How to apply for a work permit or work visa in Singapore - for Malaysians

As a close neighbour with a broad range of jobs available across both professional, skilled and semi-skilled roles, Singapore is a popular place to look for work.

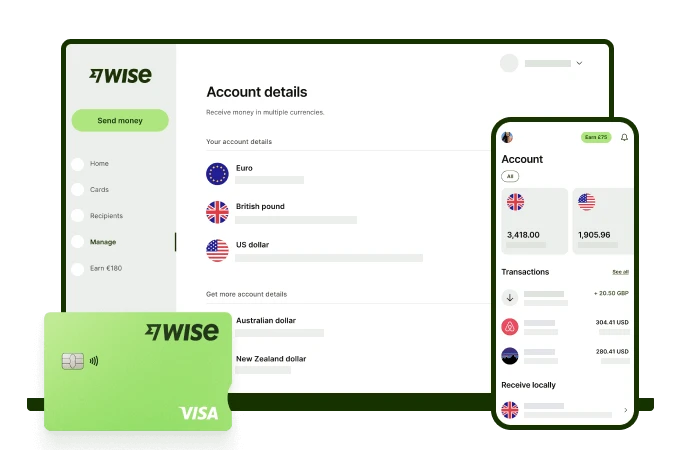

Considering a move to Singapore for your career? Join us as we walk through an overview of the types of Singapore work permit for Malaysian citizens. And if you’re planning to move to Singapore for work, you’ll also want to know about Wise, for easy and convenient ways to manage your money across both MYR and SGD with low fees and the mid-market exchange rate. More on that later, too.

Singapore work visa for Malaysian - pass types

The type of visas and passes available for Malaysians who want to take up employment in Singapore are split by job type, education, experience and salary level. Processing of passes is done by the Ministry of Manpower (MOM).

Different Singapore visa options for work include¹:

- Employment Pass

- EntrePass

- Personalised Employment Pass (PEP)

- Overseas Network & Expertise Pass (One Pass)

- S Pass

- Work Permit for migrant worker

- Work Permit for migrant domestic worker

- Training visas and permits

- Working Holiday visas for eligible candidates

The requirements for these different passes vary a lot. We’ll walk through some of the details for the most commonly used passes in just a moment, but it’s well worth visiting the MOM website to understand the full range of visas and passes, to decide which may suit you.

Singapore work visa - bringing dependents

Some Singapore work and employment visas offer the holder the option to bring dependents with them when moving to the country.

Eligibility rules apply which dictate which family members may be able to apply - usually this option is considered for:

- S Pass holders

- Employment Pass holders (including variants like the PEP and One Pass)

Work permit Singapore requirements

As we’ve seen, there are a broad range of different passes and visas that may apply for people looking to work in Singapore. In almost all cases, you’ll need to have been offered a job prior to applying for your permit, as the employer must initiate the application. The employer will also need to have proved no local talent is available for the specific role prior to application.

The main exception to this is for some permits aimed at very high earning professionals, such as the PEP and One Pass, which you can apply for as an individual without a job already lined up. However, in this case, high salary requirements are applied - check the latest figures online to learn more.

To give an example of the eligibility requirements that may apply, let’s look at the Employment Pass rules, applicable from September 2023²:

- You must earn at least the minimum qualifying salary (set in comparison to the top earning local professionals by age)

- You must be fully vaccinated against Covid, including boosters

- You must pass a points based assessment framework (COMPASS)

The COMPASS framework looks at factors like salary, education, and the specific sector related skills you have, as well as how well the employer supports local employment. A self assessment tool is offered by MOM to allow agents and employers to review their candidate’s likely success on the COMPASS framework - check out the MOM site for full details³.

Singapore work permit salary requirements

The key salary requirements and rules sit around professionals looking for positions in Singapore. The salary requirements are reviewed regularly and can vary based on the sector you work in, your age and the pass type that you need.

Salary rules include:

- Employment Pass holders must earn at least 5,000 SGD a month

- S Pass holders must earn at least 3,000 SGD a month

As some passes have an age related salary requirement, the amount you must earn increases the older you get (up to 45 years old). This is to ensure your salary remains in the top third of local employees at the same age and career stage.

No salary requirement is in place for migrant workers who intend to work as domestic helpers or in specific industries such as construction. Instead, worker numbers are controlled by a system of quotas and levies applied on the employer.

How to apply for work permit in Singapore

The process for applying for an employment pass⁴ or work permit⁵ in Singapore will be initiated by the employer. Once you’ve been offered a job in Singapore, your employer will advise you of the information and documents you must provide to get your permit issued.

Here’s an outline of the Employment Pass application process, as an example:

- Employer or agent applies for the pass

- In principle agreement issued if application is approved

- Employee must attend an appointment to have fingerprints and photo registered

- Employment Pass physical card is issued

Singapore work permit processing time

The length of time it takes to get permission to work in Singapore depends on the situation, and on the specific employer.

As an example, here are the timescales anticipated for an Employment Pass application:

- Employer or agent applies for the pass - processing takes 10 days for locally registered companies, up to 8 weeks otherwise

- In principle agreement issued if application is approved - immediately offered upon approval

- Employee must attend an appointment to have fingerprints and photo registered - timescales depend on the appointment availability

- Employment Pass physical card is issued - available 5 working days after biometric appointment

Heading to Singapore for work? Get Wise to manage your money across MYR and SGD, with low fees and the mid-market exchange rate

If you’re in the process of arranging a move to Singapore for work, you’ll need a convenient way to pay and get paid in SGD. It’s tricky to get a bank account in Singapore before you’re an official long term resident - but you can still get a SGD account from Malaysia with Wise.

Open a Wise account using your Malaysian proof of address and ID and get instant access to local bank details to get paid in MYR and SGD, with easy ways to send low cost payments between currencies, and a linked international debit card for spending and withdrawals. Wise always uses the mid-market exchange rate to convert currencies, with low fees from 0.43%⁶ based on the currency you need.

Plus, payments with Wise can be fast or even instant - 50%+ arrive in seconds⁷ .

Want more flexibility with your money? Wise accounts can hold 40+ currencies, send payments to 160+ countries, and come with account details to get paid from 30+ countries conveniently. Plus, you can use your Wise card at home and abroad, in 150+ countries in total.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

If you need a permit or pass to come to Singapore for work, you’ll be guided through the process by your employer. There’s also a lot of helpful information on the MOM website. As the visas available, and the process to apply, can vary widely depending on the situation, you’ll want to do your own research to see how it’ll work for you. The good news is that the processes are usually pretty straightforward and transparent, and MOM staff can often help with more information over the phone if you have specific queries.

Use this guide to get started, and don’t forget to look into Wise as a smart way to manage your money in SGD before you even move.

Sources:

- MOM - work pass types

- MOM - Employment Pass requirements

- COMPASS self assessment

- MOM - how to apply for an employment pass

- MOM - how to apply for a work permit

- Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

- Speed: Transaction speed claimed depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.