aged under 16 you’ll usually have to choose a joint account with an adult aged over 18 or 21. In some cases it’s required that the joint applicant is the child’s parent or legal guardian - but some banks are more flexible around this requirement, meaning you can open an account for another family member reasonably easily.

All of the major local and global banks in Singapore have options for children and young adults to get an account. Some even come with extra perks like cashback, bonuses, insurance and extra interest to encourage kids to learn about money management early. The features available vary between accounts and providers, though - so it’s worth shopping around to find the right option for you. This guide covers all you need to know.

Bank accounts available for 16 year olds and above in Singapore

Let’s look at some of the most popular accounts aimed at older teenagers and young adults in Singapore. We’ll look at both accounts for daily use and saving, and summarise the key features and fees to help you choose between them.

POSB My Account¹

- Minimum age: Open account as an individual if you’ve over 16 (you can also open as a joint account for a child - more on that later)

- Account fees: 2 SGD/month fee for paper statements

- Key features: Earn interest, hold 13 currencies, digital banking services available

- Branch network: 41 branches in Singapore

- Extras: No fee for coin deposit, automatic saving feature available

POSB eMySavings Account²

- Minimum age: Apply from age 16 - you’ll have to also have an existing DBS or POSB current or savings account to be eligible

- Account fees: No fees

- Key features: Saving account - set regular savings amounts and earn special interest rates

- Branch network: 41 branches in Singapore

- Extras: Manage your account and savings settings through the digital banking service at any time

Standard Chartered Basic Bank Account³

- Minimum age: 15 years old

- Account fees: 20 SGD minimum opening deposit,** **2 SGD/month maintenance fee - waived for applicants who are under the Government’s Public Assistance scheme or Special grants scheme. Replacement passbook - 30 SGD; early closure fee - 30 SGD

- Key features: Basic account aimed at low income Singaporeans, get a NETS card for spending and withdrawals

- Branch network: 20+ branches and priority banking centres across Singapore

OCBC Passbook Savings Account⁴

- Minimum age: Available to applicants aged 16 and over

- Account fees: Minimum balance 1,000 SGD; 2 SGD/month fall below fee; 15 SGD for a replacement passbook

- Key features: Interest earning savings account. Use your bank passbook to track transactions

- Branch network: 39 branches in Singapore

- Extras: Seasonal and occasional promotions including cashback opportunities may apply

OCBC FRANK Account⁵

- Minimum age: Apply from 16 years old

- Account fees: No minimum balance or fall below fees for customers aged under 26

- Key features: Interest earning account with a linked debit card. Possibility to earn cashback on spending

- Branch network: 39 branches in Singapore

- Extras: 60 different debit card designs

Kids bank accounts available in Singapore

If you’re looking for an account for a child you might need a specific kids bank account. Accounts tend to split into products which are intended to allow kids to learn to manage their money independently, and accounts which are more aimed at parents who want to start saving for their children. Here are a few to consider from some of the biggest banks in Singapore.

POSB Kids Account (My Account)

- Minimum age: No minimum age to open the popular My Account as a joint account where one applicant is aged 16 or over

- Account fees: No fees for account holders aged under 16; 2 SGD/month fee for paper statements

- Key features: Earn interest, hold 13 currencies, digital banking services available

- Branch network: 41 branches in Singapore

- Extras: No fee for coin deposit, 1 year POPULAR student membership for account holders aged 16 or under, automatic saving feature available

OCBC Mighty Savers children’s account⁶

- Minimum age: No minimum age to open as a joint account for a child, where the second applicant is the parent or legal guardian

- Account fees: No fees apply

- Key features: Interest earning savings account

- Branch network: 39 branches in Singapore

- Extras: Seasonal and occasional promotions may apply

UOB Junior Savers⁷

- Minimum age: No minimum age to open as a joint account for a child, where the second applicant is the parent or legal guardian

- Account fees: 500 SGD minimum deposit, 2 SGD/month fall below fee

- Key features: Interest earning savings account; you may also benefit from insurance coverage to the value of the savings held

- Branch network: 63 branches in Singapore

- Extras: Convert to a regular account once your child turns 15

Citibank Junior Savings⁸

- Minimum age: No minimum age to open as a joint account for a child with one or 2 additional applicants aged over 18

- Account fees: No fees apply for this account

- Key features: Children aged 15 and over can get a linked ATM card and internet banking services

- Branch network: 5 full service branches in Singapore

Maybank Youngstarz Savings Account⁹

- Minimum age: No minimum age to open as a joint account for a child, where the second applicant is the parent or legal guardian

- Account fees: 10 SGD minimum opening deposit

- Key features: Interest earning savings account; some insurance coverage also offered to account holders

- Branch network: 21 branches in Singapore

- Extras: Get extra benefits during your child’s birthday month

Standard Chartered e$aver Kids¹⁰

- Minimum age: No minimum age to open as a joint account for a child, where the second applicant is 21 or older

- Account fees: No minimum opening deposit, but a minimum of 50 SGD a month must be paid into the account

- Key features: Flexible savings account to allow parents to maintain control of their kids bank account

- Branch network: 20+ branches and priority banking centres across Singapore

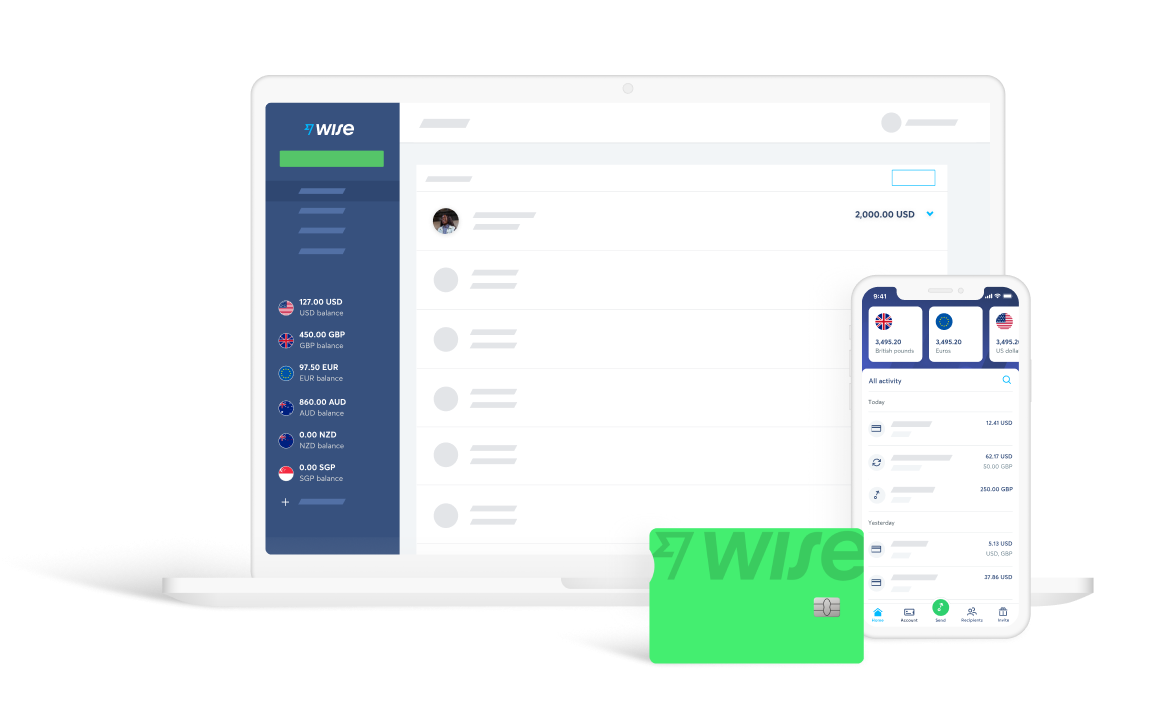

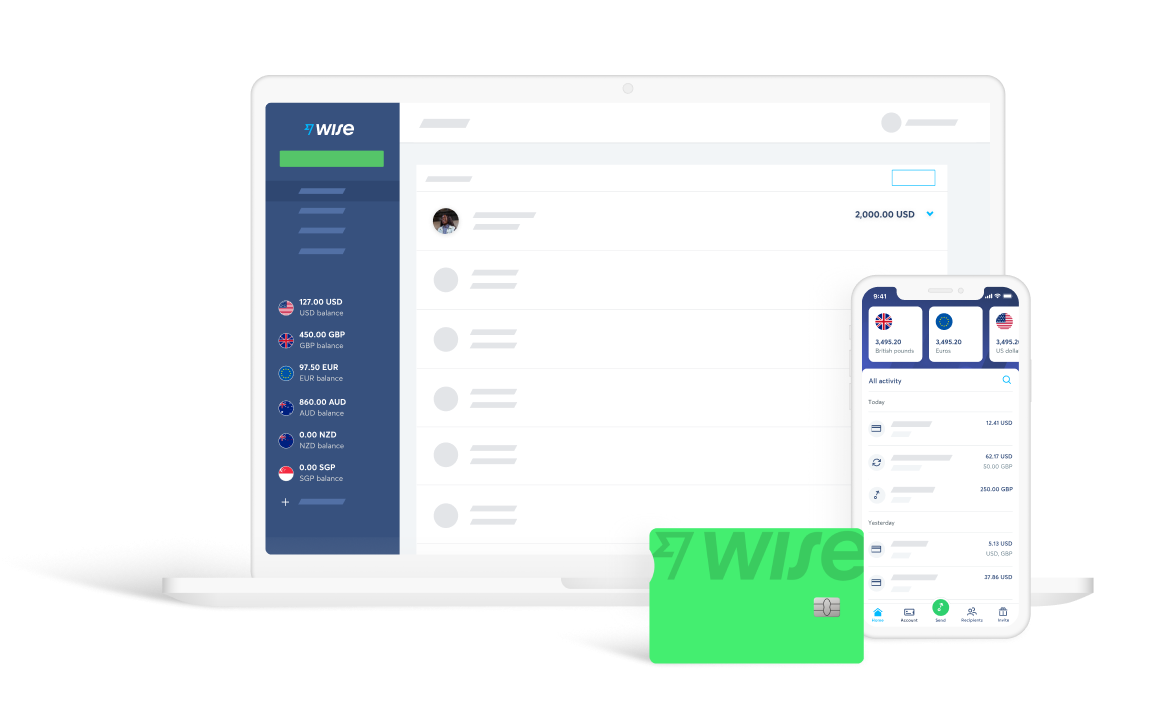

A smart alternative to banks - Wise account

If you’re aged 18 or older you can get a free online Wise multi-currency account and debit card to hold, exchange, send and spend 40+ currencies all from the same account.

There’s no minimum deposit and no monthly fee to pay, making this a great way to hold and handle foreign currencies if you’re studying abroad, travelling, sending money to a loved one overseas, or shopping online with international retailers.

Manage your money on the go in the intuitive Wise app and get the real exchange rate every time you need to switch from one currency to another.

See how much you can save with the Wise multi-currency account today!

Open a free Wise account

Sources:

- POSB My Account

- eMySavings Account

- SC Basic Bank Account

- OCBC Passbook Savings Account

- FRANK Account

- OCBC Mighty Savers Account

- UOB Junior Savers Account

- Citibank Junior Savings Account

- Maybank Youngstarz

- SC e$aver Kids

Sources checked on 01.04.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.